Earnings summaries and quarterly performance for eToro Group.

Research analysts who have asked questions during eToro Group earnings calls.

Brett Knoblauch

Cantor Fitzgerald & Co.

4 questions for ETOR

Craig Siegenthaler

Bank of America

4 questions for ETOR

Dan Dolev

Mizuho Financial Group

4 questions for ETOR

Devin Ryan

Citizens JMP

4 questions for ETOR

James Yaro

Goldman Sachs

4 questions for ETOR

Joseph Vafi

Canaccord Genuity - Global Capital Markets

4 questions for ETOR

Dan Fannon

Jefferies & Company Inc.

3 questions for ETOR

Alex Kramm

UBS Group AG

2 questions for ETOR

Brian Bedell

Deutsche Bank

2 questions for ETOR

Brian Vieten

Needham & Company

2 questions for ETOR

Charles Bendit

Rothschild & Co Redburn

2 questions for ETOR

Christopher Allen

Citigroup

2 questions for ETOR

Ed Engel

Compass Point

2 questions for ETOR

John Todaro

Needham & Company

2 questions for ETOR

Matthew O'Neill

Financial Technology Partners

2 questions for ETOR

Robin Holby

TD Cowen

2 questions for ETOR

William Katz

TD Cowen

2 questions for ETOR

Daniel Fannon

Jefferies Financial Group Inc.

1 question for ETOR

Recent press releases and 8-K filings for ETOR.

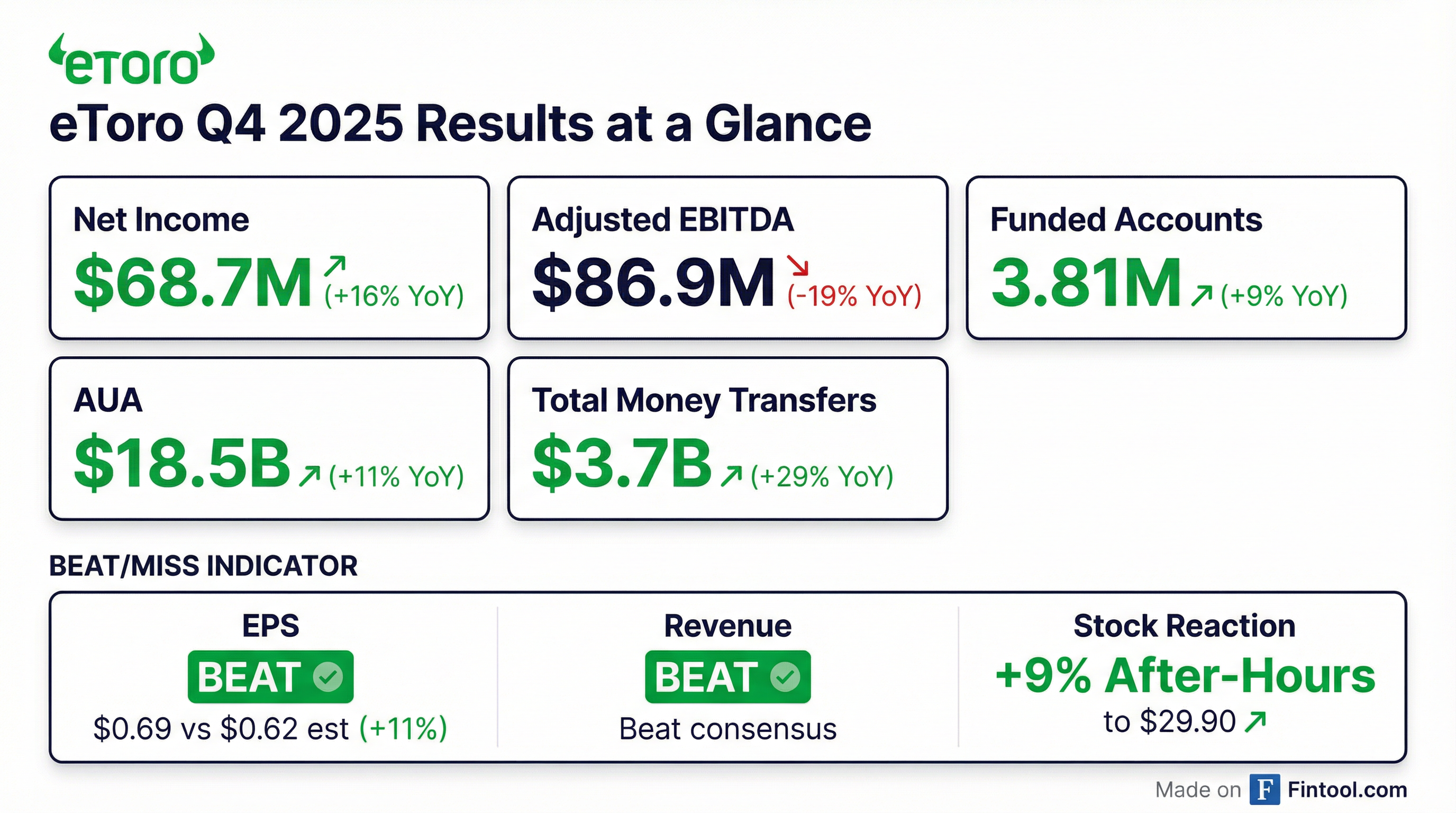

- eToro Group reported Q4 2025 net contribution of $227 million, a 6% sequential increase, and Adjusted EBITDA of $87 million, an 11% quarter-over-quarter improvement.

- Assets Under Administration (AUA) increased 11% year-over-year to $18.5 billion, and funded accounts grew 9% year-over-year to 3.81 million.

- The company plans to increase sales and marketing investment to 25% of Net Contribution in 2026 to accelerate growth and authorized an additional $100 million for its share repurchase program, bringing the total to $250 million.

- Strategic initiatives include becoming an AI-first company, expanding to over 100,000 tradable assets by the end of 2026, and launching Smart Portfolios and prediction markets in the U.S. in 2026.

- eToro reported strong Q4 2025 financial results, with net contribution increasing 6% sequentially to $227 million and adjusted EBITDA growing 11% quarter-over-quarter to $87 million, achieving a 38% adjusted EBITDA margin. For the full year 2025, net contribution increased 10% to $868 million and adjusted EBITDA grew 4% year-over-year to $317 million.

- Assets Under Administration (AUA) increased 11% year-over-year to $18.5 billion, and funded accounts grew 9% year-over-year to $3.81 million in Q4 2025.

- The company is an "AI-first" company, embedding AI across its business to accelerate product development and enhance operations. It plans to expand to 300+ crypto assets in the near term and 100,000 tradable assets across equities and crypto by the end of 2026.

- eToro plans to increase sales and marketing investment from 21% to gradually 25% of Net Contribution in 2026 to drive accelerated growth.

- An additional $100 million authorization was announced for its share repurchase program, bringing the total authorization to $250 million, with $100 million already deployed.

- eToro Group reported strong Q4 2025 financial results, with net contribution increasing 6% sequentially to $227 million and Adjusted EBITDA growing 11% quarter-over-quarter to $87 million, achieving a 38% adjusted EBITDA margin.

- The company is strategically focusing on AI adoption, aiming to become an "AI-first company" to accelerate product development and efficiency, with plans to launch an App Store featuring nearly 1,000 apps.

- Product expansion includes 24/5 trading across major US stocks, increasing supported crypto assets to over 150 (with plans for 300+), and targeting over 100,000 tradable assets by the end of 2026.

- For 2026, eToro anticipates double-digit account growth driven by an increased sales and marketing investment, scaling to 25% of Net Contribution, and expects to pursue several M&A deals in the crypto, U.S. brokerage, and wealth management sectors.

- eToro Group reported a 16% year-over-year increase in Net Income for Q4 2025 and a 12% increase for the full year 2025, reaching $69 million and $216 million, respectively. Adjusted EBITDA grew 4% year-over-year in 2025 to $317 million, despite a 19% decline in Q4 2025 compared to Q4 2024.

- Assets Under Administration (AUA) grew 11% year-over-year to $18.5 billion as of December 31, 2025. The company also saw a 7x increase in AUA in Q4 2025 compared to Q4 2024.

- The company expanded its product offerings, including a self-directed stocks & shares ISA and cash ISA in the U.K., superannuation in Australia, and retirement/life insurance products in France. Additionally, debit card transaction volume increased 6.5x in Q4 2025 compared to Q4 2024.

- Diluted GAAP EPS for Q4 2025 was $0.69 and $2.27 for the full year 2025.

- For the full year 2025, eToro reported a 10% year-over-year increase in Net Contribution to $868 million and a 12% increase in GAAP Net Income to $216 million.

- In the fourth quarter of 2025, Net Contribution decreased by 10% year-over-year to $227 million, while GAAP Net Income increased 16% year-over-year to $69 million.

- As of December 31, 2025, Assets Under Administration (AUA) grew by 11% year-over-year to $18.5 billion, and Funded Accounts increased 9% year-over-year to 3.81 million.

- eToro's Board of Directors approved a $100 million increase to its existing share repurchase program, resulting in a total remaining authorization of $150 million.

- The company expanded access to global markets, grew its crypto offering to over 150 cryptoassets, and saw AuA in UK ISA products grow by 7x from Q4 2024 to Q4 2025.

- eToro reported strong Q3 2025 financial results, with net contribution up 28% year over year to $215 million and adjusted EBITDA rising 43% to $78 million, achieving a 36% operating margin. Key performance indicators also showed significant growth, with funded accounts increasing 16% year over year to 3.73 million and assets under administration reaching an all-time high of $20.8 billion, up 76% year over year.

- The company announced a $150 million share repurchase program, underscoring confidence in its long-term growth prospects and commitment to delivering shareholder value.

- Strategic initiatives include the launch of copy trading in the U.S., expansion of crypto offerings and staking in the U.S., and plans to increase access to over 30 exchanges worldwide by 2026. Net trading contribution from crypto grew 229% year over year to $56 million, while net trading contribution from capital markets declined 21% to $73 million.

- eToro reported strong financial performance in Q3 2025, with net contribution increasing 28% year over year to $215 million and adjusted EBITDA rising 43% year over year to $78 million, resulting in an adjusted EBITDA margin of 36%.

- Key performance indicators also showed significant growth, with funded accounts growing 16% year over year to 3.73 million and assets under administration reaching a record $20.8 billion, up 76% year over year.

- The company launched Copy Trading in the US and introduced AI-driven eToro apps for investment tools, while also expanding its global market access to 22 different exchanges worldwide.

- eToro announced a $150 million share repurchase program and is actively exploring M&A opportunities for inorganic growth, supported by a strong balance sheet with $1.2 billion in cash and short-term investments.

- eToro Group Ltd. reported strong Third Quarter 2025 financial results, with Net Contribution growing 28% year-over-year to $215 million and Adjusted EBITDA increasing 43% year-over-year to $78 million.

- GAAP Net Income for Q3 2025 rose 48% year-over-year to $57 million, and Adjusted Diluted EPS (non-GAAP) was $0.60.

- The company's Assets Under Administration (AUA) surged 76% year-over-year to $20.8 billion as of September 30, 2025, while funded accounts increased 16% year-over-year to 3.73 million.

- eToro's Board of Directors authorized a $150 million share repurchase program, including an intent to enter into an Accelerated Share Repurchase (ASR) agreement for approximately $50 million.

Quarterly earnings call transcripts for eToro Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more