Earnings summaries and quarterly performance for Rush Street Interactive.

Executive leadership at Rush Street Interactive.

Richard Schwartz

Chief Executive Officer

Einar Roosileht

Chief Information Officer

Kyle Sauers

President and Chief Financial Officer

Mattias Stetz

Chief Operating Officer

Neil Bluhm

Executive Chairman

Paul Wierbicki

Chief Legal Officer and General Counsel

Board of directors at Rush Street Interactive.

Research analysts who have asked questions during Rush Street Interactive earnings calls.

Chad Beynon

Macquarie

4 questions for RSI

David Katz

Jefferies Financial Group Inc.

4 questions for RSI

Jed Kelly

Oppenheimer & Co. Inc.

4 questions for RSI

Jordan Bender

JMP Securities

4 questions for RSI

Ryan Sigdahl

Craig-Hallum Capital Group

4 questions for RSI

Joseph Stauff

Susquehanna Financial Group, LLLP

3 questions for RSI

Bernard McTernan

Needham & Company

2 questions for RSI

Daniel Politzer

Wells Fargo

2 questions for RSI

Michael Hickey

The Benchmark Company, LLC

1 question for RSI

Stefanos Crist

Needham & Company, LLC

1 question for RSI

Zachary Silverberg

Wells Fargo & Company

1 question for RSI

Recent press releases and 8-K filings for RSI.

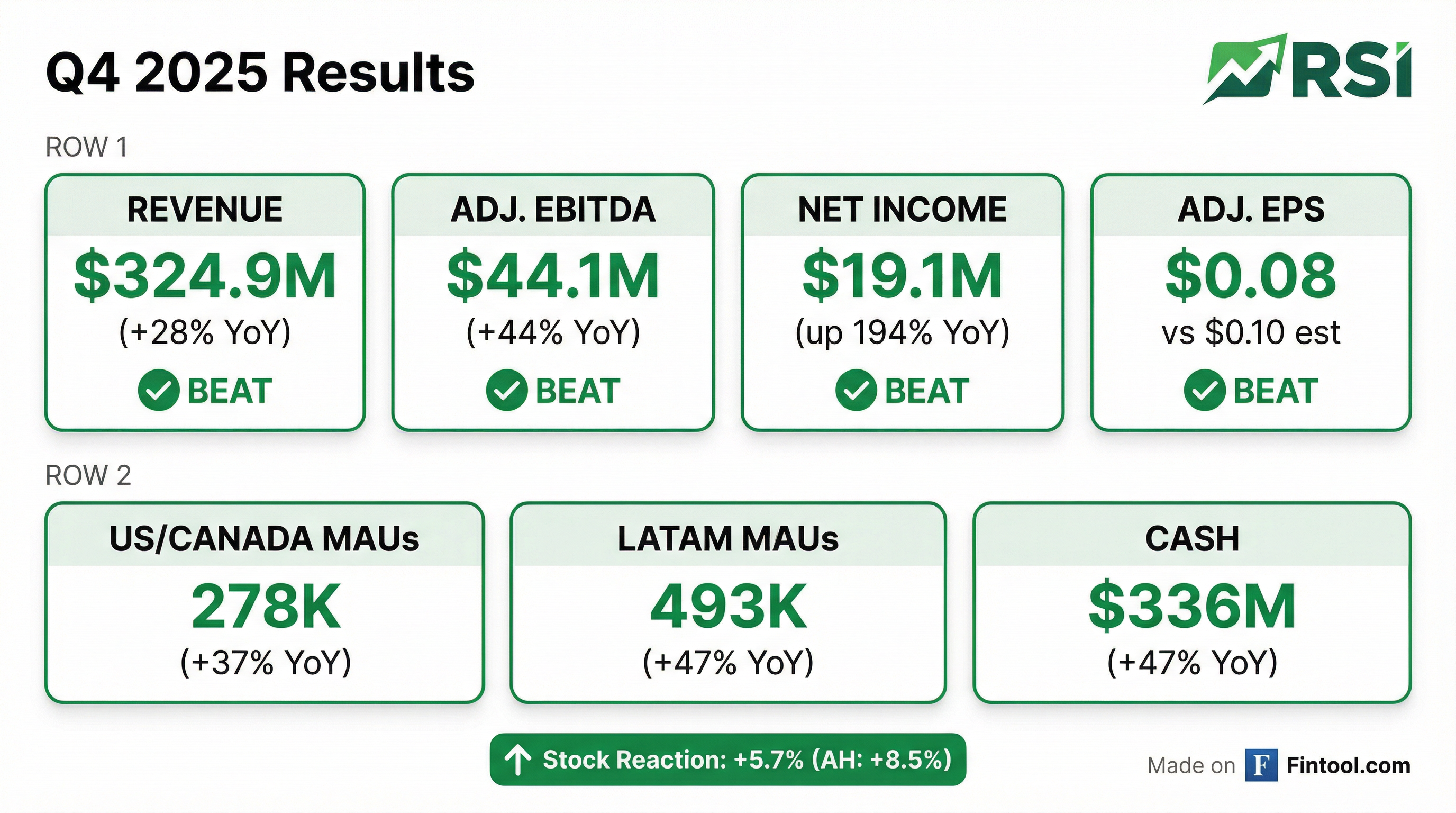

- Rush Street Interactive (RSI) reported record quarterly revenue of $325 million in Q4 2025, up 28% year-over-year, and record full-year revenue of $1.13 billion for FY 2025, an increase of 23% year-over-year. The company also achieved record Adjusted EBITDA of $44 million in Q4 2025, up 44% year-over-year, and $154 million for FY 2025, a 66% year-over-year increase.

- For FY 2026, RSI initiated revenue guidance of $1.375 billion to $1.425 billion, implying 23% year-over-year growth at the midpoint, and Adjusted EBITDA guidance of $210 million to $230 million, implying 43% growth at the midpoint.

- The company ended Q4 2025 with a strong balance sheet, holding $336 million in unrestricted cash and no debt.

- RSI expanded its offerings with the launch of BetRivers Poker Multi-State, now live with shared liquidity across Pennsylvania, Michigan, Delaware, and West Virginia.

- Rush Street Interactive reported record full-year 2025 revenue of $1.13 billion, a 23% year-over-year increase, and Adjusted EBITDA of $153.7 million, a 66% year-over-year increase, both exceeding raised guidance.

- For 2026, the company expects revenue between $1.375 billion and $1.425 billion (21%-26% year-over-year growth) and Adjusted EBITDA between $210 million and $230 million (37%-50% year-over-year growth).

- User engagement remained strong, with North American Monthly Active Users (MAUs) growing 37% year-over-year in Q4 2025 to 278,000, and Latin American MAUs increasing 47% to 493,000.

- RSI ended 2025 with $336 million in cash on hand and generated $142 million in cash during the year, net of stock repurchases.

- The company anticipates a launch in Alberta in the coming quarters, which is not included in 2026 guidance, and plans to increase investments in differentiated casino content and online casino legalization efforts.

- Rush Street Interactive reported record quarterly revenue of $324.9 million for Q4 2025, an increase of 28% year-over-year, and full-year 2025 revenue of $1,134 million, exceeding the high end of guidance.

- Net income for Q4 2025 was $19.1 million, with full-year 2025 net income at $74.0 million.

- Record quarterly Adjusted EBITDA reached $44.1 million in Q4 2025, up 44% year-over-year, and full-year Adjusted EBITDA was $153.7 million, surpassing the high end of guidance.

- For full-year 2026, RSI initiated revenue guidance between $1,375 and $1,425 million and Adjusted EBITDA guidance between $210 and $230 million.

- As of December 31, 2025, unrestricted cash and cash equivalents were $336 million.

- Rush Street Interactive reported record quarterly revenue of $324.9 million for Q4 2025, a 28% increase year-over-year, and full year 2025 revenue of $1,134 million, exceeding the high end of guidance.

- The company achieved record quarterly Adjusted EBITDA of $44.1 million for Q4 2025, up 44% year-over-year, and full year 2025 Adjusted EBITDA of $153.7 million, surpassing the high end of guidance.

- Net income for Q4 2025 was $19.1 million, with full year 2025 net income reaching $74.0 million.

- For full year 2026, RSI initiated revenue guidance of $1,375 to $1,425 million and Adjusted EBITDA guidance of $210 to $230 million.

- Rogers Sugar Inc. reported strong first quarter fiscal 2026 results, with consolidated adjusted EBITDA increasing 18% to $46.9 million and net earnings reaching $28.5 million.

- The LEAP Project is progressing as planned, with $21.1 million capitalized in Q1 2026, maintaining its total cost estimate of $280 million to $300 million and an anticipated in-service date in the first half of calendar 2027.

- The Sugar segment's adjusted EBITDA rose to $41.1 million, despite a decrease in sales volume to 175,000 metric tonnes due to declines in Industrial and Export sales, while the Maple segment's adjusted EBITDA slightly increased to $5.8 million.

- The company issued $57.5 million in Ninth series convertible unsecured subordinated debentures on January 12, 2026, maturing in 2033 with a 5.5% interest rate.

- For fiscal 2026, Rogers Sugar anticipates continued strong financial results, projecting $116 million in LEAP Project spending and a 750,000 metric tonne sales volume for the Sugar segment, a 4% reduction from 2025 due to lower export sales.

- Rush Street Interactive (RSI) achieved 46% year-over-year growth in North American online casino monthly active users in Q3 2025, alongside record first-time depositors, driven by its focus on the casino market and proprietary technology.

- The company expects significant revenue and profitability improvements from a new tax regime in Colombia, effective January 1, 2026, which replaces a prior tax that had an estimated annual impact of $70 million in revenue and $25 million in EBITDA.

- RSI is preparing for a planned iCasino launch in Alberta, Canada, later in 2026, and sees major opportunities in potential iGaming legalization in New York and Virginia.

- EBITDA margins progressed to 13.5% in 2025, with a long-term target of low to mid 20%, driven by operational leverage and strategic marketing investments.

- RSI reported significant Q3 growth in North America, with monthly active users up 34% overall and 46% in online casino markets, marking the fastest year-over-year growth in four years, alongside record first-time depositors up 10% over the prior quarter.

- The company anticipates new iGaming legalization opportunities in large states like New York, Virginia, Indiana, and Maryland, and is planning a launch in Alberta later this year, with regulations recently published.

- In Colombia, a temporary 19% tax on deposits in 2025 was replaced on January 1st, 2026, by a 19% tax on revenue after bonusing, which is expected to result in a meaningful lift in revenue and improved profitability.

- RSI's marketing team has successfully reduced the cost of acquiring new customers while increasing volume, contributing to a progression in EBITDA margins from -16% in 2022 to 13.5% in 2025, with expectations to reach low to mid 20% longer term.

- Latin American markets, including Colombia, Mexico, and Peru, are experiencing strong growth, with player counts in Latin America up 30% in Q3 and over 50% in August and September; the upcoming World Cup is expected to further boost player acquisition.

- Rush Street Interactive (RSI) projects over $1.1 billion in revenue and $150 million in Adjusted EBITDA for the midpoint of its 2025 guidance, with expectations for very solid growth in 2026.

- The company's strategy emphasizes online casino, which accounts for 70% of revenue, primarily in North America (85% of revenue), leading to significant organic growth, including a 46% year-over-year increase in North American monthly active users in online casino markets in Q3.

- RSI demonstrated strong performance in key North American markets, with Michigan revenue up 50% and New Jersey up 20% in October and November, and Delaware growing over 60% year-over-year in the same period. New online casino markets in Alberta and Maine are anticipated as future growth catalysts.

- In Latin America, despite a 2025 tax headwind, Colombia experienced growth in player count and gross gaming revenue, and a new 19% VAT on revenue for 2026 is expected to be incrementally positive for profitability. Mexico's growth accelerated, increasing over 100% year-over-year in recent quarters.

- RSI's proprietary technology, featuring unique promotional games and community features, drives an average revenue per monthly active user of $350-$400, which is 2-3 times higher than competitors, and enables new online casino markets to achieve profitability by their fourth quarter of operation.

- Rush Street Interactive (RSI) projects over $1.1 billion in revenue and $150 million in Adjusted EBITDA for 2025, with expectations for very solid growth in 2026.

- The company demonstrated strong organic growth in North America, with monthly active users in online casino markets increasing 46% year-over-year in Q3, and reported significant revenue growth in states like Michigan (up 50% for RSI) and New Jersey (up 20% for RSI) in October/November.

- RSI is poised for further expansion with Alberta (Canada) expected to launch online casino and sports in the next quarter or two, and Maine recently approving online casino. The company consistently achieves profitability in new North American online casino markets by the fourth quarter of operation.

- In Latin America, RSI's Mexico operations grew over 100% year-over-year in recent quarters, and a favorable tax change in Colombia for 2026 (19% VAT on revenue) is anticipated to enhance profitability.

- RSI's proprietary technology and customer-centric approach lead to an average revenue per monthly active user of $350-$400, which is 2-3 times higher than competitors' reported figures.

- Rush Street Interactive (RSI) provided FY 2025 guidance of approximately $1.1 billion in revenue and $150 million in Adjusted EBITDA, with expectations for solid growth in 2026.

- The company reported strong North American growth, with Q3 2025 Monthly Active Users (MAU) up 34% overall and 46% in online casino markets year over year. This momentum continued into Q4 2025, with RSI's revenue in Michigan up approximately 50% and Delaware growing over 60% year over year in October and November.

- RSI is expanding into new North American markets like Alberta and Maine, and has a proven track record of achieving profitability in new online casino markets by the fourth quarter of operation.

- In Latin America, Mexico experienced over 100% year-over-year growth in recent quarters, and a new 19% VAT on revenue in Colombia for 2026 is expected to be incrementally positive for profitability.

- RSI differentiates its online casino product with unique promotional games, leading to an average revenue per monthly active user of $350-$400, which is two to three times competitors' reported figures.

Quarterly earnings call transcripts for Rush Street Interactive.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more