Earnings summaries and quarterly performance for Orange County Bancorp, Inc. /DE/.

Executive leadership at Orange County Bancorp, Inc. /DE/.

Michael Gilfeather

President and Chief Executive Officer

David Dineen

Executive Vice President and Senior Managing Director of Wealth Services

Elizabeth Jones

Senior Vice President, Chief Operating Officer

Gregory Sousa

Executive Vice President, Chief Lending Officer

Joseph Ruhl

Executive Vice President, Regional President (Westchester) and Chief Deposit Officer

Michael Coulter

Executive Vice President, Strategic Lending Relationship Officer

Michael Lesler

Executive Vice President and Chief Financial Officer

Michael Listner

Senior Vice President, Chief Risk Officer

Stephen Rooney

Senior Vice President, Chief Credit Officer

Board of directors at Orange County Bancorp, Inc. /DE/.

Research analysts covering Orange County Bancorp, Inc. /DE/.

Recent press releases and 8-K filings for OBT.

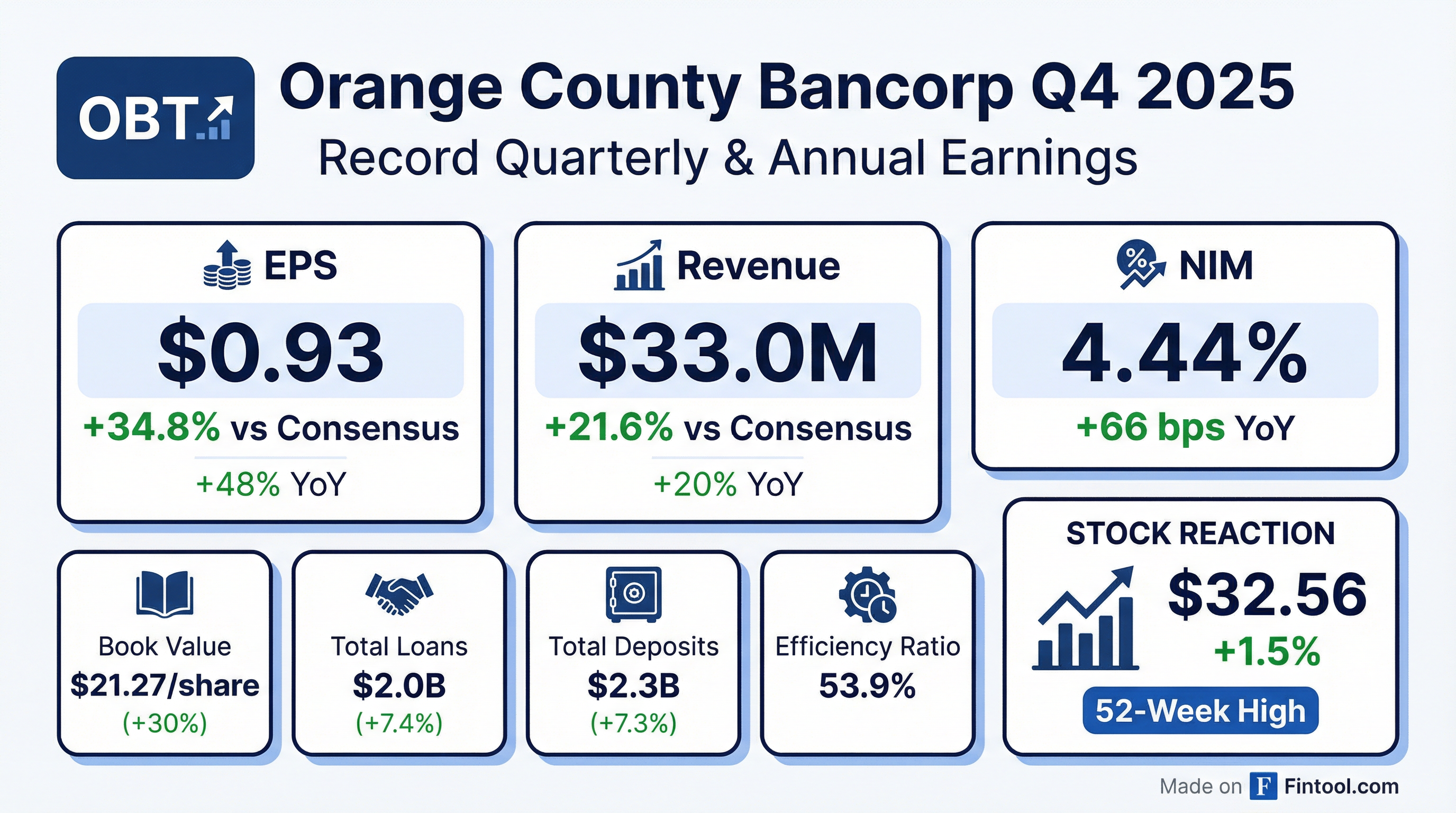

- Orange County Bancorp, Inc. reported record net income of $41.6 million for the full year ended December 31, 2025, a 49.3% increase from $27.9 million in 2024, with diluted EPS of $3.33 for the year.

- The company's net interest margin grew 35 basis points to 4.18% for the full year 2025 and 66 basis points to 4.44% for the fourth quarter of 2025, compared to the same periods in 2024.

- Total Loans increased 7.4% to $2.0 billion and Total Deposits increased 7.3% to $2.3 billion at December 31, 2025, compared to year-end 2024.

- Book value per share increased 30.1% to $21.27 at December 31, 2025, up from $16.35 at December 31, 2024.

- Trust and investment advisory income rose 15.2% to $14.1 million for the year ended December 31, 2025.

- Orange County Bancorp, Inc. announced record net income of $41.6 million for the full year ended December 31, 2025, marking a 49.3% increase from $27.9 million in 2024, with diluted earnings per share of $3.33.

- The company's Net Interest Margin (NIM) grew to 4.18% for the full year 2025, up 35 basis points from 3.83% in 2024, and reached 4.44% for the fourth quarter of 2025, an increase of 66 basis points from the prior year's fourth quarter.

- Total Loans increased by 7.4% to $2.0 billion and Total Deposits increased by 7.3% to $2.3 billion at December 31, 2025, compared to December 31, 2024.

- Book value per share grew 30.1% to $21.27 at December 31, 2025, up from $16.35 at December 31, 2024.

- The efficiency ratio improved to 53.4% for the full year 2025 from 60.5% in 2024, and to 53.9% for the fourth quarter of 2025 from 67.4% in the same period of 2024.

- For the nine months ended September 30, 2025, Orange County Bancorp, Inc. reported net income of $29.184 million and diluted earnings per share of $2.39.

- As of September 30, 2025, the company's total assets stood at $2.636 billion, with $2.279 billion in deposits and $1.906 billion in net loans. Assets Under Management (AUM) also reached $1.9 billion.

- The company achieved strong profitability for the nine months ended September 30, 2025, with a Return on Average Assets (ROAA) of 1.51%, Return on Average Equity (ROAE) of 17.48%, and a Net Interest Margin of 4.06%.

- Loan growth was 7.8% year over year and deposit growth was 6.5% year over year as of Q3 2025, supported by a low-cost deposit base with a total cost of 113 basis points for Q3 2025.

- Credit quality remains robust, with Non-Performing Loans at $12.2 million (0.63% of Total Loans) and a Loan Loss Reserve of $29.3 million (241% of NPLs) as of September 30, 2025. The Tangible Common Equity to Tangible Assets ratio was 10.04%.

- Orange County Bancorp, Inc. reported a significant increase in net income for Q3 2025, rising 211.5% to $10.0 million ($0.75 per basic and diluted share) compared to $3.2 million ($0.28 per basic and diluted share) in Q3 2024.

- Net Interest Income increased 17.3% to $27.0 million for Q3 2025, up from $23.0 million in Q3 2024, with the Net Interest Margin growing 45 basis points to 4.26%.

- Total loans grew 6.6% to $1.9 billion and total deposits rose 5.8% to $2.3 billion at September 30, 2025, compared to December 31, 2024.

- Book value per share increased 23.6% to $20.21 at September 30, 2025, from $16.35 at December 31, 2024, while tangible book value per share rose 25.1% to $19.76.

- The company's efficiency ratio improved to 49.9% for Q3 2025 from 58.8% for the same period in 2024.

- Orange County Bancorp, Inc. reported net income of $10.0 million for the third quarter ended September 30, 2025, marking a 211.5% increase from $3.2 million in the prior year period, with basic and diluted earnings per share of $0.75 compared to $0.28.

- Net interest income increased by $4.0 million, or 17.3%, to $27.0 million for the quarter ended September 30, 2025, from $23.0 million in the same period last year, and the net interest margin grew 45 basis points to 4.26%.

- Total Loans grew $119.9 million, or 6.6%, reaching $1.9 billion at September 30, 2025, compared to $1.8 billion at December 31, 2024.

- Total Deposits rose $125.5 million, or 5.8%, to $2.3 billion at September 30, 2025, from $2.2 billion at December 31, 2024.

- Book value per share increased $3.86, or 23.6%, to $20.21 at September 30, 2025, from $16.35 at December 31, 2024.

- Orange County Bancorp, Inc. (OBT) issued $25.0 million in 6.50% Fixed-to-Floating Rate Subordinated Notes due 2035 on September 25, 2025.

- The Notes are intended to qualify as Tier 2 capital and the proceeds will be used for general corporate purposes, including the potential redemption of existing 4.25% subordinated notes due 2030.

- The debt bears a fixed annual interest rate of 6.50% until September 30, 2030, after which it will adjust to a floating rate of Three-Month Term SOFR plus 320.5 basis points. The Notes received a BBB- rating from Kroll Bond Rating Agency (KBRA).

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more