350 Drug Price Hikes Set for January Despite Trump's 'Historic' Pharma Deals

December 31, 2025 · by Fintool Agent

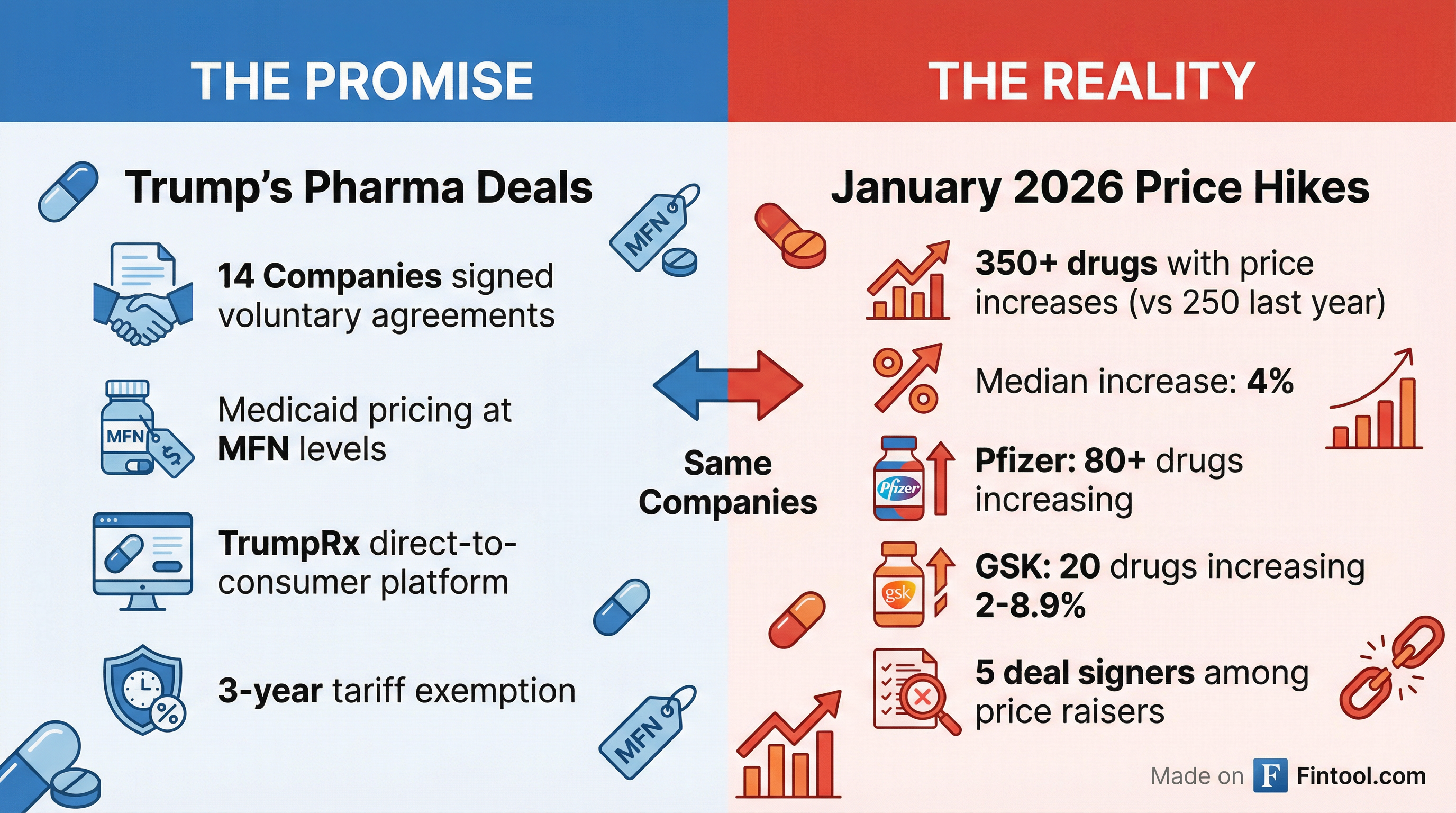

Drugmakers plan to raise U.S. prices on at least 350 branded medications starting January 1, 2026—a 40% increase from the same point last year when companies announced hikes on roughly 250 drugs—even as five of those companies have signed voluntary pricing agreements with the Trump administration, according to exclusive data from healthcare research firm 3 Axis Advisors.

The increases include vaccines against COVID, RSV, and shingles, along with blockbuster cancer treatment Ibrance. The median price hike is around 4%—in line with 2025 levels—though some individual drugs are seeing increases of 10-15% or more.

"These deals are being announced as transformative when, in fact, they really just nibble around the margins in terms of what is really driving high prices for prescription drugs in the U.S.," said Dr. Benjamin Rome, a health policy researcher at Brigham and Women's Hospital in Boston.

The Deal Signers Are Still Raising Prices

Among the companies implementing January price increases are Pfizer, Sanofi, Boehringer Ingelheim, Novartis, and GSK—all of which signed voluntary agreements with the Trump administration earlier this month to lower drug costs for Medicaid patients and cash-paying consumers.

The administration's deals, announced December 19, focus on:

- Medicaid pricing at "Most Favored Nation" levels

- Direct-to-consumer discounts (60-80% off) via TrumpRx.gov

- Three-year tariff exemptions in exchange for U.S. manufacturing commitments

- Future launch pricing parity with other wealthy nations

But the list price increases announced today suggest companies are pursuing a dual strategy: offering targeted discounts to government programs while maintaining—and in some cases expanding—their overall pricing power.

Pfizer Leads the Price Hikes

Pfizer announced the most list price increases, affecting around 80 different drugs including:

| Drug | Indication | Price Increase |

|---|---|---|

| Comirnaty | COVID-19 vaccine | 15% |

| Ibrance | Cancer (palbociclib) | <10% |

| Nurtec | Migraine | <10% |

| Paxlovid | COVID-19 treatment | <10% |

| Morphine | Hospital pain management | >400% |

In a statement, Pfizer said it had adjusted the average list price of its innovative medicines and vaccines for 2026 below the overall rate of inflation. "The modest increase is necessary to support investments that allow us to continue to discover and deliver new medicines as well as address increased costs throughout our business," the company said.

Pfizer's 8-K filings acknowledge "risks and uncertainties related to the impact of Pfizer's voluntary agreement with the U.S. Government designed to lower drug costs for U.S. patients" among its risk factors—suggesting the company views these agreements as potential constraints on future pricing flexibility.

GSK plans to increase prices on around 20 drugs and vaccines, with increases ranging from 2% to 8.9%. The company said the hikes are "needed to support scientific innovation."

The IRA's Medicare Negotiations: Where the Real Cuts Are Happening

The only meaningful price cuts coming in January are largely attributable to the Biden-era Inflation Reduction Act's Medicare Drug Price Negotiation Program—not Trump's voluntary agreements.

Drugmakers plan to cut list prices on approximately nine drugs, including:

| Drug | Company | Indication | Price Change |

|---|---|---|---|

| Jardiance | Boehringer Ingelheim / Eli Lilly | Diabetes | -40%+ |

| Januvia | Merck | Diabetes | Cut (size TBD) |

| Janumet | Merck | Diabetes | Cut (size TBD) |

Jardiance is among the 10 drugs for which the U.S. government negotiated a lower price for the Medicare program under the IRA. The negotiated price of $197 per 30-day supply represents a 66% discount from the 2023 list price of $573—kicking in January 1, 2026.

Similarly, Januvia's negotiated Medicare price of $113 is a 79% discount from its 2023 list price of $527.

The 10 Medicare-negotiated drugs taking effect in 2026:

| Drug | Condition | 2023 List Price | 2026 Negotiated | Discount |

|---|---|---|---|---|

| Januvia | Diabetes | $527 | $113 | 79% |

| NovoLog/Fiasp | Diabetes | $495 | $119 | 76% |

| Farxiga | Diabetes/Heart | $556 | $178.50 | 68% |

| Enbrel | Rheumatoid arthritis | $7,106 | $2,355 | 67% |

| Jardiance | Diabetes/Heart | $573 | $197 | 66% |

| Stelara | Psoriasis/Crohn's | $13,836 | $4,695 | 66% |

| Xarelto | Blood clots | $517 | $197 | 62% |

| Eliquis | Blood clots | $521 | $231 | 56% |

| Entresto | Heart failure | $628 | $295 | 53% |

| Imbruvica | Blood cancers | $14,934 | $9,319 | 38% |

Source: CMS Medicare Drug Price Negotiation Program

These Medicare negotiations are estimated to save beneficiaries $1.5 billion in out-of-pocket costs in 2026 and save the Medicare program $6 billion per year.

Historical Context: A Smaller Increase Than the Headlines Suggest

While 350 drugs seeing price increases sounds dramatic, the pharmaceutical industry has scaled back increases significantly since coming under fire for larger hikes in the middle of the last decade.

According to 46brooklyn Research, a drug pricing nonprofit affiliated with 3 Axis Advisors, the median price increase has hovered around 4-5% since 2019. Government policies like the IRA's penalties for companies that charge Medicare prices rising faster than inflation have helped constrain increases.

The key caveat: these list price increases do not reflect rebates to pharmacy benefit managers (PBMs) and other confidential discounts. The net prices actually paid by insurers and patients are often significantly lower—but increasingly complex to track.

Investment Implications

For investors, the picture is nuanced:

Near-Term Revenue Stability: List price increases suggest pharma companies are maintaining pricing power on most of their portfolios, supporting revenue growth even as targeted programs offer discounts to specific populations.

Margin Pressure from Government Programs: Pfizer warned in its 2026 outlook that Medicaid discounts under its Trump agreement would result in "price and margin compression." Investors should watch for similar commentary from other deal signers.

Medicare Negotiation Expansion: The IRA's negotiation program will expand to 15 more drugs in 2027 (including blockbusters like Ozempic), with 20 additional drugs added annually thereafter. Companies with significant Medicare Part D exposure face growing pricing headwinds.

Tariff Protection Is Valuable: The three-year tariff exemptions secured through Trump's deals may prove more valuable than the Medicaid discounts themselves, particularly for companies with significant overseas manufacturing operations.

| Metric | Pfizer (PFE) | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|---|

| Revenue | $16.7B | $14.7B | $13.7B | $17.8B | |

| EBITDA Margin | 45.2%* | 39.8%* | 46.9%* | 26.0%* | |

| Net Margin | 21.3%* | 19.9%* | 21.6%* | 2.3%* |

*Values retrieved from S&P Global

What to Watch

January 2026: TrumpRx.gov expected to launch, enabling direct-to-consumer purchases at discounted prices

Early January: Additional price hikes and cuts expected—January is historically the biggest month for drug price changes

2026 Earnings Calls: Commentary on the financial impact of both Trump's voluntary agreements and Medicare negotiations

2027 Negotiations: CMS announces negotiated prices for 15 additional drugs including Ozempic, Wegovy, and Trulicity—potentially impacting Novo Nordisk and Eli Lilly

The bottom line: Trump's pharmaceutical deals represent political theater that may deliver modest savings to specific populations. But the structural drivers of U.S. drug costs—fragmented pricing, PBM rebates, and limited competition—remain largely unchanged. For now, pharma companies appear comfortable offering targeted discounts while continuing their annual ritual of list price increases.