Earnings summaries and quarterly performance for Roivant Sciences.

Executive leadership at Roivant Sciences.

Board of directors at Roivant Sciences.

Research analysts who have asked questions during Roivant Sciences earnings calls.

Brian Cheng

JPMorgan Chase & Co.

6 questions for ROIV

Douglas Tsao

H.C. Wainwright & Co.

6 questions for ROIV

David Risinger

Leerink Partners

5 questions for ROIV

Dennis Ding

Jefferies Financial Group Inc.

5 questions for ROIV

Yaron Werber

TD Cowen

5 questions for ROIV

Corinne Johnson

Goldman Sachs

3 questions for ROIV

Thomas Smith

Leerink Partners

3 questions for ROIV

Yatin Suneja

Guggenheim Partners

3 questions for ROIV

Andy Chen

Wolfe Research, LLC

2 questions for ROIV

Brandon Frith

Wolfe Research, LLC

2 questions for ROIV

Derek Archila

Wells Fargo

2 questions for ROIV

Emma Gutstein

Wolfe Research

2 questions for ROIV

Prakhar Agrawal

Cantor Fitzgerald

2 questions for ROIV

Samantha Semenkow

Citigroup Inc.

2 questions for ROIV

Sam Sliski

Lifesize Capital

2 questions for ROIV

Sam Slutsky

LifeSci Capital, LLC

2 questions for ROIV

Yasmeen Rahimi

Piper Sandler & Co.

2 questions for ROIV

Anthea Li

Jefferies

1 question for ROIV

Craig McLean

Goldman Sachs

1 question for ROIV

Joyce Zhou

TD Cowen

1 question for ROIV

Louise Chen

Cantor Fitzgerald

1 question for ROIV

Recent press releases and 8-K filings for ROIV.

- Roivant Sciences reported positive Phase II results for brepocitinib in cutaneous sarcoidosis, showing a 21.6-point placebo-adjusted delta in CSAMI and 100% of patients on the 45mg dose achieving a 10-point improvement.

- The company announced an NDA filing for brepocitinib in dermatomyositis and plans to initiate a Phase III study for brepocitinib in cutaneous sarcoidosis in 2026.

- Key clinical trials, including the Phase IIb study for IMVT-1402 in D2T-RA and the Phase II study for mosliciguat in PH-ILD, have fully enrolled, with data readouts anticipated in the second half of 2026 for both.

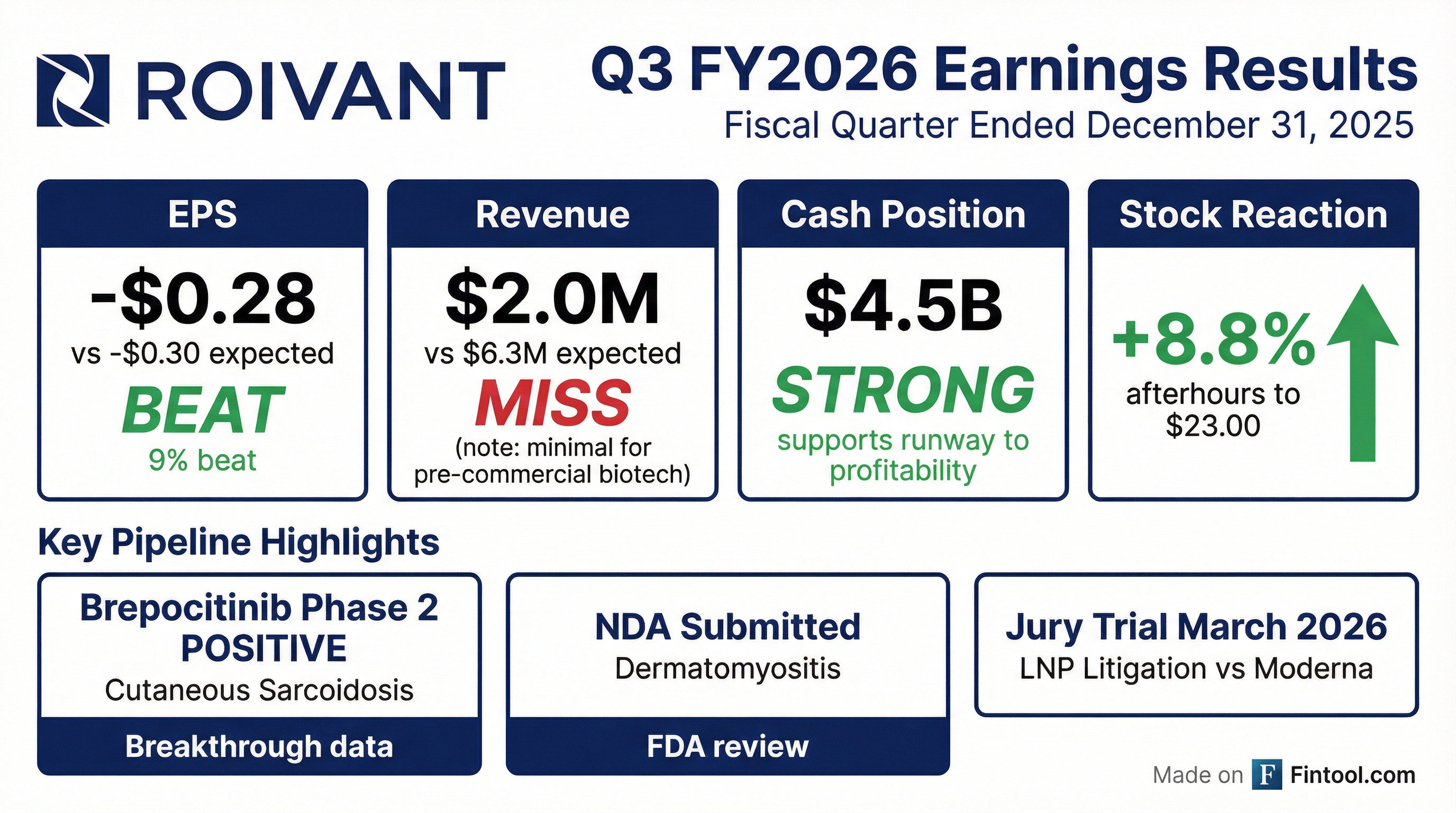

- For the third quarter ended December 31, 2025, Roivant reported a non-GAAP net loss of $167 million, with adjusted non-GAAP R&D expenses of $147 million and G&A expenses of $71 million.

- A jury trial against Moderna is scheduled to commence on March 9th.

- Roivant Sciences reported a non-GAAP net loss of $167 million for Q3 2026, with $147 million in adjusted non-GAAP R&D expense and $71 million in adjusted non-GAAP G&A expense, while maintaining $4.5 billion in consolidated cash.

- The company announced positive Phase 2 results for brepocitinib in cutaneous sarcoidosis, demonstrating a statistically significant 21.6-point placebo-adjusted delta in CSAMI, and 100% of patients on the high dose achieved at least a 10-point improvement.

- An NDA for brepocitinib in dermatomyositis has been filed, and a Phase 3 study for brepocitinib in cutaneous sarcoidosis is scheduled to commence in 2026.

- Key clinical trials, including the Phase 2b study for IMVT-1402 in D2T-RA and the Phase 2 study for mosliciguat in PH-ILD, have fully enrolled, with data for both expected in the second half of 2026.

- A jury trial against Moderna is set to begin on March 9th, following a favorable decision on Section 1498.

- Roivant reported a non-GAAP net loss of $167 million for the third quarter ended December 31, 2025, and holds $4.5 billion in consolidated cash.

- The company announced positive Phase 2 results for brepocitinib in cutaneous sarcoidosis, demonstrating a 21.6-point placebo-adjusted delta and a 100% response rate for the 45mg dose, with the drug being very well tolerated. A Phase 3 study for this indication is set to begin in 2026.

- The New Drug Application (NDA) for brepocitinib in dermatomyositis has been filed.

- Studies for 1402 in D2T-RA and mosliciguat in PH-ILD are fully enrolled, with data expected in the second half of 2026.

- The jury trial against Moderna is scheduled for March 9th, following a favorable decision on Section 1498.

- Roivant reported consolidated cash, cash equivalents, restricted cash, and marketable securities of $4.5 billion as of December 31, 2025, supporting cash runway into profitability. For the third quarter ended December 31, 2025, the company recorded a net loss attributable to Roivant Sciences Ltd. of $(265.891) million and revenue of $1.999 million.

- The company announced positive Phase 2 results for brepocitinib in cutaneous sarcoidosis (CS), with the 45 mg dose significantly improving disease activity, and plans to progress to a Phase 3 study in 2026.

- A New Drug Application (NDA) was submitted to the FDA for brepocitinib in dermatomyositis (DM), and topline data from Phase 3 studies for brepocitinib in non-infectious uveitis (NIU) are expected in the second half of calendar year 2026.

- Roivant-led Immunovant financing generated approximately $550 million in gross proceeds, extending Immunovant’s cash runway.

- Priovant Therapeutics announced positive results from its Phase 2 BEACON study for brepocitinib in cutaneous sarcoidosis (CS), a condition currently lacking approved therapies.

- The brepocitinib 45 mg arm demonstrated significant efficacy, achieving a 22.3-point improvement in mean CSAMI-A at Week 16 versus a 0.7-point improvement in placebo (P<0.0001).

- Additionally, 69% of brepocitinib 45 mg patients achieved a two-point improvement to "Clear" or "Almost Clear" on the Investigator’s Global Assessment (IGA), compared to 0% of placebo patients (P=.0047).

- Brepocitinib was well tolerated during the study, with no Serious Adverse Events (SAEs) reported and all Adverse Events (AEs) graded mild or moderate.

- Priovant plans to initiate a Phase 3 study for brepocitinib in CS in calendar year 2026, making it the third indication for brepocitinib to enter a pivotal program.

- Roivant reported a net loss attributable to Roivant Sciences Ltd. of $265.891 million for the three months ended December 31, 2025, compared to a net income of $169.381 million for the same period in 2024.

- The company announced positive Phase 2 results for brepocitinib in cutaneous sarcoidosis (CS), with the 45 mg arm achieving a 22.3-point improvement in mean CSAMI-A at Week 16 versus a 0.7-point improvement in placebo (Δ21.6 p<0.0001), and plans to initiate a Phase 3 study in calendar year 2026.

- A New Drug Application (NDA) was submitted to the FDA for brepocitinib in dermatomyositis (DM).

- As of December 31, 2025, Roivant held $4.5 billion in consolidated cash, cash equivalents, restricted cash, and marketable securities, supporting cash runway into profitability.

- Roivant maintains a strong financial position with $4.4 billion in cash as of its last filing, is capitalized to profitability, and has an additional $500 million authorized for share buybacks.

- The company expects to file its NDA for brepocitinib in dermatomyositis by early 2026, setting up a commercial launch.

- Key clinical milestones for 2026 include top-line data for brepocitinib in non-infectious uveitis (NIU) and mosliciguat in PH-ILD in the second half, as well as full RA data for IMVT-1402.

- A jury trial for ongoing litigation with Moderna is scheduled for March 2026.

- Roivant reported a strong financial position with $4.4 billion in cash as of its last filing, stating it is capitalized to profitability and does not need to raise money.

- The company achieved positive data for brepocitinib in dermatomyositis (DM) in 2025 and expects to file its NDA by early 2026.

- For 2026, key milestones include the NDA filing for brepocitinib in DM, top-line data for brepocitinib in NIU and mosliciguat in PH-ILD in the second half, and a jury trial in March for the Moderna litigation.

- Roivant has executed a $1.5 billion stock buyback at an average of $10 per share, with an additional $500 million authorized.

- The company has simplified its focus to a smaller subset of higher-value products, with brepocitinib and IMVT-1402 identified as potential multi-billion dollar opportunities, contributing to an eventual $15 billion-plus peak sales opportunity.

- Roivant reported a strong capital position with $4.4 billion in cash as of its last filing, stating it does not need to raise money and has a pipeline capitalized to profitability.

- The company expects an NDA filing for brepocitinib in dermatomyositis by early 2026 and anticipates top-line data in the second half of 2026 for brepocitinib in NIU and mosliciguat for PH-ILD.

- Roivant has a jury trial scheduled for March in its ongoing litigation with Moderna regarding lipid nanoparticle chemistry.

- The company also completed a $1.5 billion stock buyback at an average of $10 per share, with an additional $500 million authorized.

- Roivant reported a strong capital position with $4.4 billion in cash and equivalents as of January 12, 2026, and is funded into profitability.

- The company achieved strong execution in 2025, including positive VALOR data for brepocitinib in DM, positive Phase 3 batoclimab data in MG and CIDP, and a favorable Markman ruling for Genevant in the Pfizer case.

- Roivant anticipates a catalyst-rich year in 2026, with a planned NDA filing for brepocitinib in DM in early 2026 and multiple key topline data readouts for brepocitinib, mosliciguat, and IMVT-1402.

- A jury trial in the US Moderna LNP litigation case is scheduled for March 2026, with initial court hearings in ex-US Moderna cases expected in 2026.

Quarterly earnings call transcripts for Roivant Sciences.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more