Earnings summaries and quarterly performance for PEABODY ENERGY.

Executive leadership at PEABODY ENERGY.

James Grech

President and Chief Executive Officer

Darren Yeates

Executive Vice President and Chief Operating Officer

Malcolm Roberts

Executive Vice President and Chief Commercial Officer

Mark Spurbeck

Executive Vice President and Chief Financial Officer

Patrick Forkin

Chief Development Officer

Scott Jarboe

Chief Administrative Officer and Corporate Secretary

Board of directors at PEABODY ENERGY.

Research analysts who have asked questions during PEABODY ENERGY earnings calls.

Katja Jancic

BMO Capital Markets

9 questions for BTU

Nathan Martin

The Benchmark Company

9 questions for BTU

Nick Giles

B. Riley Securities

8 questions for BTU

George Eadie

UBS

6 questions for BTU

Chris LaFemina

Jefferies Financial Group

4 questions for BTU

Christopher LaFemina

Jefferies

3 questions for BTU

Lucas Pipes

B. Riley Securities

1 question for BTU

Matt Water

coltragger.com

1 question for BTU

Recent press releases and 8-K filings for BTU.

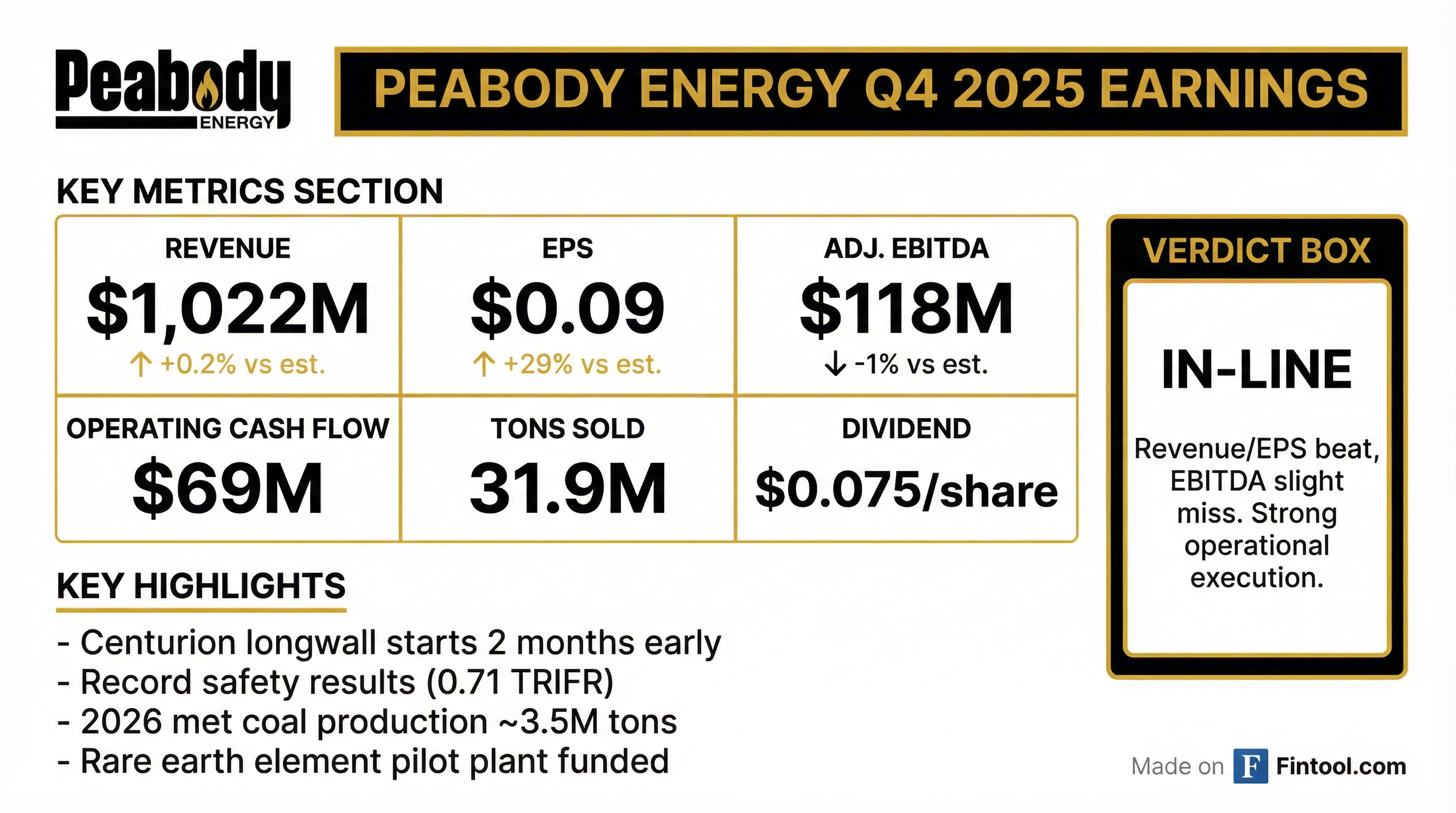

- Peabody Energy reported Q4 2025 net income of $10.4 million ($0.09 per diluted share) and adjusted EBITDA of $118 million, a 19% increase from the prior quarter. For the full year 2025, the company generated $336 million in operating cash flow and ended with $575 million in cash and over $900 million in total liquidity.

- The Centurion Mine commenced longwall mining ahead of its original schedule, with expected shipments of 3.5 million tons in 2026, ramping up to an average of 4.7 million tons per year by 2028. This is anticipated to increase segment-wide met coal price realizations to 80% of the Premium Hard Coking Coal index in 2026.

- For 2026, Peabody projects seaborne met volumes to increase to 10.8 million tons and U.S. Thermal PRB shipments between 82-88 million tons. Total capital expenditures are estimated at $340 million, a $70 million reduction from 2025.

- Shareholder returns remain the number one priority for capital allocation, with expectations for substantial free cash flow generation in 2026 due to reduced Centurion capital spending and improved met coal prices.

- Peabody reported Q4 2025 net income attributable to common stockholders of $10.4 million or $0.09 per diluted share, and adjusted EBITDA of $118 million, a 19% increase from the prior quarter. The company ended 2025 with $575 million in cash and total liquidity above $900 million.

- The Centurion Mine in Australia has commenced longwall mining ahead of schedule, with expected shipments of 3.5 million tons of premium hard coking coal in 2026, projected to increase segment-wide met coal price realizations from 70% in 2025 to 80% of the recognized benchmark in 2026.

- For 2026, Peabody anticipates total capital expenditures of $340 million, a $70 million reduction from 2025, and projects seaborne met volumes to reach 10.8 million tons and U.S. thermal PRB shipments between 82-88 million tons.

- The company highlighted strong market fundamentals, with global coal use reaching an all-time record of 8.8 billion metric tons in 2025 and U.S. coal-fueled generation increasing an estimated 13% year-over-year. Peabody also secured a recommended $6.25 million grant for a rare earth pilot processing plant in Wyoming.

- Shareholder returns are the top priority for capital allocation, with expectations of substantial free cash flow generation in 2026 due to lower Centurion capital spend and higher metallurgical coal prices.

- Peabody Energy reported Q4 2025 net income of $10.4 million or $0.09 per diluted share and Adjusted EBITDA of $118 million, a 19% increase from the prior quarter. The company ended 2025 with $575 million in cash and over $900 million in total liquidity.

- The Centurion Mine commenced longwall mining ahead of schedule, expected to ship 3.5 million tons of premium hard coking coal in 2026, ramping to 4.7 million tons by 2028. This is projected to increase the met coal segment's price realizations to 80% of the Premium Hard Coking Coal index in 2026, up from 70% in 2025.

- For 2026, Peabody forecasts seaborne metallurgical volumes to reach 10.8 million tons at costs of $113 per ton, and U.S. Thermal PRB shipments of 82-88 million tons at costs of $11.50 per ton. Total capital expenditures are estimated at $340 million, a $70 million reduction from 2025.

- Shareholder returns remain the first priority for cash allocation, with expectations for returns to be much closer to 100% of free cash flow, up from 65%, following the reduced Centurion development risk.

- The company highlighted strong market fundamentals, including global coal use setting a record in 2025 at 8.8 billion metric tons and a 13% year-over-year increase in U.S. coal-fueled generation. Peabody also secured a $1 billion contract for over 20 million tons of Illinois-based coal over five years.

- Peabody reported Q4 2025 net income attributable to common stockholders of $10.4 million ($0.09 per diluted share) and a full-year 2025 net loss of $(52.9) million ($(0.43) per diluted share), compared to net income of $30.6 million ($0.25 per diluted share) and $370.9 million ($2.70 per diluted share) in the prior year periods, respectively.

- Full-year 2025 revenue totaled $3,861.5 million and Adjusted EBITDA was $454.9 million, both lower than the prior year's $4,236.7 million revenue and $871.7 million Adjusted EBITDA.

- The Board of Directors declared a quarterly dividend of $0.075 per share, payable on March 10, 2026, to stockholders of record on February 23, 2026.

- The Centurion mine's longwall operations commenced two months ahead of schedule, with an anticipated production of 3.5 million tons of premium low vol hard coking coal in 2026, ramping up to 4.7 million tons annually by 2028.

- Peabody ended 2025 with $575 million in Cash and Cash Equivalents and generated $336 million in operating cash flow from continuing operations for the full year.

- For the fourth quarter of 2025, Peabody reported net income attributable to common stockholders of $10.4 million, or $0.09 per diluted share, and Adjusted EBITDA of $118.1 million. For the full year 2025, the company reported a net loss attributable to common stockholders of $(52.9) million, or $(0.43) per diluted share, on revenue of $3,861.5 million, and Adjusted EBITDA of $454.9 million.

- The Centurion longwall mining operation commenced two months ahead of schedule, projected to produce 3.5 million tons of premium low vol hard coking coal in 2026 and ramping up to 4.7 million tons in 2028. This is expected to improve metallurgical coal realizations from approximately 70% of benchmark in 2025 to 80% in 2026.

- For full-year 2026, Peabody anticipates Seaborne Metallurgical volumes between 10.3 and 11.3 million tons with average costs of $108.00 - $118.00 per short ton, and PRB U.S. Thermal volumes between 82.0 and 88.0 million tons with average costs of $11.25 - $11.75 per short ton. Total capital expenditures are projected at $340 million.

- Peabody ended 2025 with $575 million in Cash and Cash Equivalents and generated $336 million in operating cash flow from continuing operations for the full year.

- Peabody Energy reported a GAAP net loss of $70.1 million or $0.58 per diluted share for Q3 2025, which included $54 million in acquisition termination costs, while adjusted EBITDA was just under $100 million.

- The company is on track to begin longwall production at its Centurion mine next quarter, with shipments of premium hard coking coal expected to expand sevenfold in 2026 to 3.5 million tons and significantly boost average met coal portfolio realizations.

- Peabody updated its full-year 2025 guidance, increasing seaborne thermal volumes to 15.1 to 15.4 million tons and PRB volumes to 84 to 86 million tons, while also improving seaborne met cost targets to $115 per ton and PRB costs to $11.25 to $11.75 per ton.

- U.S. thermal coal demand is growing, with total U.S. electricity demand up 2% year-over-year and U.S. coal burn increasing 11% this year, driven by data center build-out, increased manufacturing, and favorable natural gas prices.

- The company is in the early stages of assessing its potential for rare earth elements and critical minerals in the Powder River Basin, with preliminary data showing promising concentrations and ongoing discussions with the Trump administration.

- Peabody Energy reported a GAAP net loss of $70.1 million or $0.58 per diluted share for Q3 2025, primarily due to $54 million in acquisition termination costs, while generating just under $100 million in adjusted EBITDA. The company ended the quarter with a strong liquidity position, including $603 million in cash and over $950 million in total liquidity.

- The Centurion mine's longwall production is scheduled to begin in Q4 2025, with expectations for premium hard coking coal shipments to expand sevenfold in 2026 to 3.5 million tons. This mine is anticipated to be Peabody's lowest cost metallurgical coal mine and is projected to increase average met coal portfolio realizations from 70% this year to approximately 80% in 2026.

- Peabody provided a favorable full-year 2025 guidance update, raising anticipated seaborne thermal volumes to 15.1 to 15.4 million tons and Powder River Basin (PRB) volumes to 84 to 86 million tons. Concurrently, seaborne met cost targets were improved to $115 per ton and PRB costs lowered to $11.25 to $11.75 per ton.

- The company is actively exploring its potential in rare earth elements and critical minerals within the PRB, with preliminary studies indicating similar or better concentrations than other reported findings. Further details on mineral types, concentrations, and future plans are expected by year-end reporting early next year.

- Peabody Energy reported a GAAP net loss of $70.1 million or $0.58 per diluted share for Q3 2025, which included $54 million in acquisition termination costs primarily related to the terminated Anglo American deal, while adjusted EBITDA was just under $100 million and operating cash flow was $122 million. The company expects $5 million per year in legal defense costs for the ongoing arbitration.

- The Centurion mine's longwall production begins next quarter, with shipments of premium hard coking coal expected to expand sevenfold in 2026 to 3.5 million tons, making it the company's lowest cost metallurgical coal mine and boosting average met coal portfolio realizations to roughly 80% of benchmark in 2026.

- Peabody updated its full-year 2025 guidance, anticipating higher seaborne thermal volumes (15.1 to 15.4 million tons) and PRB volumes (84 to 86 million tons) with improved cost targets. This comes amidst strong U.S. thermal demand, with total U.S. electricity demand up 2% year-over-year and coal generation growth five times greater than overall electricity generation growth year-to-date.

- Peabody reported a net loss attributable to common stockholders of $(70.1) million, or $(0.58) per diluted share, for the third quarter of 2025, compared to a net income of $101.3 million in the prior-year quarter.

- Adjusted EBITDA was $99.5 million in Q3 2025, reflecting a 14% increase in revenues over the second quarter.

- The company declared a quarterly dividend of $0.075 per share on common stock, payable on December 3, 2025, to stockholders of record on November 13, 2025.

- Peabody generated $122 million of operating cash flow in Q3 2025, ending the quarter with $603.3 million in cash and total liquidity exceeding $950 million as of September 30, 2025.

- The Centurion Mine's longwall production remains on schedule for an accelerated startup in February 2026, and the company is strengthening its full-year 2025 targets for seaborne met, seaborne thermal, and PRB segments.

- Peabody reported a net loss attributable to common stockholders of $(70.1) million, or $(0.58) per diluted share, for the third quarter of 2025, compared to a net income of $101.3 million, or $0.74 per diluted share, in the prior-year quarter.

- Adjusted EBITDA for Q3 2025 was $99.5 million, a decrease from $224.8 million in the prior-year quarter, but an increase from Q2 2025 due to higher Powder River Basin and seaborne thermal volumes and lower metallurgical costs.

- The company declared a $0.075 per share dividend on common stock on October 30, 2025.

- Peabody generated $122 million in operating cash flow during Q3 2025, ending the quarter with $603.3 million in cash and over $950 million in total liquidity as of September 30, 2025.

- The company is strengthening its full-year 2025 targets for seaborne metallurgical, seaborne thermal, and Powder River Basin segments, with the Centurion Mine longwall operations scheduled to begin in February 2026.

Quarterly earnings call transcripts for PEABODY ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more