Earnings summaries and quarterly performance for NEW YORK TIMES.

Executive leadership at NEW YORK TIMES.

Meredith Kopit Levien

President and Chief Executive Officer

A.G. Sulzberger

Chairman of the Board and Publisher of The New York Times

Diane Brayton

Executive Vice President and Chief Legal Officer

Jacqueline Welch

Executive Vice President and Chief Human Resources Officer

William Bardeen

Executive Vice President and Chief Financial Officer

Board of directors at NEW YORK TIMES.

Amanpal S. Bhutani

Independent Director

Anuradha B. Subramanian

Independent Director

Arthur Golden

Non-Employee Director

Beth Brooke

Independent Director

Brian P. McAndrews

Presiding Director

David Perpich

Director

John W. Rogers, Jr.

Independent Director

Manuel Bronstein

Independent Director

Margot Golden Tishler

Non-Employee Director

Rachel Glaser

Independent Director

Rebecca Van Dyck

Independent Director

Research analysts who have asked questions during NEW YORK TIMES earnings calls.

Thomas Yeh

Morgan Stanley

8 questions for NYT

Benjamin Soff

Deutsche Bank

7 questions for NYT

David Karnovsky

JPMorgan Chase & Co.

7 questions for NYT

Kutgun Maral

Evercore ISI

6 questions for NYT

Doug Arthur

Huber Research

4 questions for NYT

Douglas Arthur

Huber Research Partners

4 questions for NYT

Jason Bazinet

Citigroup

4 questions for NYT

Kannan Venkateshwar

Barclays PLC

3 questions for NYT

Vasily Karasyov

Cannonball Research

2 questions for NYT

Benjamin Soffer

Deutsche Bank AG

1 question for NYT

David Karnivosky

JPMorgan

1 question for NYT

Recent press releases and 8-K filings for NYT.

- Berkshire Hathaway disclosed a new roughly $352 million stake in The New York Times, acquiring approximately 5.1 million shares.

- This investment, the only new position reported by Berkshire for the period, was interpreted by investors as a strong vote of confidence in The New York Times' subscription- and product-driven digital transformation.

- Following the disclosure, shares of The New York Times jumped more than 10% in after-hours trading.

- The New York Times now counts more than 12 million digital subscribers and has diversified revenue through products such as Wordle, cooking offerings, and The Athletic.

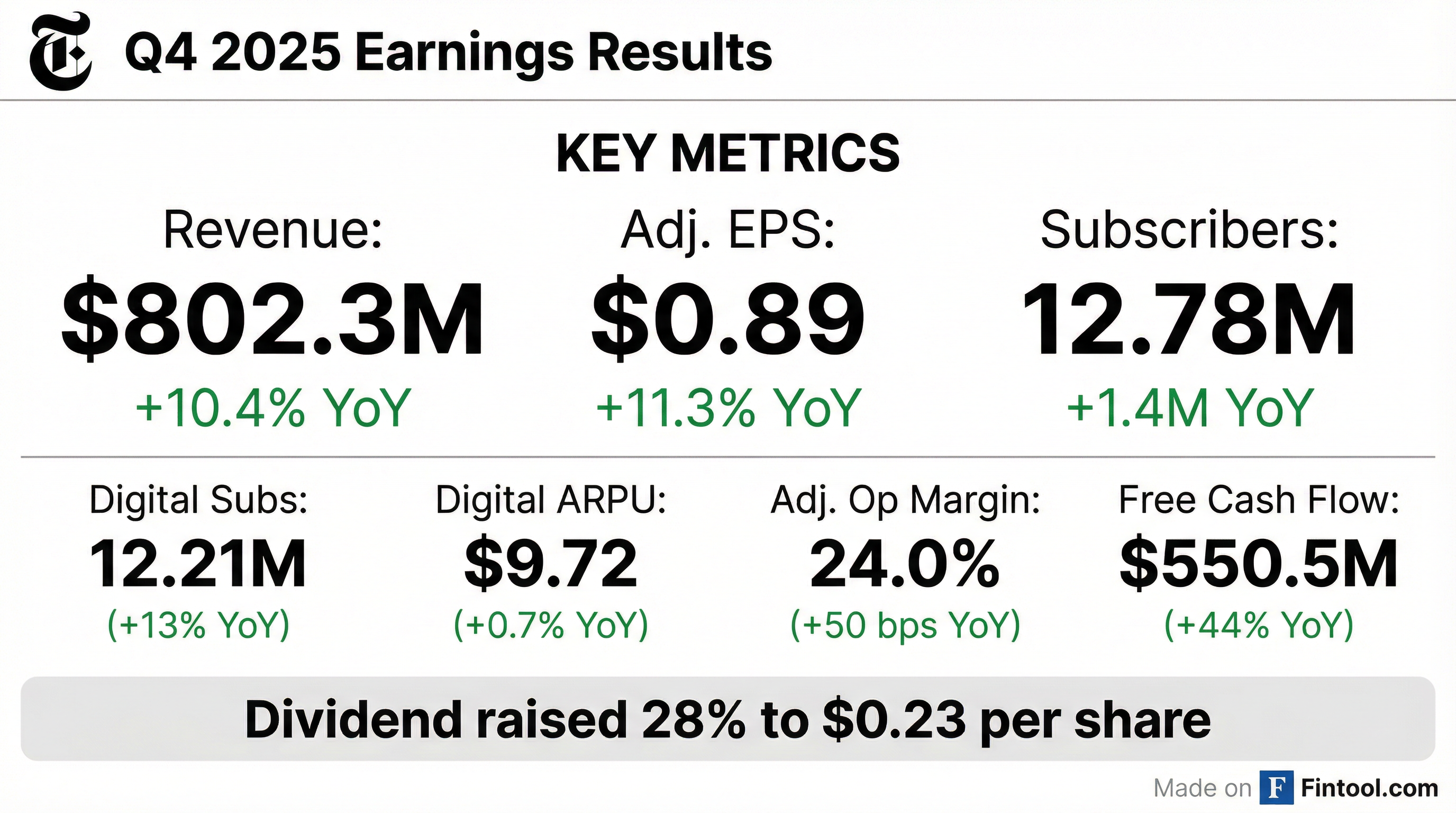

- The New York Times Company reported total revenues of $802 million in Q4 2025, marking a 10.4% increase year-over-year. This growth was driven by a 13.9% rise in digital-only subscription revenues and a 24.9% increase in digital advertising revenues.

- The company added approximately 450K net digital-only subscribers in Q4 2025, bringing the total subscriber count to 12.78 million. Total digital-only average revenue per user (ARPU) also increased 0.7% year-over-year to $9.72.

- Profitability improved, with Adjusted Operating Profit growing 12.8% year-over-year to $192 million and the Adjusted Operating Profit margin expanding by 50 basis points to 24.0%. Adjusted diluted EPS was $0.89.

- The company generated $551 million in Free Cash Flow as of December 31, 2025.

- For Q1 2026, the company anticipates continued growth, with digital-only subscription revenues expected to increase 14-17% and digital advertising revenues projected to rise by high-teens-to-low-twenties.

- The New York Times (NYT) reported a strong Q4 2025 and full year 2025, adding 1.4 million net new digital subscribers in 2025 to reach 12.8 million total subscribers.

- For full year 2025, NYT generated over $2 billion in total digital revenues for the first time, with digital subscription revenues growing 14% and digital advertising increasing 20%. Adjusted operating profit (AOP) grew 21% to $550 million, and AOP margin expanded to 19.5%.

- In Q4 2025, digital advertising revenue grew 25% to $147 million, and adjusted diluted EPS was $0.89, an increase of $0.09.

- The company generated $551 million in free cash flow in 2025 and returned $275 million to shareholders, including $165 million in share repurchases and $110 million in dividends. The quarterly dividend was increased from $0.18 to $0.23.

- For Q1 2026, NYT expects digital-only subscription revenues to increase 14%-17% and digital advertising revenues to increase high teens to low twenties. The company anticipates another year of healthy revenue and AOP growth, margin expansion, and strong free cash flow generation in 2026.

- The New York Times Company achieved a strong 2025, adding 1.4 million net new digital subscribers to reach 12.8 million total subscribers, and generating over $2 billion in total digital revenues for the first time.

- For the full year 2025, adjusted operating profit (AOP) grew over 20% to $550 million, with AOP margin expanding to 19.5%, and total revenue increased approximately 9%.

- In Q4 2025, the company added 450,000 net new digital subscribers, saw digital subscription revenues grow 14%, and digital advertising revenues increase 25%.

- The company generated $551 million in free cash flow in 2025, returned $275 million to shareholders through share repurchases and dividends, and increased its quarterly dividend from $0.18 to $0.23.

- For Q1 2026, The New York Times Company expects digital-only subscription revenues to increase 14%-17% and digital advertising revenues to increase high-teens to low-20%s, while continuing strategic investments in areas like video.

- The New York Times Company concluded 2025 with strong results, adding 1.4 million net new digital subscribers to reach 12.8 million total, and generating over $2 billion in total digital revenues for the first time.

- In Q4 2025, the company added 450,000 net new digital subscribers, with digital subscription revenues growing 14% to $382 million and digital advertising revenues increasing 25% to $147 million.

- Adjusted operating profit (AOP) grew more than 20% to $550 million in 2025, expanding the AOP margin to 19.5%, and adjusted diluted EPS for Q4 2025 increased to $0.89.

- The company returned approximately $275 million to shareholders in 2025 and announced an increase in the quarterly dividend from $0.18 to $0.23.

- For Q1 2026, the company forecasts digital-only subscription revenues to increase 14%-17% and digital advertising revenues to increase in the high teens to low twenties, expecting another year of healthy growth in revenues and AOP, margin expansion, and strong free cash flow generation for the full year 2026.

- The New York Times Company reported Q4 2025 total revenues of $802.3 million, a 10.4% increase year-over-year, with diluted earnings per share of $0.79 and adjusted diluted earnings per share of $0.89.

- The company added approximately 450,000 net digital-only subscribers in Q4 2025, bringing the total number of subscribers to 12.78 million, including 12.21 million digital-only subscribers. Digital subscription revenues increased 13.9% year-over-year to $381.5 million.

- For full-year 2025, net cash provided by operating activities was $584.5 million and free cash flow was $550.5 million.

- The Board of Directors declared a $0.23 dividend per share, an increase of $0.05 from the previous quarter, and the company repurchased approximately $55.4 million of Class A Common Stock during Q4 2025. The company also provided guidance for Q1 2026, expecting digital-only subscription revenues to increase 14 - 17% and total advertising revenues to increase low-double-digits.

- The New York Times is nearing 12 million digital subscribers with a goal of 15 million by 2027, driven by strategic priorities for 2026 including ambitious journalism, expanded video content (like the Watch Tab launched in Q3), and adding value across its diverse product portfolio.

- The company aims for long-term subscription revenue growth through subscriber additions and ARPU expansion, supported by strong subscriber engagement and the monetization of new offerings like games. Digital advertising revenue is also showing strong performance with a low 20s/high teens growth rate.

- The New York Times maintains a strong track record of cost management and margin improvement, achieving approximately 200 basis points of margin improvement per year and margins in the high teens. Capital allocation prioritizes investment in the subscription strategy and returning at least 50% of free cash flow to shareholders.

- The company is leveraging AI to enhance operations and journalism, while simultaneously engaging in legal proceedings against entities like Perplexity, Microsoft, and OpenAI to protect its intellectual property and ensure fair value exchange.

- The New York Times (NYT) is focused on its essential subscription strategy, aiming to continue delivering high-quality independent journalism in diverse formats, particularly video, and enhancing its product portfolio to foster direct customer relationships in 2026.

- The company is nearing 12 million digital subscribers with a goal of 15 million by 2027, expressing confidence in an underpenetrated addressable market. It anticipates continued strong ARPU trajectory and sustained digital advertising revenue growth, driven by added product value, engagement, and effective pricing strategies.

- NYT aims for ongoing margin expansion, historically achieving 200 basis points per year, through active cost management and strategic investments in journalism and digital products. With a strong balance sheet, the primary capital allocation is investing in its subscription strategy, committing to return at least 50% of free cash flow to shareholders via buybacks and dividends.

- The company is actively leveraging AI to enhance journalism, accessibility, and customer experience, while also pursuing legal actions against unauthorized use of its intellectual property to ensure sustainable fair value exchange in licensing agreements.

- The New York Times Company reported adding approximately 460K net digital-only subscribers in Q3 2025, reaching a total of 12.33 million subscribers, with 51% now being bundle and multiproduct subscribers.

- Total revenues for Q3 2025 increased to $701 million, driven by a 14.0% year-over-year rise in digital-only subscription revenues and a 20.3% year-over-year increase in digital advertising revenues.

- Adjusted operating profit (AOP) grew 26.1% year-over-year to approximately $131 million, with the AOP margin expanding 240 basis points to 18.7% in Q3 2025.

- For Q4 2025, the Company anticipates digital-only subscription revenues to increase 13 - 16% and total advertising revenues to increase high-single-to-low-double-digits.

- The New York Times Company reported strong Q3 2025 results, with consolidated revenues growing approximately 9.5% and Adjusted Operating Profit (AOP) increasing by approximately 26%, leading to an AOP margin expansion of approximately 240 basis points.

- The company added 460,000 net new digital subscribers, bringing the total subscriber base to 12.3 million, with digital subscription revenue increasing 14% and digital-only ARPU growing 3.6% to $9.79.

- Advertising revenues also showed significant growth, with digital advertising increasing over 20% and total advertising growing nearly 12% in Q3 2025.

- For Q4 2025, the company anticipates continued growth, with digital-only subscription revenues expected to increase 13-16% and total advertising revenues projected to increase high single to low double digits.

- The company generated approximately $393 million of free cash flow in the first nine months of the year and returned approximately $191 million to shareholders through share repurchases and dividends, consistent with its capital allocation strategy.

Quarterly earnings call transcripts for NEW YORK TIMES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more