Earnings summaries and quarterly performance for AGCO CORP /DE.

Executive leadership at AGCO CORP /DE.

Eric Hansotia

Chief Executive Officer

Damon Audia

Chief Financial Officer

Ivory Harris

Senior Vice President, Chief Human Resources Officer

Kelvin Bennett

Senior Vice President, Engineering

Luis Felli

Senior Vice President, General Manager, Massey Ferguson

Roger Batkin

General Counsel, Chief ESG Officer and Corporate Secretary

Stefan Caspari

Senior Vice President, Customer Success and Business Effectiveness

Timothy Millwood

Senior Vice President, Chief Supply Chain Officer

Torsten Dehner

Senior Vice President, General Manager, Fendt/Valtra

Viren Shah

Senior Vice President, Chief Digital & Information Officer

Board of directors at AGCO CORP /DE.

Research analysts who have asked questions during AGCO CORP /DE earnings calls.

Jamie Cook

Truist Securities

6 questions for AGCO

Kristen Owen

Oppenheimer & Co. Inc.

6 questions for AGCO

Stephen Volkmann

Jefferies

6 questions for AGCO

Tami Zakaria

JPMorgan Chase & Co.

6 questions for AGCO

Mircea Dobre

Robert W. Baird & Co.

5 questions for AGCO

Jerry Revich

Goldman Sachs Group Inc.

4 questions for AGCO

Kyle Menges

Citigroup

3 questions for AGCO

Steven Fisher

UBS

2 questions for AGCO

Angel Castillo Malpica

Morgan Stanley

1 question for AGCO

Clay Williams

Goldman Sachs

1 question for AGCO

Esther Oshina

Morgan Stanley

1 question for AGCO

Esther Osinaiya

Morgan Stanley

1 question for AGCO

Joel Jackson

BMO Capital Markets

1 question for AGCO

Michael Feniger

Bank of America

1 question for AGCO

Timothy Thein

Raymond James

1 question for AGCO

Tim Thein

Raymond James Financial

1 question for AGCO

Recent press releases and 8-K filings for AGCO.

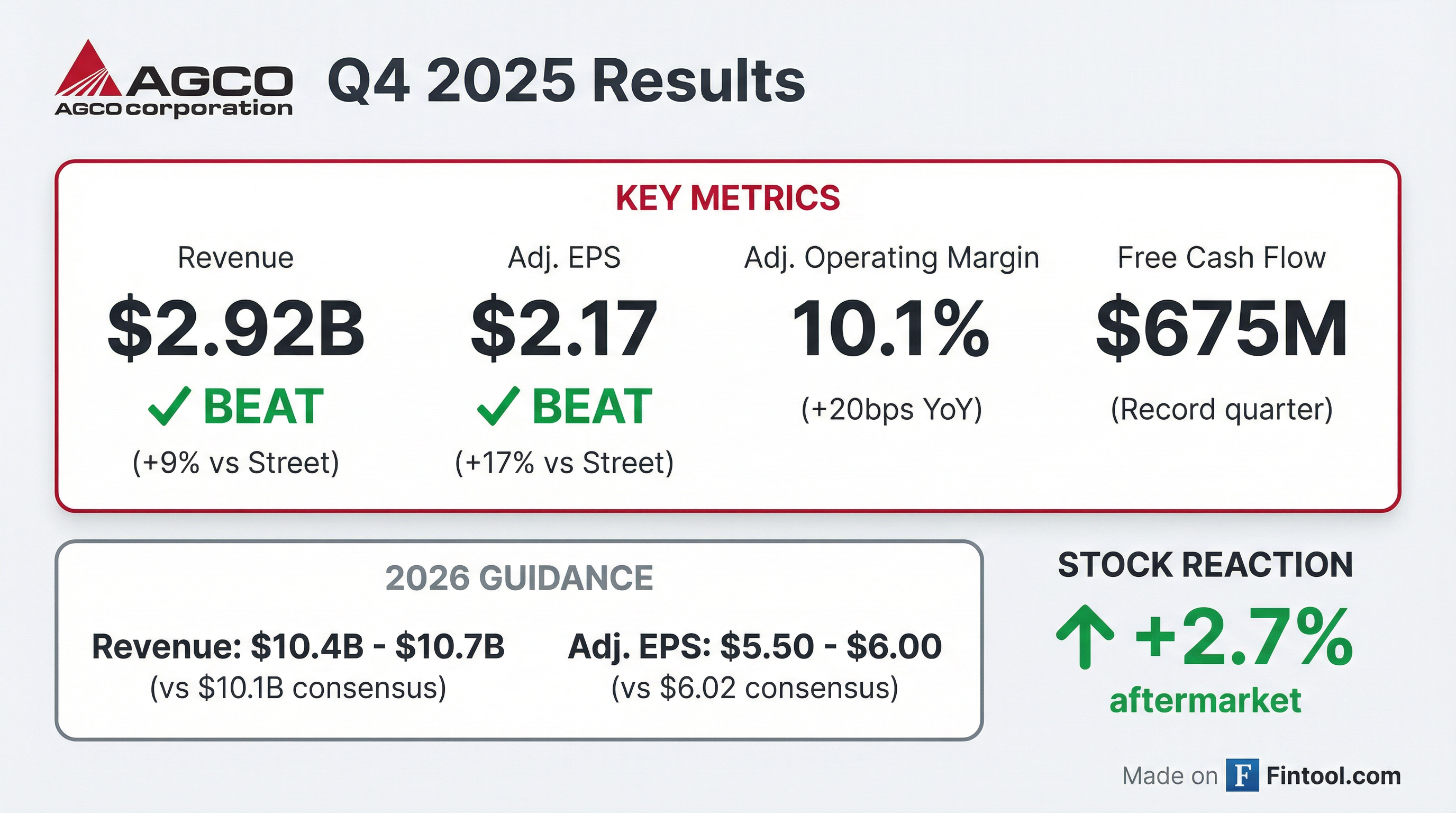

- AGCO reported record free cash flow of $740 million in 2025, an increase of over $440 million from 2024, and a Q4 2025 adjusted operating margin of 10.1%.

- For 2026, the company forecasts net sales between $10.4 billion and $10.7 billion and Adjusted Earnings Per Share in the range of $5.50-$6.00, with anticipated adjusted operating margins between 7.5% and 8%. Global industry demand is expected to be relatively flat year-over-year.

- AGCO achieved its highest market share in history in 2025 globally and introduced new technologies such as SymphonyVision Duo, ArrowTube, and FarmENGAGE. The company also executed a $250 million accelerated share repurchase in Q4 2025.

- The company expects incremental tariff costs to be a $65 million headwind in 2026 compared to 2025, with the majority of this impact occurring in the first half of the year.

- AGCO reported Q4 2025 net sales of $2.9 billion, up 1% year-over-year (or 4% excluding the Grain and Protein divestiture), with an adjusted operating margin of 10.1%. For the full year 2025, net sales were $10.1 billion and adjusted earnings per share were $5.28.

- The company provided a 2026 full-year net sales outlook of $10.4 billion to $10.7 billion and targeted Adjusted Earnings Per Share in the range of $5.50 to $6.00. Adjusted operating margins are expected to be between 7.5% and 8%.

- AGCO achieved a record free cash flow of $740 million in 2025 and executed a $250 million accelerated share repurchase in Q4 2025 as part of its $1 billion program.

- Strategic initiatives included the divestiture of the majority of the Grain and Protein business and the formation of the PTX business, which delivered ~$860 million in revenue in 2025 and introduced 14 new products. The company also made significant progress in reducing dealer inventories across regions.

- Management believes 2025 was the bottom of the trough, with fleets in major markets at their peak age, and expects the future to look brighter.

- AGCO reported Q4 2025 net sales of $2.9 billion and a full-year 2025 adjusted operating margin of 7.7%, with adjusted EPS of $5.28.

- The company generated record free cash flow of $740 million in 2025 and executed a $250 million accelerated share repurchase in Q4 2025.

- For full-year 2026, AGCO projects net sales between $10.4 billion and $10.7 billion and adjusted EPS in the range of $5.50-$6.00, with adjusted operating margins expected between 7.5% and 8%.

- The 2026 outlook anticipates an incremental $65 million tariff headwind and an almost $50 million increase in engineering expense, partially offset by $40 million-$60 million in restructuring benefits.

- Management stated that 2025 was the bottom of the trough for the industry, with North America large ag industry sales forecast down approximately 15% in 2026, while Western European tractor volumes are expected to be up modestly.

- AGCO reported Q4 2025 net sales of $2,920.2 million, a 1.1% increase from Q4 2024, with reported operating income surging 185.8% to $230.7 million.

- For the full year 2025, net sales decreased 13.5% to $10,082.0 million, but reported operating income significantly increased 587.9% to $595.7 million compared to 2024.

- The company generated $675 million in free cash flow in Q4 2025, contributing to a record $740 million for the full year 2025, with a Free Cash Flow Conversion of 188%.

- AGCO repurchased $250 million of shares in Q4 2025 as part of its $1 billion share repurchase program and declared a quarterly dividend of $0.29 per share.

- Looking ahead, AGCO projects full-year 2026 production to be flat compared to 2025, following a 12% decrease in 2025 production versus 2024. The 2026 market outlook for industry unit tractor sales is mixed, with Large Ag in North America expected to be down ~15% and Western Europe up 0%-5%.

- AGCO reported net sales of $2.9 billion for the fourth quarter of 2025, an increase of 1.1% compared to the fourth quarter of 2024. For the full year 2025, net sales were $10.1 billion, a 13.5% decrease compared to 2024.

- Full-year 2025 reported earnings per share were $9.75, and adjusted earnings per share were $5.28.

- The company achieved a full-year adjusted operating margin of 7.7% and generated record free cash flow of $740 million in 2025.

- AGCO projects 2026 net sales to range from $10.4 billion to $10.7 billion and earnings per share to be approximately $5.50 to $6.00, both of which are above 2025 levels.

- Global agricultural markets remained under significant pressure in 2025, with industry unit retail sales for tractors and combines decreasing across North America, Brazil, and Western Europe.

- AGCO reported full-year 2025 net sales of $10.1 billion, a 13.5% decrease compared to 2024, with adjusted earnings per share of $5.28.

- For the fourth quarter of 2025, net sales increased 1.1% to $2.9 billion, and adjusted earnings per share were $2.17.

- The company achieved record free cash flow of $740 million in 2025.

- AGCO projects 2026 net sales between $10.4 and $10.7 billion and earnings per share between $5.50 and $6.00.

- Global agricultural markets experienced significant pressure in 2025, leading to moderated demand for new equipment, with North American industry retail tractor sales down 10% and combine unit sales down 27% compared to 2024.

- The global installed base of active off-highway vehicle telematics systems reached 10 million units in 2024 and is projected to grow at a 12.0% compound annual growth rate (CAGR) to 17.6 million units worldwide by 2029.

- Caterpillar is identified as the leading off-highway vehicle telematics provider, having surpassed 1.5 million connected assets, with SANY, Komatsu, and Deere & Company as runners-up.

- AGCO is among other manufacturers noted for having a sizeable installed base of off-highway vehicle telematics units, estimated to be in the tens of thousands.

- The aftermarket for off-highway vehicle telematics is expected to shrink due to equipment manufacturers introducing standard fitment and longer free software subscriptions, but opportunities exist in upselling advanced functionality and asset tracking solutions.

- AGCO Corporation is undergoing significant transformation, including the formation of the PTx organization, divestment of its grain and protein business, and Project Reimagine, which aims for $175 million-$200 million in run rate structural cost savings by the end of 2026.

- The company has shifted its capital allocation strategy from variable dividends to share repurchases, announcing a $1 billion program with $300 million expected to commence in Q4 2025.

- AGCO's PTx precision agriculture business, currently generating approximately $900 million in revenues, targets growth to $2 billion through new product introductions like Symphony Vision and Autonomy, and expansion in the retrofit channel.

- For 2026, AGCO initially projected mid-single-digit declines in North America but will likely revise this to a "little bit more negative" view, while Europe is expected to be up, and South America is anticipated to be flat.

- AGCO is undergoing a significant transformation, including the PTX organization, divestment of its low-margin grain and protein business, and Project Reimagine, which targets $175 million-$200 million in structural cost savings by the end of next year.

- The company has pivoted its capital allocation strategy to share repurchases, announcing a $1 billion program with approximately $300 million expected to commence in Q4.

- AGCO's PTX technology business aims to grow revenue from approximately $900 million to $2 billion by 2029, driven by new product introductions, geographic expansion, and increased share with other OEMs.

- The company is focused on expanding its Fendt brand in North and South America, leveraging product performance, a three-year Gold Star warranty, the FarmerCore service model, and the FarmEngage mixed fleet management system.

- AGCO anticipates a more negative industry outlook for North America in 2026 than previously thought, leading to continued efforts to reduce dealer inventories and potential further underproduction, while Europe is expected to be up next year.

- AGCO implemented five key strategic shifts in 2025, including the formation of the PTX organization, the divestiture of its grain and protein business, and Project Reimagine, which is projected to achieve $175 million-$200 million in structural cost savings by the end of 2026.

- The company announced a shift in capital allocation to share repurchases, initiating a $1 billion program with $300 million expected to commence in Q4 2025.

- AGCO targets growing its PTX technology stack revenue from approximately $900 million to $2 billion by 2029, driven by new product introductions and geographic expansion.

- The 2026 industry outlook for North America is anticipated to be more negative than previously thought, with Europe expected to be up slightly and South America flat. AGCO plans underproduction in 2026 to reduce dealer inventories.

Quarterly earnings call transcripts for AGCO CORP /DE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more