Earnings summaries and quarterly performance for Blue Bird.

Executive leadership at Blue Bird.

Board of directors at Blue Bird.

Research analysts who have asked questions during Blue Bird earnings calls.

Eric Stine

Craig-Hallum Capital Group LLC

8 questions for BLBD

Craig Irwin

ROTH Capital Partners

6 questions for BLBD

Chris Pierce

Needham

4 questions for BLBD

Christopher Pierce

Needham & Company

4 questions for BLBD

Greg Lewis

BTIG

4 questions for BLBD

Mike Shlisky

D.A. Davidson

4 questions for BLBD

Michael Shlisky

D.A. Davidson

3 questions for BLBD

Andrew Scutt

ROTH Capital Partners

2 questions for BLBD

Gregory Lewis

BTIG, LLC

2 questions for BLBD

Sherif El-Sabbahy

Bank of America

2 questions for BLBD

Tyler DiMatteo

BTIG, LLC

2 questions for BLBD

Recent press releases and 8-K filings for BLBD.

- Blue Bird raised its FY2026 guidance for Adjusted EBITDA to $215 - $235 Million and Adjusted Free Cash Flow to $40 - $60 Million, while maintaining Net Revenue guidance at $1,450 - $1,550 Million.

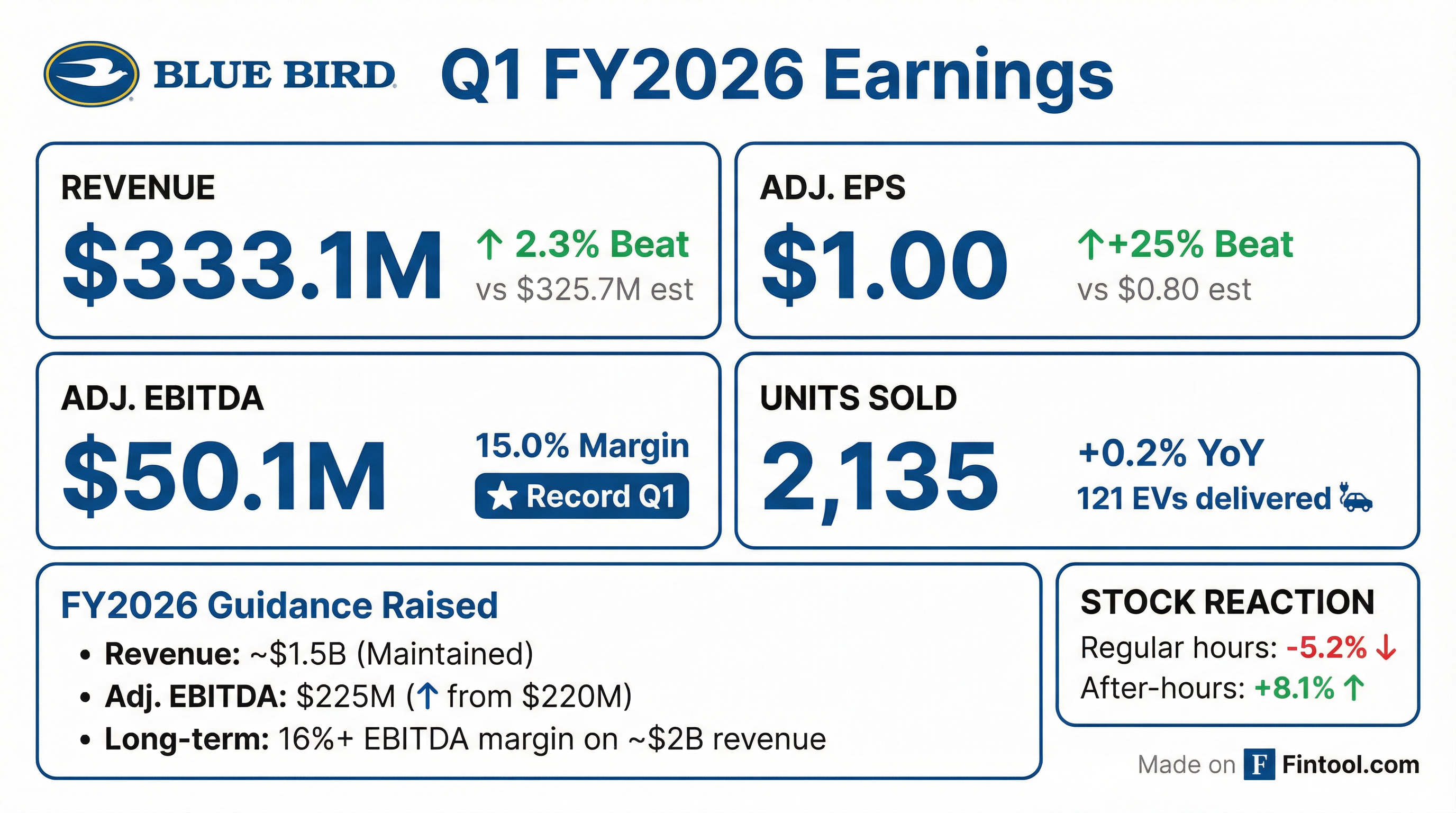

- The company reported strong FY2026 Q1 financial results, beating guidance on all metrics, with Net Revenue of $333.1 Million, Adjusted EBITDA of $50.1 Million, and Adjusted Diluted EPS of $1.00.

- Blue Bird is expanding its market with the introduction of an EV commercial chassis offering, receiving its first order in January 2026 with production starting in FY26-Q4.

- The company announced a new share repurchase program of up to $100 Million over two years, as part of its capital allocation strategy which also includes ~$200 Million for manufacturing expansion.

- Blue Bird reported record Q1 2026 financial results, with $333 million in revenue and $50 million in Adjusted EBITDA, surpassing prior guidance.

- Order intake for the period was exceptionally strong, increasing 45% from the first quarter of 2025, leading to a backlog of 3,400 units.

- The company updated its fiscal 2026 guidance, raising Adjusted EBITDA to $225 million (from a range of $215 million - $235 million) while maintaining revenue guidance of $1.45 billion - $1.55 billion.

- Blue Bird maintains a strong liquidity position with $242 million in cash and $385 million in total liquidity, and executed a $15 million share buyback in Q1 2026.

- Strategic initiatives include a new assembly plant scheduled for 2028 and ongoing automation efforts, with commercial chassis sales now projected for fiscal 2027.

- Blue Bird delivered record Q1 2026 financial results, with $333 million in revenue, $50 million in Adjusted EBITDA, and $1.00 in Adjusted diluted earnings per share, surpassing guidance on all metrics.

- The company raised its fiscal year 2026 Adjusted EBITDA guidance to a range of $215 million-$235 million, while maintaining revenue guidance at $1.45 billion-$1.55 billion.

- Order intake for Q1 2026 was up 45% from Q1 2025, leading to a backlog of 3,400 units, with 25% of these being EVs.

- Blue Bird sold 121 EV units in Q1 2026 and updated its fiscal year 2026 EV unit sales guidance to 800 units, with the EV backlog extending into 2027.

- The company is investing in a new assembly plant and has a $100 million share buyback program, with $5 million executed in Q1 2026.

- Blue Bird reported record fiscal Q1 2026 revenue of $333 million and Adjusted EBITDA of $50 million, with Adjusted diluted earnings per share of $1.00.

- Order intake for the quarter was up 45% from Q1 2025, resulting in a backlog of 3,400 units, including 855 EV units extending into 2027.

- The company raised its fiscal 2026 Adjusted EBITDA guidance to a range of $215 million to $235 million, while maintaining revenue guidance between $1.45 billion and $1.55 billion.

- Blue Bird executed $15 million in share buybacks during Q1 2026 and ended the quarter with record liquidity of $385 million.

- Production for the new commercial chassis is now projected to start in late Q4 2026, with sales expected to begin in fiscal 2027.

- Blue Bird reported strong Q1 FY2026 results, beating guidance on all metrics, with net sales of $333 million and Adjusted EBITDA of $50 million (15.0% margin).

- The company achieved Adjusted Diluted EPS of $1.00 and Adjusted Free Cash Flow of $31 million for Q1 FY2026, representing increases of $0.08 and $9.3 million, respectively, compared to Q1 FY2025.

- Backlog remained seasonally strong at 3.4k units ($602 million in revenue), including 855 EV units ($277 million in revenue), reflecting strong EV demand and a 48% alternative power sales mix.

- Blue Bird updated its FY2026 guidance, raising the Adjusted EBITDA range to $215 - $235 million and Adjusted Free Cash Flow to $40 - $60 million (excluding new plant impact), and executed a $15 million stock buyback during the quarter.

- Blue Bird reported net sales of $333.1 million and GAAP net income of $30.8 million for the first quarter of fiscal 2026.

- Adjusted EBITDA for Q1 2026 was $50.1 million, with a 15% margin, and the company sold 2,135 units.

- Based on a strong start to the year, Blue Bird raised its fiscal year 2026 Adjusted EBITDA guidance to $225 million and reaffirmed its full-year 2026 Net Revenue guidance at ~$1.5 Billion.

- Blue Bird reported net sales of $333.1 million, GAAP net income of $30.8 million, and Adjusted EBITDA of $50.1 million for the first fiscal quarter of 2026, with diluted EPS of $0.94.

- The company sold 2,135 buses in the first fiscal quarter of 2026, including 121 electric-powered buses, and achieved a new all-time first-quarter record for Adjusted EBITDA.

- Based on these strong results, Blue Bird raised its fiscal 2026 full-year Adjusted EBITDA guidance to $225 million and reaffirmed its net revenue guidance at approximately $1.5 billion.

- Blue Bird Corporation reported record financial results for Fiscal Year 2025, achieving $1.48 billion in revenue and $221 million in adjusted EBITDA, representing 15% of revenue.

- The company sold 9,409 units in FY 2025, including 901 electric vehicles, and generated $153 million in free cash flow.

- For Fiscal Year 2026, Blue Bird reconfirmed its guidance, projecting 9,500 units and $1.5 billion in revenue, with an adjusted EBITDA of $220 million.

- The backlog, which was 3,100 units at the end of Q4 2025, has since increased to nearly 4,000 units, including 850 EVs.

- Blue Bird plans to invest up to $200 million over the next two years in manufacturing capabilities and has an ongoing share buyback program, with $50 million completed in FY 2025 Q4 and a new program for up to $100 million.

- Blue Bird reported record financial results for Fiscal Year 2025, achieving $1.48 billion in revenue and $221 million in adjusted EBITDA, marking increases of 10% and 21% respectively from the prior year. The fourth quarter of 2025 also set records with $409 million in net revenue and $68 million in adjusted EBITDA.

- The company sold 9,409 buses in FY 2025, including 901 electric vehicles. The backlog, which was 3,100 units at the end of Q4 2025, has since grown to nearly 4,000 units, including over 850 EVs, as of the earnings call date.

- For Fiscal Year 2026, Blue Bird reconfirmed its guidance, expecting 9,500 units and $1.5 billion in revenue (midpoint), with adjusted EBITDA projected at $220 million (midpoint).

- Strategic investments include up to $200 million over the next two years for manufacturing capabilities, such as a new plant, and a new share buyback program of up to $100 million over the next two years.

- The company's long-term target for 2029 and beyond aims for $1.8-$2 billion in revenue, 12,000-13,500 units, and EBITDA of $280-$320+ million.

- Blue Bird delivered record sales and Adjusted EBITDA for fiscal year 2025, with revenue of $1.48 billion and Adjusted EBITDA of $221 million (15% of revenue). The company also achieved a record $153 million in free cash flow.

- For the fourth quarter of fiscal 2025, the company reported record consolidated net revenue of $409 million and a record Adjusted EBITDA of $68 million (16.6%), with adjusted diluted earnings per share of $1.32.

- The company provided fiscal year 2026 guidance, targeting net revenue of $1.45 billion to $1.55 billion and Adjusted EBITDA of $210 million to $230 million.

- The backlog at the end of Q4 2025 was 3,100 units, including 680 EVs, which has since increased to nearly 4,000 units and over 850 EVs. Blue Bird sold 901 electric vehicles in fiscal 2025.

Quarterly earnings call transcripts for Blue Bird.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more