CFPB Faces Shutdown in Days as 22 States Sue to Block Trump's Defunding Gambit

December 26, 2025 · by Fintool Agent

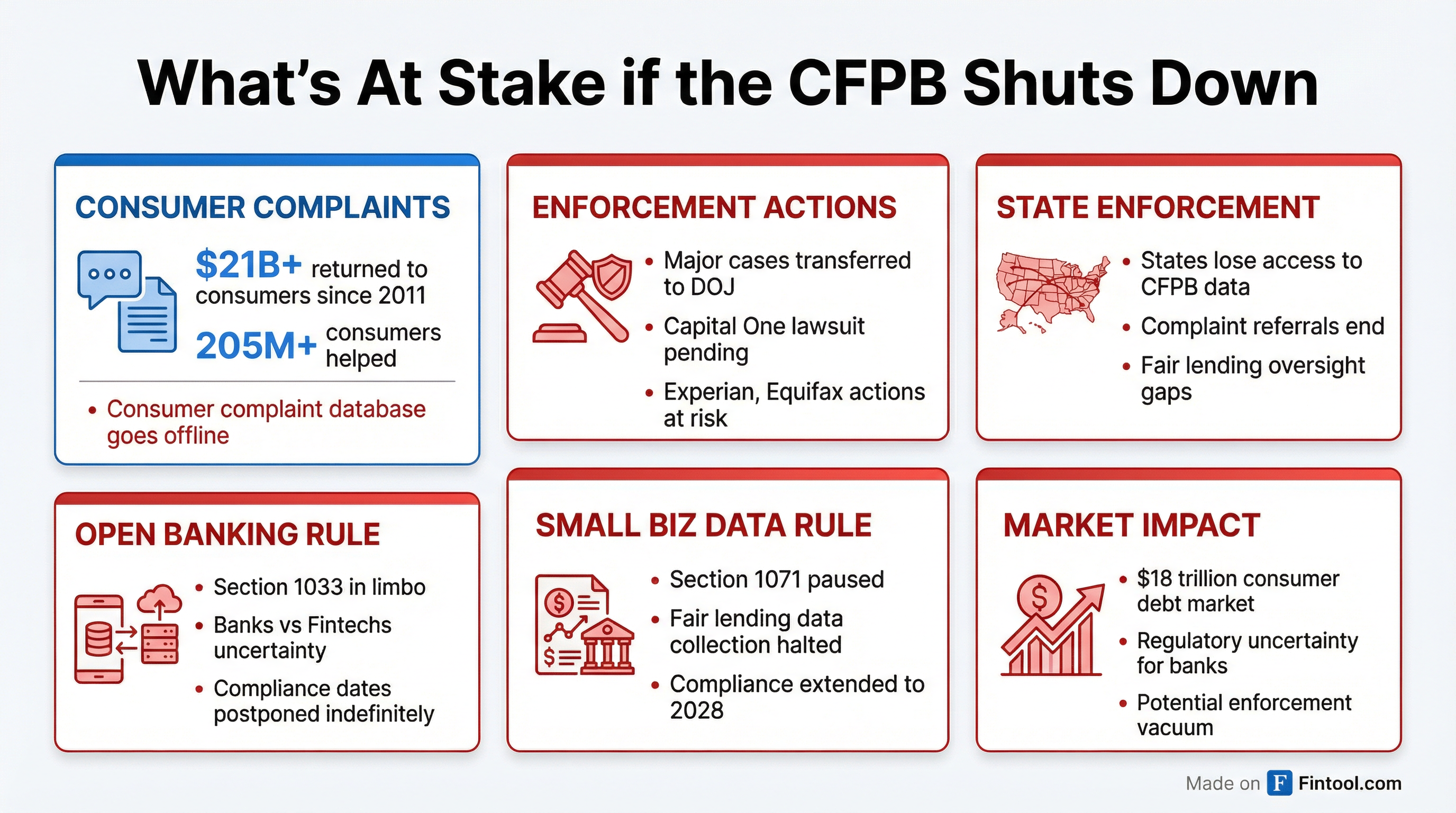

The Consumer Financial Protection Bureau, the post-crisis watchdog that has returned more than $21 billion to over 205 million Americans since 2011, is days away from running out of money. A coalition of 22 Democratic state attorneys general filed a lawsuit on December 22 to stop what they call an "unlawful defunding ruse" by the Trump administration—setting up a constitutional showdown that will determine whether the federal government's primary consumer financial regulator survives into 2026.

The agency says it expects to exhaust funds by early January. If the courts don't intervene, the CFPB will enter a "zombie state"—legally existing but operationally dead—leaving thousands of employees furloughed, millions of consumer complaints unaddressed, and an $18 trillion consumer debt market without its primary federal overseer.

The Funding Fight

At the center of this crisis is a novel legal argument from Acting CFPB Director Russell Vought: the agency cannot lawfully draw funds from the Federal Reserve.

Unlike most federal agencies funded through congressional appropriations, the CFPB was designed with a unique funding mechanism. Under the Dodd-Frank Act, Congress authorized the bureau to request funds from the Fed's "combined earnings"—a structure specifically chosen to insulate the consumer watchdog from political interference.

But Vought, relying on a November legal opinion from the Department of Justice's Office of Legal Counsel, has adopted an extraordinary interpretation: "combined earnings" means profits, and since the Federal Reserve has been operating at a loss since 2022 (paying out more in interest than it's taking in), there's legally "$0" available for the CFPB.

The states call this interpretation "unreasonable and unlawful."

"The Trump Administration has sharpened its message that it does not care about affordability, that it does not care to be on the side of families and working Americans," California Attorney General Rob Bonta said in a statement announcing the lawsuit.

The irony isn't lost on legal observers: even conservative Texas Attorney General Ken Paxton has previously rejected the argument that the CFPB can only be funded through Fed profits, calling it inconsistent with the text of Dodd-Frank.

Timeline of a Dismantling

The defunding crisis is the culmination of a year-long campaign to dismantle the bureau:

- January 2025: Trump administration begins efforts to gut the CFPB

- April 2025: Administration attempts to fire 90% of CFPB staff—blocked by federal courts

- Summer 2025: Senate parliamentarian blocks attempts to defund CFPB through budget reconciliation

- October 2025: Administration succeeds in cutting the CFPB's funding ceiling from 12% to 6.5% of Fed operating expenses via the "Big Beautiful Bill"

- November 10, 2025: Vought announces the CFPB cannot draw Fed funding, triggering the current crisis

- November 2025: Bureau transfers enforcement authority and remaining litigation to the Department of Justice; some staff furloughed

- December 22, 2025: 22 state AGs file lawsuit in U.S. District Court in Oregon

- December 31, 2025: CFPB expects to exhaust operating funds

- January 2026: Agency faces complete operational shutdown without intervention

What's At Stake

The CFPB isn't just another regulatory agency—it's the only federal body authorized to supervise the nation's largest banks for compliance with consumer financial protection laws. A shutdown would ripple across the entire financial services ecosystem:

For Consumers:

- The nationwide consumer complaint database goes offline—a system that has processed millions of complaints and serves as an early warning system for predatory practices

- Ongoing investigations and enforcement actions stall

- Protections against unfair, deceptive, and abusive practices weaken

For States:

- State attorneys general lose access to CFPB data that powers their own investigations

- Fair lending oversight suffers from loss of Home Mortgage Disclosure Act data

- Consumer complaint referrals—a critical pipeline for state enforcement—end

For Banks and Fintechs:

- Major pending cases face uncertain futures, including the January 2025 lawsuit against Capital One+2.70% and actions against Equifax+2.41%, Experian, and Block+4.83% (Cash App)

- Open banking rules under Section 1033 remain in limbo—the CFPB is rushing to issue an interim final rule before funds run out

- Small business data collection under Section 1071 paused, with compliance extended to 2028

Open Banking in the Crossfire

Perhaps no regulatory initiative is more affected than the CFPB's open banking rule under Section 1033 of Dodd-Frank.

The October 2024 final rule would have required banks to share customer financial data with authorized third parties (like fintech apps) at no cost—a provision that banks argued compromised security and that fintechs championed as essential for innovation.

In May 2025, the CFPB itself acknowledged the rule "exceeds the agency's statutory authority" and asked a court to vacate it. The rule is now stayed while the bureau conducts a new rulemaking process.

The CFPB has signaled it will try to issue an interim final rule before funds run out, but any hastily drafted revision risks continued litigation and market uncertainty.

"Hastily drafted revised rules aren't likely to satisfy the market and could risk continued litigation," noted one analyst in American Banker.

For banks like JPMorgan+3.95%, Bank of America+2.89%, and Wells Fargo+2.09%, the regulatory uncertainty cuts both ways: less CFPB oversight could mean reduced enforcement risk, but the lack of clear rules on data sharing and consumer protection creates compliance headaches that could persist for years.

For fintechs like Paypal+1.30%, Affirm-4.02%, and Upstart+10.46%, the stakes are equally high—they've invested heavily in preparing for open banking requirements that may never materialize.

The Legal Battle Ahead

The lawsuit filed in U.S. District Court for the District of Oregon makes several arguments:

- Statutory Violation: The states argue that refusing to request funding violates the Dodd-Frank Act's mandate that the CFPB be funded from the Federal Reserve

- Separation of Powers: Congress created the CFPB and established its funding mechanism—the executive branch cannot unilaterally dismantle it by starving it of funds

- Statutory Duties: The CFPB has legal obligations to states, including providing consumer complaint data, that it cannot fulfill without funding

The coalition is led by New York Attorney General Letitia James and includes the AGs of California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New Mexico, North Carolina, Oregon, Rhode Island, Vermont, Wisconsin, and the District of Columbia—plus Arizona, which joined December 23.

The states are seeking an emergency injunction to force the CFPB to request funding from the Federal Reserve.

Market Implications

The financial services sector is watching closely. In thin post-holiday trading on December 26, the broader market showed muted reaction, but the implications for specific sectors are significant:

Banks (Potentially Positive):

- Less CFPB enforcement scrutiny

- But: regulatory uncertainty creates compliance complications

- Major banks like Wells Fargo+2.09% have faced billions in CFPB fines historically ($1.7B penalty in 2022 alone)

Consumer Finance (Mixed):

- Capital One+2.70% faces pending CFPB lawsuit from January 2025

- Synchrony+1.58% and credit card issuers could see reduced oversight

- Subprime and BNPL lenders may face less scrutiny

Fintechs (Uncertain):

- Open banking rule chaos creates strategic planning challenges

- Block+4.83% faced January 2025 CFPB order over Cash App practices

- Paypal+1.30%, Affirm-4.02%, Upstart+10.46% must navigate shifting regulatory landscape

Credit Bureaus (Mixed):

- Equifax+2.41% and Transunion+4.64% have faced CFPB enforcement

- Pending Experian lawsuit from January 2025 at risk

What Happens Next

The courts will determine the immediate fate of the CFPB. The Oregon District Court will weigh the states' request for an injunction, which could force the Federal Reserve to resume transfers.

If the court rules in favor of the states, it could set up a Supreme Court showdown by mid-2026—the second major constitutional test for the CFPB's funding structure in two years. (The Supreme Court upheld the agency's funding mechanism in 2024.)

If the court denies the injunction, the CFPB enters shutdown mode. Most enforcement, supervision, and rulemaking activities would pause. The consumer complaint database goes dark. And states would become the de facto front line for consumer financial protection.

"These industries at some level need to be regulated," Steve Ornstein, a partner at Alston & Bird, told American Banker. "Many in the financial services industry want effective regulators to handle new products and technologies like AI and crypto."

For investors, the message is clear: the regulatory framework for consumer finance in America is entering a period of profound uncertainty—one that could reshape the competitive landscape for banks, fintechs, and everyone in between.

Related

- JPMorgan Chase & Co.+3.95%

- Bank of America Corporation+2.89%

- Wells Fargo & Company+2.09%

- Citigroup Inc.+5.98%

- Capital One Financial Corporation+2.70%

- U.s. Bancorp+2.67%

- American Express Company+1.28%

- Synchrony Financial+1.58%

- Block, Inc.+4.83%

- Paypal Holdings, Inc.+1.30%

- Affirm Holdings, Inc.-4.02%

- Upstart Holdings, Inc.+10.46%

- Equifax Inc.+2.41%

- Transunion+4.64%