Earnings summaries and quarterly performance for TRUSTMARK.

Executive leadership at TRUSTMARK.

Duane Dewey

President and Chief Executive Officer

Barry Harvey

Executive Vice President, Chief Credit and Operations Officer (Trustmark Bank)

Granville Tate Jr.

Executive Vice President, Chief Administrative Officer, and Secretary (Trustmark Bank); Secretary (Trustmark Corporation)

Tom Owens

Treasurer and Principal Financial Officer; Executive Vice President and Chief Financial Officer (Trustmark Bank)

Wayne Stevens

President – Retail Banking (Trustmark Bank)

Board of directors at TRUSTMARK.

Adolphus Baker

Director

Augustus Collins

Director

Clay Hays Jr., M.D.

Director

Gerard Host

Chair of the Board

Harris Morrissette

Director

Lea Turnipseed

Director

Marcelo Eduardo

Director

Richard Puckett

Lead Independent Director

Tracy Conerly

Director

William Yates III

Director

Research analysts who have asked questions during TRUSTMARK earnings calls.

Christopher Marinac

Janney Montgomery Scott LLC

13 questions for TRMK

Catherine Mealor

Keefe, Bruyette & Woods

11 questions for TRMK

Feddie Strickland

Hovde Group

9 questions for TRMK

Tim Mitchell

Raymond James Financial

7 questions for TRMK

Gary Tenner

D.A. Davidson & Co.

5 questions for TRMK

Stephen Scouten

Piper Sandler & Co.

3 questions for TRMK

Michael Rose

Raymond James Financial, Inc.

2 questions for TRMK

Timothy Mitchell

Raymond James

2 questions for TRMK

William Jones

Truist Securities

2 questions for TRMK

Andrew Gorczyca

Piper Sandler

1 question for TRMK

David Bishop

Hovde Group

1 question for TRMK

Eric Spector

Raymond James

1 question for TRMK

Recent press releases and 8-K filings for TRMK.

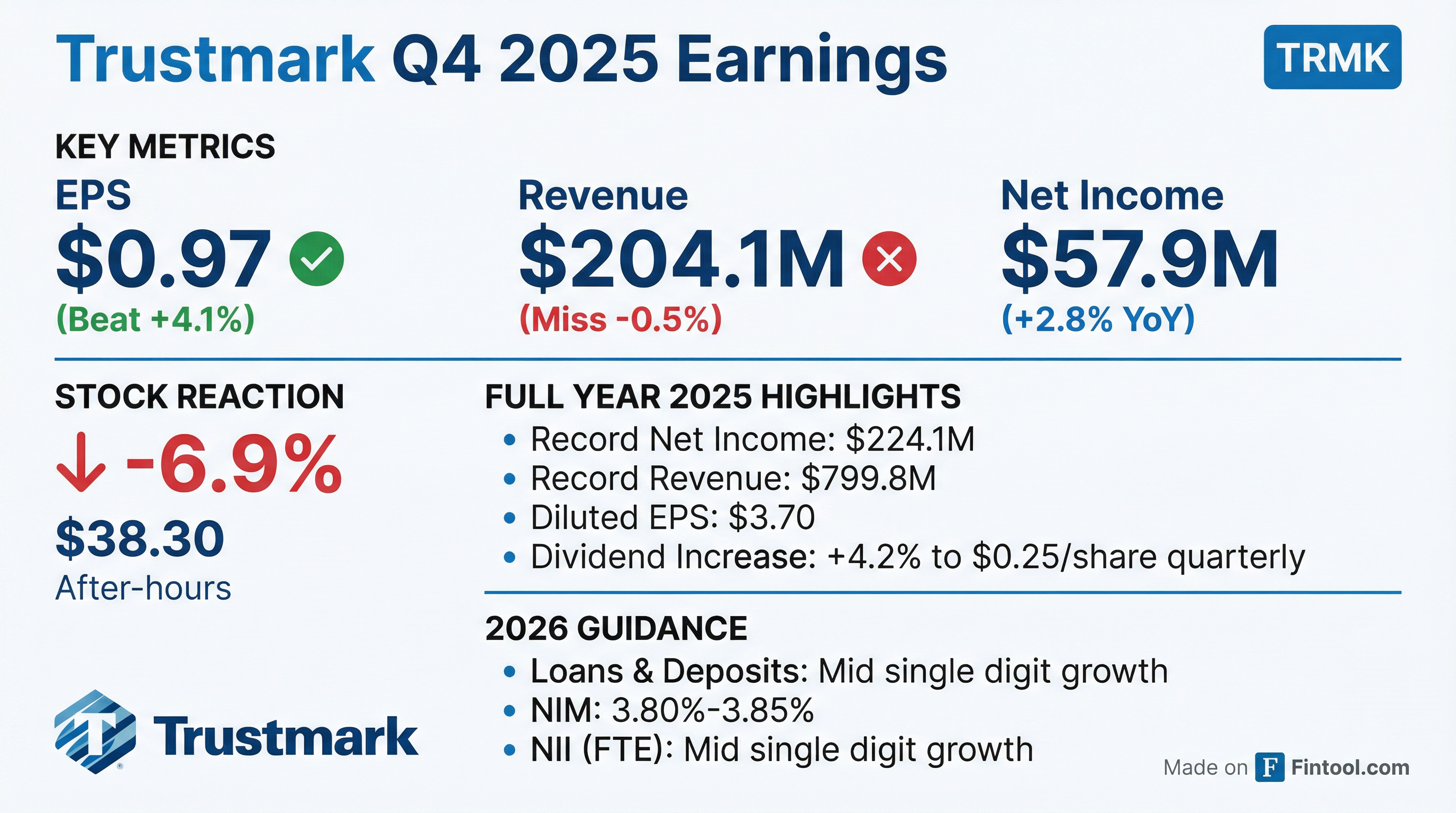

- Trustmark Corporation achieved record net income of $224.1 million and record revenue of $800 million for the full year 2025, with diluted EPS of $3.70.

- For Q4 2025, net income totaled $57.9 million, representing diluted EPS of $0.97, and total revenue was $204 million.

- The company provided full-year 2026 guidance, projecting mid-single digit increases for loans held for investment, deposits (excluding brokered), net interest income, non-interest income, and non-interest expense. The net interest margin is anticipated to be in the range of 3.8%-3.85%.

- Trustmark increased its regular quarterly dividend by 4.2% to $0.25 per share and repurchased $80 million of common stock in 2025, with a $100 million authorization for 2026.

- TRMK reported record net income of $224.1 million and diluted EPS of $3.70 for the full year 2025, with Q4 2025 net income at $57.9 million and diluted EPS at $0.97. The company also achieved record revenue of $799.8 million in 2025.

- Loans held for investment (HFI) increased 4.5% year-over-year to $13.7 billion at December 31, 2025, and total deposits were $15.5 billion, up 2.6% from the prior year.

- Trustmark's Board of Directors announced a 4.2% increase in its regular quarterly dividend to $0.25 per share from $0.24 per share, raising the indicated annual dividend rate to $1.00 per share. Additionally, the company repurchased $80.0 million of common shares in 2025 and authorized a new $100.0 million stock repurchase program for 2026.

- For FY 2026, TRMK expects mid-single-digit increases for Loans HFI, Deposits (excluding brokered), Net Interest Income (FTE), Noninterest Income, and Noninterest Expense, with a Net Interest Margin range of 3.80% to 3.85%.

- Trustmark achieved record net income of $224.1 million and diluted EPS of $3.70 for the full year 2025, with Q4 2025 net income totaling $57.9 million and diluted EPS at $0.97.

- Full year 2025 revenue reached $800 million, and the net interest margin for Q4 2025 was 3.81%. The company's CET1 ratio stood at 11.72% at year-end 2025.

- The company repurchased $80 million of common stock in 2025, including $43 million in Q4, and announced a 4.2% increase in its regular quarterly dividend to $0.25 per share.

- For 2026, Trustmark expects mid-single digit increases in loans held for investment, deposits (excluding brokered), net interest income, non-interest income, and non-interest expense, with a full-year net interest margin projected to be in the range of 3.8%-3.85%.

- Trustmark Corporation reported net income of $57.9 million and diluted earnings per share of $0.97 for the fourth quarter of 2025, with full-year 2025 net income totaling $224.1 million and diluted EPS of $3.70.

- Total revenue reached a record level of $799.8 million in 2025, driven by an 8.4% increase in net interest income (FTE) to $647.2 million and a net interest margin of 3.80%.

- The company experienced continued growth in its core business, with loans held for investment increasing 4.5% and deposits growing 2.6% in 2025.

- Trustmark's Board of Directors approved a 4.2% increase in the regular quarterly dividend to $0.25 per share, and the company repurchased 2.2 million shares of common stock during 2025.

- In the fourth quarter of 2025, Trustmark issued $175.0 million in 6.00% Fixed-to-Floating Rate Subordinated Notes and repaid $125.0 million of existing subordinated notes.

- Trustmark Corporation reported net income of $57.9 million and diluted earnings per share of $0.97 for the fourth quarter of 2025. For the full year 2025, net income totaled $224.1 million, representing diluted earnings per share of $3.70.

- Total revenue reached a record level of $799.8 million in 2025, an 8.0% increase from adjusted continuing operations in the prior year.

- The Board of Directors announced a 4.2% increase in its regular quarterly dividend to $0.25 per share, raising the indicated annual dividend rate to $1.00 per share.

- Trustmark repurchased 2.2 million shares of common stock, totaling $80.0 million, during 2025.

- Loans held for investment increased 4.5% to $13.7 billion at December 31, 2025, and deposits increased 2.6% to $15.5 billion in 2025.

- Trustmark reported Q4 2025 adjusted EPS of $0.97 and revenue of roughly $207.06 million, with earnings beating consensus and revenue largely in line with estimates.

- The company achieved record earnings in 2025, driven by loan and deposit growth, a strong net interest margin, and improved mortgage and wealth-management results.

- Trustmark announced a new share buyback plan and plans for technology investments.

- Shares were volatile and analysts trimmed outlooks and price targets after the mixed top-line data, while insider activity has been exclusively sales over the past six months.

- Trustmark Corporation agreed to issue and sell $175,000,000 aggregate principal amount of its 6.00% Fixed-to-Floating Rate Subordinated Notes due 2035.

- The offering is expected to close on November 20, 2025, with net proceeds of approximately $173.1 million after a 1.1% underwriting discount.

- The company intends to use the net proceeds to repay $125,000,000 of its outstanding 3.625% Fixed-to-Floating Rate Subordinated Notes due 2030 and for general corporate purposes.

- The new notes will bear a fixed interest rate of 6.00% per year until December 1, 2030, and then a floating rate equal to the Benchmark (expected to be Three-Month Term SOFR) plus 260 basis points until the maturity date of December 1, 2035.

- These notes will be unsecured, subordinated obligations, ranking junior to senior indebtedness, equal to certain other subordinated indebtedness, and senior to junior subordinated debentures.

- Trustmark Corporation reported net income of $56.8 million and fully diluted EPS of $0.94 for Q3 2025.

- Revenue increased 1.9% linked-quarter to $202.4 million, with net interest income (FTE) rising 2.4% linked-quarter to $165.2 million and a net interest margin of 3.83%.

- Loans held for investment (HFI) increased $83.4 million (0.6%) linked-quarter to $13.5 billion, and total deposits grew $515.1 million (3.4%) linked-quarter to $15.6 billion as of September 30, 2025.

- The company maintained a strong capital position with a Common Equity Tier 1 (CET1) ratio of 11.88% and a Tangible Common Equity to Tangible Assets ratio of 9.6% at September 30, 2025.

- During Q3 2025, Trustmark repurchased $11.0 million of common shares and declared a quarterly cash dividend of $0.24 per share.

- Trustmark reported net income of $56.8 million and fully diluted EPS of $0.94 for Q3 2025, marking increases of 2.2% linked quarter and 11.9% year-over-year.

- The company achieved diversified loan growth of 0.6% linked quarter and 3.4% year-over-year, alongside core deposit growth of 3.4% linked quarter.

- Net interest margin expanded by two basis points to 3.83% in Q3 2025, and the full-year 2025 guidance for net interest margin was tightened to 3.78% to 3.82%.

- Credit quality remained solid with net charge-offs of $4.4 million (13 basis points of average loans) and a $1.7 million provision for credit losses; criticized loans decreased by $49 million in the quarter.

- Trustmark repurchased $11 million of common stock in Q3 2025, contributing to a $37 million year-to-date total, and increased its CET1 ratio by 18 basis points to 11.88%.

- Trustmark Corporation (TRMK) reported net income of $56.8 million and fully diluted EPS of $0.94 for Q3 2025, representing an 11.9% increase from the prior year.

- The company experienced diversified growth, with loans held for investment increasing $83 million (0.6%) linked quarter and the deposit base growing $550 million (3.4%) linked quarter, including a 5.9% increase in non-interest-bearing deposits.

- Net interest income expanded 2.4% to $165.2 million, resulting in a net interest margin of 3.83%, an increase of two basis points from the prior quarter.

- TRMK repurchased $11 million of common stock in Q3 2025, bringing the year-to-date total to $37 million, with $63 million in repurchase authority remaining. The CET1 ratio expanded 18 basis points to 11.88%.

- For the full year 2025, the company tightened its net interest margin guidance to a range of 3.78% to 3.82% and affirmed expectations for mid-single-digit growth in loans held for investment and low single-digit growth in deposits. Non-interest expense is expected to increase mid-single digits, partly due to the hiring of 29 new associates in Q3, primarily in production roles.

Quarterly earnings call transcripts for TRUSTMARK.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more