Earnings summaries and quarterly performance for COUSINS PROPERTIES.

Executive leadership at COUSINS PROPERTIES.

Colin Connolly

President and Chief Executive Officer

Gregg Adzema

Executive Vice President and Chief Financial Officer

John McColl

Executive Vice President, Development

Kennedy Hicks

Executive Vice President, Chief Investment Officer and Managing Director

Pamela Roper

Executive Vice President, General Counsel & Corporate Secretary

Richard Hickson IV

Executive Vice President, Operations

Board of directors at COUSINS PROPERTIES.

Research analysts who have asked questions during COUSINS PROPERTIES earnings calls.

Blaine Heck

Wells Fargo Securities

6 questions for CUZ

Brendan Lynch

Barclays

6 questions for CUZ

Dylan Burzinski

Green Street Advisors, LLC

6 questions for CUZ

John Kim

BMO Capital Markets

6 questions for CUZ

Anthony Paolone

JPMorgan Chase & Co.

5 questions for CUZ

Upal Rana

KeyBanc Capital Markets

5 questions for CUZ

Nicholas Thillman

Robert W. Baird & Co.

4 questions for CUZ

Peter Abramowitz

Jefferies

3 questions for CUZ

Steve Sakwa

Evercore ISI

3 questions for CUZ

Andrew Berger

Bank of America

2 questions for CUZ

Jeffrey Spector

BofA Securities

2 questions for CUZ

Michael Lewis

Truist Securities, Inc.

2 questions for CUZ

Nick Thillman

Robert W. Baird & Co. Incorporated

2 questions for CUZ

Shashank Saravanan

Mizuho Financial Group, Inc.

2 questions for CUZ

James Feldman

Wells Fargo

1 question for CUZ

Jana Galan

Bank of America

1 question for CUZ

Recent press releases and 8-K filings for CUZ.

- Cousins Properties LP, guaranteed by Cousins Properties Incorporated, issued $500,000,000 aggregate principal amount of 4.875% Senior Notes due 2033 on February 20, 2026.

- The net proceeds from the notes will be used to repay a portion of borrowings under its credit facility and for general corporate purposes, including repayment of other outstanding indebtedness.

- The Indenture for the notes requires the Company and its subsidiaries to maintain total unencumbered assets of not less than 150% of total unsecured debt.

- Cousins Properties Incorporated intends to continue to be taxed as a Real Estate Investment Trust (REIT), with an opinion confirming its conformity with REIT requirements through December 31, 2025, and for December 31, 2026, and thereafter.

- On February 17, 2026, Cousins Properties Incorporated (CUZ) announced that its Board of Directors authorized a new share repurchase program.

- The program allows for the repurchase of up to $250 million of its outstanding common shares.

- The company anticipates funding the program through a combination of non-core asset sales, retained cash, debt financing, and/or settlement of common shares previously issued under its ATM program.

- The program does not have an expiration date and does not obligate the company to repurchase any specific amount, allowing for its suspension or discontinuation at any time.

- Cousins Properties Incorporated (NYSE:CUZ) announced that its Board of Directors has authorized a new share repurchase program.

- The program allows for the repurchase of up to $250 million of its outstanding common shares.

- Funding for the program is anticipated to come from a combination of proceeds from non-core asset sales, retained cash, debt financing, and/or the settlement of common shares previously issued on a forward basis.

- The program does not have an expiration date and does not obligate the Company to repurchase any specific dollar amount or number of shares.

- Cousins Properties' operating partnership priced an offering of $500 million aggregate principal amount of 4.875% senior unsecured notes due 2033 at 99.259% of the principal amount.

- The offering is expected to close on February 20, 2026.

- The net proceeds will primarily be used to repay a portion of borrowings under its credit facility, which were partially incurred for the acquisition of 300 South Tryon, with any remaining amounts for working capital, capital expenditures, and other general corporate purposes.

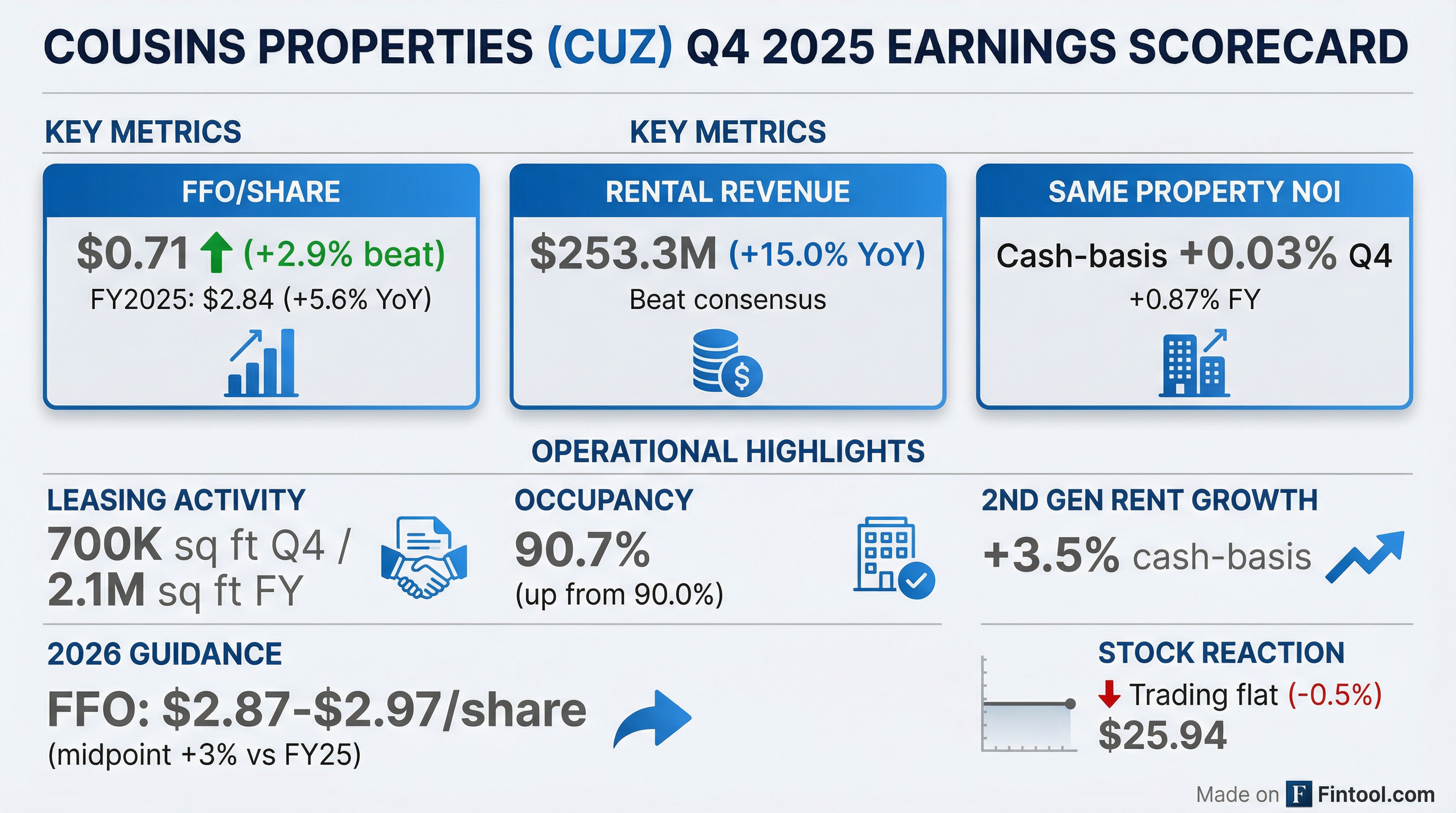

- Cousins Properties reported Q4 2025 FFO of $0.71 per share and full-year 2025 FFO of $2.84 per share, representing 5.6% growth over 2024.

- The company issued 2026 FFO guidance of $2.92 per share at the midpoint, projecting 2.8% growth over 2025.

- Leasing activity was strong, with 700,000 sq ft of leases completed in Q4 2025 and over 2.1 million sq ft for the full year, bringing portfolio occupancy to 88.3% with a target of 90% or higher by year-end 2026.

- Strategic capital allocation included the acquisition of 300 South Tryon in Charlotte for $317 million and planned dispositions of Harborview Plaza for $39.5 million and a land parcel at 303 Tremont for $23.7 million.

- Management highlighted improving office fundamentals, accelerating demand, and low new supply in Sunbelt markets, anticipating a shortage of high-quality space in the coming years.

- Cousins Properties reported Q4 2025 FFO of $0.71 per share and full-year 2025 FFO of $2.84 per share, marking 5.6% growth over 2024. For 2026, the company issued FFO guidance of $2.92 per share at the midpoint, projecting 2.8% growth over 2025.

- The company completed 700,000 sq ft of leases in Q4 2025, bringing portfolio occupancy to 88.3% at quarter-end. A goal has been set to reach 90% or higher occupancy by year-end 2026, supported by a late-stage leasing pipeline of over 1.1 million sq ft.

- Cousins Properties acquired 300 South Tryon in Charlotte for $317 million. To fund this, the company is under contract to sell Harborview Plaza for $39.5 million and a land parcel at 303 Tremont for $23.7 million.

- Management noted improving office market fundamentals with accelerating demand and declining new supply, particularly in Sunbelt markets. The company intends to identify a new development project to break ground in late 2026 or 2027 to address the anticipated shortage of premier space.

- Cousins Properties reported Q4 2025 FFO of $0.71 per share and full-year 2025 FFO of $2.84 per share, representing 5.6% growth over 2024.

- The company issued 2026 FFO guidance of $2.92 per share at the midpoint, forecasting 2.8% growth over 2025.

- Leasing activity was robust, with 700,000 sq ft of leases completed in Q4 2025 and over 2.1 million sq ft for the full year, the most since 2019. The portfolio was 88.3% occupied at quarter-end, with a goal to achieve 90% or higher occupancy by year-end 2026.

- Cousins Properties acquired 300 South Tryon in Charlotte for $317.5 million and is under contract to sell Harbourview Plaza for $39.5 million and a land parcel at 303 Tremont for $23.7 million. Management noted improving office fundamentals in Sunbelt markets and plans to identify a new development start for late 2026 or 2027.

- Cousins Properties (CUZ) acquired 300 South Tryon, a 638,000 square foot lifestyle office property in Uptown Charlotte, for $317.5 million.

- The property, built in 2017, is 100% leased with a weighted average lease term of six years.

- The acquisition, which closed on February 2, 2026, is expected to be immediately accretive to earnings and strengthen future cash flows.

- Funding for the acquisition will come from a combination of non-core asset sales, debt financing, and/or the settlement of common shares. Cousins is also under contract to sell Harborview Plaza and a land parcel for combined gross proceeds of $63.2 million.

- Cousins Properties reported a net loss available to common stockholders of $3.5 million, or $0.02 per share, for Q4 2025, and net income of $40.5 million, or $0.24 per share, for the full year 2025.

- Funds From Operations (FFO) for Q4 2025 was $119.5 million, or $0.71 per share, and for the full year 2025 was $478.4 million, or $2.84 per share.

- The company executed 700,000 square feet of leases in Q4 2025 and 2,125,000 square feet for the full year 2025, with cash-basis same property net operating income (NOI) increasing 0.03% in Q4 and 0.87% for the full year.

- Cousins Properties provided initial 2026 earnings guidance, projecting net income between $0.23 and $0.33 per share and FFO between $2.87 and $2.97 per share.

- Subsequent to year-end, on February 2, 2026, the company acquired 300 South Tryon for $317.5 million and entered into agreements to sell Harborview Plaza and a land parcel for gross proceeds totaling $63.2 million.

- Cousins Properties (NYSE: CUZ) has acquired 300 South Tryon, a 638,000 square foot lifestyle office property in Charlotte, for $317.5 million.

- The property, located in the Uptown submarket of Charlotte and built in 2017, is 100% leased with a weighted average lease term of six years.

- The acquisition will be funded through a combination of non-core asset sales, debt financing, and/or common share settlement, with $63.2 million in gross proceeds expected from two asset sales.

- CEO Colin Connolly stated the transaction is an "off-market acquisition" that is immediately accretive to earnings and strengthens future cash flows.

Quarterly earnings call transcripts for COUSINS PROPERTIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more