The Great Rotation: Russell 2000 Posts Longest Winning Streak Since 2008 as Wall Street Dumps Magnificent Seven

January 16, 2026 · by Fintool Agent

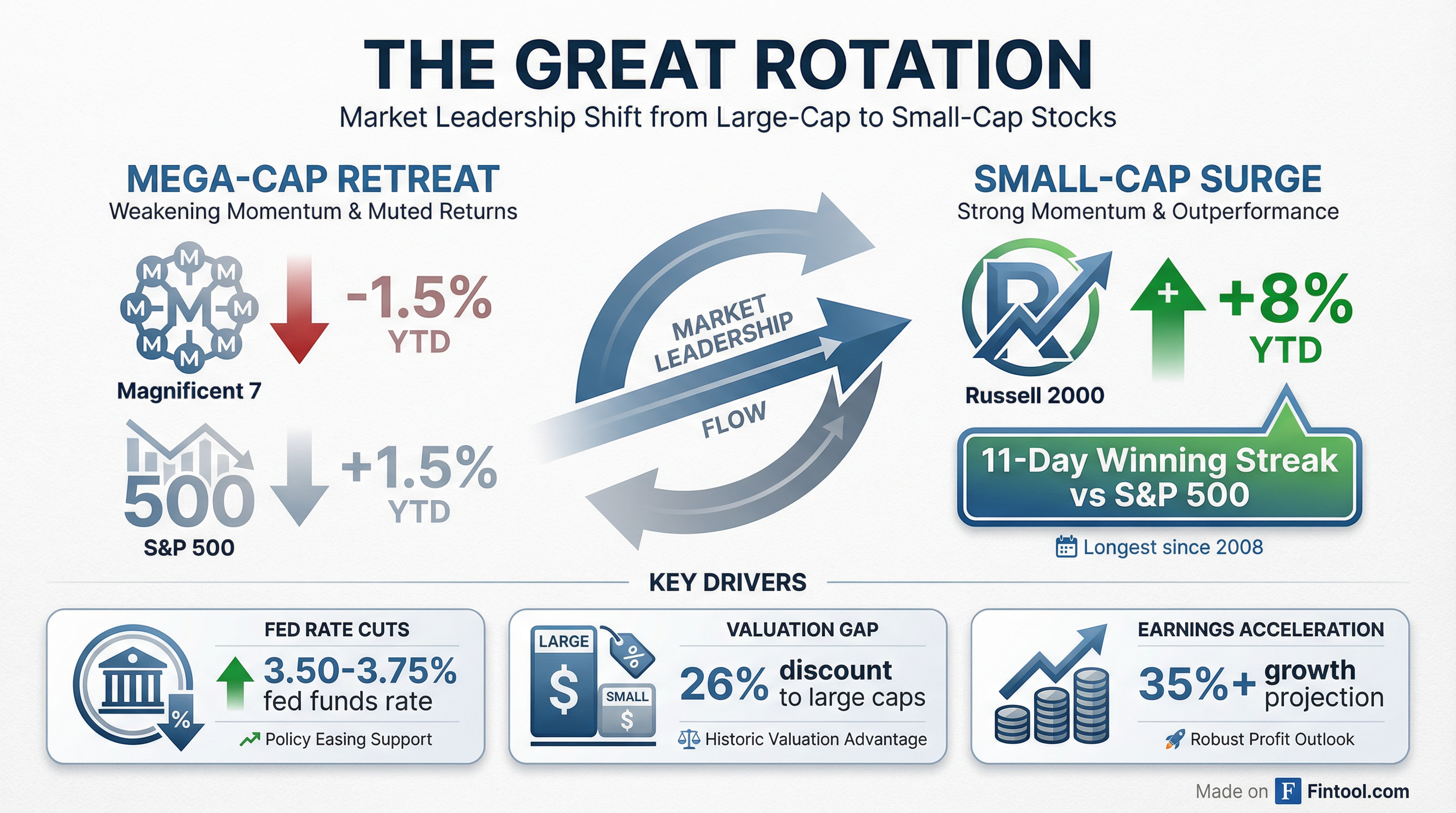

The Russell 2000 is on track to beat the S&P 500 for the 11th consecutive session—its longest winning streak since 2008—as a "Great Rotation" reshapes American equity markets.

Small caps have surged over 8% year-to-date while the S&P 500 has gained just 1.5%. The Magnificent Seven—Apple+0.80%, Microsoft+1.90%, Alphabet-2.53%, Amazon-5.55%, Nvidia+7.87%, Meta-1.31%, and Tesla+3.50%—are down 1.5% year-to-date, their worst relative start to a year in memory.

What's Driving the Rotation

The shift isn't panic selling or momentum chasing. It's allocation discipline kicking in after three consecutive years of U.S. equity gains where a handful of mega-cap tech stocks did all the heavy lifting.

Three catalysts converged:

-

Fed Rate Cuts: The Federal Reserve has cut rates three times, bringing the federal funds rate to 3.50%–3.75%. Small-cap companies, which typically carry more floating-rate debt, benefit disproportionately from lower borrowing costs.

-

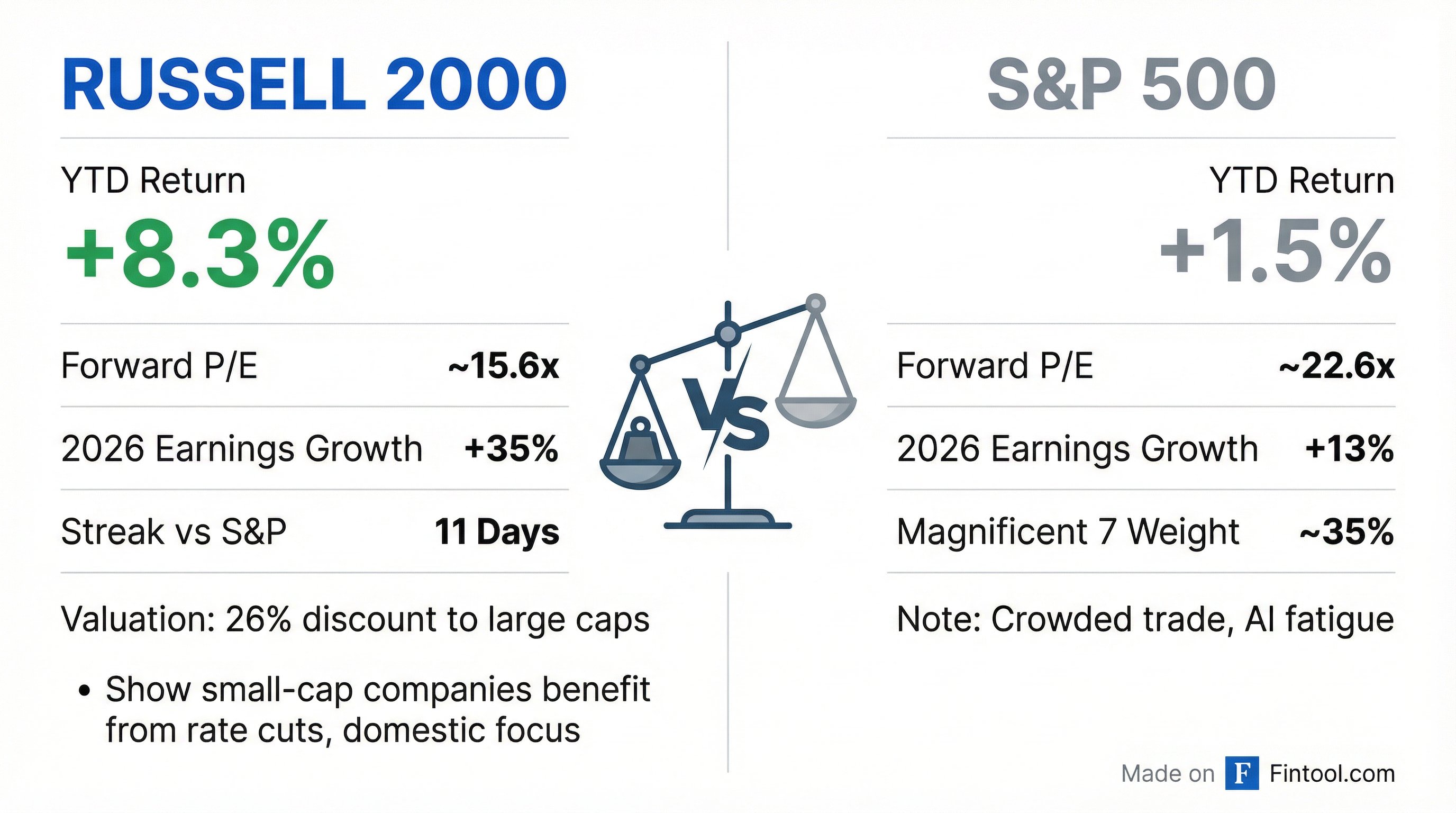

Historic Valuation Gap: Small caps entered 2026 trading at a ~26% discount to large caps on forward P/E—near 25-year lows. The S&P 600 small-cap index trades at roughly 15.6x forward earnings versus 22.6x for the S&P 500.

-

Earnings Acceleration: Russell 2000 earnings growth is projected at 35–44% in 2026, far outpacing the S&P 500's 13–15% expected growth. After years of underperformance, small-cap fundamentals are finally improving.

The Numbers Tell the Story

| Metric | Russell 2000 | S&P 500 |

|---|---|---|

| YTD Return | +8.3% | +1.5% |

| Forward P/E | 15.6x | 22.6x |

| 2026 Earnings Growth | +35% | +13% |

| Consecutive Days Outperforming | 11 | — |

Data as of January 16, 2026

The last time small caps had a run this strong was January 2019, when the market was rebounding from a bear market precipice. Before that, you have to go back to 2008.

Retail Leads the Charge

JPMorgan data shows retail investors pulled $12 billion into cash equities last week—the largest weekly inflow since the post-Liberation Day recovery. But crucially, the money isn't going where it used to.

Deutsche Bank reports that 318 of the 500 S&P components advanced on Wednesday even as the headline index fell. The "equal-weight" S&P 500 is up 3.6% year-to-date versus just 1.2% for the cap-weighted version.

Translation: traders are selling the Magnificent Seven and buying everything else.

Winners in the New Regime

The clear beneficiaries are domestic-focused sectors that populate the Russell 2000:

-

Regional Banks: Benefiting from a steepening yield curve and resurgent middle-market M&A activity. Companies like Keycorp+2.25% have seen significant appreciation as credit concerns ease.

-

Industrials: Reshoring trends and infrastructure spending are driving renewed interest in manufacturers like Caterpillar+7.06% and Rockwell Automation+2.05%.

-

Defense: Structural allocation rather than tactical positioning, with spending ambitions providing a tailwind regardless of whether specific programs materialize.

The Catch

Not all small caps are created equal. Roughly 40% of Russell 2000 companies are unprofitable. The junk rallies first in a rotation, but quality wins over time.

For context, large caps outperformed small caps for five straight years (2020–2025). The last time that happened was 1994–1998, which was followed by six consecutive years of small-cap leadership (1999–2004).

History doesn't repeat, but the setup is interesting.

What to Watch

The true test comes in Q2 when earnings reports reveal whether the small-cap "earnings catch-up" is real. Key catalysts ahead:

- January 29: Fed rate decision—markets expect steady rates but dovish guidance

- Q1 Earnings Season: Russell 2000 earnings expected to accelerate; any miss could reverse momentum

- Inflation Data: Continued moderation keeps the rate-cut narrative alive

The rotation appears durable because it's driven by allocation discipline rather than positioning stress. When small caps outperform without the accelerant of forced buying, that tends to signal something more sustainable than a trade.