Earnings summaries and quarterly performance for SSR MINING.

Executive leadership at SSR MINING.

Bill MacNevin

Executive Vice President, Operations and Sustainability

Edward Farid

Executive Vice President, Chief Strategy Officer

John Ebbett

Executive Vice President, Growth and Innovation

Michael Sparks

Executive Vice President, Chief Financial Officer

Rod Antal

Executive Chairman

Board of directors at SSR MINING.

Research analysts who have asked questions during SSR MINING earnings calls.

Ovais Habib

Scotiabank

5 questions for SSRM

Cosmos Chiu

CIBC World Markets

4 questions for SSRM

Don DeMarco

National Bank Financial

3 questions for SSRM

George Eadie

UBS

2 questions for SSRM

Lawson Winder

Bank of America

1 question for SSRM

Recent press releases and 8-K filings for SSRM.

- SSR Mining Inc. has issued a notice of redemption for its 2.50% Convertible Senior Notes due 2039, with $227,495,000 aggregate principal amount currently outstanding.

- The redemption date is March 20, 2026, and holders can convert their Notes before 5:00 PM New York City time on March 19, 2026.

- The conversion rate for these Notes is 56.7931 common shares per $1,000 principal amount. If all notes are converted, approximately 13 million common shares would be issued, which are already reflected in the company's fully diluted share count.

- Separately, on February 17, 2026, the Board approved a share buyback program of up to $300 million.

- SSR Mining has issued a notice of redemption for its $227,495,000 outstanding 2.50% Convertible Senior Notes due 2039, with the redemption date set for March 20, 2026.

- Holders can convert their notes before 5:00 PM New York City time on March 19, 2026, at a rate of 56.7931 common shares per $1,000 principal amount, with conversions settled in common shares, cash for fractional shares, accrued interest, and a make-whole premium.

- If all notes are converted, approximately 13 million common shares would be issued, which are already reflected in the company's fully diluted share count.

- The company also announced Board approval on February 17, 2026, for a share buyback program of up to $300 million, following repurchases of approximately 20 million shares between 2021 and 2024.

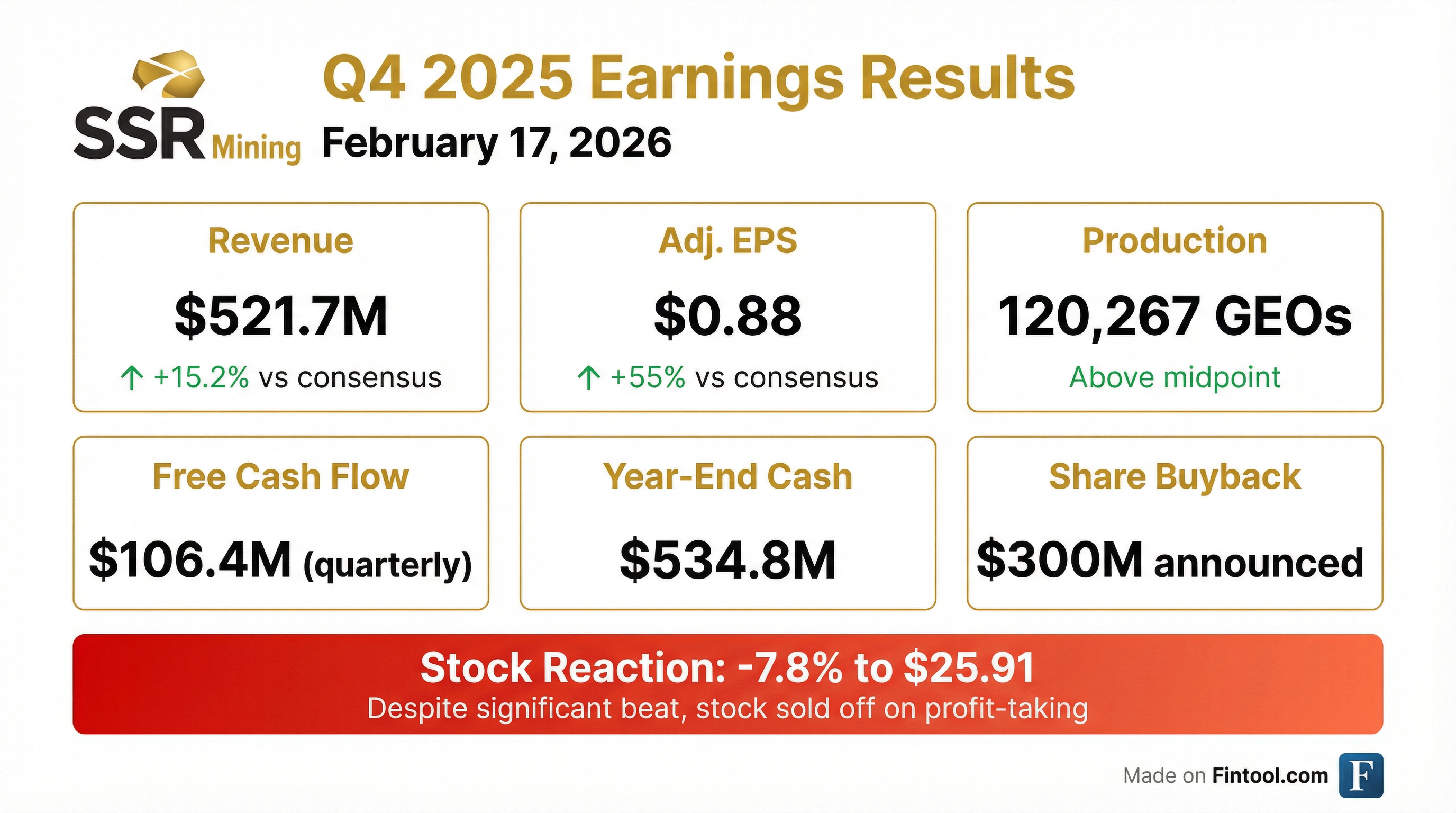

- SSR Mining closed 2025 with strong financial results, reporting $535 million in cash and over $1 billion in liquidity, and generating $106 million in free cash flow in Q4 and $252 million for the full year.

- The company announced a new share buyback program of up to $300 million, driven by its strong financial position and the belief that its share price does not reflect the full value of its portfolio.

- For 2026, SSR Mining expects to produce between 450,000 and 535,000 gold equivalent ounces at all-in sustaining costs (AISC) ranging from $2,360 to $2,440 per ounce.

- Key project updates include the Hod Maden Development Project's Technical Report Summary (TRS) highlighting a $1.7 billion NPV and 39% internal rate of return, and the Cripple Creek & Victor (CC&V) TRS with an $824 million NPV.

- SSR Mining closed 2025 with $535 million in cash and over $1 billion in liquidity, generating $106 million in free cash flow in Q4 and $252 million for the full year.

- The company's board has approved a new share buyback program of up to $300 million, anticipating continued material free cash flow generation in 2026.

- For 2026, SSR Mining expects to produce between 450,000 and 535,000 gold equivalent ounces at an All-in Sustaining Cost (AISC) of $2,360 to $2,440 per ounce.

- Key project updates include the Hod Maden Development Project TRS highlighting a $1.7 billion NPV and 39% IRR, with a remaining investment of $470 million , and a nearly 40% year-over-year increase in mineral reserves to 11 million gold equivalent ounces.

- SSR Mining closed 2025 with $535 million in cash and over $1 billion in liquidity, delivering $106 million in free cash flow in Q4 2025 and $252 million for the full year.

- The company's Board approved a share buyback program of up to $300 million, reflecting confidence in continued material free cash flow generation in 2026 and the belief that the share price is undervalued.

- For 2026, SSR Mining expects to produce between 450,000 and 535,000 gold equivalent ounces with All-in Sustaining Costs (AISC) ranging from $2,360 to $2,440 per ounce.

- Technical Report Summaries (TRS) were released for the Hod Maden Development Project, highlighting a $1.7 billion NPV and 39% internal rate of return, and for the Cripple Creek & Victor (CC&V) Mine, showing an $824 million NPV. The company also closed 2025 with 11 million ounces of gold equivalent mineral reserves, up nearly 40% year-over-year.

- SSR Mining Inc. reported strong full-year 2025 financial results, with net income attributable to shareholders of $395.8 million ($1.85 per diluted share) and $471.9 million in operating cash flow.

- The company's full-year 2025 production was 447,207 gold equivalent ounces (GEOs), surpassing the midpoint of its annual guidance.

- For 2026, SSR Mining expects to deliver 450,000 to 535,000 GEOs, representing a 10% year-over-year increase at the midpoint.

- As of December 31, 2025, Mineral Reserves increased by nearly 40% year-over-year to 11 million GEOs, and the Board approved a share buyback program of up to $300 million.

- SSR Mining announced the results of the 2025 Hod Maden Technical Report Summary (TRS), projecting an after-tax NPV 5% of $1.66 billion and an Internal Rate of Return (IRR) of 39% at consensus metals prices.

- The Hod Maden project is anticipated to generate average annual after-tax operating cash flow of $343 million and free cash flow of $328 million at consensus metals prices.

- The total remaining project development capital spend is estimated at $910 million as of November 30, 2025, with SSR Mining's attributable remaining capital and acquisition earn-in spend expected to be approximately $469 million.

- Life of mine production is projected to be 1.6 million ounces of gold and 209 million pounds of copper, with estimated by-product all-in-sustaining costs (AISC) of $590 per ounce of payable gold.

- A project decision for Hod Maden is expected in 2026, following significant de-risking efforts and nearing completion of detailed engineering.

- SSR Mining announced the results of the 2025 Hod Maden Technical Report Summary (TRS), which estimates an after-tax NPV5% of $1.66 billion and a projected Internal Rate of Return (IRR) of 39% for the Hod Maden project at consensus metals prices.

- The project is expected to generate average annual free cash flow of $328 million, with $131 million attributable to SSR Mining based on its 40% ownership, at consensus metals prices.

- The total remaining project development capital spend is estimated at $910 million as of November 30, with SSR Mining's remaining attributable capital and acquisition earn-in spend expected to be approximately $469 million.

- Significant project de-risking efforts have been completed, with detailed engineering nearing completion and most major contracts tendered or in place.

- SSR Mining Inc. reported the results of a Technical Report Summary for its Cripple Creek & Victor Gold Mine in Colorado.

- The report highlights an after-tax Net Present Value (NPV) of $824 million at consensus gold prices averaging $3,240 per ounce over the life of the mine.

- The mine has a 12-year mine life and 26 years of total production based on 2.8 million ounces of gold Mineral Reserves.

- An average annual production of 141,000 ounces of gold is projected over the three-year period from 2026 to 2028.

- The mine also holds 4.8 million ounces of Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, with an additional 2 million ounces of Inferred Mineral Resources, indicating potential for future growth.

- SSR Mining announced an initial 12-year life of mine plan for its Cripple Creek & Victor Gold Mine (CC&V), with an after-tax NPV 5% of $824 million at consensus gold prices averaging $3,240 per ounce, as detailed in a Technical Report Summary (TRS) with an effective date of July 1, 2025.

- The CC&V mine is projected to have average annual gold production of 141,000 ounces and average annual after-tax free cash flow of $128 million over the three-year period from 2026 to 2028.

- The acquisition of CC&V, which closed on February 28, 2025, has an implied after-tax transaction Internal Rate of Return (IRR) in excess of 100%.

- As of July 1, 2025, CC&V holds 2.8 million ounces of gold Mineral Reserves, with additional Measured & Indicated Mineral Resources of 4.8 million ounces and Inferred Mineral Resources of 2.0 million ounces.

Quarterly earnings call transcripts for SSR MINING.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more