Earnings summaries and quarterly performance for REINSURANCE GROUP OF AMERICA.

Executive leadership at REINSURANCE GROUP OF AMERICA.

Tony Cheng

President and Chief Executive Officer

Axel André

Executive Vice President and Chief Financial Officer

Leslie Barbi

Executive Vice President and Chief Investment Officer

Mark Brooks

Executive Vice President and Chief Information Officer

Ronald Herrmann

Executive Vice President, Head of RGA Americas

Board of directors at REINSURANCE GROUP OF AMERICA.

Alison Rand

Director

Hazel McNeilage

Director

John Gauthier

Director

Khanh Tran

Director

Michele Bang

Director

Patricia Guinn

Director

Pina Albo

Director

Shundrawn Thomas

Director

Stephen O'Hearn

Chair of the Board

Steven Van Wyk

Director

Research analysts who have asked questions during REINSURANCE GROUP OF AMERICA earnings calls.

John Barnidge

Piper Sandler

7 questions for RGA

Suneet Kamath

Jefferies

7 questions for RGA

Thomas Gallagher

Evercore

7 questions for RGA

Joel Hurwitz

Dowling & Partners Securities, LLC

6 questions for RGA

Elyse Greenspan

Wells Fargo

5 questions for RGA

Ryan Krueger

KBW

5 questions for RGA

Wesley Carmichael

Autonomous Research

5 questions for RGA

Jimmy Bhullar

JPMorgan Chase & Co.

4 questions for RGA

Michael Ward

Citi Research

4 questions for RGA

Jamminder Bhullar

JPMorgan Chase & Co.

3 questions for RGA

Alex Scott

Barclays PLC

2 questions for RGA

Taylor Scott

BofA Securities

2 questions for RGA

Wes Carmichael

Wells Fargo

2 questions for RGA

Wilma Burdis

Raymond James Financial

2 questions for RGA

Wilma Jackson Burdis

Raymond James

2 questions for RGA

Bob Huang

Morgan Stanley

1 question for RGA

Jian Huang

Morgan Stanley

1 question for RGA

Mike Ward

UBS

1 question for RGA

Recent press releases and 8-K filings for RGA.

- Reinsurance Group of America (RGA) has priced $400,000,000 of 6.375% Fixed-Rate Reset Subordinated Debentures due 2056.

- The debentures have a maturity date of September 15, 2056, an issue price of 100.000%, and a fixed-rate coupon of 6.375% payable semiannually.

- The offering is expected to close on March 3, 2026, with net proceeds intended for general corporate purposes, which may include refinancing debt obligations.

- AM Best affirmed the Financial Strength Rating of A+ (Superior) and Long-Term Issuer Credit Ratings (Long-Term ICRs) of "aa-" (Superior) for Reinsurance Group of America's (RGA) subsidiaries, with a stable outlook.

- The Long-Term ICR of "a-" (Excellent) and all Long-Term Issue Credit Ratings for Reinsurance Group of America, Incorporated were also affirmed, with a stable outlook.

- These ratings reflect RGA's very strong balance sheet strength, strong operating performance, favorable business profile, and very strong enterprise risk management.

- Partially offsetting factors include earnings volatility in certain segments and increased exposure to higher-risk, long-dated product lines such as annuities, longevity reinsurance, and a moderate block of long-term care business.

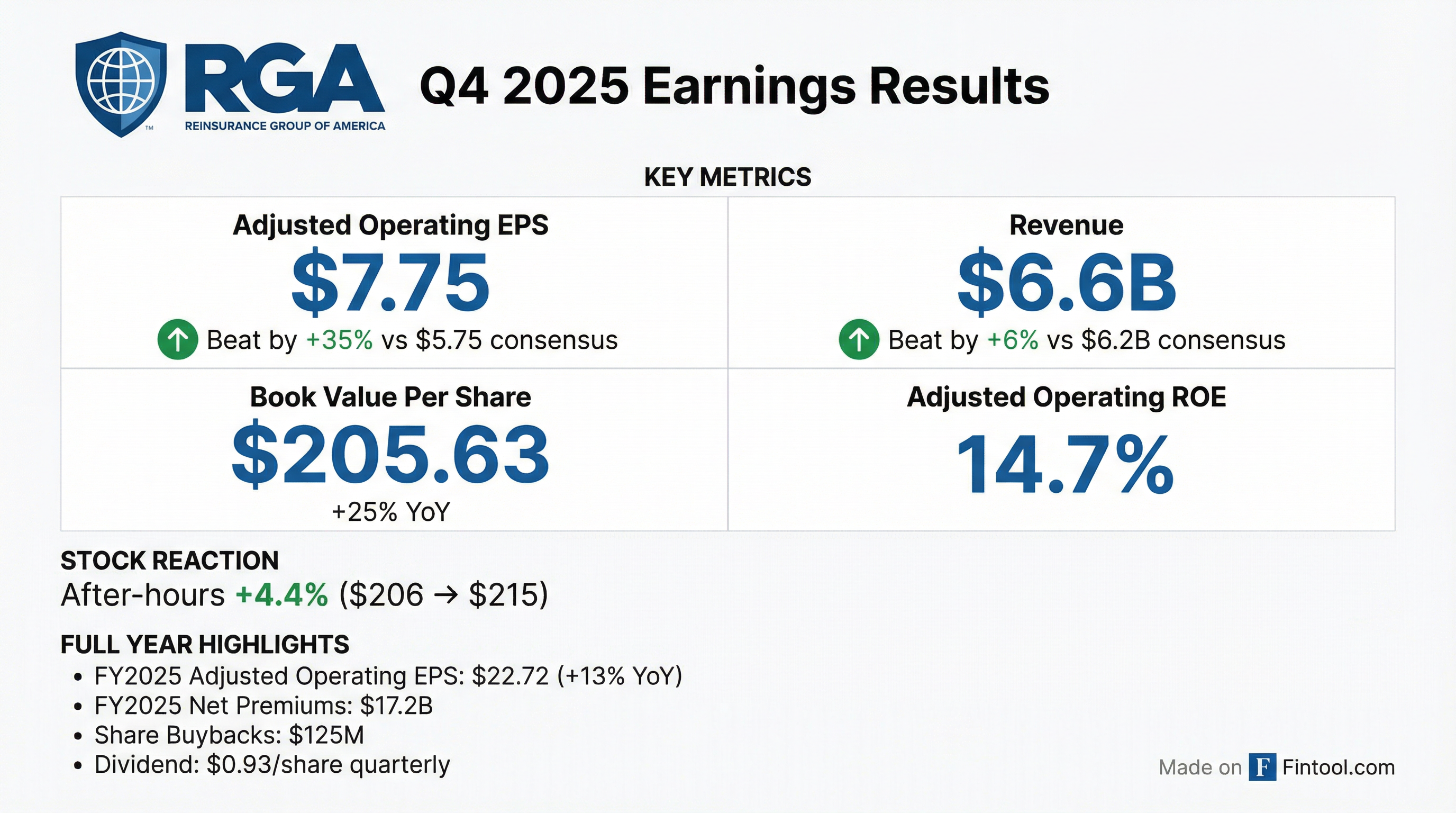

- Reinsurance Group of America (RGA) reported record Q4 operating EPS of $7.75 per share and record full-year 2025 operating EPS, with an adjusted operating return on equity of 15.7% for the trailing 12 months, exceeding its intermediate-term target range of 13%-15%.

- For the full year 2025, RGA deployed $2.5 billion of capital into Inforce transactions and repurchased $125 million of stock since reinstating buybacks in Q3 2025, ending Q4 2025 with an estimated $2.7 billion in excess capital.

- The company reiterated its intermediate-term targets of 8%-10% annual EPS growth and 13%-15% return on equity, with a 2025 run rate EPS of approximately $24.75 per share.

- For 2026, RGA expects to deploy around $1.5 billion into Inforce transactions, allocate $400 million of excess capital to reduce financial leverage, and aims for a total shareholder return of capital between 20%-30% of after-tax operating earnings.

- RGA decided to exit the U.S. Group healthcare lines of business, which had approximately $400 million in annual premium and $25 million in pre-tax run rate earnings in a typical year, with the primary financial impact expected in 2027 results.

- Reinsurance Group of America (RGA) reported record Q4 2025 operating EPS of $7.75 per share and a trailing 12-month adjusted operating return on equity of 15.7%, exceeding its intermediate-term target.

- For the full year 2025, RGA deployed $2.5 billion of capital into in-force transactions and repurchased $125 million of stock since reinstating buybacks in Q3.

- The company ended Q4 2025 with $2.7 billion in estimated excess capital and targets a 20%-30% total payout ratio for shareholder returns.

- RGA reiterated intermediate-term targets of 8%-10% annual EPS growth and 13%-15% return on equity, with a 2025 run rate EPS of $24.75 per share as a starting point for future growth expectations.

- RGA will stop writing new U.S. group healthcare business and not renew existing business, which had approximately $400 million in annual premium and typically generated $25 million in pre-tax run rate earnings.

- Reinsurance Group of America reported record Q4 operating EPS of $7.75 per share and record operating EPS for the full year 2025.

- The company achieved an adjusted operating return on equity of 15.7% for the trailing 12 months, surpassing its intermediate-term target range of 13%-15%.

- In 2025, RGA deployed $2.5 billion of capital into Inforce transactions and repurchased $125 million of stock since reinstating buybacks in Q3, ending the year with $2.7 billion of estimated excess capital.

- For 2026, RGA expects to deploy around $1.5 billion into Inforce transactions, allocate $400 million of excess capital to reduce financial leverage, and target a total shareholder return of capital between 20%-30% of after-tax operating earnings.

- RGA has decided to exit the US Group healthcare lines of business, stopping new business immediately and not renewing existing business, which had approximately $400 million of annual premium and typically generated $25 million of pre-tax run rate earnings.

- Reinsurance Group of America (RGA) reported net income available to shareholders of $6.97 per diluted share and adjusted operating income of $7.75 per diluted share for the fourth quarter of 2025.

- For the full year 2025, RGA's net income available to shareholders was $17.69 per diluted share and adjusted operating income was $22.72 per diluted share.

- The company repurchased $50 million of common shares in Q4 2025, contributing to a total of $125 million for the full year.

- RGA's board authorized a new share repurchase program of up to $500 million of common stock, effective January 29, 2026.

- A regular quarterly dividend of $0.93 was declared, payable on March 3, 2026.

- RGA's new research indicates that incretin-based drugs, such as GLP-1s, could reduce US mortality by 3.5% by 2045 in a central scenario, with optimistic and pessimistic scenarios projecting 8.8% and 1.0% reductions, respectively.

- Under the same central scenario, mortality could decrease by 2.0% in the UK, 2.6% in Canada, and 1.4% in Hong Kong by 2045.

- The research also suggests that insured groups and annuitants are likely to experience somewhat lower mortality and morbidity reductions compared to the general population.

- Mortality improvements are expected to vary by age, with the 45-59 age group seeing the biggest reduction.

- RGA reported record operating EPS, excluding notable items, of $6.37 per share for Q3 2025, with a trailing 12-month adjusted operating return on equity of 14.2%.

- The Equitable transaction closed during the quarter, contributing a full quarter of earnings in line with expectations, and is projected to contribute $70 million of pre-tax income for the full year, increasing to $160 to $170 million in 2026, and approximately $200 million per year by 2027.

- The company repurchased $75 million of common shares at an average price of $184.58 and ended the quarter with an estimated $2.3 billion in excess capital and $3.4 billion in deployable capital.

- Traditional business premium growth was 8.5% year-to-date on a constant currency basis, and the overall economic impact of annual actuarial assumption updates is positive for long-term value, expected to increase annual run rates by $15 million, growing to $25 million annually by 2040.

- Reinsurance Group of America (RGA) reported record operating EPS, excluding notable items, of $6.37 per share for Q3 2025, driven by strong performance in Asia Traditional, EMEA, and U.S. Financial Solutions.

- The Equitable transaction closed this quarter, contributing a full quarter of earnings, and is expected to contribute $70 million in pre-tax income for the full year, increasing to approximately $200 million annually by 2027.

- The company demonstrated strong new business momentum, with traditional business premiums growing 8.5% year-to-date on a constant currency basis, and deployed $2.4 billion of capital year-to-date into transactions.

- RGA repurchased $75 million of common shares during the quarter and ended with an estimated $2.3 billion in excess capital.

- Reinsurance Group of America (RGA) reported record operating EPS, excluding notable items, of $6.37 per share for Q3 2025, with strong performance in Asia Traditional, EMEA, and U.S. Financial Solutions.

- The company deployed $2.4 billion of capital year-to-date, including $1.5 billion for the Equitable transaction which closed this quarter and is expected to contribute approximately $70 million of pre-tax income for the full year 2025.

- RGA's Traditional business premiums grew 8.5% year-to-date on a constant currency basis, and the value of in-force business margins increased by 16% over the past three quarters.

- The company repurchased $75 million of common shares and ended Q3 2025 with estimated excess capital of $2.3 billion and deployable capital of $3.4 billion.

Quarterly earnings call transcripts for REINSURANCE GROUP OF AMERICA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more