Earnings summaries and quarterly performance for Equitable Holdings.

Executive leadership at Equitable Holdings.

Mark Pearson

President and Chief Executive Officer

Jeffrey Hurd

Chief Operating Officer

José González

Chief Legal Officer and Secretary

Nick Lane

President, Equitable

Robin Raju

Chief Financial Officer

Seth Bernstein

President and Chief Executive Officer, AllianceBernstein

Board of directors at Equitable Holdings.

Arlene Isaacs-Lowe

Director

Bertram Scott

Director

Charles Stonehill

Director

Craig MacKay

Director

Daniel Kaye

Director

Douglas Dachille

Director

Francis Hondal

Director

George Stansfield

Director

Joan Lamm-Tennant

Chair of the Board

Research analysts who have asked questions during Equitable Holdings earnings calls.

Suneet Kamath

Jefferies

6 questions for EQH

Michael Ward

Citi Research

5 questions for EQH

Alex Scott

Barclays PLC

4 questions for EQH

Joel Hurwitz

Dowling & Partners Securities, LLC

4 questions for EQH

Ryan Krueger

KBW

4 questions for EQH

Thomas Gallagher

Evercore

4 questions for EQH

Jimmy Bhullar

JPMorgan Chase & Co.

3 questions for EQH

Mark Hughes

Truist Securities

3 questions for EQH

Elyse Greenspan

Wells Fargo

2 questions for EQH

Francis Matten

BMO Capital Markets

2 questions for EQH

Jamminder Bhullar

JPMorgan Chase & Co.

2 questions for EQH

Tom Gallagher

Evercore ISI

2 questions for EQH

Wes Carmichael

Wells Fargo

2 questions for EQH

Wilma Jackson Burdis

Raymond James

2 questions for EQH

Yaron Kinar

Oppenheimer & Co. Inc.

2 questions for EQH

Cave Montazeri

Deutsche Bank

1 question for EQH

Jack Matten

BMO Capital Markets

1 question for EQH

Maxwell Fritscher

Truist Financial Corporation

1 question for EQH

Mick Anita

Wells Fargo

1 question for EQH

Nicholas Annitto

Wells Fargo & Company

1 question for EQH

Wilma Burdis

Raymond James Financial

1 question for EQH

Recent press releases and 8-K filings for EQH.

- Equitable Holdings' Board of Directors has approved an additional $1 billion share repurchase authorization.

- The company declared a quarterly cash dividend of $0.27 per share of common stock, payable on March 11, 2026, to shareholders of record on March 4, 2026.

- Quarterly dividends were also declared for Series A 5.25% Non-Cumulative Perpetual Preferred Stock ($0.328125 per depositary share) and Series C 4.30% Non-Cumulative Perpetual Preferred Stock ($0.26875 per depositary share), both payable on March 15, 2026.

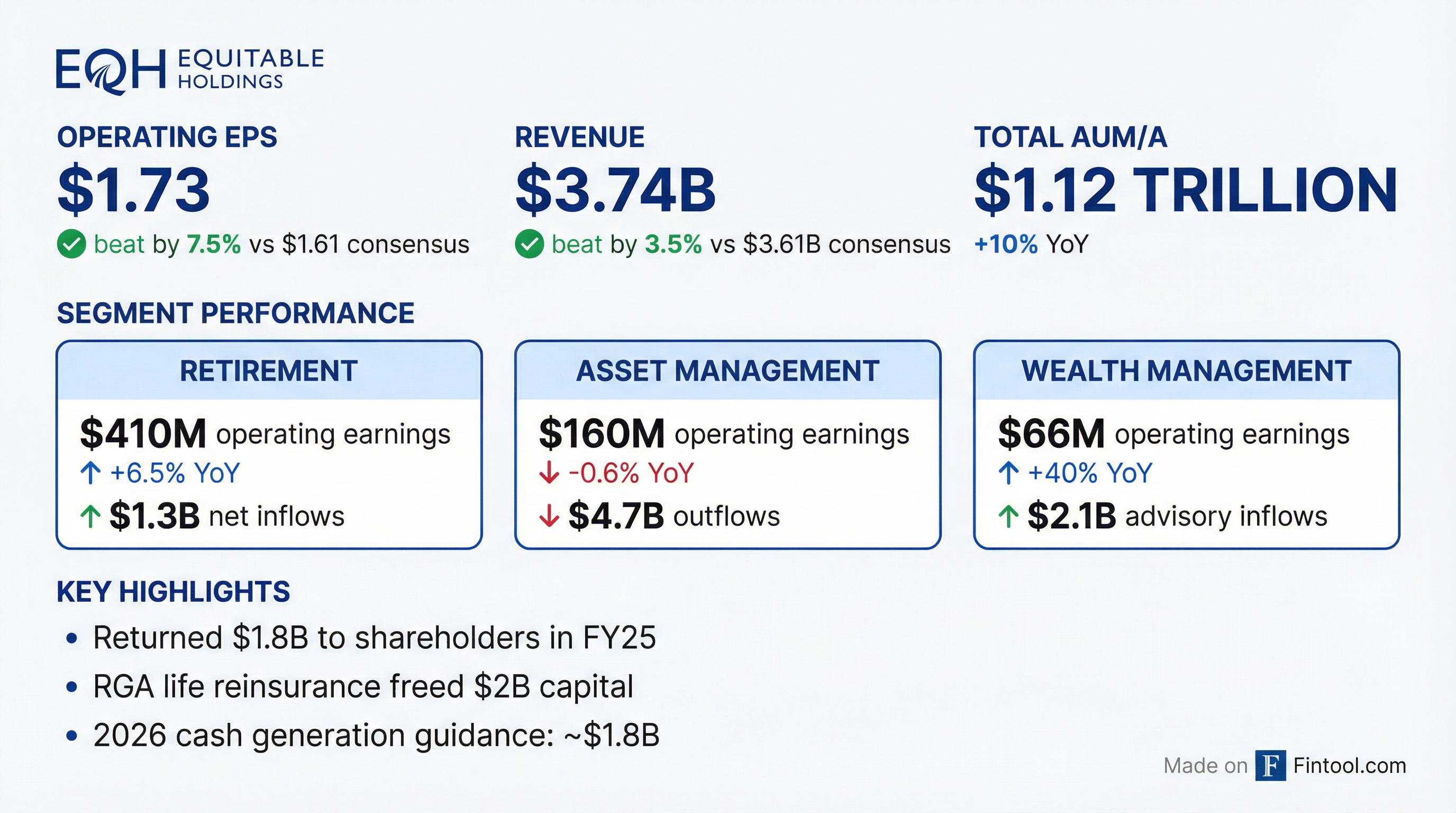

- Equitable Holdings reported full-year 2025 non-GAAP operating earnings of $6.21 per share (adjusted for notable items) and anticipates EPS growth to exceed its 12%-15% target in 2026.

- The company generated $1.6 billion in organic cash in 2025, with a forecast of approximately $1.8 billion in 2026, and ended the year with record assets under management and administration of $1.1 trillion.

- In 2025, $1.8 billion was returned to shareholders, including $500 million of additional share repurchases funded by a life reinsurance transaction with RGA, which reduced mortality exposure by 75% and freed $2 billion of capital.

- The Wealth Management segment achieved its $200 million annual earnings target two years early and is expected to maintain double-digit annual earnings growth.

- Equitable Holdings reported full year 2025 Non-GAAP operating earnings per share of $5.64, or $6.21 per share after adjusting for notable items, and generated $1.6 billion in organic cash.

- For Q4 2025, Non-GAAP operating EPS was $1.73, or $1.76 per share adjusted for notable items.

- The company projects approximately $1.8 billion in cash generation for 2026, an increase of over 10% year-over-year, and anticipates 2026 EPS growth above its 12-15% target.

- EQH returned $1.8 billion of capital to shareholders in 2025 and achieved a record $1.1 trillion in Assets Under Management/Administration (AUM/A), up 10% from year-end 2024.

- Equitable Holdings reported full-year 2025 non-GAAP operating earnings of $6.21 per share (adjusted for notable items) and Q4 2025 non-GAAP operating earnings of $1.73 per share.

- The company achieved $1.6 billion in organic cash generation for 2025, with projections to reach $1.8 billion in 2026 and $2 billion in 2027.

- Assets under management and administration grew 10% year-over-year to a record $1.1 trillion by the end of 2025.

- $1.8 billion was returned to shareholders in 2025, including $500 million in additional share repurchases which reduced shares outstanding by 9%.

- Following a life reinsurance transaction with RGA that freed $2 billion of capital and reduced mortality exposure by 75%, the company expects 2026 EPS growth to exceed its 12%-15% target.

- Equitable Holdings reported full-year 2025 non-GAAP operating earnings of $6.21 per share (adjusted for notable items), an increase of 1% over 2024, with 2026 EPS growth expected to exceed the 12%-15% target.

- The company generated $1.6 billion in organic cash in 2025, consistent with guidance, and projects this to increase to approximately $1.8 billion in 2026 and $2 billion by 2027.

- Assets under management and administration reached a record $1.1 trillion at the end of 2025, marking a 10% year-over-year increase, and the life reinsurance transaction with RGA in 2025 freed $2 billion of capital while reducing mortality exposure by 75%.

- In 2025, Wealth Management achieved $8.4 billion in full-year net inflows, representing a 13% organic growth rate, while AllianceBernstein experienced overall net outflows of $11.3 billion, which included $4 billion related to the RGA transaction.

- Equitable Holdings reported a full year 2025 net loss of $1.4 billion, or $(4.83) per share, but a fourth quarter 2025 net income of $215 million, or $0.70 per share.

- Non-GAAP operating earnings for full year 2025 were $1.7 billion, or $5.64 per share, and for the fourth quarter 2025 were $513 million, or $1.73 per share.

- The company generated $1.6 billion in organic cash in 2025, with an expectation to increase to approximately $1.8 billion in 2026.

- Equitable Holdings returned $1.8 billion to shareholders in 2025 and executed strategic initiatives including reinsuring 75% of its individual life block, which freed $2 billion of capital.

- Total assets under management and administration (AUM/A) reached a record $1.1 trillion as of December 31, 2025, a 10% year-over-year increase.

- Equitable Holdings reported a full year 2025 net loss of $1.4 billion, or $(4.83) per share, and Non-GAAP operating earnings of $1.7 billion, or $5.64 per share. For the fourth quarter 2025, net income was $215 million, or $0.70 per share, with Non-GAAP operating earnings of $513 million, or $1.73 per share.

- The company returned $1.8 billion to shareholders in 2025 and generated $1.6 billion in organic cash, which is projected to increase to c.$1.8 billion in 2026.

- Total Assets Under Management/Administration (AUM/A) reached a record $1.1 trillion as of December 31, 2025, marking a 10% year-over-year increase. This growth was supported by strategic initiatives, including the reinsurance of 75% of its individual life block, which freed over $2 billion of capital.

- Equitable Holdings reported non-GAAP operating earnings per share of $1.67 for Q3 2025, an increase of 2% year-over-year, with total assets under management and administration rising 7% year-over-year to $1.1 trillion.

- The company saw strong performance in its Asset Management and Wealth Management segments, with Asset Management earnings up 39% year-over-year and AUM reaching a record $860 billion, while Wealth Management earnings increased 12% year-over-year with $6.2 billion in year-to-date advisory net inflows.

- Equitable Holdings returned $757 million to shareholders in Q3 2025, including $676 million in share repurchases, and has reduced its share count by approximately 8% over the past four quarters.

- The company reaffirmed its 12%-15% EPS CAGR target and $2 billion annual cash generation target for 2027, and announced the acquisition of Stifel Independent Advisors, expected to add $10 million to Wealth Management earnings in 2027.

- EQH reported Non-GAAP operating earnings per share of $1.67 (adjusted for notable items) for Q3 2025, an increase of 2% year-over-year, and achieved record Assets Under Management/Administration (AUM/A) of $1.1 trillion, up 7% from the prior year quarter.

- The company demonstrated healthy organic growth momentum, with Retirement net inflows of $1.1 billion (3% annualized organic growth rate) and Wealth Management advisory net inflows of $2.2 billion (12% annualized organic growth rate) in the quarter.

- EQH deployed $1.5 billion in capital during Q3 2025, including $757 million returned to shareholders (comprising $676 million in share repurchases) and a $500 million reduction in debt.

- Strategic initiatives included the announced acquisition of Stifel Independent Advisors, which has over 110 advisors and approximately $9 billion of AUM, and an allocation of $100 million to support AB's investment in FCA Re.

- Equitable Holdings reported non-GAAP operating earnings of $455 million, or $1.48 per share, for Q3 2025, with adjusted non-GAAP operating EPS at $1.67, reflecting a 2% increase year-over-year.

- The company allocated $1.5 billion of capital, including returning $757 million to shareholders (with $676 million in share repurchases) and reducing outstanding debt by $500 million.

- Assets under management reached a record $1.1 trillion, up 4% sequentially, driven by $1.1 billion in retirement net flows and $2.2 billion in wealth management advisory net inflows.

- Strategic investments included the acquisition of Stifel Independent Advisors, which has over 110 advisors and $9 billion of advisory assets, and a $100 million allocation to support AB's investment in FCA REIT.

- Wealth management earnings are on track to reach $200 million in 2025, two years ahead of plan, and are expected to continue growing at a double-digit rate.

Quarterly earnings call transcripts for Equitable Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more