Earnings summaries and quarterly performance for XCEL ENERGY.

Executive leadership at XCEL ENERGY.

Bob Frenzel

Chief Executive Officer

Amanda Rome

Executive Vice President, Group President, Utilities and Chief Customer Officer

Brian Van Abel

Executive Vice President, Chief Financial Officer

Ryan Long

Executive Vice President, Chief Legal and Compliance Officer

Tim O'Connor

Executive Vice President, Chief Operations Officer

Board of directors at XCEL ENERGY.

Charles Pardee

Director

Devin Stockfish

Director

George Kehl

Director

James Prokopanko

Director

Lynn Casey

Director

Megan Burkhart

Director

Netha Johnson

Director

Patricia Kampling

Lead Independent Director

Richard O'Brien

Director

Tim Welsh

Director

Research analysts who have asked questions during XCEL ENERGY earnings calls.

Carly Davenport

Goldman Sachs

6 questions for XEL

Nicholas Campanella

Barclays

6 questions for XEL

Travis Miller

Morningstar

5 questions for XEL

Jeremy Tonet

JPMorgan Chase & Co.

4 questions for XEL

Julien Dumoulin-Smith

Jefferies

4 questions for XEL

Durgesh Chopra

Evercore ISI

3 questions for XEL

Paul Patterson

Glenrock Associates

3 questions for XEL

Anthony Crowdell

Mizuho Financial Group

2 questions for XEL

Brian Rusel

Jefferies Financial Group Inc.

2 questions for XEL

Diana Niles

JPMorgan Chase & Co.

2 questions for XEL

Sophie Karp

KeyBanc Capital Markets Inc.

2 questions for XEL

Steven Fleishman

Wolfe Research

2 questions for XEL

David Arcaro

Morgan Stanley

1 question for XEL

Ross Fowler

Bank of America

1 question for XEL

Ryan Levine

Citigroup

1 question for XEL

Steve Fleishman

Wolfe Research, LLC

1 question for XEL

Steven

ABL Investments

1 question for XEL

Steven Lewis

RBC Capital Markets

1 question for XEL

Recent press releases and 8-K filings for XEL.

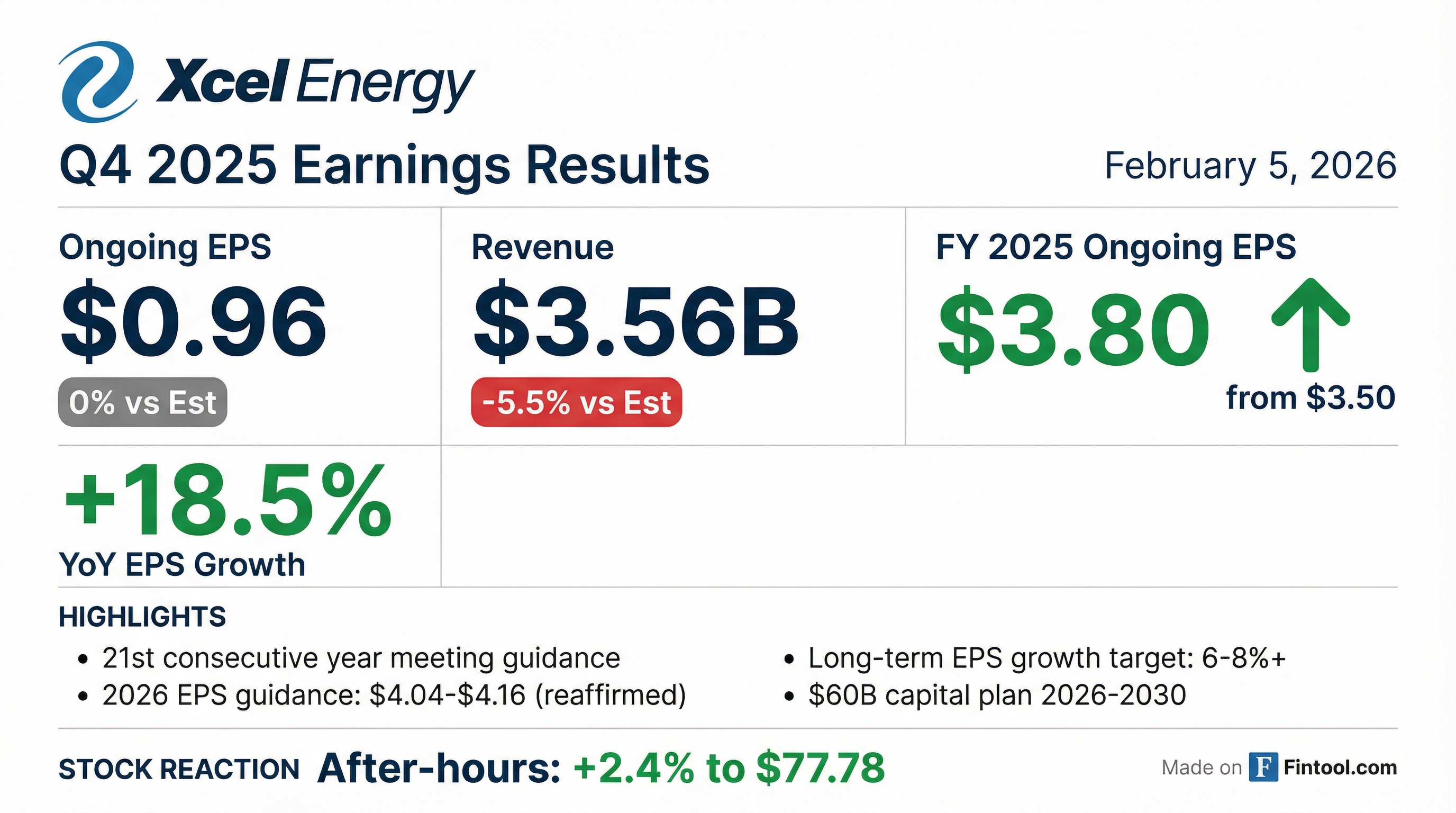

- Full year 2025 ongoing EPS of $3.80, marking the 21st consecutive year of meeting or exceeding guidance, and reaffirmed 2026 EPS guidance of $4.04–$4.16 per share.

- Weather-adjusted electric sales rose 2.2% in 2025, driven by increased C&I load, while O&M expenses increased by $190 million primarily due to accelerated wildfire mitigation, insurance, and maintenance costs.

- Committed over $60 billion in capital investments from 2026–2030 to modernize the grid, including $12 billion invested in 2025, and have contracted 2 GW of data center capacity—targeting 3 GW by end-2026 and 6 GW by end-2027.

- Announced strategic alliances with NextEra Energy to co-develop generation and storage for data centers and with GE Vernova to supply gas turbines and renewable energy equipment, and advanced wildfire mitigation plans across key jurisdictions.

- Xcel Energy delivered $3.80 ongoing EPS in FY 2025, marking its 21st consecutive year of meeting or exceeding guidance (vs. $3.50 in 2024).

- The company reaffirmed FY 2026 EPS guidance of $4.04–$4.16, targeting 6%–8%+ long-term earnings growth and 9% EPS CAGR through 2030.

- Updated 2026–2030 capital plan adds 7 GW of renewables, natural gas generation, and storage, as part of over $60 billion in grid modernization investments over the next five years.

- Xcel has signed ESAs for over 2 GW of data center capacity, aiming for 3 GW by end-2026 and 6 GW by end-2027 to extend sales and investment opportunities.

- The low-end liability estimate for Smokehouse Creek wildfire claims was revised to $430 million, with $382 million committed and $500 million in insurance coverage.

- Q4 2025 GAAP EPS $0.95 and ongoing EPS $0.96, up from $0.81 in Q4 2024

- 2025 annual GAAP EPS $3.42, ongoing EPS $3.80; 2026 ongoing EPS guidance $4.04–$4.16

- Invested nearly $12 billion in infrastructure during 2025 and updated its five-year capital plan to $60 billion

- Contracted over 2 GW of new data centers, raising its data center capacity to 6 GW by end of 2027

- Reached a comprehensive settlement to resolve the Marshall Fire litigation

- Ongoing EPS of $3.80 in 2025 (+$0.30 YoY), with weather-adjusted electric sales up 2.2%, and 2026 sales growth guidance of 3%.

- Reaffirmed 2026 EPS guidance of $4.04–$4.16 and long-term earnings growth of 6–8%+, targeting 9% EPS growth through 2030.

- Released 2026–2030 capital plan adding 7,000 MW of new renewables, natural gas generation and storage; awarded over 760 miles of 765 kV transmission lines, with $1.5 billion of additional investment visibility.

- Expanded data center pipeline to >2 GW contracted, targeting 3 GW by end-2026 and 6 GW by end-2027 through MOU with NextEra.

- Settled 320 of ~420 Smokehouse Creek wildfire claims; updated low-end liability to $430 million with $382 million committed and $500 million insurance coverage.

- Full-year 2025 GAAP diluted EPS of $3.42 (vs. $3.44 in 2024) and ongoing diluted EPS of $3.80 (vs. $3.50) on net income of $2.02 B

- Q4 2025 GAAP diluted EPS of $0.95 (vs. $0.81) and ongoing EPS of $0.96

- Reaffirmed 2026 EPS guidance of $4.04 to $4.16 per share

- Forecast $60 B in base capital expenditures for 2026–2030, to be funded ~40% equity/60% debt; financing plan includes $30.18 B cash from operations, $22.82 B new debt and $7 B equity

- Recorded a $298 M nonrecurring charge for the Marshall Wildfire settlement and recognized $430 M of estimated probable losses (before insurance) for the Smokehouse Creek Fire Complex

- Xcel Energy signed a memorandum of understanding (MOU) with NextEra Energy to accelerate delivery of generation resources for large load customers, including data centers.

- The agreement expands their commercial relationship to collaborate on generation, storage and transmission investments across Xcel’s service territories.

- Xcel expects to increase data center demand it can serve through the 2030s while ensuring existing customers benefit and data centers pay their fair share.

- A formal joint development agreement is expected in the coming months, subject to definitive terms and regulatory approvals.

- Xcel Energy and GE Vernova signed a Strategic Alliance Agreement to support generation and grid projects into the 2030s, enhancing supply certainty, operational flexibility, and cost predictability.

- As a first step, Xcel executed a reservation for five F-class gas turbines and a capacity reservation for multiple gigawatts of wind turbines, all manufactured in the U.S..

- The companies will collaborate on grid equipment opportunities, building on a critical order for systems—including synchronous condenser technology—in 2025.

- The alliance will explore advancements in artificial intelligence, grid modernization, and joint R&D to pilot next-generation energy technologies.

- On January 30, 2026, Xcel Energy entered into a $1.5 billion 364-day delayed-draw term loan facility and immediately drew $750 million to fund general corporate operations.

- The unsecured facility, maturing January 30, 2027, carries interest at Term SOFR + 85 basis points or an alternate base rate.

- It includes a covenant requiring consolidated funded debt-to-total capitalization ≤ 70 % and standard restrictions on mergers, asset sales, liens and cross-default events.

- On Dec. 29, 2025, Public Service Company of Colorado filed a natural gas rate case with the Colorado Public Utilities Commission seeking a $190 million (11.6%) increase in revenue, based on a 10.75% return on equity, 55% equity ratio and a 2025 test year with a projected $4.7 billion rate base.

- The base rate request breakdown includes $90 million for capital investments, $53 million for cost of capital changes, $42 million for O&M expenses, a $7 million reduction from sales growth and $12 million for other items.

- A CPUC decision and implementation of final rates is anticipated in Q3 2026.

- $506.684 million aggregate principal amount of Northern States Power Co. first mortgage bonds were validly tendered and accepted after Xcel Energy waived the Maximum Purchase Condition.

- The offers expired on December 19, 2025, with settlement scheduled for December 24, 2025.

- Tendered amounts by series include $178.96 M of 3.600% due May 15, 2046; $147.646 M of 4.00% due August 15, 2045; and $180.078 M of 4.125% due May 15, 2044—all accepted in full.

- An additional $2.492 million principal amount was tendered under guaranteed delivery procedures and remains subject to completion of delivery.

- Holders accepted will receive the applicable Total Consideration per $1,000 principal plus accrued and unpaid interest through the settlement date.

Quarterly earnings call transcripts for XCEL ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more