Earnings summaries and quarterly performance for ENERGIZER HOLDINGS.

Research analysts who have asked questions during ENERGIZER HOLDINGS earnings calls.

Peter Grom

UBS Group

8 questions for ENR

William Reuter

Bank of America

8 questions for ENR

Lauren Lieberman

Barclays

7 questions for ENR

Robert Ottenstein

Evercore ISI

6 questions for ENR

Andrea Teixeira

JPMorgan Chase & Co.

5 questions for ENR

Brian McNamara

Canaccord Genuity - Global Capital Markets

5 questions for ENR

Carla Casella

JPMorgan Chase & Co.

5 questions for ENR

Shovana Chowdhury

JPMorgan Chase & Co.

3 questions for ENR

William Chappell

Truist Securities

3 questions for ENR

Rob Ottenstein

Evercore

2 questions for ENR

Bill Chappell

Truist Securities

1 question for ENR

Dara Mohsenian

Morgan Stanley

1 question for ENR

Recent press releases and 8-K filings for ENR.

- WSP Global Inc. completed its acquisition of TRC Companies on February 24, 2026.

- TRC Companies is a premier U.S. Power & Energy brand with approximately 8,000 professionals.

- This acquisition establishes WSP as the #1 Power & Energy platform in the U.S. and the country's largest engineering and design firm by revenue.

- The acquisition aligns with WSP's 2025-2027 Global Strategic Action Plan, enhancing capabilities in high-growth areas including water, infrastructure, environment, and digital solutions.

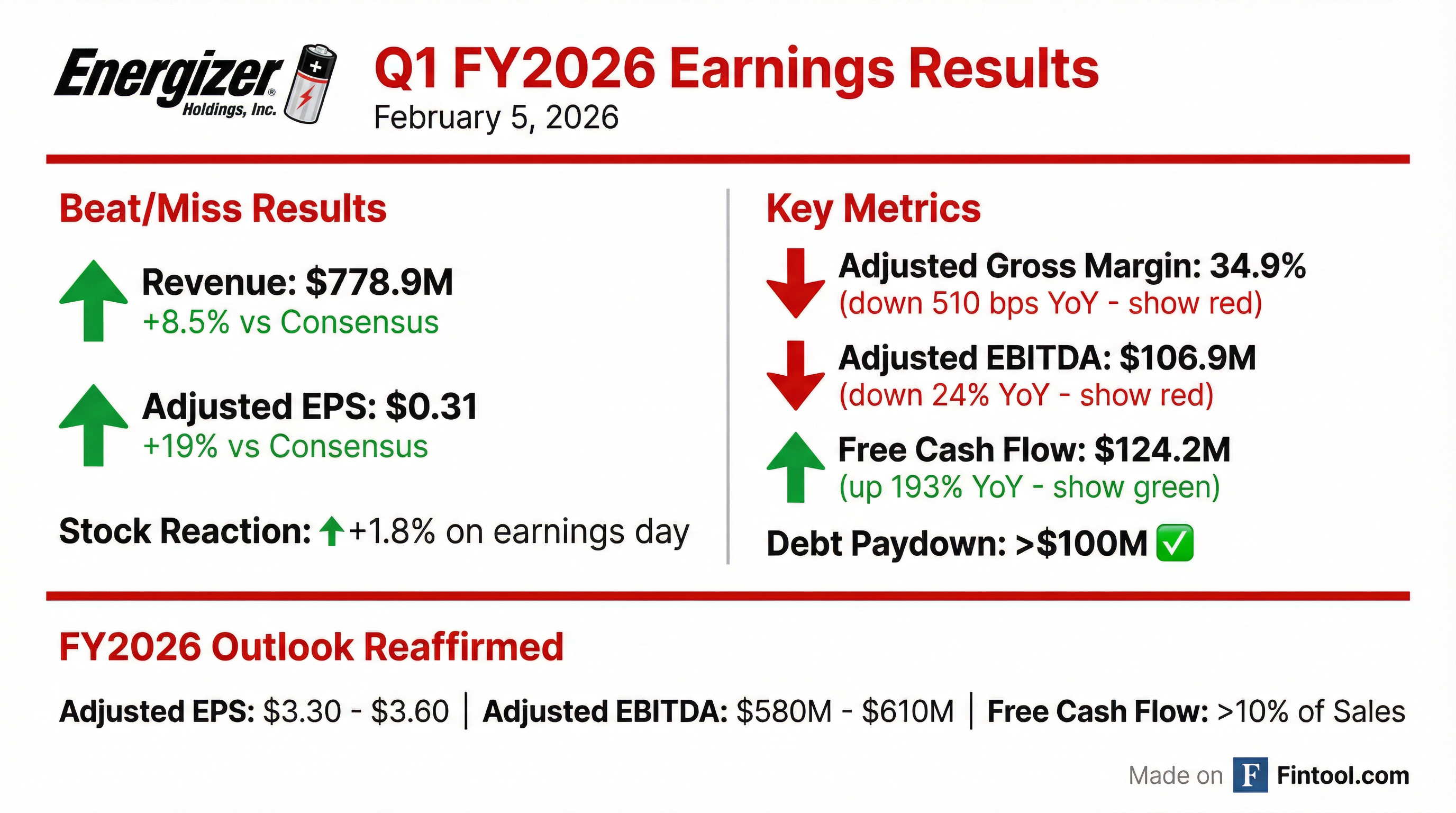

- Energizer's Q1 fiscal year 2026 performance exceeded expectations, showing meaningful progress on restoring growth, rebuilding margins, and returning to its historical cash flow profile.

- The company anticipates significant gross margin expansion, with 300 basis points expected from Q1 to Q2, and an additional 300-400 basis points anticipated by year-end. Q1 gross margin was notably impacted by tariffs (300 bps), the Panasonic-branded product sell-through (200 bps hit), and transitional product costs.

- Energizer paid down over $100 million of debt in Q1 2026 and is targeting $150 million-$200 million for the full year, aiming for a leverage ratio of five or a little below by year-end. The company also returned nearly $28 million to shareholders through dividends and share repurchases.

- Key growth drivers include the APS to Energizer brand transition, projected to contribute over $30 million in organic growth, along with increased distribution and innovation. The year is expected to be back-half weighted for net sales and earnings acceleration.

- Energizer's Q1 fiscal year 2026 performance exceeded expectations, demonstrating meaningful progress in restoring growth, rebuilding margins, and returning to historical cash flow.

- The company anticipates significant gross margin expansion, with 300 basis points expected from Q1 to Q2 and an additional 300-400 basis points by year-end , ,. This improvement is attributed to factors such as cycling through higher-rate inventory and the non-recurrence of a 200 basis point impact from Panasonic-branded product sales ,.

- Energizer paid down over $100 million of debt in Q1 2026 and returned nearly $28 million to shareholders through dividends and share repurchases. The company targets $150 million-$200 million in debt paydown for the full year, aiming for a leverage of 5x or below by year-end.

- Organic growth is expected to be driven by the APS to Energizer brand transition, projected to contribute over $30 million primarily in Q3 and Q4, and strengthened distribution ,. The fiscal year 2026 outlook is back-half weighted, projecting a strong acceleration of net sales and earnings in the latter half of the year ,.

- ENR reported Q1 2026 Net Sales of $778.9 million, an increase of 6.5% reported but a 4.3% organic decrease.

- Adjusted EPS for Q1 2026 was $0.31, down from $0.67 in the prior year, with an Adjusted Gross Margin of 34.9%, a decrease of 510 basis points.

- The company achieved over $100 million in debt paydown and generated $124.2 million in Free Cash Flow in Q1 2026.

- ENR reaffirmed its Fiscal Year 2026 outlook, projecting Adjusted EPS between $3.30 and $3.60 and Adjusted EBITDA between $580 million and $610 million.

- For Q2 2026, the company expects Organic Net Sales to be (4%) to (5%) and Adjusted EPS between $0.40 and $0.50.

- Energizer's Q1 2026 performance exceeded expectations, demonstrating meaningful progress towards restoring growth, rebuilding margins, and returning to its historical cash flow profile.

- The company anticipates significant gross margin expansion, with over 300 basis points of sequential improvement from Q1 to Q2, and an additional 300-400 basis points by year-end.

- Energizer generated robust cash flow, enabling a debt reduction of over $100 million in Q1, with a full-year target of $150 million-$200 million and an aim to achieve a leverage ratio of 5x or below by year-end.

- The APS to Energizer brand transition is projected to contribute over $30 million of organic growth in the year, primarily in the third and fourth quarters.

- For the first fiscal quarter ended December 31, 2025, Energizer Holdings, Inc. reported Net sales of $778.9 million, an increase of +6.5%, while Organic Net sales decreased 4.3%. The company posted a loss per share of $(0.05) and Adjusted Earnings per share of $0.31.

- The company generated $149.5 million in operating cash flows and $124.2 million in Free cash flow, leading to a debt reduction of over $100 million during the quarter.

- Energizer Holdings, Inc. reaffirmed its fiscal year 2026 outlook, expecting Adjusted Earnings per share in the range of $3.30 to $3.60 and Adjusted EBITDA in the range of $580 million to $610 million. Organic Net sales are projected to be flat to slightly up for the full year.

- For the second fiscal quarter, the company anticipates Organic Net sales to decline 4% to 5% and expects Adjusted Earnings per share in the range of $0.40 to $0.50.

- Econergy Renewable Energy Ltd. (TASE: ECNR) has reached financial close on its Dalmarnock 40MW / 120MWh battery energy storage system (BESS) project in Scotland.

- The company secured £21 million in project finance from Santander UK for the Dalmarnock project.

- A long-term optimisation partnership has been established with EDF, which provides a guaranteed minimum income level and retains full upside exposure.

- This milestone represents a significant step in Econergy's UK storage strategy, marking its transition from a developer to an operational independent power producer (IPP).

- For Fiscal Year 2025, ENR reported net sales of $2,952.7 million, a 2.3% reported increase and 0.7% organic growth, with Adjusted EPS growing 6% to $3.52 and Adjusted EBITDA increasing 1.8% to $623.6 million.

- In Q4 2025, net sales were $832.8 million, a 3.4% reported increase, though organic sales decreased 2.2%. Adjusted EPS was $1.05, down from $1.22 in the prior year, and Adjusted EBITDA was $171.2 million, down from $187.3 million in the prior year.

- The company returned $177 million to shareholders in FY 2025, including $87 million in dividends and $90 million for share repurchases of 4 million shares.

- Project Momentum generated $206 million in savings and contributed to $741 million in cumulative Free Cash Flow over the FY'23-FY'25 period, alongside $254 million in debt paydown.

- Energizer reported fiscal year 2025 net sales growth of 2.3% to nearly $3 billion and adjusted earnings per share increased 6% to $3.52.

- The company returned $177 million to shareholders in fiscal 2025 through dividends and share repurchases, reducing outstanding shares by roughly 5%.

- Management expects Q1 2026 to be transitional due to challenging sales comparisons, tariff-related costs, and moderating consumer sentiment, but anticipates double-digit adjusted EPS growth for Q2-Q4 2026.

- Project Momentum has achieved over $200 million in savings to date and has been extended for a fourth year, with an additional $15 million-$20 million per year in benefits expected from domestic production credits in 2026.

- Energizer's first priority for capital allocation in 2026 is to pay down debt, with an expectation to reduce debt by $150-$200 million.

- Energizer reported net sales growth of 2.3% to nearly $3 billion and an increase in adjusted earnings per share of 6% to $3.52 for fiscal year 2025.

- The company expects a transitional first quarter in fiscal 2026 due to challenging comparisons and tariff-related costs, but anticipates double-digit adjusted earnings per share growth over the subsequent three quarters.

- Project Momentum has achieved over $200 million in savings to date, and the company expects an additional $15 million-$20 million annually from domestic production credits starting in fiscal 2026.

- Energizer plans to prioritize debt reduction, aiming to pay down $150-$200 million of debt in fiscal 2026, and saw its e-commerce business grow 25% in fiscal 2025, with 15% growth expected in fiscal 2026.

Fintool News

In-depth analysis and coverage of ENERGIZER HOLDINGS.

Quarterly earnings call transcripts for ENERGIZER HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more