Earnings summaries and quarterly performance for EXPAND ENERGY.

Executive leadership at EXPAND ENERGY.

Nick Dell’Osso

President and Chief Executive Officer

Brittany Raiford

Vice President, Interim Chief Financial Officer and Treasurer

Chris Lacy

Executive Vice President, General Counsel and Corporate Secretary

Joshua Viets

Executive Vice President, Chief Operations Officer

Board of directors at EXPAND ENERGY.

Benjamin Duster IV

Director

Brian Steck

Director

Catherine Kehr

Director

Chip Johnson

Director

John Gass

Director

Matthew Gallagher

Lead Independent Director

Michael Wichterich

Chairman of the Board

Sarah Emerson

Director

Shameek Konar

Director

Timothy Duncan

Director

Research analysts who have asked questions during EXPAND ENERGY earnings calls.

John Freeman

Raymond James Financial

6 questions for EXE

Kevin MacCurdy

Pickering Energy Partners

6 questions for EXE

Neil Mehta

Goldman Sachs

6 questions for EXE

Scott Hanold

RBC Capital Markets

6 questions for EXE

Zach Parham

JPMorgan Chase & Co.

6 questions for EXE

Doug Leggate

Wolfe Research

5 questions for EXE

Josh Silverstein

UBS Group

5 questions for EXE

Betty Jiang

Barclays

3 questions for EXE

Charles Meade

Johnson Rice & Company L.L.C.

3 questions for EXE

Devin Mcdermott

Morgan Stanley

3 questions for EXE

Matthew Portillo

Tudor, Pickering, Holt & Co.

3 questions for EXE

Paul Diamond

Citigroup

3 questions for EXE

Phillips Johnston

Capital One Securities, Inc.

3 questions for EXE

John Annis

Texas Capital Bank

2 questions for EXE

Kalei Akamine

Bank of America

2 questions for EXE

Leo Mariani

ROTH MKM

2 questions for EXE

Neal Dingmann

Truist Securities

2 questions for EXE

Phillip Jungwirth

BMO Capital Markets

2 questions for EXE

David Deckelbaum

TD Cowen

1 question for EXE

Douglas Leggate

Wolfe Research

1 question for EXE

John Ennis

Texas Capital

1 question for EXE

Recent press releases and 8-K filings for EXE.

- Extendicare reported strong financial results for Q4 and full year 2025, with Adjusted EBITDA (excluding out-of-period items) increasing by 36.4% to $45.6 million in Q4 2025 and 24.3% to $160.6 million for the full year 2025.

- The company announced a 5% increase to its monthly dividend to 4.41 cents per common share, effective with the dividend to be declared in March 2026.

- Extendicare entered into a definitive agreement to acquire CBI Home Health for $570.0 million, anticipated to close in early Q2 2026, and expects the acquisition to be 20% accretive to fully diluted AFFO per share.

- The CBI Home Health acquisition is being partially funded by $191.5 million net proceeds from a private placement of common shares in December 2025 and a $214.5 million upsizing of its senior secured credit facility.

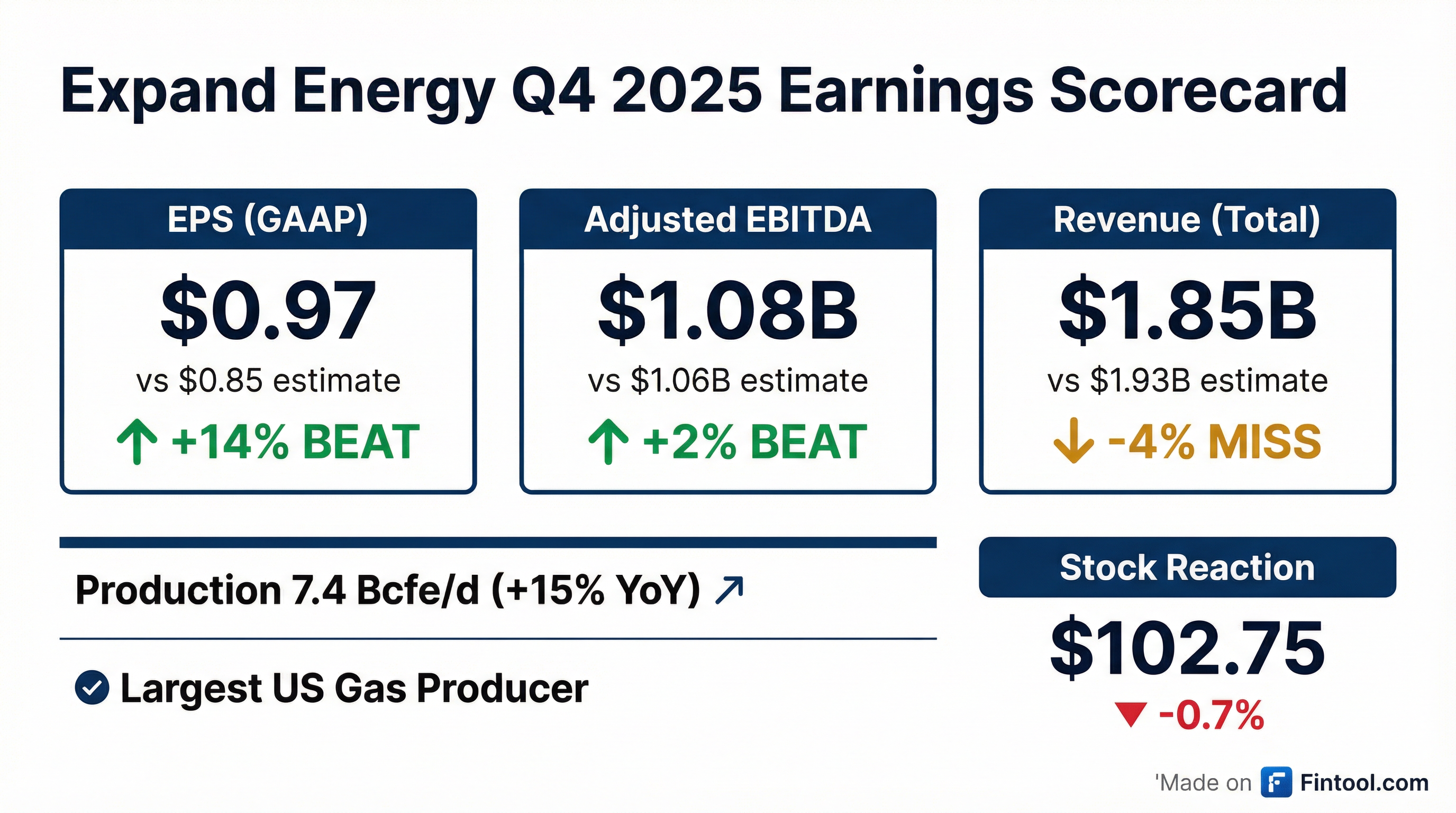

- EXPAND ENERGY reported Adjusted EBITDAX of $1,425 million for Q4 2025 and $5,078 million for FY 2025, with Net Income of $553 million for Q4 2025 and $1,819 million for FY 2025.

- The company returned ~$865 million to shareholders in 2025 and announced an annual base dividend of $2.30 per share for 2026, with a $0.575 per share payment for Q4 2025.

- For 2026, EXPAND ENERGY projects total production of 7,400-7,600 MMcfe/d and total capital expenditures of $2,750-$2,950 million.

- The company achieved ~$1.2 billion in gross debt reduction since the merger close and anticipates at least $1 billion in net debt reduction in 2026.

- Operational improvements led to a ~15% improvement in Haynesville breakeven to less than $2.75.

- Expand Energy achieved a 15% reduction in breakevens in the Haynesville in 2025 and reported $200 million in hedging gains for the year.

- The company is undergoing a CEO search, with Mike Wichterich serving as interim CEO, and expects the search to take 6 to 9 months.

- A key strategic focus for 2026 is enhancing its marketing business, aiming for $0.20 improved realizations across its business, which is projected to add approximately $500 million in EBITDA.

- For 2026, the company plans to continue reducing debt and considering shareholder returns, while also reducing maintenance capital.

- Expand Energy discussed its 2025 Fourth Quarter and Full Year Financial and Operating Results.

- The company is actively searching for a new CEO, with Mike Wichterich serving as Interim President and CEO, and the search is anticipated to take six to nine months.

- A key strategic focus is to increase realizations by $0.20, which is projected to generate an additional $500 million in EBITDA through premium markets, storage, and value chain participation.

- Expand Energy expects to average 7.5 Bcf per day in production for the full year with $2.85 billion in CapEx. The company also expanded its storage capacity by 3.5 Bcf in Q4 2025, reaching a total of 5 Bcf.

- EXPAND ENERGY (EXE) achieved a 15% reduction in breakevens in the Haynesville and $200 million in hedging gains for 2025, while also reducing debt and returning capital to shareholders.

- The company is undergoing a strategic shift to enhance its marketing capabilities, moving to Houston to capture new demand and aiming for a $0.20 improvement in realizations across its business, which is projected to add approximately $500 million in EBITDA.

- Operational improvements in the Haynesville, including advanced completion designs and D&C cost reductions, are expected to drive sustainable higher productivity.

- A search for a new CEO is underway, anticipated to last six to nine months, to lead the company's broader energy vision.

- EXPAND ENERGY prioritizes balance sheet strength through debt reduction and maintains a disciplined approach to M&A, having completed over $15 billion in transactions in the past five years.

- Expand Energy Corporation reported net income of $553 million or $2.30 per fully diluted share for Q4 2025, and $1,819 million or $7.57 per fully diluted share for the full-year 2025. Adjusted EBITDAX was $1,425 million for Q4 2025 and $5,078 million for the full year.

- The company's net production in Q4 2025 was approximately 7.40 Bcfe/d (92% natural gas), representing a 15% increase compared to Q4 2024. Full-year 2025 net production was approximately 7.18 Bcfe/d.

- In 2025, Expand Energy reduced gross debt by approximately $660 million and returned $865 million to shareholders through quarterly base dividends, variable dividends, and share repurchases.

- For 2026, Expand Energy expects to produce approximately 7.5 Bcfe/d with ~$2.85 billion of capital. The company plans to prioritize further debt reduction of at least $1 billion and will pay a quarterly base dividend of $0.575 per common share in March 2026.

- Expand Energy Corporation (EXE) plans to relocate its corporate headquarters from Oklahoma City, Oklahoma, to Houston, Texas, by mid-2026 to strengthen industry relationships and accelerate its strategy.

- Michael Wichterich has been appointed Interim President and Chief Executive Officer, effective immediately, succeeding Domenic (Nick) J. Dell’Osso, Jr., who has stepped down from the Board.

- As Interim President and CEO, Mr. Wichterich will receive a monthly base salary of $125,000 and an annual long-term incentive award with an aggregate grant date fair value of $3,600,000.

- The company reaffirmed its synergy, capital, and operating outlook for the fourth quarter and full year 2025.

- Expand Energy (EXE) maintains a constructive outlook on natural gas macro, anticipating volatility but also opportunities, with mid-cycle price expectations of $3.50-$4 for 2026 and 2027.

- The company was surprised by the significant U.S. natural gas production growth in 2025, particularly from Haynesville, and questions its sustainability at current price levels, noting the marginal break-even for growth is above $3.50.

- EXE employs a "Hedge-to-Wedge" strategy, hedging for an eight-quarter period using collars and swaps to protect capital and reduce cash flow volatility.

- Expand Energy's capital allocation is stable between Marcellus and Haynesville, with a focus on optimizing cash flow at mid-cycle prices and developing the Western Haynesville as a new, high-cost but strategically advantageous area.

- The company believes the traditional Haynesville can only grow a few more Bcf/d, and future demand growth will necessitate activating higher-cost assets, potentially requiring $4-$4.50 to incentivize supply.

- Expand Energy (EXE) maintains a constructive outlook on the natural gas macro for 2026 and 2027, anticipating volatility with opportunities and positioning its portfolio with low-cost assets and strong inventory.

- The company employs a "Hedge-to-wedge" strategy, hedging eight quarters forward to manage near-term price risk and protect capital, particularly when the forward curve exceeds its mid-cycle price expectation of $3.50-$4.

- Expand's capital allocation is stable between the Marcellus and Haynesville, aiming for 7.5 Bcf/day total production optimized for $3.50-$4 mid-cycle prices. The company is also developing the Western Haynesville, having acquired inventory at under $1 million per location.

- While U.S. natural gas production, led by Haynesville, saw significant growth in the past year, the sustainability of this growth at current price levels is questioned, with the marginal break-even for growth estimated above $3.50.

- Expand believes the traditional Haynesville core can add a few more Bcf/day, but significant future supply growth to meet demand will require activating higher-cost assets, potentially needing $4-$4.50.

- Expand Energy's CEO, Nick Dell'Osso, maintains a constructive macro outlook for natural gas, expecting volatility but with opportunities, and notes the 2026 and 2027 forward strip aligns with their mid-cycle price expectations of $3.50-$4.

- The company utilizes a "Hedge-to-wedge" strategy, hedging for an eight-quarter period with collars and swaps to protect capital and manage near-term price risk, aiming to reduce cash flow volatility.

- Expand Energy's capital allocation between Marcellus and Haynesville is stable, designed to optimize cash flow at $3.50-$4 mid-cycle prices.

- The company is developing the Western Haynesville, having acquired acreage at a cost well under $1 million per location, significantly below other Haynesville transactions, and plans to leverage its experience to be a cost leader in this high-cost area.

- Dell'Osso believes the traditional Haynesville cannot fully meet the projected 18 Bcf/d of additional U.S. gas demand over the next few years, suggesting that $4-$4.50 prices will be necessary to activate higher-cost assets to meet this demand.

Fintool News

In-depth analysis and coverage of EXPAND ENERGY.

Quarterly earnings call transcripts for EXPAND ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more