Earnings summaries and quarterly performance for SIRIUS XM HOLDINGS.

Executive leadership at SIRIUS XM HOLDINGS.

Jennifer Witz

Chief Executive Officer

Richard Baer

Executive Vice President, General Counsel and Secretary

Scott Greenstein

President and Chief Content Officer

Thomas Barry

Executive Vice President and Chief Financial Officer

Wayne Thorsen

Executive Vice President and Chief Operating Officer

Board of directors at SIRIUS XM HOLDINGS.

Anjali Sud

Director

Dave Stephenson

Director

David Zaslav

Director

Eddy Hartenstein

Director

Evan Malone

Director

Gregory Maffei

Chairman of the Board

Jonelle Procope

Director

Kristina Salen

Lead Independent Director

Michael Rapino

Director

Research analysts who have asked questions during SIRIUS XM HOLDINGS earnings calls.

Cameron Mansson-Perrone

Morgan Stanley

6 questions for SIRI

Kutgun Maral

Evercore ISI

6 questions for SIRI

Stephen Laszczyk

Goldman Sachs

6 questions for SIRI

Steven Cahall

Wells Fargo & Company

6 questions for SIRI

Barton Crockett

Rosenblatt Securities

5 questions for SIRI

David Joyce

Seaport Research Partners

5 questions for SIRI

Brian Kraft

Deutsche Bank

2 questions for SIRI

Jessica Reif

Bank of America

2 questions for SIRI

Jessica Reif Cohen

Bank of America Merrill Lynch

2 questions for SIRI

Jason Bazinet

Citigroup

1 question for SIRI

Jessica Reif Ehrlich

Bank of America Securities

1 question for SIRI

Sebastiano Petti

JPMorgan Chase & Co.

1 question for SIRI

Recent press releases and 8-K filings for SIRI.

- SiriusXM reported full-year 2025 revenue of $8.56 billion, Adjusted EBITDA of $2.67 billion, and free cash flow of $1.26 billion, exceeding its original free cash flow guidance.

- For 2026, the company projects revenue of approximately $8.5 billion and Adjusted EBITDA of approximately $2.6 billion, both largely flat year-over-year, while free cash flow is expected to grow to approximately $1.35 billion.

- The company achieved $250 million in incremental gross cost savings in 2025, surpassing its target, and anticipates an additional $100 million in gross cost savings in 2026.

- Zach Coughlin joined as Chief Financial Officer on January 1, 2026, and SiriusXM reduced total debt by $669 million in 2025, ending the year with a net debt to Adjusted EBITDA ratio of 3.6x.

- Strategic highlights include a new three-year agreement with Howard Stern, the launch of a new automotive Pandora app, and the expansion of its dealer three-year subscription program with OEMs.

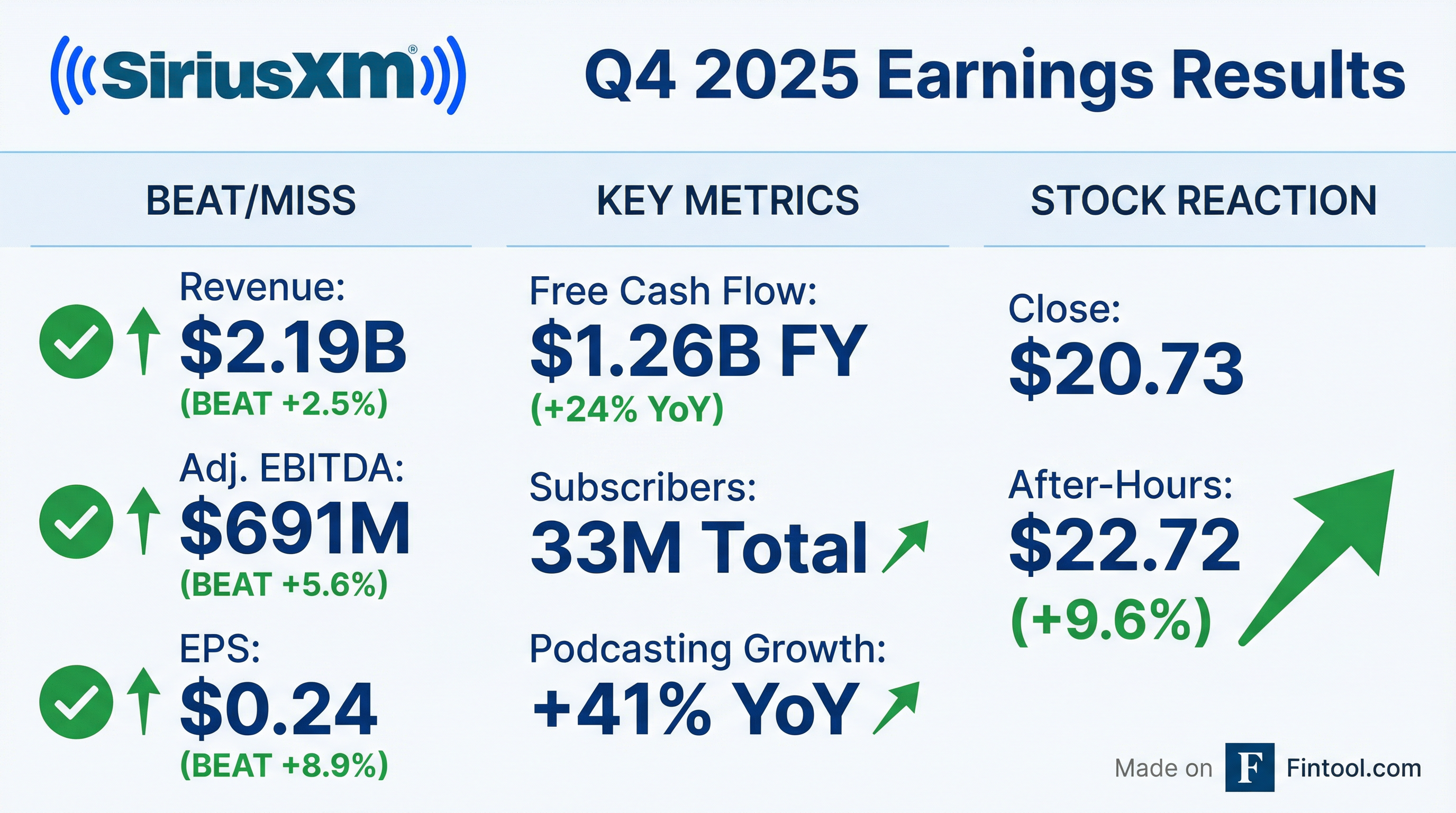

- SiriusXM reported strong Q4 2025 results with $2.19 billion in total revenue and $691 million in adjusted EBITDA, and full-year 2025 results exceeding guidance, including $8.56 billion in revenue, $2.67 billion in adjusted EBITDA, and $1.26 billion in free cash flow.

- For 2026, the company expects approximately $8.5 billion in revenue, $2.6 billion in adjusted EBITDA, and $1.35 billion in free cash flow, while also targeting an additional $100 million in gross cost savings.

- Strategic highlights include a new three-year agreement with Howard Stern , 41% growth in podcast ad revenue for the full year , and the launch of Continuous Service and companion subscriptions, which contributed to 110,000 net adds in Q4 2025.

- The company ended 2025 with a net debt to adjusted EBITDA ratio of 3.6x, with a target to reach the low- to mid-3x range by late 2026. Zach Coughlin officially joined as the new Chief Financial Officer on January 1, 2026.

- SiriusXM exceeded its revised 2025 guidance, reporting $8.56 billion in revenue, $2.67 billion in adjusted EBITDA, and $1.26 billion in free cash flow for the full year.

- For Q4 2025, the company delivered $2.19 billion in total revenue, $691 million in adjusted EBITDA, and a record $541 million in free cash flow.

- The company introduced 2026 guidance, expecting approximately $8.5 billion in revenue and $2.6 billion in adjusted EBITDA (both largely flat year-over-year), while projecting free cash flow to grow to approximately $1.35 billion.

- In 2025, SiriusXM reduced total debt by $669 million, achieving a net debt to adjusted EBITDA ratio of 3.6x, and returned $501 million to shareholders through dividends and share repurchases.

- Zach Coughlin officially joined as the new Chief Financial Officer on January 1, 2026.

Sirius XM Holdings reported strong financial results for full-year 2025, exceeding its guidance, with revenue of $8.56 billion, net income of $805 million, Adjusted EBITDA of $2.67 billion, and free cash flow of $1.26 billion. For the fourth quarter of 2025, the company recorded revenue of $2.19 billion, net income of $99 million, and diluted earnings per common share of $0.24.

The company provided 2026 full-year financial guidance, projecting total revenue of approximately $8.5 billion, Adjusted EBITDA of approximately $2.6 billion, and free cash flow of approximately $1.35 billion.

SiriusXM ended 2025 with approximately 33 million total subscribers, though self-pay subscribers decreased by 301 thousand for the full year.

In 2025, the company returned $501 million to shareholders through $365 million in dividends and $136 million in share repurchases.

Here is a summary of Sirius XM Holdings' financial performance for Q4 2025 and Full-Year 2025, along with 2026 guidance:

| Metric | Q4 2025 | FY 2025 | FY 2026 (Guidance) |

|---|---|---|---|

| Revenue ($USD Millions) | $2,193 | $8,558 | ~$8,500 |

| Net Income ($USD Millions) | $99 | $805 | N/A |

| Adjusted EBITDA ($USD Millions) | $691 | $2,665 | ~$2,600 |

| Free Cash Flow ($USD Millions) | $541 | $1,256 | ~$1,350 |

| Diluted EPS ($USD) | $0.24 | $2.23 | N/A |

- Sirius XM reaffirmed and recently raised its guidance for the year across EBITDA, free cash flow, and revenue, marking the second time free cash flow guidance was raised. The company also announced the appointment of Zac Coughlin as the new CFO, bringing experience from Ford and public companies.

- The company reported a churn rate of 1.6% and is modernizing its pricing architecture to "good, better, best" tiers, with the ad-supported "Play" plan successfully widening the top of the funnel and most users migrating to higher price points. 360L is now in over 50% of new car trials and is projected to be in nearly 90% by 2030, while extended three-year trials with auto OEMs are significantly contributing to gross additions.

- Sirius XM achieved its $200 million annual run rate cost savings goal early through product and technology improvements, and its podcast business has grown 50% year over year.

- The company expects its satellite program's capital expenditure to be roughly zero by 2028.

| Metric | FY 2025 | FY 2026 |

|---|---|---|

| Non-Satellite CapEx ($USD Millions) | $450 - $500 | $400 |

- Sirius XM reaffirmed its recently raised guidance for the year across EBITDA, free cash flow, and revenue, noting this is the second time free cash flow guidance has been raised in recent months.

- Zac Coughlin has been appointed as the new Chief Financial Officer, with his experience at Ford expected to benefit OEM relationships.

- The company is modernizing its pricing architecture to a "good, better, best" model to optimize EBITDA, focusing on managing churn (currently 1.6%), widening the top of the funnel, and increasing ARPU.

- Strategic initiatives like continuous service and the increasing penetration of 360L (over 50% of new car trials, projected to be 90% by 2030) are expected to improve churn and conversion, alongside new extended three-year trials with auto OEMs.

- Sirius XM achieved its $200 million annual run rate cost savings goal early and projects non-satellite CapEx to be $400 million next year, down from $450 million to $500 million this year.

- SiriusXM reported Q3 2025 total revenue of $2.16 billion, essentially flat year-over-year, with Adjusted EBITDA of $676 million (down 2%) and free cash flow of $257 million, significantly up from $93 million in Q3 2024.

- The company increased its full year 2025 guidance by $25 million across revenue, Adjusted EBITDA, and free cash flow.

- Advertising revenue grew by $5 million to $455 million in Q3 2025, primarily driven by podcasting revenue which was up almost 50% year-over-year.

- Strategic initiatives include enhancing the subscriber experience, expanding ad-supported offerings, and implementing cost savings, with a goal of reaching $1.5 billion in free cash flow by 2027 and beyond.

- SiriusXM is actively exploring opportunities to monetize its 35 MHz of contiguous spectrum assets.

- SiriusXM reported Q3 2025 total revenue of $2.16 billion, which was essentially flat year-over-year, alongside net income of $297 million and free cash flow of $257 million, significantly up from $93 million in Q3 2024.

- The company increased its full-year 2025 guidance by $25 million across revenue, Adjusted EBITDA, and free cash flow, now projecting approximately $8.525 billion in total revenue, $2.625 billion in Adjusted EBITDA, and $1.225 billion in free cash flow.

- SiriusXM's cost savings program achieved its $200 million target for 2025 , and the company reduced total debt by $120 million while returning $111 million to shareholders through dividends and share repurchases in the quarter.

- Podcast ad revenue continued strong performance, growing by nearly 50% year-over-year in Q3 2025.

- SiriusXM reported Q3 2025 revenue of $2.16 billion, a 1% decrease from the prior-year period, with net income of $297 million and diluted EPS of $0.84.

- For the quarter, Adjusted EBITDA was $676 million and Free Cash Flow was $257 million.

- The company increased its full-year 2025 guidance for revenue, Adjusted EBITDA, and Free Cash Flow by $25 million each, now targeting $8.525 billion in revenue, $2.625 billion in Adjusted EBITDA, and $1.225 billion in Free Cash Flow.

- SiriusXM ended the quarter with approximately 33 million total subscribers, experiencing a decrease of approximately 40,000 self-pay net subscribers.

- In Q3 2025, the company returned $111 million to shareholders through $91 million in dividends and $20 million in share repurchases.

- SiriusXM is raising its 2025 free cash flow guidance by $50 million to approximately $1.2 billion, while reiterating revenue guidance of approximately $8.5 billion and adjusted EBITDA guidance of approximately $2.6 billion.

- The company expects a significant reduction in capital expenditures, with satellite CapEx projected to decrease from approximately $200 million in 2025 to $115 million in 2026, $50 million in 2027, and near zero in 2028. Non-satellite CapEx is also expected to decrease from the lower end of $450 million to $500 million in 2025 to approximately $400 million in 2026.

- SiriusXM aims to reach its target leverage range by the end of 2026, coinciding with its 2027 free cash flow target of $1.5 billion, which will enable further expansion of capital returns.

- The company is seeing improved subscriber metrics from its 360L platform, with 50% of new car trial starts and over 10% of used car trial starts utilizing 360L, leading to better conversion rates, churn rates, and ARPU.

Fintool News

In-depth analysis and coverage of SIRIUS XM HOLDINGS.

Quarterly earnings call transcripts for SIRIUS XM HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more