Earnings summaries and quarterly performance for SMITH A O.

Executive leadership at SMITH A O.

Stephen Shafer

President and Chief Executive Officer

Charles Lauber

Executive Vice President and Chief Financial Officer

James Stern

Executive Vice President, General Counsel and Secretary

Kevin Wheeler

Executive Chairman

Stephen O'Brien

Senior Vice President, President and General Manager – North America Water Heating

Board of directors at SMITH A O.

Research analysts who have asked questions during SMITH A O earnings calls.

Bryan Blair

Oppenheimer

8 questions for AOS

David Macgregor

Longbow Research

8 questions for AOS

Scott Graham

Seaport Research Partners

8 questions for AOS

Andrew Kaplowitz

Citigroup

7 questions for AOS

Jeffrey Hammond

KeyBanc Capital Markets

6 questions for AOS

Saree Boroditsky

Jefferies

5 questions for AOS

Damian Karas

UBS

4 questions for AOS

Michael Halloran

Baird

4 questions for AOS

Mike Halloran

Robert W. Baird & Co. Incorporated

4 questions for AOS

Susan Maklari

Goldman Sachs Group Inc.

4 questions for AOS

Matt Summerville

D.A. Davidson & Co.

3 questions for AOS

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

3 questions for AOS

Adam Farley

Stifel Financial Corp.

2 questions for AOS

Ethan Morgan

JPMorgan Chase & Co.

2 questions for AOS

Mitch Moran

KeyBanc Capital Markets

2 questions for AOS

Nathan Jones

Stifel

2 questions for AOS

Tomohiko Sano

JPMorgan Chase & Co.

2 questions for AOS

James Heaney

Jefferies

1 question for AOS

Jefferies Analyst

Jefferies Financial Group Inc.

1 question for AOS

Samuel Snyder

Northcoast Research

1 question for AOS

Recent press releases and 8-K filings for AOS.

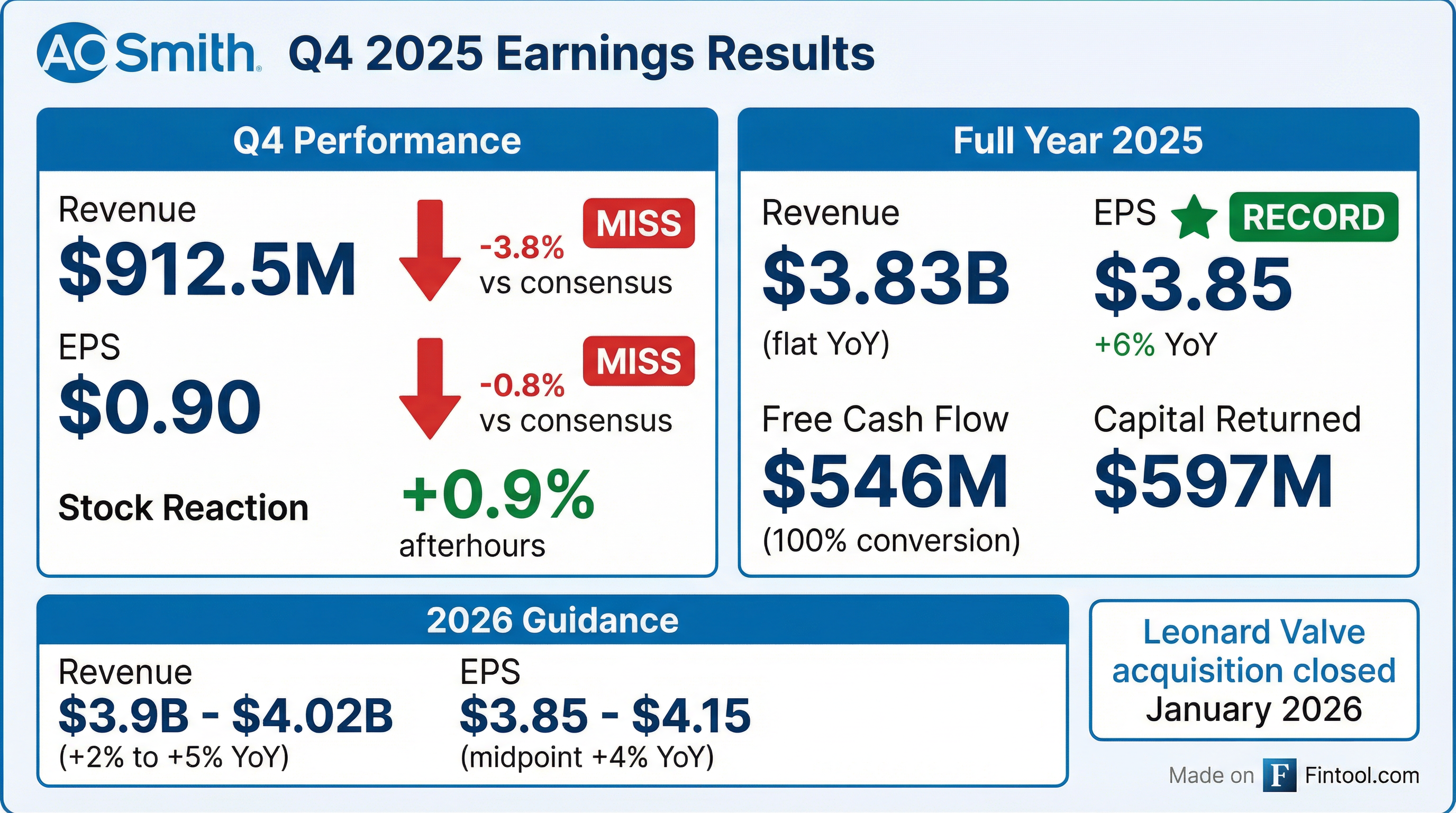

- A. O. Smith delivered 2025 sales of $3.8 B and EPS of $3.85 (+6% YoY), driven by improved segment profitability.

- North America segment posted 2025 sales of $3 B, earnings of $728 M (+2%), and margin of 24.4% (+20 bps); Q4 sales rose 3% to $714 M with margin up 70 bps to 23.1%.

- Rest of World segment saw 2025 sales of $880 M (−4%) with margin expansion to 8.7% (+40 bps); Q4 sales declined 13% to $206 M, margin at 7.8%.

- Generated $546 M free cash flow (+15%) with 100% conversion, end-of-year net cash of $38 M, and returned ~$1.1 B to shareholders through dividends and buybacks.

- 2026 guidance includes EPS of $3.85–$4.15, sales growth of 2%–5%, CapEx of $70–$80 M, free cash flow of $525–$575 M, and $200 M planned share repurchases; completed Leonard Valve acquisition expected to add $70 M in sales.

- A. O. Smith posted $3.8 billion in 2025 sales (slight increase) and record EPS of $3.85, up 6% year-over-year.

- North America segment sales were $3.0 billion with a 24.4% margin (+20 bp); Rest of World sales declined 4% to $880 million with an 8.7% margin (+40 bp).

- Generated $546 million of free cash flow (100% conversion) and returned $597 million to shareholders via dividends and buybacks; repurchased 5.9 million shares for $401 million and raised the quarterly dividend to $0.36 per share.

- Completed the acquisition of Leonard Valve in January, expected to contribute $70 million in 2026 sales and expand A. O. Smith’s water management offerings.

- Issued 2026 guidance of $3.85–$4.15 EPS (midpoint +4%), top-line growth of ~2–5%, free cash flow of $525–$575 million, and CapEx of $70–$80 million.

- Q4 sales were $913 million, flat year-over-year, and EPS rose 6% to $0.90, driven by North America pricing benefits and Rest-of-World cost-control actions.

- Full-year 2025 EPS increased 6% to a record $3.85, while free cash flow grew 15% to $546 million with 100% conversion, enabling $597 million in dividends and share repurchases.

- North America segment saw boiler sales up 8% and water treatment margin expand 400 bps to ~13%; Rest-of-World margin rose 40 bps despite a 12% China sales decline.

- Completed the acquisition of Leonard Valve, adding a water management platform with $70 million of expected 2026 sales; issued 2026 guidance of $3.85–$4.15 EPS (+4% midpoint), 2–5% revenue growth, and $525–$575 million free cash flow.

- Net sales were flat at $913 M, while adjusted EPS rose 6% to $0.90 in Q4 2025.

- North America segment sales increased 3% to $714 M, driving a segment margin of 23.1%, up 70 bps year-over-year.

- Rest of World sales declined 13% to $206 M, with segment margin down 30 bps to 7.8%.

- 2026 guidance calls for revenue growth of 2–5%, diluted EPS of $3.85–$4.15, and free cash flow of $525–$575 M.

- Record 2025 EPS of $3.85, up 6% YoY; net earnings of $546.2 M on net sales of $3.83 B

- Q4 2025 sales of $912.5 M and diluted EPS of $0.90, a 20% YoY increase

- Free cash flow of $546 M, with $597 M returned to shareholders via dividends and share repurchases

- Closed acquisition of Leonard Valve in January 2026 to expand water management platform

- 2026 outlook: net sales projected at $3.90 – $4.02 B and EPS of $3.85 – $4.15

- A. O. Smith posted record 2025 EPS of $3.85, up 6% on net sales of $3.83 billion and net earnings of $546.2 million.

- Generated $546 million in free cash flow and returned $597 million to shareholders through dividends and share repurchases.

- Completed the acquisition of Leonard Valve in January 2026, advancing its water management platform.

- Projects 2026 net sales of $3.9 billion–$4.02 billion and EPS of $3.85–$4.15, implying 2%–5% sales growth.

- Completed acquisition of LVC Holdco LLC for $470 million (approximately $412 million after tax benefits), finalized January 6, 2026.

- Funded via an unsecured $470 million term loan due January 5, 2029, with variable interest of Term SOFR + 0.875–1.375% or Base Rate + 0–0.375%; covenants include maximum leverage ratio of 0.60 x (temporary increase to 0.65 x) and minimum interest coverage of 3.0 x.

- Acquisition expands A. O. Smith’s water management presence, enhances digital expertise, and broadens integrated commercial and institutional product offerings.

- Bessemer Investors completed the sale of Leonard Valve to A. O. Smith on January 6, 2026, following a definitive agreement signed November 12, 2025.

- Bessemer, which invested in Leonard Valve in 2019, supported growth by tripling digital offerings and acquiring Heat-Timer Corporation.

- Leonard Valve, founded in 1911 and based in Cranston, Rhode Island, designs water temperature and flow control valves, digital and thermostatic mixing systems, and monitoring devices.

- A. O. Smith will integrate Leonard Valve’s digital and thermostatic mixing solutions and advanced boiler controls into its global water heating and treatment platform.

- A. O. Smith has completed the acquisition of Leonard Valve for $470 million (approximately $412 million after tax benefits), funded with cash borrowed under a new credit agreement.

- The transaction expands A. O. Smith’s presence in the water management market and enhances its digital and integrated product offerings for commercial and institutional customers.

- Leonard Valve, founded in 1911 and headquartered in Cranston, Rhode Island, designs and manufactures water temperature control valves, digital and thermostatic mixing systems, and related monitoring devices.

- BofA Securities served as exclusive financial advisor and Foley & Lardner LLP served as legal advisor to A. O. Smith.

- A.O. Smith signed a definitive agreement to acquire Leonard Valve Company for $470 million, approximately $412 million net of expected tax benefits; transaction expected to close in Q1 2026.

- The all-cash deal will be funded with cash on hand and committed debt financing, representing an adjusted multiple of ~12× forecasted 2026 EBITDA.

- The acquisition expands A.O. Smith’s water management platform by integrating Leonard Valve’s digital and thermostatic mixing valves and Heat-Timer heating controls with A.O. Smith’s core water heating and boiler offerings.

- After purchase accounting charges and fees, the transaction is expected to be accretive to A.O. Smith’s EPS in 2026, with anticipated strong growth, margins and free cash flow.

Quarterly earnings call transcripts for SMITH A O.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more