Earnings summaries and quarterly performance for Super Micro Computer.

Executive leadership at Super Micro Computer.

Board of directors at Super Micro Computer.

Research analysts who have asked questions during Super Micro Computer earnings calls.

Jonathan Tanwanteng

CJS Securities

8 questions for SMCI

Ananda Baruah

Loop Capital Markets LLC

6 questions for SMCI

Nehal Chokshi

Northland Capital Markets

6 questions for SMCI

Ruplu Bhattacharya

Bank of America

6 questions for SMCI

Samik Chatterjee

JPMorgan Chase & Co.

6 questions for SMCI

Brandon Nispel

KeyBanc Capital Markets

5 questions for SMCI

Quinn Bolton

Needham & Company, LLC

5 questions for SMCI

Mark Newman

Bernstein

4 questions for SMCI

Michael Ng

Goldman Sachs

4 questions for SMCI

Asiya Merchant

Citigroup Global Markets Inc.

3 questions for SMCI

Aaron Rakers

Wells Fargo

2 questions for SMCI

Ananda Prosad Baruah

Loop Capital

2 questions for SMCI

Asiya Merchant

Citigroup

2 questions for SMCI

Catherine Murphy

Goldman Sachs

2 questions for SMCI

Dong Wang

Nomura Instinet

2 questions for SMCI

Mehdi Hosseini

Susquehanna Financial Group

2 questions for SMCI

Nehal Sushil Chokshi

Northland

2 questions for SMCI

Shadi Mitwalli

Needham & Company

2 questions for SMCI

Vijay Rakesh

Mizuho

2 questions for SMCI

George Wang

Barclays PLC

1 question for SMCI

MP

JPMorgan Chase & Co.

1 question for SMCI

Nicolas Doyle

Needham & Company, LLC

1 question for SMCI

Simon Leopold

Raymond James

1 question for SMCI

Recent press releases and 8-K filings for SMCI.

- Supermicro, VAST Data and NVIDIA introduced the CNode-X Solution, a fully integrated AI infrastructure stack combining Supermicro compute/storage servers, VAST AI OS, and NVIDIA accelerated models for rapid AI factory deployment.

- The platform features Supermicro’s CloudDC AS-1116CS-TN and SYS-212GB-FNR 2U multi-GPU servers equipped with NVIDIA RTX PRO 6000 GPUs, plus VAST’s InsightEngine and AgentEngine for real-time and generative AI workflows.

- CNode-X can scale into larger enterprise AI factories using Supermicro’s 8-way GPU servers and liquid cooling, with rack integration, testing, installation, and end-to-end management via the SuperCloud Suite.

- The solution was unveiled at the VAST Forward conference in Salt Lake City (Feb. 24–26), underscoring its role in accelerating large-scale and enterprise AI deployments.

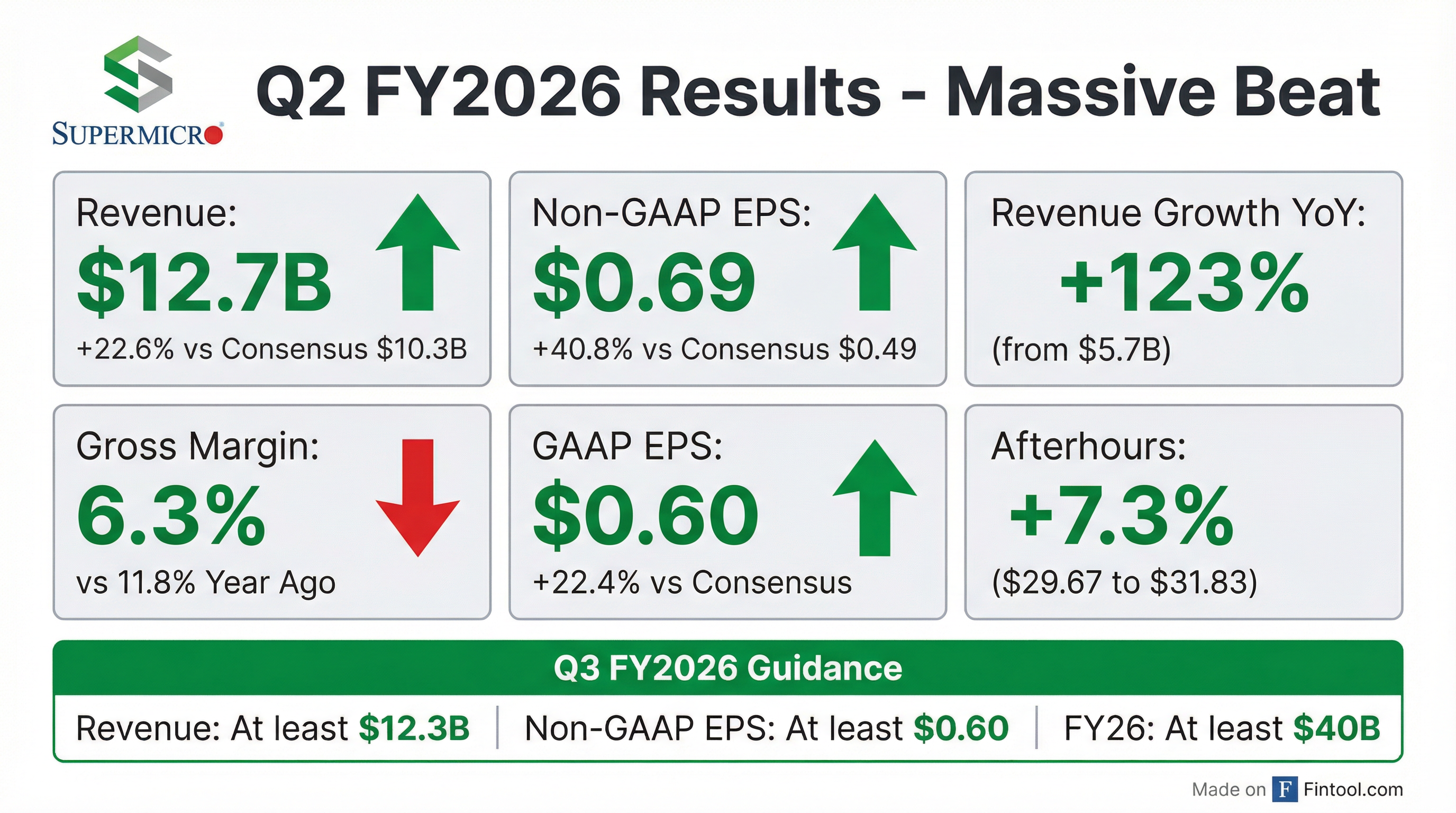

- Super Micro reported Q2 revenue of $12.7 B, up 123% YoY and 153% QoQ, driven by AI GPU platforms (>90% of sales); one large data center customer accounted for ~63% of revenue.

- Q2 non‐GAAP gross margin declined to 6.4% from 9.5% in Q1 due to product mix, freight and expedited costs; non‐GAAP operating margin was 4.5% with OpEx at 1.9% of sales, reflecting strong operating leverage.

- End-Q2 cash balance stood at $4.1 B against net debt of $787 M; cash conversion cycle improved to 54 days, with inventory days down to 63 days.

- Q3 guidance: net sales of at least $12.3 B, GAAP EPS ≥$0.52, non-GAAP EPS ≥$0.60, and ~30 bps gross margin expansion; FY26 revenue outlook raised to at least $40 B.

- Super Micro delivered record Q2 revenue of $12.7 billion, up 123% year-over-year and 153% quarter-over-quarter, driven by AI GPU platforms representing over 90% of sales.

- Non-GAAP gross margin contracted to 6.4% (from 9.5% in Q1), pressured by customer/product mix, higher freight and expedited transport costs, and component shortages.

- Data Center Building Block Solutions (DCBBS) accounted for 4% of profit in H1 FY 2026 and are expected to double their profit contribution by end-calendar 2026, with over 10 subsystems now available.

- One large AI data center customer represented 63% of Q2 revenue; the enterprise channel was 16% and OEM/large data center 84%. Geographically, the US contributed 86% of sales.

- Guidance for Q3 FY 2026 includes ≥ $12.3 billion in revenue, GAAP EPS ≥ $0.52 and non-GAAP EPS ≥ $0.60; full-year revenue is guided at ≥ $40 billion, with gross margin expected to improve ~30 bps sequentially.

- GAAP net income was $400.6 million, up from $320.6 million year-over-year.

- Adjusted EBITDA rose to $628.6 million, compared to $475.4 million in the prior year period.

- Gross margin declined to 6.3% from 11.8% a year ago, reflecting cost and mix pressures.

- The company is scaling AI infrastructure and expanding its DCBBS product portfolio with new 2026 releases, while initiating volume shipments of production DCBBS SKUs and establishing a Federal Business Unit.

- Manufacturing capacity has been expanded to support high-volume deliveries of NVIDIA GB300 NVL72, HGX B300, RTX6000Pro, and AMD MI350/355 systems globally.

- Super Micro delivered a record $12.68 billion in Q2 revenue, up 123% YoY and 153% QoQ, driven by rapid ramp of AI GPU platforms representing over 90% of sales.

- Q2 non-GAAP gross margin declined to 6.4% (from 9.5% in Q1) due to customer mix, expedited freight, and component cost pressures, while non-GAAP operating expenses fell to 1.9% of revenue, driving a 4.5% operating margin.

- The company’s data center building block solution (DCBBS) contributed 4% of profit in H1 FY 2026 and is targeted to double its profit share by end of calendar 2026, supporting long-term margin improvement.

- Super Micro raised its outlook, guiding Q3 net sales of at least $12.3 billion and full-year FY 2026 net sales of at least $40 billion, reflecting continued strong AI infrastructure demand.

- Net sales of $12.7 B, gross margin of 6.3%, net income of $401 M, and diluted EPS of $0.60.

- Cash & cash equivalents of $4.1 B against $4.9 B of bank debt and convertible notes as of December 31, 2025.

- Q3 FY2026 outlook: at least $12.3 B in net sales, GAAP EPS ≥ $0.52 and non-GAAP EPS ≥ $0.60; FY2026 net sales guidance ≥ $40.0 B.

- Supermicro reported net sales of $12.7 billion in Q2 FY2026, up from $5.7 billion in Q2 FY2025.

- Gross margin declined to 6.3%, versus 11.8% in Q2 FY2025.

- GAAP net income was $401 million (diluted EPS $0.60), compared with $321 million (EPS $0.51) a year ago.

- On a non-GAAP basis, the company achieved gross margin of 6.4% and diluted EPS of $0.69.

- Supermicro expects Q3 FY2026 net sales of at least $12.3 billion, GAAP EPS of at least $0.52, and FY2026 net sales of at least $40.0 billion.

- On January 21, 2026, Super Micro Computer, Inc. Taiwan entered into revolving credit facilities totaling $710 million ($350 M Facility A1; $360 M Facility A2) with an option to increase up to $2 billion for procurement of components and raw materials.

- USD Facility A1 loans accrue interest at TAIFX3 + 1.0%, USD Facility A2 at Term SOFR + 1.2%, and NTD-denominated loans at TAIBOR + 1.0% (floor 1.7%).

- The Borrower pays a 0.15% per annum commitment fee on unused amounts, a 0.10% fee for extending maturity, and a 0.15% fee on prepayments or cancellations.

- The facilities are guaranteed by Super Micro Computer, Inc. and secured by a second-ranking lien on the Borrower’s Bade District facility, all receivables and term-deposit accounts (up to $2.4 B).

- The loans mature one year after initial utilization, with up to two one-year extension options.

- Super Micro Computer entered into a $2.0 billion senior revolving credit facility led by JPMorgan Chase Bank, N.A.

- The facility matures on 12/29/2030 and may be used for working capital, letters of credit, and other general corporate purposes

- Borrowings are secured and subject to customary representations, warranties, affirmative and negative covenants, and events of default

- CEO Charles Liang said the facility provides additional financial flexibility to support operations and growth initiatives

- Supermicro debuts the Super AI Station (ARS-511GD-NB-LCC) delivering over 5× AI PFLOPS and 775 GB of coherent memory in a deskside liquid-cooled form factor for on-prem AI model development and inference.

- Introduces the SYS-542T-2R workstation powered by Intel Xeon 6 SoC, offering agentic AI performance, broad GPU support, and 2×100 GbE connectivity for media transcoding and CDN applications.

- Launches the AI PC (AS-C521D-11302U) with the latest AMD CPUs, targeting slim desktops for optimized office and personal AI workloads.

- Unveils three Edge AI Systems based on AMD EPYC™ 4005 (1U, mini-1U, slim tower) with up to 16 cores for high performance-per-watt, plus a fanless SYS-E103-14P-H featuring Intel Core Ultra Series 3 delivering up to 180 TOPS for edge robotics and AI.

Fintool News

In-depth analysis and coverage of Super Micro Computer.

Quarterly earnings call transcripts for Super Micro Computer.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more