Earnings summaries and quarterly performance for SS&C Technologies Holdings.

Executive leadership at SS&C Technologies Holdings.

Board of directors at SS&C Technologies Holdings.

Research analysts who have asked questions during SS&C Technologies Holdings earnings calls.

Peter Heckmann

D.A. Davidson

8 questions for SSNC

Daniel Perlin

RBC Capital Markets

7 questions for SSNC

Kevin McVeigh

Credit Suisse Group AG

6 questions for SSNC

Alexei Gogolev

JPMorgan Chase & Co.

5 questions for SSNC

Jeff Schmitt

William Blair & Company, L.L.C.

5 questions for SSNC

Andrew Schmidt

Citigroup Inc.

3 questions for SSNC

Jeffrey Schmitt

William Blair

3 questions for SSNC

Michael Infante

Morgan Stanley

3 questions for SSNC

Patrick O'Shaughnessy

Raymond James

3 questions for SSNC

Surinder Thind

Jefferies Financial Group

3 questions for SSNC

Eleanor Smith

JPMorgan Chase & Co.

2 questions for SSNC

James Faucette

Morgan Stanley

2 questions for SSNC

Ella Smith

JPMorgan Chase & Co.

1 question for SSNC

Matthew Roswell

RBC Capital Markets

1 question for SSNC

Recent press releases and 8-K filings for SSNC.

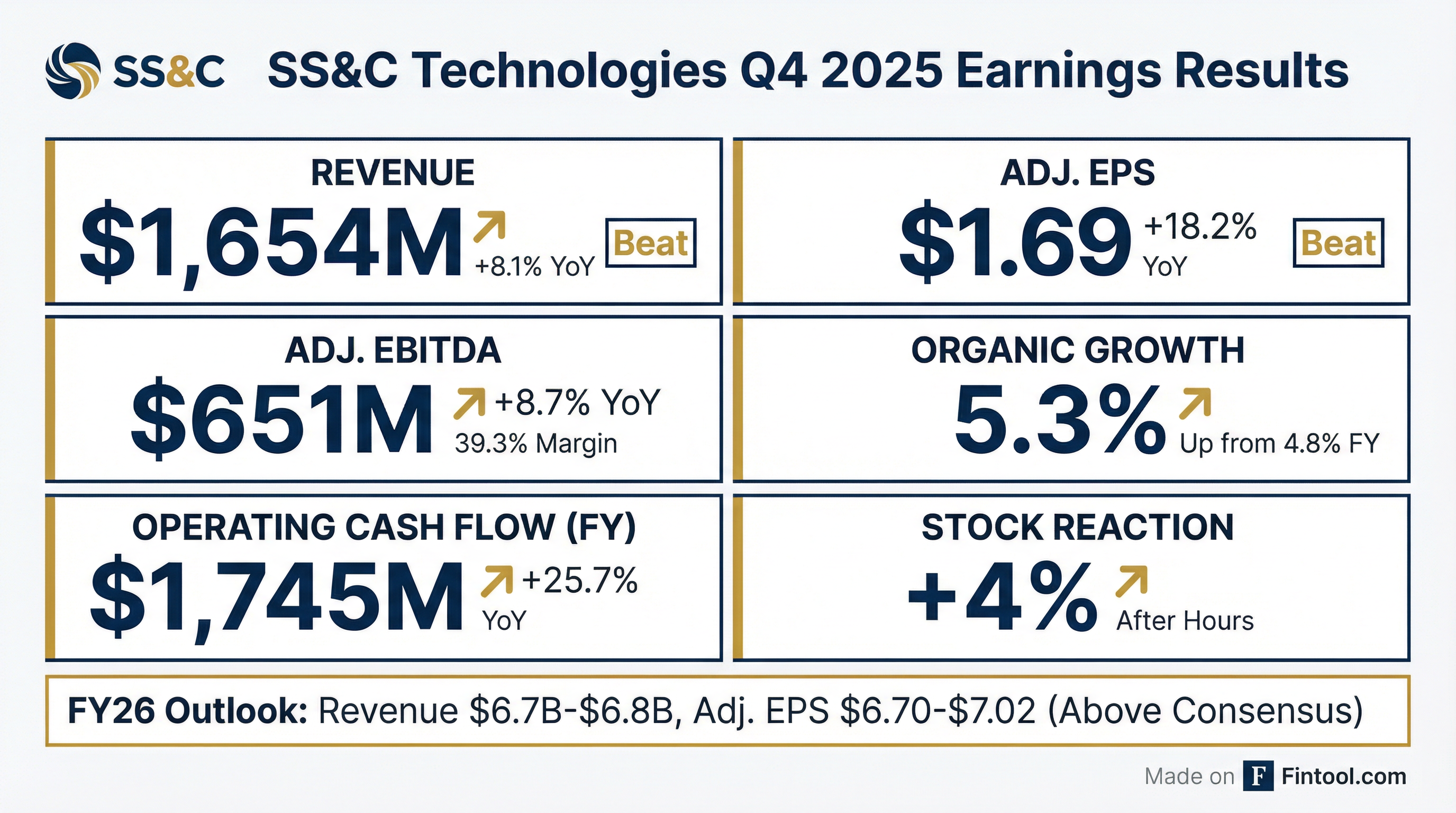

- SS&C Technologies Holdings reported record adjusted revenue of $1.655 billion, an 8% increase, and adjusted diluted earnings per share of $1.69, an 18% increase, for Q4 2025.

- The company achieved record adjusted consolidated EBITDA of $651 million, up 9%, with an adjusted consolidated EBITDA margin of 39.3% in Q4 2025. Adjusted organic revenue growth was 5.3%.

- For the full year 2025, cash from operating activities was $1.745 billion, up 26% year-over-year. SS&C returned $384 million to shareholders in Q4 2025, including $319 million in share repurchases, and allocated over $1 billion to share repurchases in 2025.

- For the full year 2026, SS&C expects revenue in the range of $6.65 billion-$6.74 billion and adjusted diluted EPS in the range of $6.70-$7.02, reflecting approximately 12% growth at the midpoint. The company targets an annual EBITDA expansion of 50 basis points with a goal of a 40% margin in Q4 2026.

- The company views the AI boom as a tailwind and is deploying solutions rapidly, leveraging its ownership of software and code. They also noted positive early progress with the Calastone acquisition and are prioritizing share repurchases in the absence of high-quality, accretive acquisitions.

- SS&C reported strong Q4 2025 results with adjusted revenue of $1.655 billion, an 8% increase, and adjusted diluted EPS of $1.69, up 18%.

- Adjusted consolidated EBITDA reached $651 million, a 9% increase, with an EBITDA margin of 39.3%, and adjusted organic revenue growth was 5.3%.

- For the full year 2025, cash from operating activities was $1.745 billion, a 26% year-over-year increase, and the company allocated over $1 billion in share repurchases, buying 12.3 million shares.

- The company provided 2026 full-year guidance, expecting revenue between $6.65 billion and $6.74 billion and adjusted diluted EPS in the range of $6.70 to $7.02.

- SS&C maintains a focus on AI adoption as a tailwind and will prioritize share repurchases in the absence of high-quality, accretive acquisitions, with a net leverage ratio of 2.8 times.

- SSNC reported Q4 2025 Adjusted Revenues of $1,654.6 million, an 8.1 percent increase, and Adjusted Diluted EPS of $1.69, up 18.2%.

- For the full year 2025, net cash generated from operating activities was $1,744.8 million, a 25.7 percent increase compared to 2024.

- In Q4 2025, the company returned $384.2 million to shareholders, including $318.7 million in share repurchases and $65.5 million in common stock dividends, and paid down $205.0 million of debt.

- SSNC provided FY 2026 guidance for Adjusted Revenues between $6,654 million and $6,814 million and Adjusted Diluted EPS between $6.70 and $7.02.

- SS&C Technologies Holdings reported record adjusted revenue of $1.655 billion, an 8% increase, and adjusted diluted earnings per share of $1.69, an 18% increase, for Q4 2025. Adjusted consolidated EBITDA reached $651 million, up 9%, with an adjusted consolidated EBITDA margin of 39.3%, and adjusted organic revenue growth was 5.3%.

- For the full year 2025, cash from operating activities was $1.745 billion, up 26% year-over-year. The company returned $384 million to shareholders in Q4 2025, including $319 million for share repurchases of 3.7 million shares at an average price of $85.81, and allocated over $1 billion to share repurchases in 2025, purchasing 12.3 million shares at an average price of $84.12.

- SS&C provided Q1 2026 guidance with expected revenue between $1.608 billion and $1.648 billion and adjusted diluted EPS between $1.62 and $1.68. For the full year 2026, revenue is projected to be between $6.65 billion and $6.74 billion, with adjusted diluted EPS in the range of $6.70 to $7.02, reflecting approximately 12% growth at the midpoint, and a goal of a 40% EBITDA margin in Q4 2026.

- The company sees the AI boom as a tailwind, leveraging its software and code for unique advantages. Key business segments like GIDS and GlobeOp showed strong revenue growth, with GlobeOp seeing new opportunities in Australia. The wealth management business, particularly the Black Diamond platform, is highlighted as a "crown jewel" administrating approaching $3.5 trillion for approximately 4,000 RIAs.

- SS&C Technologies reported record adjusted revenue of $1,654.6 million for Q4 2025, an 8.1% increase, and $6,276.2 million for the full year 2025, up 6.6%.

- For Q4 2025, adjusted diluted earnings per share attributable to SS&C increased by 18.2% to $1.69, while GAAP diluted earnings per share decreased by 21.4% to $0.77.

- The company generated net cash from operating activities of $1,744.8 million for the full year 2025, a 25.7% increase compared to 2024.

- SS&C returned $384.2 million to shareholders in Q4 2025, which included $318.7 million for share repurchases and $65.5 million in common stock dividends.

- For Q1 2026, SS&C provided guidance for adjusted revenue between $1,608 million and $1,648 million and adjusted diluted earnings per share between $1.62 and $1.68.

- SS&C Technologies Holdings reported record adjusted revenue of $1,654.6 million for Q4 2025, an 8.1% increase, and $6,276.2 million for the full year 2025, up 6.6%.

- Adjusted diluted earnings per share for Q4 2025 increased 18.2% to $1.69, and for the full year 2025, it rose 13.5% to $6.14.

- The company generated $1,744.8 million in net cash from operating activities for the full year 2025, a 25.7% increase compared to 2024, and returned $384.2 million to shareholders in Q4 2025 through share repurchases and dividends.

- SS&C provided Q1 2026 guidance for adjusted revenue between $1,608 million and $1,648 million, and adjusted diluted earnings per share between $1.62 and $1.68.

- For full year 2026, the company expects adjusted revenue of $6,654 million to $6,814 million and adjusted diluted EPS of $6.70 to $7.02.

- The SS&C GlobeOp Forward Redemption Indicator for January 2026 measured 1.46%, a decrease from 2.35% in December.

- This 1.46% figure represents the lowest monthly redemption notice in the past five years and is the all-time low for the indicator.

- SS&C Technologies' CEO, Bill Stone, commented that elevated market volatility and the potential for significant drawdowns are creating favorable conditions for hedge funds to generate attractive risk-adjusted returns.

- The SS&C GlobeOp Forward Redemption Indicator for December 2025 measured 2.35%, marking a decrease from 2.43% in November 2025 and 3.54% reported for the same period a year ago.

- Bill Stone, Chairman and CEO of SS&C Technologies, noted that despite emerging market headwinds like slowing growth and historically high valuations, the company anticipates robust asset retention heading into 2026.

- The indicator, which reflects investor confidence in hedge fund allocations, has trended significantly lower since its all-time high of 19.27% in November 2008.

- SS&C achieved organic growth of 5.1% in Q1, 3.5% in Q2, and 5.2% in Q3 2025, with a Q4 forecast of 4.5%, aligning with its medium-term target of 4%-8%.

- Growth is primarily driven by client success and expanded services in its GlobeOp and GIDS businesses, including international expansion into Australia's superannuation funds.

- The company's capital allocation strategy prioritizes value-adding M&A, followed by share buybacks (with authorization increased to $1.5 billion), and debt reduction, while also increasing its dividend by 8%.

- SS&C maintains adjusted EBITDA margins between 39%-40% and aims for an annual improvement of 50 basis points through revenue growth, productivity, and strategic investments in areas like AI.

- Intralinks' performance has been affected by an 8% decline in M&A transactions through Q3, but SS&C is investing in R&D and AI to enhance the product and expects an upward trajectory in 2026-2027.

- SS&C reported organic growth of 5.1% in Q1 2025, 3.5% in Q2, and 5.2% in Q3, with a target of 4.5% for Q4, aligning with their medium-term goal of 4%-8%.

- The company's growth is primarily driven by its GlobeOp and GIDS businesses, with expectations for Intralinks to see an upward trajectory in 2026 and 2027 following a period of deceleration due to lower M&A transaction volumes.

- SS&C maintains adjusted EBITDA margins of 39%-40% and aims for an annual 50 basis point improvement through scale growth, productivity, and strategic reinvestment.

- Capital allocation priorities include M&A for value-adding opportunities, followed by share buybacks (with a $1.5 billion authorization), and debt paydown, while dividend growth is not the top priority but will continue.

- The company is actively investing in AI, packaging its capabilities as an annual license, and views tokenization as an opportunity for new revenue streams, anticipating a meaningful impact in 3-4 years.

Quarterly earnings call transcripts for SS&C Technologies Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more