Earnings summaries and quarterly performance for WHIRLPOOL CORP /DE/.

Executive leadership at WHIRLPOOL CORP /DE/.

Marc Bitzer

Chief Executive Officer

Alessandro Perucchetti

Executive Vice President and President, Whirlpool North America

Carey Martin

Executive Vice President, Chief Human Resources and Corporate Relations Officer

James Peters

Executive Vice President, Chief Financial and Administrative Officer and President, Whirlpool Asia

Juan Carlos Puente

Executive President, Whirlpool North America and Global Strategic Sourcing (effective Jan 1, 2026)

Ludovic Beaufils

Executive President, KitchenAid Small Appliances, Whirlpool Latin America, Global Information Technology, and Design (effective Jan 1, 2026)

Roxanne Warner

Chief Financial Officer (effective Jan 1, 2026)

Todd Tomczak

Vice President and Controller (Principal Accounting Officer) (effective Jan 1, 2026)

Board of directors at WHIRLPOOL CORP /DE/.

Diane Dietz

Director

Gerri Elliott

Director

Greg Creed

Director

Harish Manwani

Director

James Loree

Director

Jennifer LaClair

Director

John Liu

Director

John Morikis

Director

Judith Buckner

Director

Mary Ellen Adcock

Director

Richard Kramer

Director

Rudy Wilson

Director

Samuel Allen

Presiding Director

Research analysts who have asked questions during WHIRLPOOL CORP /DE/ earnings calls.

David Macgregor

Longbow Research

6 questions for WHR

Eric Bosshard

Cleveland Research Company

6 questions for WHR

Rafe Jadrosich

Bank of America

6 questions for WHR

Michael Rehaut

JPMorgan Chase & Co.

4 questions for WHR

Sam Darkatsh

Raymond James & Associates, Inc.

4 questions for WHR

Susan Maklari

Goldman Sachs Group Inc.

4 questions for WHR

Laura Champine

Loop Capital Markets LLC

3 questions for WHR

Michael Dahl

RBC Capital Markets

3 questions for WHR

Mike Dahl

RBC Capital Markets

3 questions for WHR

Jeffrey Stevenson

Loop Capital Markets LLC

2 questions for WHR

Joshua Wilson

Raymond James Financial, Inc.

2 questions for WHR

Alex Isaac

JPMorgan Chase & Co.

1 question for WHR

Andrew Carter

Stifel Financial Corp.

1 question for WHR

Charles Perron

The Goldman Sachs Group, Inc.

1 question for WHR

Charles Perron-Piché

Goldman Sachs

1 question for WHR

W. Andrew Carter

Stifel

1 question for WHR

Recent press releases and 8-K filings for WHR.

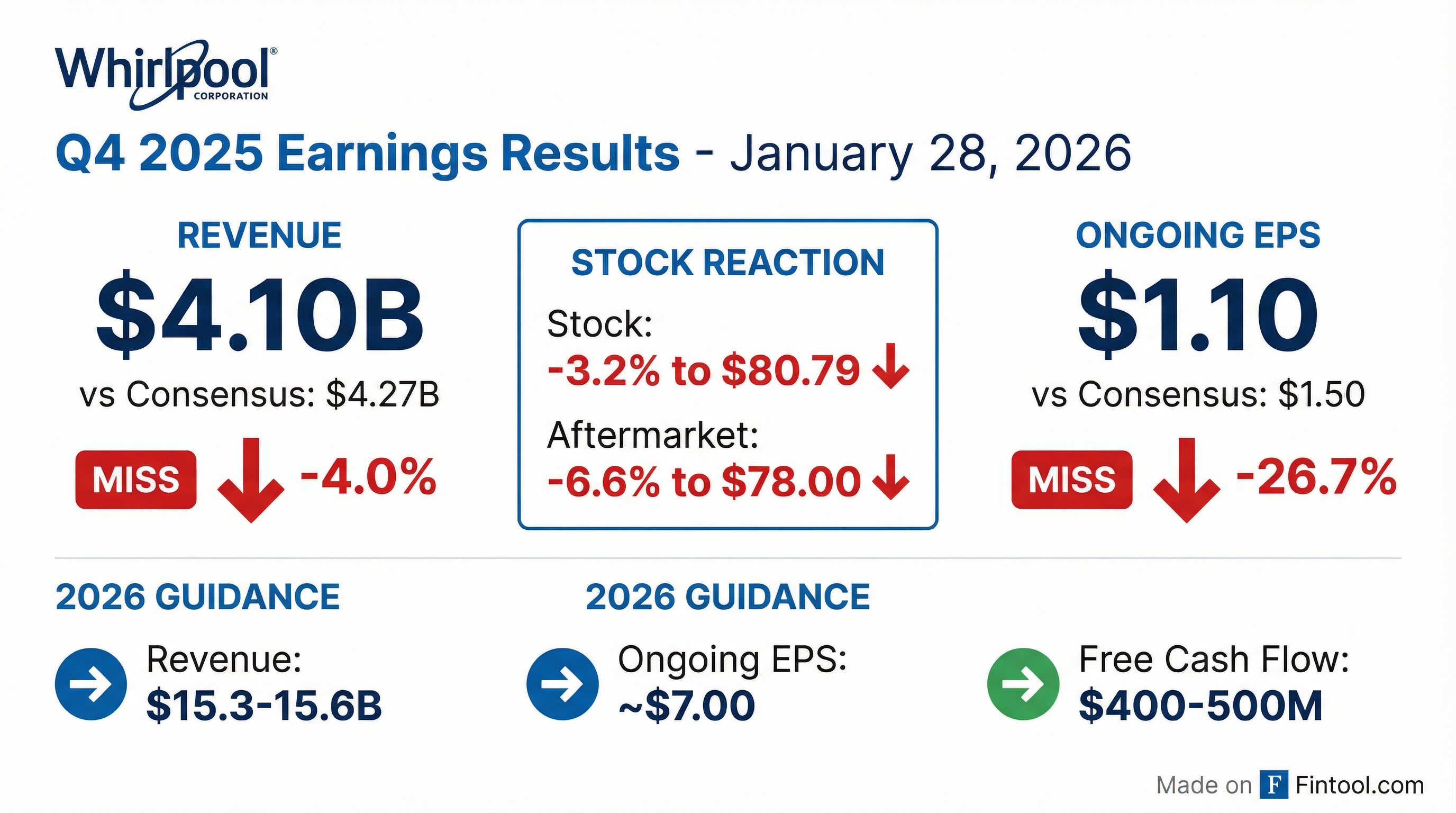

- Whirlpool Corporation reported disappointing fourth-quarter results, with adjusted EPS of $1.10 and revenue of $4.098 billion, both below analyst estimates and down year-over-year. Ongoing EBIT fell about 45.6% to $135 million, and margins contracted roughly 270 basis points.

- The company cut its fiscal 2026 guidance, setting an EPS target of about $7 and revenue guidance of $15.30 billion to $15.60 billion, both below analyst expectations.

- Gross profit decreased to $575 million (down 14.3% year over year), and gross margin declined about 220 basis points to 14%. MDA North America sales fell about 1% to $2.57 billion, with EBIT dropping roughly 59%.

- In response to the news, the stock declined roughly 3–5%. Separately, Whirlpool of India Ltd. reported weak quarterly results, with PAT down 34.4% to Rs.34.13 crore, and promoters reduced their stake by 11.24 percentage points.

- Whirlpool (WHR) reported flat global organic revenues and an ongoing EBIT margin of 4.7% for the full year 2025, with ongoing earnings per share of $6.23 and $78 million in free cash flow.

- The company absorbed approximately $300 million of tariffs in 2025, which, combined with a 30-year low in existing home sales and an intense promotional environment, unfavorably impacted margins.

- For 2026, WHR expects approximately 5% like-for-like revenue growth, an ongoing EBIT margin of 5.5%-5.8%, ongoing earnings per share of approximately $7, and free cash flow between $400 million and $500 million.

- WHR plans to pay down at least $400 million of debt in 2026 and expects to achieve over $150 million in cost takeout actions, primarily in North America.

- For the full-year 2025, Whirlpool Corporation reported global organic revenues were essentially flat to the prior year, with an ongoing EBIT margin of 4.7% and ongoing earnings per share of $6.23. The company also generated $78 million of free cash flow.

- For 2026, the company expects like-for-like revenue growth of approximately 5% and an ongoing EBIT margin expansion of 80-110 basis points, leading to an EBIT margin of 5.5%-5.8%.

- Full-year 2026 ongoing earnings per share are projected at approximately $7, which includes an estimated $2 impact from an increased adjusted effective tax rate of 25%.

- Whirlpool anticipates free cash flow of $400 million-$500 million for 2026 and plans to pay down at least $400 million of debt.

- The company expects a positive price mix impact of 175 basis points in 2026, driven by new product launches and a reduced promotional environment, although potential upside from a housing recovery is not yet factored into guidance.

- Whirlpool reported flat global organic revenues and an ongoing EBIT margin of 4.7% for full-year 2025, with ongoing earnings per share of $6.23 and $78 million in free cash flow, primarily impacted by an intense promotional environment and tariffs.

- For 2026, the company forecasts approximately 5% like-for-like revenue growth, an ongoing EBIT margin of approximately 5.5%-5.8%, and full-year ongoing earnings per share of approximately $7.

- The 2026 outlook is supported by over $150 million in cost actions, a normalized promotional environment, and strong performance from new product launches, with free cash flow expected to be between $400 million and $500 million.

- The company also plans to pay down at least $400 million of debt in 2026 and returned approximately $300 million to shareholders in 2025 through dividends.

- Whirlpool provided 2026 full-year guidance, projecting Net Sales of $15.3-$15.6 billion, an Ongoing EBIT Margin of 5.5-5.8%, Free Cash Flow of $400-500 million, and Ongoing Earnings per Diluted Share of ~$7.00.

- The company expects to improve its 2026 Ongoing EBIT Margin by 1.75% from Price/Mix actions and 1.00% from Net Cost actions, which include over $150 million in cost take-out initiatives.

- Key capital allocation priorities for 2026 include funding organic growth with ~$400 million in Capex and launching ~100 new products, along with debt paydown of ~$400 million; share buybacks or value-creating M&A are not a priority.

- Whirlpool is focusing on growth in MDA Latin America with leading brands and expanding its SDA Global business, particularly with the KitchenAid brand, which is recognized for high margins and strong brand preference. The company also introduced an industry-first UV Clean Technology for its Laundry Tower.

- Whirlpool reported fourth-quarter GAAP net income of $108 million ($1.91 per share) and adjusted ongoing EPS of $1.10, missing analyst estimates as revenue declined to approximately $4.1 billion.

- The company set fiscal 2026 guidance for roughly $6.25 GAAP EPS and $7.00 ongoing EPS, with net sales of $15.3–15.6 billion, which is below some consensus forecasts and led to a 7.26% drop in share price.

- Management plans to reduce debt by approximately $400 million by 2026, but the company faces significant leverage and margin pressures, highlighted by a debt-to-equity ratio of ~3.48 and an Altman Z-Score of 1.25.

- Whirlpool Corporation reported full-year 2025 net sales of $15,524 million, with GAAP earnings per diluted share of $5.66 and ongoing earnings per diluted share of $6.23.

- For the fourth quarter of 2025, the company reported net sales of $4,098 million, GAAP earnings per diluted share of $1.91, and ongoing earnings per diluted share of $1.10.

- The company provided full-year 2026 guidance, expecting net sales between $15.3 billion and $15.6 billion, GAAP earnings per diluted share of approximately $6.25, and ongoing earnings per diluted share of approximately $7.00.

- Whirlpool anticipates cash provided by operating activities of approximately $850 million and free cash flow of $400 million to $500 million for 2026, alongside plans to pay down approximately $400 million of debt.

- In 2025, the company executed $200 million in structural cost take out and reduced its ownership stake in Whirlpool of India to approximately 40%, utilizing the proceeds to reduce debt.

- Whirlpool Corporation reported full-year 2025 net sales of $15.524 billion, GAAP net earnings per diluted share of $5.66, and ongoing earnings per diluted share of $6.23.

- For 2026, the company expects net sales between $15.3 billion and $15.6 billion, GAAP earnings per diluted share of approximately $6.25, and ongoing earnings per diluted share of approximately $7.00.

- The 2026 outlook includes cash provided by operating activities of approximately $850 million and free cash flow of $400 - $500 million, with plans to pay down approximately $400 million of debt.

- In 2025, Whirlpool executed $200 million in structural cost take-out and launched a record number of new products in North America.

- On November 27, 2025, Whirlpool Corporation's wholly-owned subsidiary, Whirlpool Mauritius Limited, sold 14,255,000 equity shares of its publicly listed Whirlpool of India Limited subsidiary via an on-market trade.

- This transaction reduced the Seller's ownership in Whirlpool India from 51% to approximately 40%.

- The sale generated gross sales proceeds of approximately $166 million, with settlement occurring on November 28, 2025.

- Whirlpool Corporation expects to use these proceeds to reduce debt and continues to evaluate options to further reduce its equity stake in Whirlpool India by the end of the first half of 2026.

- Whirlpool reported Q3 2025 Net Sales of $4.0 billion, representing a 1.0% year-over-year increase, with an Ongoing EBIT Margin of 4.5% and Ongoing EPS of $2.09.

- The company updated its 2025 full-year guidance, projecting ongoing EPS of ~$7.00 and Free Cash Flow of ~$200 million (approximately 1.25% of net sales).

- Q3 2025 Free Cash Flow was $(907) million, significantly impacted by ~$100 million in tariff payments and inventory build, with the full-year tariff impact estimated at ~$225 million.

- Whirlpool expects to announce the share sale transaction for Whirlpool of India by December 2025, targeting closure in H1 2026, which will reduce its stake from 51% to ~20%.

- Capital allocation priorities for 2025 include funding organic growth with ~$400 million in Capex and a Q4 dividend of $0.90 per share, with debt paydown delayed to 2026.

Quarterly earnings call transcripts for WHIRLPOOL CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more