Earnings summaries and quarterly performance for SIRIUS XM HOLDINGS.

Executive leadership at SIRIUS XM HOLDINGS.

Jennifer Witz

Chief Executive Officer

Richard Baer

Executive Vice President, General Counsel and Secretary

Scott Greenstein

President and Chief Content Officer

Thomas Barry

Executive Vice President and Chief Financial Officer

Wayne Thorsen

Executive Vice President and Chief Operating Officer

Board of directors at SIRIUS XM HOLDINGS.

Anjali Sud

Director

Dave Stephenson

Director

David Zaslav

Director

Eddy Hartenstein

Director

Evan Malone

Director

Gregory Maffei

Chairman of the Board

Jonelle Procope

Director

Kristina Salen

Lead Independent Director

Michael Rapino

Director

Research analysts who have asked questions during SIRIUS XM HOLDINGS earnings calls.

Cameron Mansson-Perrone

Morgan Stanley

6 questions for SIRI

Kutgun Maral

Evercore ISI

6 questions for SIRI

Stephen Laszczyk

Goldman Sachs

6 questions for SIRI

Steven Cahall

Wells Fargo & Company

6 questions for SIRI

Barton Crockett

Rosenblatt Securities

5 questions for SIRI

David Joyce

Seaport Research Partners

5 questions for SIRI

Brian Kraft

Deutsche Bank

2 questions for SIRI

Jessica Reif

Bank of America

2 questions for SIRI

Jessica Reif Cohen

Bank of America Merrill Lynch

2 questions for SIRI

Jason Bazinet

Citigroup

1 question for SIRI

Jessica Reif Ehrlich

Bank of America Securities

1 question for SIRI

Sebastiano Petti

JPMorgan Chase & Co.

1 question for SIRI

Recent press releases and 8-K filings for SIRI.

- Sirius XM Holdings Inc. announced the pricing of an upsized offering of $1,250,000,000 of 5.875% Senior Notes due 2032, an increase of $250 million from the original offering size.

- The proceeds will be used to purchase or redeem existing debt, specifically the 3.125% Senior Notes due 2026 and $250 million of the 5.000% Senior Notes due 2027, both at par plus accrued interest.

- As of December 31, 2025, $1.0 billion of the 3.125% Notes and $1.5 billion of the 5.000% Notes were outstanding.

- The offering is expected to close on or about March 4, 2026, subject to customary closing conditions.

- Sirius XM Radio LLC, a subsidiary of SiriusXM, priced an offering of $1,250,000,000 of 5.875% Senior Notes due 2032.

- The offering size was increased by $250,000,000, and the sale is expected to be consummated on or about March 4, 2026.

- The net proceeds, combined with cash on hand, will be used to purchase or redeem 3.125% Senior Notes due 2026 (with $1,000 million outstanding as of December 31, 2025) and redeem $250.0 million aggregate principal amount of 5.000% Senior Notes due 2027.

- Sirius XM Radio LLC, a subsidiary of SiriusXM, announced its intention to offer $1,000,000,000 of Senior Notes due 2032.

- The net proceeds from this new offering, combined with cash on hand, will be used to purchase any and all of its outstanding 3.125% Senior Notes due 2026 through a concurrent cash tender offer.

- As of December 31, 2025, the aggregate principal amount of the 3.125% Notes outstanding was $1,000,000,000.

- The cash tender offer for the 3.125% Senior Notes due 2026 commenced on February 26, 2026, and is scheduled to expire on March 4, 2026.

- Sirius XM Radio LLC, a subsidiary of Sirius XM Holdings Inc. (NASDAQ: SIRI), has launched a cash tender offer to purchase any and all of its outstanding $1,000,000,000 3.125% Senior Notes due 2026.

- The offer is set to expire at 5:00 p.m., New York City time, on March 4, 2026, with the initial payment expected on March 5, 2026.

- The tender offer is contingent upon the successful completion of a contemporaneous senior notes offering that yields at least $1,000.0 million in gross cash proceeds.

- Sirius XM Radio LLC, a subsidiary of SiriusXM, intends to offer $1,000,000,000 of Senior Notes due 2032.

- The net proceeds from this offering, along with cash on hand, will be used to purchase or redeem its outstanding 3.125% Senior Notes due 2026.

- As of December 31, 2025, $1,000,000,000 aggregate principal amount of the 3.125% Notes were outstanding.

- SiriusXM reported full-year 2025 revenue of $8.56 billion, Adjusted EBITDA of $2.67 billion, and free cash flow of $1.26 billion, exceeding its original free cash flow guidance.

- For 2026, the company projects revenue of approximately $8.5 billion and Adjusted EBITDA of approximately $2.6 billion, both largely flat year-over-year, while free cash flow is expected to grow to approximately $1.35 billion.

- The company achieved $250 million in incremental gross cost savings in 2025, surpassing its target, and anticipates an additional $100 million in gross cost savings in 2026.

- Zach Coughlin joined as Chief Financial Officer on January 1, 2026, and SiriusXM reduced total debt by $669 million in 2025, ending the year with a net debt to Adjusted EBITDA ratio of 3.6x.

- Strategic highlights include a new three-year agreement with Howard Stern, the launch of a new automotive Pandora app, and the expansion of its dealer three-year subscription program with OEMs.

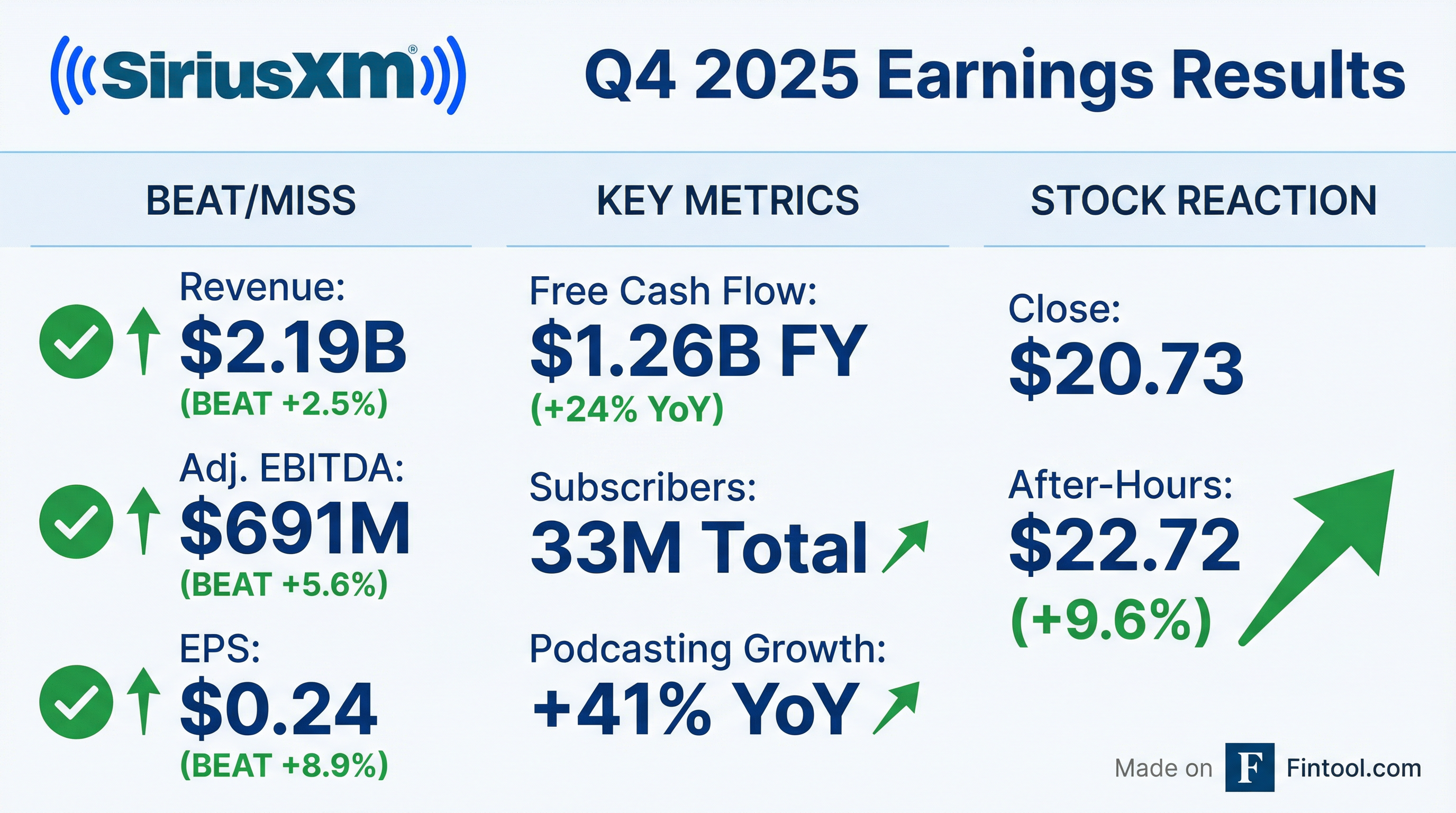

- SiriusXM reported strong Q4 2025 results with $2.19 billion in total revenue and $691 million in adjusted EBITDA, and full-year 2025 results exceeding guidance, including $8.56 billion in revenue, $2.67 billion in adjusted EBITDA, and $1.26 billion in free cash flow.

- For 2026, the company expects approximately $8.5 billion in revenue, $2.6 billion in adjusted EBITDA, and $1.35 billion in free cash flow, while also targeting an additional $100 million in gross cost savings.

- Strategic highlights include a new three-year agreement with Howard Stern , 41% growth in podcast ad revenue for the full year , and the launch of Continuous Service and companion subscriptions, which contributed to 110,000 net adds in Q4 2025.

- The company ended 2025 with a net debt to adjusted EBITDA ratio of 3.6x, with a target to reach the low- to mid-3x range by late 2026. Zach Coughlin officially joined as the new Chief Financial Officer on January 1, 2026.

- SiriusXM exceeded its revised 2025 guidance, reporting $8.56 billion in revenue, $2.67 billion in adjusted EBITDA, and $1.26 billion in free cash flow for the full year.

- For Q4 2025, the company delivered $2.19 billion in total revenue, $691 million in adjusted EBITDA, and a record $541 million in free cash flow.

- The company introduced 2026 guidance, expecting approximately $8.5 billion in revenue and $2.6 billion in adjusted EBITDA (both largely flat year-over-year), while projecting free cash flow to grow to approximately $1.35 billion.

- In 2025, SiriusXM reduced total debt by $669 million, achieving a net debt to adjusted EBITDA ratio of 3.6x, and returned $501 million to shareholders through dividends and share repurchases.

- Zach Coughlin officially joined as the new Chief Financial Officer on January 1, 2026.

Sirius XM Holdings reported strong financial results for full-year 2025, exceeding its guidance, with revenue of $8.56 billion, net income of $805 million, Adjusted EBITDA of $2.67 billion, and free cash flow of $1.26 billion. For the fourth quarter of 2025, the company recorded revenue of $2.19 billion, net income of $99 million, and diluted earnings per common share of $0.24.

The company provided 2026 full-year financial guidance, projecting total revenue of approximately $8.5 billion, Adjusted EBITDA of approximately $2.6 billion, and free cash flow of approximately $1.35 billion.

SiriusXM ended 2025 with approximately 33 million total subscribers, though self-pay subscribers decreased by 301 thousand for the full year.

In 2025, the company returned $501 million to shareholders through $365 million in dividends and $136 million in share repurchases.

Here is a summary of Sirius XM Holdings' financial performance for Q4 2025 and Full-Year 2025, along with 2026 guidance:

| Metric | Q4 2025 | FY 2025 | FY 2026 (Guidance) |

|---|---|---|---|

| Revenue ($USD Millions) | $2,193 | $8,558 | ~$8,500 |

| Net Income ($USD Millions) | $99 | $805 | N/A |

| Adjusted EBITDA ($USD Millions) | $691 | $2,665 | ~$2,600 |

| Free Cash Flow ($USD Millions) | $541 | $1,256 | ~$1,350 |

| Diluted EPS ($USD) | $0.24 | $2.23 | N/A |

- Sirius XM reaffirmed and recently raised its guidance for the year across EBITDA, free cash flow, and revenue, marking the second time free cash flow guidance was raised. The company also announced the appointment of Zac Coughlin as the new CFO, bringing experience from Ford and public companies.

- The company reported a churn rate of 1.6% and is modernizing its pricing architecture to "good, better, best" tiers, with the ad-supported "Play" plan successfully widening the top of the funnel and most users migrating to higher price points. 360L is now in over 50% of new car trials and is projected to be in nearly 90% by 2030, while extended three-year trials with auto OEMs are significantly contributing to gross additions.

- Sirius XM achieved its $200 million annual run rate cost savings goal early through product and technology improvements, and its podcast business has grown 50% year over year.

- The company expects its satellite program's capital expenditure to be roughly zero by 2028.

| Metric | FY 2025 | FY 2026 |

|---|---|---|

| Non-Satellite CapEx ($USD Millions) | $450 - $500 | $400 |

Fintool News

In-depth analysis and coverage of SIRIUS XM HOLDINGS.

Quarterly earnings call transcripts for SIRIUS XM HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more