Earnings summaries and quarterly performance for Sunoco.

Research analysts who have asked questions during Sunoco earnings calls.

Theresa Chen

Barclays PLC

4 questions for SUN

Also covers: CQP, DINO, DTM +21 more

EJ

Eli Jossen

JPMorgan Chase & Co.

2 questions for SUN

Also covers: AROC, ATGFF, EE +6 more

ES

Elvira Scotto

RBC Capital Markets

2 questions for SUN

Also covers: AROC, ET, GEL +5 more

JJ

Justin Jenkins

Raymond James

2 questions for SUN

Also covers: LNG, PSX, WKC

Ned Baramov

Wells Fargo & Company

2 questions for SUN

Also covers: AM, NGL, WES

NK

Noah Katz

JPMorgan Chase & Co.

2 questions for SUN

Also covers: AM, ARIS, EE +3 more

SA

Selman Akyol

Stifel

2 questions for SUN

Also covers: ARIS, AROC, GLP +7 more

Spiro Dounis

Citigroup Inc.

2 questions for SUN

Also covers: ARIS, CQP, DTM +16 more

CD

Charles Douglas Bryant

Mizuho Securities USA LLC

1 question for SUN

GM

Gabriel Moreen

Mizuho Financial Group, Inc.

1 question for SUN

Also covers: AROC, ATO, DKL +16 more

JT

Jeremy Tonet

JPMorgan Chase & Co.

1 question for SUN

Also covers: AEE, AEP, AM +46 more

Recent press releases and 8-K filings for SUN.

Sunoco LP Prices Upsized Private Offering of Senior Notes

SUN

Debt Issuance

- Sunoco LP priced an upsized private offering on February 26, 2026, totaling $1.2 billion in senior notes, comprising $600 million of 5.375% senior notes due 2031 and $600 million of 5.625% senior notes due 2034.

- The offering was upsized from an initial aggregate principal amount of $1 billion.

- The net proceeds are intended to redeem NuStar Logistics, L.P.'s 6.000% senior notes due 2026 and Sunoco's 6.000% senior notes due 2027, with any remaining funds allocated for general partnership purposes.

- The sale of the new notes is expected to settle on March 9, 2026.

- Redemption notices were issued for the NuStar 2026 Notes (redemption on March 9, 2026) and Sunoco 2027 Notes (redemption on March 30, 2026), with the latter contingent on the closing of the new notes offering.

1 day ago

Sunoco LP Announces Pricing of Upsized Private Offering of Senior Notes

SUN

Debt Issuance

- Sunoco LP priced an upsized private offering of $1.2 billion in senior notes, consisting of $600 million of 5.375% senior notes due 2031 and $600 million of 5.625% senior notes due 2034.

- The offering was upsized from an initial aggregate principal amount of $1 billion.

- The net proceeds are intended to redeem NuStar Logistics, L.P.'s 6.000% senior notes due 2026 and Sunoco's 6.000% senior notes due 2027, with remaining proceeds for general partnership purposes.

- The sale of the notes is expected to settle on March 9, 2026.

1 day ago

Sunoco LP Announces Private Offering of Senior Notes and Debt Redemption Plans

SUN

Debt Issuance

M&A

- Sunoco LP announced a private offering of $1 billion in senior notes, consisting of $500 million due 2031 and $500 million due 2034.

- The net proceeds from this offering, combined with borrowings under its revolving credit facility, are intended to redeem NuStar Logistics, L.P.'s 6.000% senior notes due 2026 and Sunoco's 6.000% senior notes due 2027. These redemptions are expected on or about March 9, 2026, and March 30, 2026, respectively.

- As of February 23, 2026, Sunoco LP reported $500 million in cash and cash equivalents and approximately $2,109 million in additional available borrowing capacity under its revolving credit facility.

- The document also includes unaudited pro forma financial information for the year ended December 31, 2025, reflecting the Parkland Acquisition as if it had been completed on January 1, 2025.

2 days ago

Sunoco LP Announces Private Offering of Senior Notes

SUN

Debt Issuance

- Sunoco LP announced a private offering of senior notes totaling $1 billion, comprising $500 million due 2031 and $500 million due 2034.

- The net proceeds from this offering, along with borrowings under its revolving credit facility, are intended to redeem NuStar Logistics, L.P.'s 6.000% senior notes due 2026 and Sunoco's 6.000% senior notes due 2027.

- The offering is private and not registered under the Securities Act of 1933, with notes to be offered to qualified institutional buyers and non-U.S. persons.

2 days ago

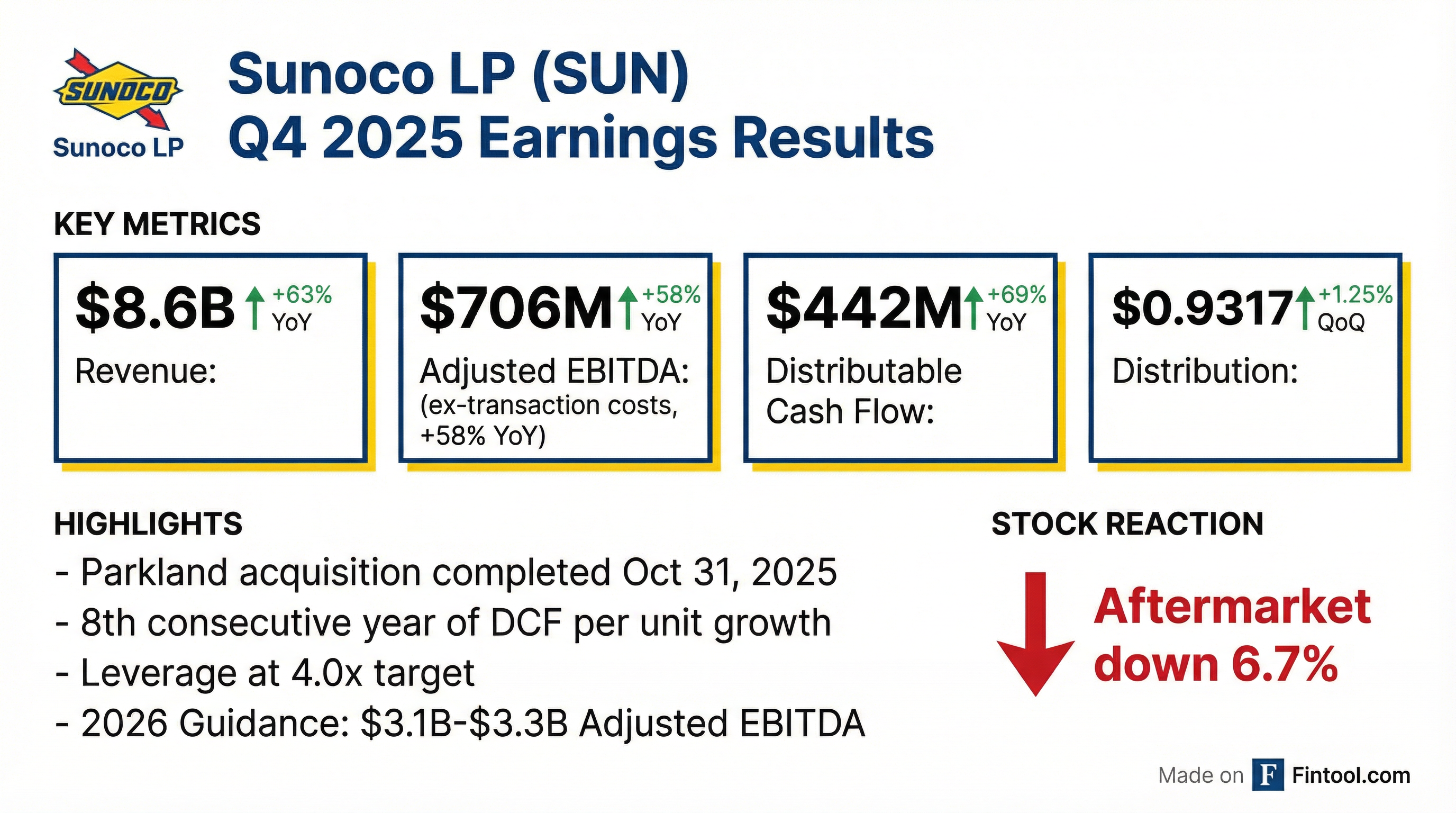

Sunoco LP Reports Record Q4 and Full-Year 2025 Results and Provides 2026 Guidance

SUN

Earnings

Guidance Update

M&A

- Sunoco LP achieved record adjusted EBITDA of $706 million in Q4 2025 (excluding one-time transaction expenses) and $2.12 billion for the full year 2025, representing a 36% increase over the prior year.

- The company declared a Q4 2025 distribution of $0.9317 per common unit, marking its fifth consecutive quarterly increase, and reported a strong trailing twelve-month coverage ratio of 1.9x.

- For 2026, Sunoco LP issued Adjusted EBITDA guidance of $3.1-$3.3 billion, anticipating $125 million of the total $250 million annual synergy target from the Parkland acquisition to be realized in 2026.

- Sunoco LP expects an annual distribution growth rate of at least 5% over multiple years, plans for at least $500 million in annual bolt-on acquisitions, and maintains a strong balance sheet with leverage at approximately 4x.

Feb 17, 2026, 3:00 PM

Sunoco Reports Record Q4 and Full Year 2025 Results, Provides Strong 2026 Guidance

SUN

Earnings

Guidance Update

M&A

- Sunoco LP reported record Adjusted EBITDA of $706 million for Q4 2025 and $2.12 billion for the full year 2025, a 36% increase over the prior year, reflecting strong operations and the contribution from the Parkland acquisition.

- The company declared a Q4 2025 distribution of $0.9317 per common unit, marking its fifth consecutive quarterly increase, and maintains a multi-year path for an annual distribution growth rate of at least 5%.

- For 2026, Sunoco LP provided Adjusted EBITDA guidance of $3.1 billion to $3.3 billion, supported by the realization of $125 million of the $250 million annual synergy target from Parkland and plans for at least $600 million in growth capital projects and at least $500 million in bolt-on acquisitions.

- The Parkland transaction, closed on October 31st, significantly expanded Sunoco's operations, making it the largest independent fuel distributor in the Americas, and the company expects minimal corporate income taxes for SUNC for at least five years.

Feb 17, 2026, 3:00 PM

Sunoco Reports Record FY 2025 Adjusted EBITDA and Provides Strong 2026 Guidance

SUN

Earnings

Guidance Update

M&A

- Sunoco reported a record Adjusted EBITDA of $2.12 billion for the full year 2025, representing a 36% increase over the prior year, attributed to solid underlying growth and contributions from new acquisitions.

- The Fuel Distribution segment's Adjusted EBITDA for Q4 2025 was $391 million, excluding transaction expenses, with 3.3 billion gallons distributed and a reported margin of $0.177 per gallon, reflecting the addition of the Parkland business.

- The company's balance sheet remains robust, with leverage at approximately 4x at the end of 2025, in line with its long-term target, and $2.5 billion in availability under its revolving credit facility.

- For 2026, Sunoco anticipates Adjusted EBITDA in the range of $3.1 billion-$3.3 billion and expects to realize $125 million of the total $250 million annual synergy target from the Parkland acquisition.

- Sunoco projects at least 5% annual distribution growth for 2026 and over a multi-year period, alongside at least $500 million in bolt-on acquisition opportunities and at least $600 million in growth capital projects for 2026.

Feb 17, 2026, 3:00 PM

Sunoco Reports Q4 2025 Earnings Miss

SUN

Earnings

M&A

- Sunoco LP reported Q4 2025 revenue of $8.6 billion and non-GAAP EPS of $0.09, missing analyst estimates of ~$9.45 billion and ~$1.05 respectively.

- Revenue increased approximately 63% year-over-year, largely driven by the acquisition of Parkland’s U.S. business, which also contributed to integration costs and a more complex capital structure.

- Despite the revenue miss, Adjusted EBITDA showed strong operational performance, with Q4 up 47% to $646 million and full-year Adjusted EBITDA rising about 40% to $2.05 billion.

- The market reacted negatively, with SUN units falling about 2.6% in pre-market trading immediately after the results were released, and the stock recently traded near $59.51. Institutional trading activity was mixed, with 98 investors increasing and 117 decreasing their holdings.

Feb 17, 2026, 12:20 PM

Sunoco LP Reports Solid Q4 2025 Results, Completes Acquisitions, and Increases Distribution

SUN

Earnings

M&A

Dividends

- Sunoco LP reported solid fourth quarter 2025 results, including $97 million in net income, $706 million in Adjusted EBITDA (excluding one-time transaction-related expenses), and $442 million in Distributable Cash Flow, as adjusted.

- The company completed the acquisition of Parkland Corporation on October 31, 2025, and the acquisition of TanQuid in January 2026.

- Sunoco LP ended 2025 at its long-term leverage target of approximately 4 times.

- The quarterly distribution was increased by 1.25% to $0.9317 per common unit for Q4 2025, with a target of at least 5% annual distribution growth for 2026.

Feb 17, 2026, 12:09 PM

Sunoco Reports Solid Q4 and Full-Year 2025 Results, Completes Acquisitions

SUN

Earnings

M&A

Dividends

- Sunoco reported solid fourth quarter 2025 results, including net income of $97 million, Adjusted EBITDA of $706 million (excluding one-time transaction-related expenses), and Distributable Cash Flow, as adjusted, of $442 million.

- For the full-year 2025, the company achieved net income of $527 million, Adjusted EBITDA of $2.05 billion, and Distributable Cash Flow, as adjusted, of $1.38 billion.

- The company completed the acquisition of Parkland Corporation on October 31, 2025, and the acquisition of TanQuid in January 2026.

- Sunoco ended 2025 at its long-term leverage target of approximately 4 times and increased its quarterly distribution by 1.25% to $0.9317 per common unit for Q4 2025, targeting an annual distribution growth rate of at least 5% for 2026.

Feb 17, 2026, 12:00 PM

Quarterly earnings call transcripts for Sunoco.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more