Earnings summaries and quarterly performance for SS&C Technologies Holdings.

Executive leadership at SS&C Technologies Holdings.

Board of directors at SS&C Technologies Holdings.

Research analysts who have asked questions during SS&C Technologies Holdings earnings calls.

Peter Heckmann

D.A. Davidson

8 questions for SSNC

Daniel Perlin

RBC Capital Markets

7 questions for SSNC

Kevin McVeigh

Credit Suisse Group AG

6 questions for SSNC

Alexei Gogolev

JPMorgan Chase & Co.

5 questions for SSNC

Jeff Schmitt

William Blair & Company, L.L.C.

5 questions for SSNC

Andrew Schmidt

Citigroup Inc.

3 questions for SSNC

Jeffrey Schmitt

William Blair

3 questions for SSNC

Michael Infante

Morgan Stanley

3 questions for SSNC

Patrick O'Shaughnessy

Raymond James

3 questions for SSNC

Surinder Thind

Jefferies Financial Group

3 questions for SSNC

Eleanor Smith

JPMorgan Chase & Co.

2 questions for SSNC

James Faucette

Morgan Stanley

2 questions for SSNC

Ella Smith

JPMorgan Chase & Co.

1 question for SSNC

Matthew Roswell

RBC Capital Markets

1 question for SSNC

Recent press releases and 8-K filings for SSNC.

- SS&C Technologies Holdings has successfully completed the onboarding process for REI Super, now providing superannuation administration services and operations support to 24,000 members across Australia.

- The onboarding was completed within a compressed timeline of 5 months after REI Super selected SS&C in April 2025.

- SS&C now services over 2 million superannuation members and wealth accounts across Australia, accounting for $296 billion (AUD) in funds under management.

- The Australian market is a key growth market for SS&C, supported by 1,746 Australian employees across nine local offices.

- SS&C has significantly reduced its leverage from approximately 7% to 2.7% since 2018, while generating about $1.5 billion of free cash flow annually, resulting in an 8.5% free cash flow yield.

- The company's capital allocation priorities include acquisitions, debt paydown, and share buybacks, with a recent skew towards buybacks (approximately 60% of capital allocated to buybacks and 30% to debt paydown).

- SS&C is leveraging AI and automation, including its Blue Prism acquisition, to drive internal productivity and achieve headcount stability over the last three years despite company growth, which also helps offset inflationary pressures.

- The company is focused on margin improvement, with a 2026 guidance committing to 50 basis points of margin improvement and aiming to end the year at a 40% margin.

- SS&C maintains strong customer relationships, reflected in a high gross retention rate of 96.4% in the most recent quarter, indicating sticky relationships in mission-critical services.

- SS&C has demonstrated strong financial discipline, reducing leverage to 2.7% and generating approximately $1.5 billion in free cash flow, with capital allocated primarily to share buybacks (around 60%) and debt reduction (around 30%).

- The company anticipates continued organic growth, with an average of 5% over the last two years and 5% projected for 2026, alongside a commitment to 50 basis points of margin improvement in 2026, targeting a 40% margin by year-end.

- SS&C is strategically integrating AI, developing secure solutions like AI Gateway and WorkHQ to enhance product quality and customer interactions, leveraging its ownership of source code and high customer retention rates (most recently 96.4%) as key competitive advantages.

- Recent acquisitions, such as Calastone, are expanding SS&C's capabilities in areas like tokenization, while significant investments in the healthcare segment, including the DomaniRx system, are expected to contribute to future growth.

- SS&C provides mission-critical infrastructure for financial services and healthcare, operating as the world's largest fund administrator and transfer agent. The company has a history of strategic acquisitions, including DST Systems, Intralinks, and Eze in 2018, and more recently Calastone for its network and blockchain capabilities, and Blue Prism for automation.

- The company demonstrates strong financial discipline, having reduced leverage from approximately 7% to 2.7% since 2018 and generating about $1.5 billion in free cash flow annually. Capital allocation priorities are acquisitions, followed by debt paydown and stock buybacks, with a recent skew of 60%+ towards stock buybacks and 30%+ towards debt paydown.

- SS&C has achieved 5% average organic growth over the past two years, with 2026 guidance implying 5%. The company expects 50 basis points of margin improvement in 2026, aiming for a 40% margin by Q4 2026, driven partly by technology and headcount efficiencies from acquisitions like Blue Prism.

- SS&C is actively deploying AI, including its AI Gateway for secure, internal large language model (LLM) use and WorkHQ for data orchestration, focusing on improving data inputs, outputs, and customer interfaces. The company's ownership of source code and strong, sticky customer relationships are key competitive advantages, particularly in data security and trust.

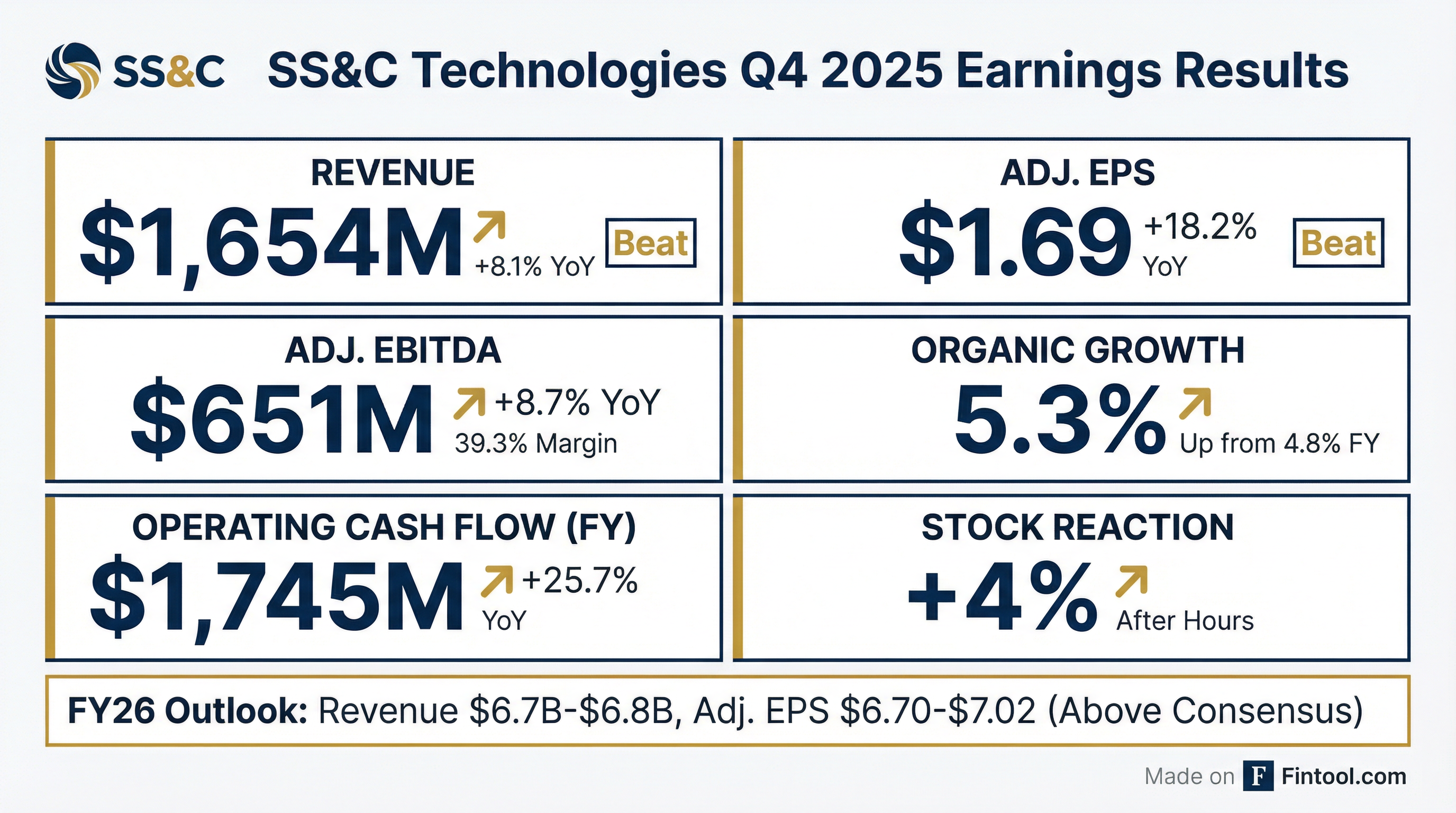

- SS&C Technologies Holdings reported record adjusted revenue of $1.655 billion, an 8% increase, and adjusted diluted earnings per share of $1.69, an 18% increase, for Q4 2025.

- The company achieved record adjusted consolidated EBITDA of $651 million, up 9%, with an adjusted consolidated EBITDA margin of 39.3% in Q4 2025. Adjusted organic revenue growth was 5.3%.

- For the full year 2025, cash from operating activities was $1.745 billion, up 26% year-over-year. SS&C returned $384 million to shareholders in Q4 2025, including $319 million in share repurchases, and allocated over $1 billion to share repurchases in 2025.

- For the full year 2026, SS&C expects revenue in the range of $6.65 billion-$6.74 billion and adjusted diluted EPS in the range of $6.70-$7.02, reflecting approximately 12% growth at the midpoint. The company targets an annual EBITDA expansion of 50 basis points with a goal of a 40% margin in Q4 2026.

- The company views the AI boom as a tailwind and is deploying solutions rapidly, leveraging its ownership of software and code. They also noted positive early progress with the Calastone acquisition and are prioritizing share repurchases in the absence of high-quality, accretive acquisitions.

- SS&C reported strong Q4 2025 results with adjusted revenue of $1.655 billion, an 8% increase, and adjusted diluted EPS of $1.69, up 18%.

- Adjusted consolidated EBITDA reached $651 million, a 9% increase, with an EBITDA margin of 39.3%, and adjusted organic revenue growth was 5.3%.

- For the full year 2025, cash from operating activities was $1.745 billion, a 26% year-over-year increase, and the company allocated over $1 billion in share repurchases, buying 12.3 million shares.

- The company provided 2026 full-year guidance, expecting revenue between $6.65 billion and $6.74 billion and adjusted diluted EPS in the range of $6.70 to $7.02.

- SS&C maintains a focus on AI adoption as a tailwind and will prioritize share repurchases in the absence of high-quality, accretive acquisitions, with a net leverage ratio of 2.8 times.

- SSNC reported Q4 2025 Adjusted Revenues of $1,654.6 million, an 8.1 percent increase, and Adjusted Diluted EPS of $1.69, up 18.2%.

- For the full year 2025, net cash generated from operating activities was $1,744.8 million, a 25.7 percent increase compared to 2024.

- In Q4 2025, the company returned $384.2 million to shareholders, including $318.7 million in share repurchases and $65.5 million in common stock dividends, and paid down $205.0 million of debt.

- SSNC provided FY 2026 guidance for Adjusted Revenues between $6,654 million and $6,814 million and Adjusted Diluted EPS between $6.70 and $7.02.

- SS&C Technologies Holdings reported record adjusted revenue of $1.655 billion, an 8% increase, and adjusted diluted earnings per share of $1.69, an 18% increase, for Q4 2025. Adjusted consolidated EBITDA reached $651 million, up 9%, with an adjusted consolidated EBITDA margin of 39.3%, and adjusted organic revenue growth was 5.3%.

- For the full year 2025, cash from operating activities was $1.745 billion, up 26% year-over-year. The company returned $384 million to shareholders in Q4 2025, including $319 million for share repurchases of 3.7 million shares at an average price of $85.81, and allocated over $1 billion to share repurchases in 2025, purchasing 12.3 million shares at an average price of $84.12.

- SS&C provided Q1 2026 guidance with expected revenue between $1.608 billion and $1.648 billion and adjusted diluted EPS between $1.62 and $1.68. For the full year 2026, revenue is projected to be between $6.65 billion and $6.74 billion, with adjusted diluted EPS in the range of $6.70 to $7.02, reflecting approximately 12% growth at the midpoint, and a goal of a 40% EBITDA margin in Q4 2026.

- The company sees the AI boom as a tailwind, leveraging its software and code for unique advantages. Key business segments like GIDS and GlobeOp showed strong revenue growth, with GlobeOp seeing new opportunities in Australia. The wealth management business, particularly the Black Diamond platform, is highlighted as a "crown jewel" administrating approaching $3.5 trillion for approximately 4,000 RIAs.

- SS&C Technologies reported record adjusted revenue of $1,654.6 million for Q4 2025, an 8.1% increase, and $6,276.2 million for the full year 2025, up 6.6%.

- For Q4 2025, adjusted diluted earnings per share attributable to SS&C increased by 18.2% to $1.69, while GAAP diluted earnings per share decreased by 21.4% to $0.77.

- The company generated net cash from operating activities of $1,744.8 million for the full year 2025, a 25.7% increase compared to 2024.

- SS&C returned $384.2 million to shareholders in Q4 2025, which included $318.7 million for share repurchases and $65.5 million in common stock dividends.

- For Q1 2026, SS&C provided guidance for adjusted revenue between $1,608 million and $1,648 million and adjusted diluted earnings per share between $1.62 and $1.68.

- SS&C Technologies Holdings reported record adjusted revenue of $1,654.6 million for Q4 2025, an 8.1% increase, and $6,276.2 million for the full year 2025, up 6.6%.

- Adjusted diluted earnings per share for Q4 2025 increased 18.2% to $1.69, and for the full year 2025, it rose 13.5% to $6.14.

- The company generated $1,744.8 million in net cash from operating activities for the full year 2025, a 25.7% increase compared to 2024, and returned $384.2 million to shareholders in Q4 2025 through share repurchases and dividends.

- SS&C provided Q1 2026 guidance for adjusted revenue between $1,608 million and $1,648 million, and adjusted diluted earnings per share between $1.62 and $1.68.

- For full year 2026, the company expects adjusted revenue of $6,654 million to $6,814 million and adjusted diluted EPS of $6.70 to $7.02.

Fintool News

In-depth analysis and coverage of SS&C Technologies Holdings.

Quarterly earnings call transcripts for SS&C Technologies Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more