Earnings summaries and quarterly performance for BROADRIDGE FINANCIAL SOLUTIONS.

Executive leadership at BROADRIDGE FINANCIAL SOLUTIONS.

Tim Gokey

Chief Executive Officer

Ashima Ghei

Chief Financial Officer

Christopher Perry

President

Douglas DeSchutter

Corporate Vice President, Investor Communication Solutions

Hope Jarkowski

Chief Legal Officer

Richard Stingi

Chief Human Resources Officer

Thomas Carey

Corporate Vice President, Global Technology and Operations

Board of directors at BROADRIDGE FINANCIAL SOLUTIONS.

Research analysts who have asked questions during BROADRIDGE FINANCIAL SOLUTIONS earnings calls.

Patrick O'Shaughnessy

Raymond James

7 questions for BR

Puneet Jain

JPMorgan Chase & Co.

6 questions for BR

Kyle Peterson

Needham & Company

5 questions for BR

Michael Infante

Morgan Stanley

5 questions for BR

Scott Wurtzel

Wolfe Research

5 questions for BR

Daniel Perlin

RBC Capital Markets

3 questions for BR

James Faucette

Morgan Stanley

3 questions for BR

Alex Kramm

UBS Group AG

2 questions for BR

Matthew Roswell

RBC Capital Markets

2 questions for BR

Peter Heckmann

D.A. Davidson

2 questions for BR

Alex Kram

UBS

1 question for BR

Recent press releases and 8-K filings for BR.

- Broadridge’s Distributed Ledger Repo (DLR) platform processed an average of $365 billion in daily repo transactions in January, with total volumes of $7.3 trillion.

- This represents a 508% year-over-year increase, highlighting accelerated institutional adoption of tokenized real-asset settlement.

- In 2026, Broadridge plans to expand DLR into intraday funding, enhanced collateral mobility, and additional tokenized asset classes.

- Broadridge is targeting 7–9% recurring revenue growth (5–7% organic plus 1–2% M&A) and 8–12% earnings growth, with a 2% dividend and 1% share buyback, aiming for low-teens total shareholder returns.

- Agreed to acquire CQG for $170 million, anticipated to add ~5 points of growth to its capital markets business upon closing later this year.

- Governance segment to capture >$100 million of new revenue through expanded pass-through voting (600 funds, $4 trillion AUM), a custom AI-driven proxy policy engine, and issuer standing-instruction services.

- Advancing tokenized securities with Digital Ledger Repo usage growing from $100 billion to $400 billion/day, moving toward real-time, multi-asset settlement on the public Canton network.

- Announced acquisition of CQG for $170 million to establish an execution management business in futures and options, expected to contribute about 5 points of growth to the capital markets segment upon close later this year.

- Digital Ledger Repo platform now processes $400 billion in tokenized assets daily; Broadridge plans to migrate from a private Canton network to the public Canton network and enable real-time atomic settlement later in 2026, paving the way for multi-asset tokenization.

- Embedding AI across its offerings, including a predictive data & analytics product sold to ~20 clients, a custom proxy-voting AI engine deployed with Wells Fargo, a 10× increase in fund report engagement, and a 20% improvement in back-office productivity with further gains planned.

- Maintains a balanced capital allocation policy—investment-grade rating, dividends, tuck-in M&A and share buybacks—with historical M&A IRRs of 18–20% and a roughly 50/50 split between acquisitions and buybacks; backlog of $430 million underpins near-term revenue.

- Broadridge serves 28 of the 29 globally significant financial institutions with $4.5 billion in recurring fee revenues, processing $15 trillion of trades and $400 billion of tokenized assets daily.

- Targets 5–7% organic and 1–2% M&A–driven revenue growth (total 7–9%), 10% earnings growth, a 1% share buyback and 2% dividend yield.

- Governance business expanding: pass-through voting grew from 100 to 600 funds covering $4 trillion AUM; deploying AI-driven proxy policy engine with Tier One clients and piloting standing instructions with ExxonMobil.

- Advancing tokenization via Digital Ledger Repo roadmap to public ledger and leveraging AI (predictive analytics sold to ~20 clients; 20% productivity gain in operations) to enhance products and margins.

- Completed $170 million CQG acquisition to enter futures/options execution, adding ~5 pp growth to capital markets; maintains balanced capital allocation with tuck-in M&A IRRs of 18–20% alongside buybacks.

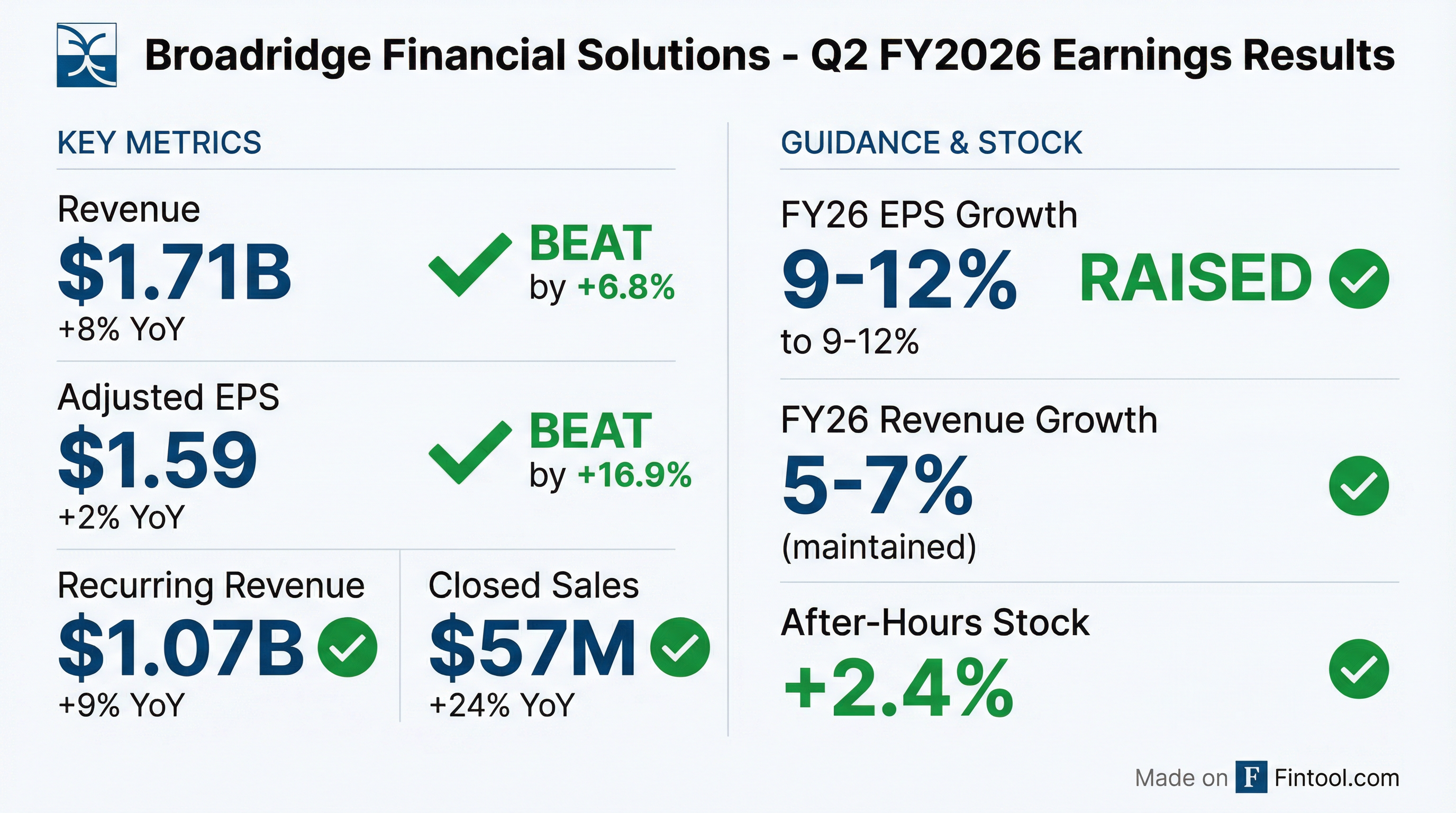

- Broadridge delivered 8% recurring revenue growth (constant currency) and Adjusted EPS of $1.59 in Q2 FY26.

- Q2 FY26 recurring revenues reached $1,070 M (+9% YoY) and total revenues were $1,714 M (+8% YoY); Adjusted operating income margin was 15.5%.

- The company raised FY’26 Adjusted EPS growth guidance to 9–12%, while reaffirming its recurring revenue growth, adjusted operating income margin, and closed sales targets.

- Broadridge targets 7–9% recurring revenue growth and 8–12% Adj. EPS growth over FY’24–26, supported by its platform-based model and balanced capital allocation.

- Broadridge delivered 8% recurring revenue growth (constant currency) and adjusted EPS of $1.59 in Q2 FY2026.

- Governance recurring revenues rose 9% (constant currency), with equity positions up 17% and revenue positions up 11% year-over-year.

- Capital markets recurring revenues grew 6% (constant currency); tokenization volumes reached $384 billion/day in December (≈$9 trillion/month), more than doubling since June 2025.

- Wealth management recurring revenues increased 11%, and Q2 closed sales jumped 24% to $57 million, while new pipeline generation rose over 20% year-over-year.

- Reaffirmed fiscal 2026 guidance for 5%–7% recurring revenue growth (constant currency), 9%–12% adjusted EPS growth, and $290 M–$330 M in closed sales.

- Broadridge delivered 8% constant-currency recurring revenue growth and adjusted EPS of $1.59 in Q2, driven by strong governance, capital markets, and wealth segments.

- The company reaffirmed fiscal 2026 recurring revenue growth at the high end of 5%–7%, raised adjusted EPS growth guidance to 9%–12%, and expects closed sales of $290–330 million.

- Broadridge generated >100% free cash flow conversion, invested $126 million in three tuck-in acquisitions (including Acolin), and returned $367 million to shareholders via dividends and repurchases in H1.

- Its tokenization platform processed $384 billion per day in December (more than double June levels) and will extend capabilities to tokenized equities, corporate actions, and digital wallets by year-end.

- Broadridge delivered 8% constant-currency recurring revenue growth and $1.59 adjusted EPS in Q2 2026.

- Reaffirmed fiscal 2026 guidance for recurring revenue growth and raised adjusted EPS growth outlook to 9%–12%.

- Generated $319 million of free cash flow in H1 and is on track for over 100% free cash flow conversion.

- Recorded a $187 million non-cash mark-to-market gain on digital asset holdings, which rose to $265 million at quarter-end.

- Advanced strategic initiatives with the Acolin acquisition and expanded tokenization efforts, including $7 million of digital asset revenues and $9 trillion of tokenized collateral in December.

- Recurring revenues of $1.07 B, up 9% YoY; 8% constant currency growth

- Total revenues of $1.714 B, up 8% YoY; Operating income of $206 M, down 2%

- Adjusted EPS of $1.59, up 2%, and GAAP EPS of $2.42

- Closed sales of $57 M, up 24%; raised FY ’26 guidance to 5–7% recurring revenue growth, 9–12% Adjusted EPS growth, and $290–330 M closed sales

- Q2 total revenues were $1.714 B, up 8%, with recurring revenues of $1.070 B, up 9% (8% constant currency).

- Diluted EPS was $2.42 (102% YoY increase) and adjusted EPS was $1.59, up 2%.

- Closed sales reached $57 M, up 24% year-over-year.

- Raised FY ’26 adjusted EPS growth guidance to 9–12% and reaffirmed recurring revenue growth (5–7% CC) and adjusted operating income margin (20–21%).

Fintool News

In-depth analysis and coverage of BROADRIDGE FINANCIAL SOLUTIONS.

Quarterly earnings call transcripts for BROADRIDGE FINANCIAL SOLUTIONS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more