Earnings summaries and quarterly performance for RENASANT.

Executive leadership at RENASANT.

Kevin Chapman

Chief Executive Officer and President

Curtis Perry

Executive Vice President, Chief Corporate Banking Officer

David Meredith

Chief Credit Officer

James Mabry IV

Chief Financial Officer

Kelly Hutcheson

Chief Accounting Officer

Mark Jeanfreau

General Counsel

Mitchell Waycaster

Executive Vice Chairman

Scott Cochran

Executive Vice President, Chief Core Banking Officer

Board of directors at RENASANT.

Albert Dale III

Director

Connie Engel

Director

Donald Clark Jr.

Director

Gary Butler

Director

Jill Deer

Director

John Creekmore

Lead Independent Director

John Foy

Director

Neal Holland Jr.

Director

Richard Heyer Jr.

Director

Robinson McGraw

Chairman of the Board

Rose Flenorl

Director

Sean Suggs

Director

Research analysts who have asked questions during RENASANT earnings calls.

David Bishop

Hovde Group

8 questions for RNST

Stephen Scouten

Piper Sandler & Co.

8 questions for RNST

Catherine Mealor

Keefe, Bruyette & Woods

7 questions for RNST

Michael Rose

Raymond James Financial, Inc.

7 questions for RNST

Matt Olney

Stephens Inc.

6 questions for RNST

Janet Lee

TD Cowen

4 questions for RNST

Jordan Ghent

Stephens Inc.

2 questions for RNST

Joseph Yanchunis

Raymond James

1 question for RNST

William Jones

Truist Securities

1 question for RNST

Recent press releases and 8-K filings for RNST.

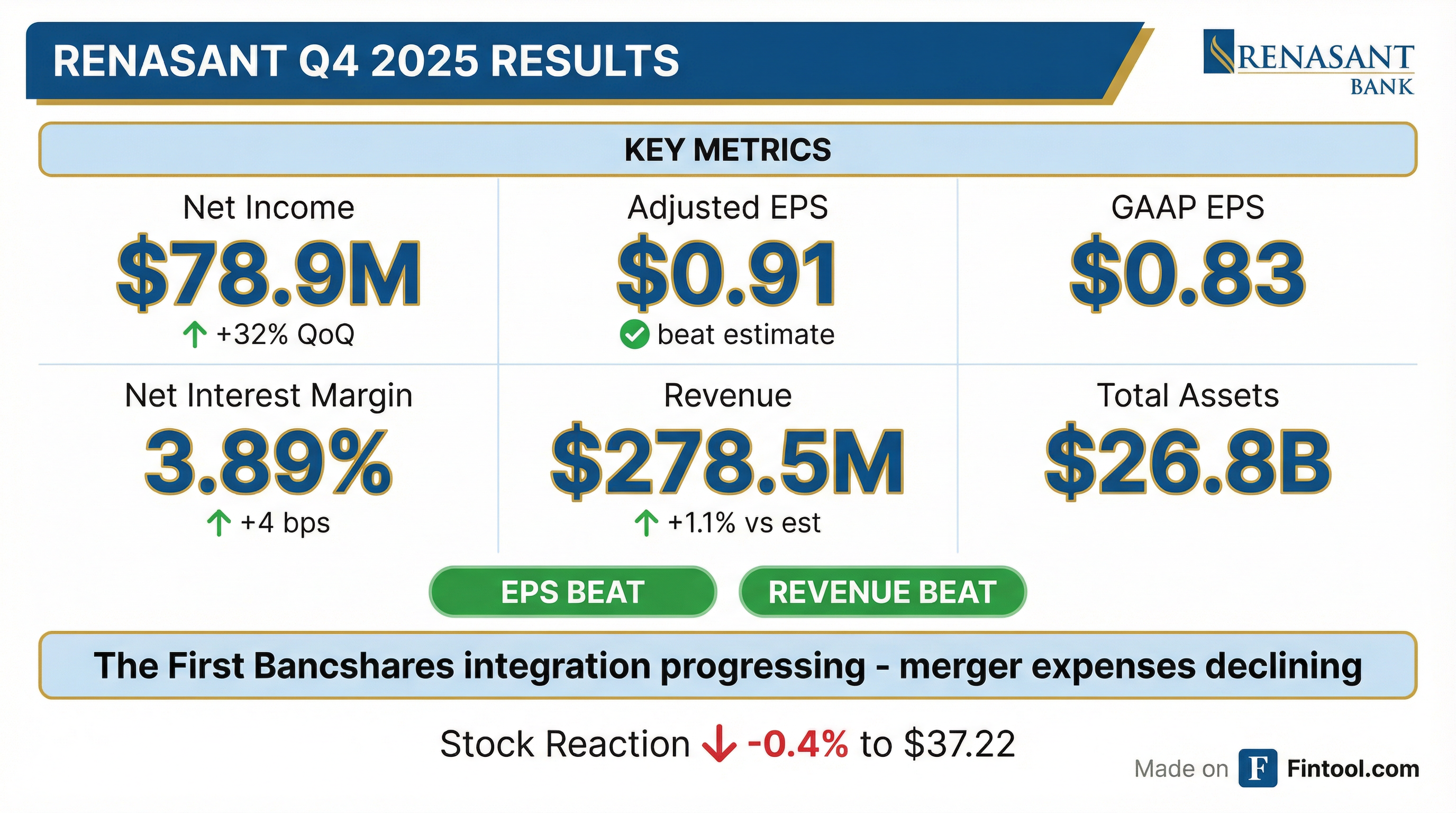

- Renasant Corporation reported net income of $78.9 million and diluted EPS of $0.83 for the fourth quarter of 2025.

- As of December 31, 2025, the company's assets were $26.8 billion, loans $19.0 billion, deposits $21.5 billion, and equity $3.9 billion.

- During Q4 2025, loans increased $21.5 million (0.4% annualized) and deposits increased $48.5 million linked quarter.

- The company repurchased $13.2 million of common stock at a weighted average price of $34.29 in Q4 2025.

- Renasant Corporation (RNST) reported strong adjusted earnings for Q4 2025, with adjusted diluted EPS of $0.91, adjusted return on average assets (ROAA) of 1.29%, and adjusted return on tangible common equity (ROTCE) of 16.18%.

- For the full year 2025, adjusted EPS increased 11% to $3.06, adjusted ROA grew to 110 basis points, and the adjusted efficiency ratio improved to 57.46%.

- The company achieved organic loan and deposit growth in 2025 and completed the systems conversion from the merger with The First. Additionally, $117 million of non-core loans acquired from The First were sold in Q4 2025.

- Management expects core expense reductions of $2-$3 million in Q1 2026 and projects a stable Net Interest Margin (NIM) with mid-single-digit loan growth for 2026.

- Capital deployment priorities include organic growth and continued share buybacks into 2026, with M&A remaining a potential option.

- Renasant Corporation reported adjusted earnings per share of $3.06 for the full year 2025, representing an 11% increase year-over-year, with adjusted ROA growing to 110 basis points and the adjusted efficiency ratio improving to 57.46%.

- For Q4 2025, the company's net income was $78.9 million or $0.83 per diluted share, with adjusted earnings reaching $86.9 million or $0.91 per diluted share.

- The company experienced organic growth in Q4 2025, with loans up $21.5 million (0.4% annualized) and deposits up $48.5 million (0.9% annualized) on a linked-quarter basis.

- Management anticipates continued core expense reduction of $2-$3 million in Q1 2026 and targets mid-single-digit loan growth for the full year 2026, with a relatively stable net interest margin.

- Renasant aims to further improve its profitability to achieve a top-performing status, acknowledging that its current performance places it in the middle of its peer group.

- Renasant Corporation reported adjusted earnings per share of $3.06 for the full year 2025, an 11% increase year-over-year, with adjusted return on assets (ROA) growing to 110 basis points and the adjusted efficiency ratio improving to 57.46%.

- For Q4 2025, the company achieved adjusted diluted EPS of $0.91, an adjusted return on average assets of 1.29%, and an adjusted return on tangible common equity of 16.18%. Loans grew 0.4% annualized and deposits grew 0.9% annualized on a linked-quarter basis.

- Management projects mid-single-digit loan growth for 2026 and expects the net interest margin to remain relatively stable despite anticipated Fed rate cuts.

- The company plans to continue share buyback activity in 2026, aiming to maintain its CET1 ratio around 11.25% by year-end.

- Renasant reported a net income of $78.9 million with diluted EPS of $0.83 and adjusted diluted EPS of $0.91 for the fourth quarter of 2025.

- Loans increased by $21.5 million, or 0.4% annualized, despite the sale of approximately $117.3 million of non-core loans acquired from The First. Deposits increased by $48.5 million linked quarter, representing 0.9% annualized growth.

- Asset quality metrics showed nonperforming loans at 0.92% of total loans, an increase of 2 basis points, while the allowance for credit losses on loans to total loans decreased 2 basis points to 1.54%.

- The company repurchased $13.2 million of common stock at a weighted average price of $34.29 during the quarter.

- Renasant Corporation reported net income of $78.9 million for the fourth quarter of 2025, with diluted EPS of $0.83 and adjusted diluted EPS (non-GAAP) of $0.91.

- The company's net interest margin was 3.89% for Q4 2025, an increase of 4 basis points linked quarter, while the cost of total deposits decreased by 17 basis points to 1.97%.

- Loans increased by $21.5 million and deposits grew by $48.5 million linked quarter as of December 31, 2025.

- During the fourth quarter of 2025, Renasant repurchased $13.2 million of common stock at a weighted average price of $34.29 and redeemed $60.0 million in subordinated notes.

- As of December 31, 2025, nonperforming loans to total loans stood at 0.92%, and the allowance for credit losses on loans to total loans was 1.54%.

- Renasant Corporation reported net income of $78,948 thousand and diluted EPS of $0.83 for the fourth quarter of 2025.

- The company's net interest income (fully tax equivalent) was $232.4 million, an increase of $4.2 million linked quarter, with a net interest margin of 3.89%.

- Loans increased by $21.5 million and deposits increased by $48.5 million linked quarter.

- During the fourth quarter of 2025, the company repurchased $13.2 million of common stock under its $150.0 million stock repurchase program.

- The CEO noted continued improvement in profitability and significant progress on the integration of The First.

- Renasant reported net income of $59.8 million and diluted EPS of $0.63 for Q3 2025, with adjusted diluted EPS (non-GAAP) of $0.77.

- Loans increased by $462.1 million, or 9.9% annualized, while deposits decreased by $158.1 million linked quarter.

- Nonperforming loans represented 0.90% of total loans, an increase of 14 basis points linked quarter.

- The Board of Directors approved a $150.0 million stock repurchase program, replacing the previous $100.0 million program, effective October 28, 2025.

- Renasant Corporation reported net income of $59.8 million or $0.63 per diluted share for Q3 2025, with adjusted earnings (excluding merger charges) of $72.9 million or $0.77 per diluted share.

- The company achieved loan growth of $462 million on a linked quarter basis, representing a 9.9% annualized increase, while deposits decreased $158 million due to seasonal public funds outflows.

- Adjusted net interest margin improved by four basis points to 3.62% on a linked quarter basis, and adjusted return on average assets reached 1.09%, an improvement of 12 basis points from a year ago.

- Management expects a $2 million to $3 million decrease in core non-interest expense in Q4 2025 and another similar decrease in Q1 2026, with a modest contraction in net interest margin in Q4 2025 followed by modest expansion in 2026.

- The company's regulatory capital ratios remain strong, and it is considering share buybacks as a capital lever, having recently redeemed $60 million of sub debt.

- Renasant Corporation reported Q3 2025 net income of $59.8 million or $0.63 per diluted share, with adjusted earnings of $72.9 million or $0.77 per diluted share. The company achieved 9.9% annualized loan growth and improved its adjusted return on average assets to 1.09% and adjusted return on tangible common equity to 14.22%.

- The company anticipates a $2 million to $3 million decrease in core non-interest expense for Q4 2025 and an additional $2 million to $3 million decrease in Q1 2026. Management expects modest core margin contraction in Q4 2025, followed by modest expansion in 2026, assuming four rate cuts by year-end 2026.

- Capital ratios are projected to grow 60 to 70 basis points by year-end 2026, and the company recently redeemed $60 million of sub debt and increased its common dividend announcement, with buybacks being considered as a capital lever.

- Deposits decreased by $158 million from Q2, primarily due to a $169 million seasonal decrease in public funds, with a strategic focus on growing core deposits in line with loan growth.

Quarterly earnings call transcripts for RENASANT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more