Earnings summaries and quarterly performance for FIRST FINANCIAL BANCORP /OH/.

Executive leadership at FIRST FINANCIAL BANCORP /OH/.

Archie Brown

President and Chief Executive Officer

Amanda Neeley

Chief Consumer Banking and Strategy Officer

James Anderson

Chief Financial Officer and Chief Operating Officer

Karen Woods

General Counsel and Chief Administrative Officer

Richard Dennen

Chief Corporate Banking Officer

Board of directors at FIRST FINANCIAL BANCORP /OH/.

Andre Porter

Director

Anne Arvia

Director

Claude Davis

Chair of the Board

Dawn Morris

Director

Gary Warzala

Director

Maribeth Rahe

Director

Thomas O’Brien

Director

Vincent Berta

Lead Independent Director

William Kramer

Director

Research analysts who have asked questions during FIRST FINANCIAL BANCORP /OH/ earnings calls.

Daniel Tamayo

Raymond James Financial, Inc.

8 questions for FFBC

Brendan Nosal

Hovde Group, LLC

4 questions for FFBC

David Konrad

Keefe, Bruyette & Woods (KBW)

3 questions for FFBC

Jon Arfstrom

RBC Capital Markets

3 questions for FFBC

Terence McEvoy

Stephens Inc.

3 questions for FFBC

Terry McEvoy

Stephens Inc.

3 questions for FFBC

Andrew Steven Leischner

Keefe, Bruyette & Woods

2 questions for FFBC

Brian Foran

Truist Financial

2 questions for FFBC

Karl Shepard

RBC Capital Markets

2 questions for FFBC

Mark Shutley

Keefe, Bruyette & Woods

2 questions for FFBC

Terry McEvoy

Stephens

2 questions for FFBC

Christopher McGratty

Keefe, Bruyette & Woods

1 question for FFBC

Recent press releases and 8-K filings for FFBC.

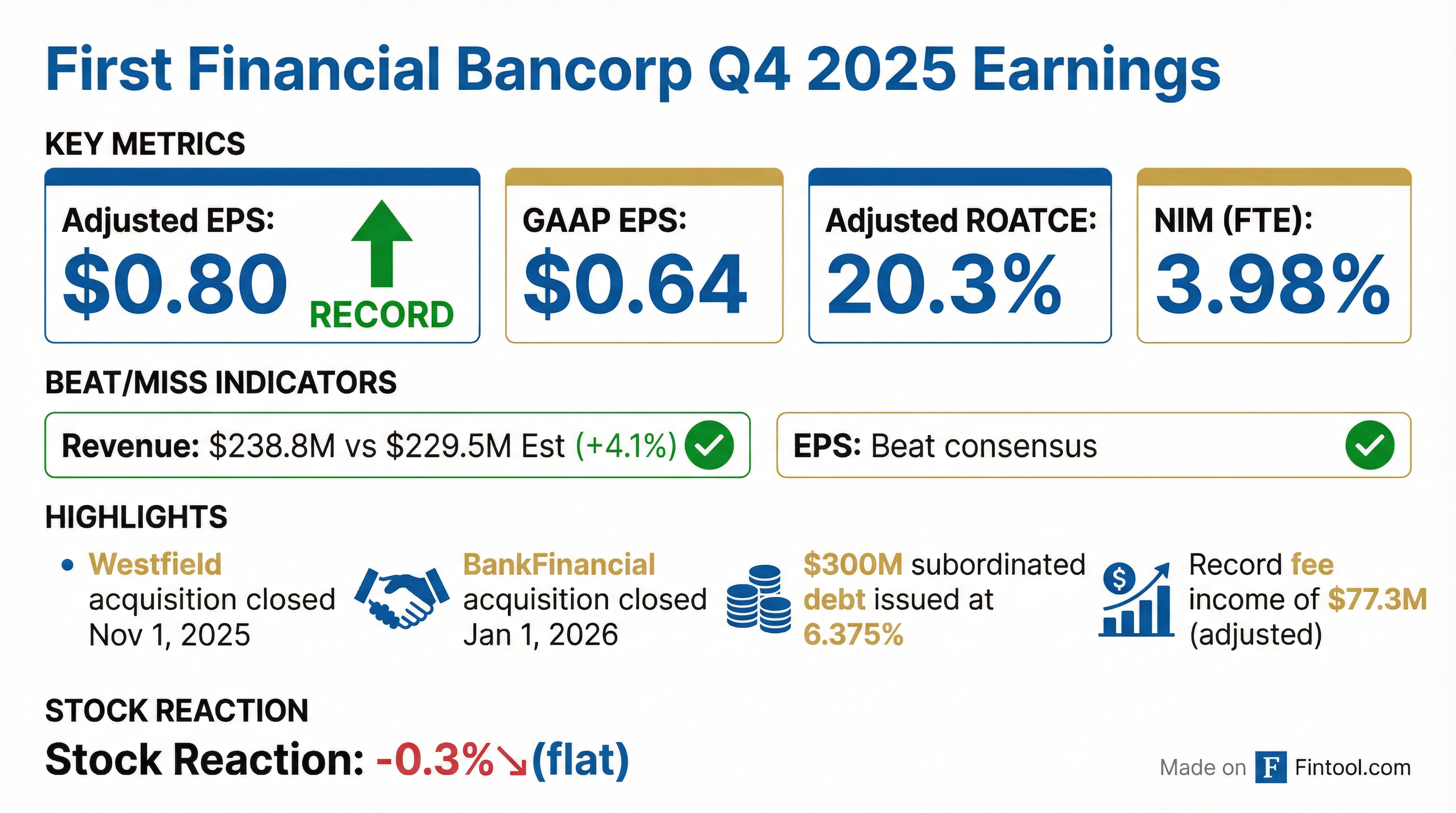

- First Financial Bancorp reported adjusted diluted EPS of $0.80 and an adjusted return on average assets of 1.52% for Q4 2025.

- As of December 31, 2025, total assets increased to $21.1 billion and loans to $13.4 billion, with significant growth attributed to the Westfield acquisition.

- The company's net interest income was $174.0 million with a net interest margin (FTE) of 3.98% in Q4 2025.

- First Financial Bancorp's Tier 1 common equity ratio was 11.32% as of December 31, 2025, and it issued $300 million of 6.375% subordinated debt during the quarter.

- The company completed the Westfield Bancorp acquisition and announced the acquisition of BankFinancial, which closed on January 1, 2026.

- First Financial Bancorp (FFBC) reported record adjusted earnings per share of $0.80 for Q4 2025 and $2.92 for the full year 2025, with an adjusted return on assets of 1.52% and 1.49% respectively.

- In Q4 2025, the company achieved 4% annualized organic loan growth and 7% annualized organic deposit growth (excluding the Westfield acquisition), while the net interest margin remained strong at 3.98%.

- Adjusted non-interest income reached a record $77 million in Q4 2025, contributing to record total revenue of almost $922 million for the full year 2025, an 8% increase over 2024.

- For Q1 2026, FFBC anticipates low single-digit annualized organic loan growth, with full-year 2026 organic loan growth projected at 6%-8%.

- The net interest margin for Q1 2026 is expected to be between 3.94% and 3.99%, and adjusted non-interest expense is projected at $156-$158 million, reflecting the impact of the Westfield and BankFinancial acquisitions.

- First Financial Bancorp (FFBC) reported record adjusted earnings per share of $0.80 for Q4 2025 and $2.92 for the full year 2025, with adjusted return on assets of 1.52% and 1.49%, respectively.

- The company achieved 4% annualized organic loan growth and 7% annualized organic deposit growth in Q4 2025, excluding acquisition impacts, and recorded total adjusted fee income of $77 million.

- The net interest margin (NIM) was 3.98% in Q4 2025 and is projected to be between 3.94% and 3.99% for Q1 2026.

- For Q1 2026, FFBC expects low single-digit organic loan growth on an annualized basis, fee income between $71-$73 million, and non-interest expense between $156-$158 million, with cost savings from acquisitions materializing later in 2026.

- First Financial Bancorp reported record adjusted earnings per share of $0.80 for Q4 2025, with an adjusted return on assets of 1.52% and an adjusted return on tangible common equity of 20.3%. For the full year 2025, adjusted net income was $281 million or $2.92 per share, with record revenue of almost $922 million.

- In Q4 2025, loan balances increased $1.7 billion, including $1.6 billion from the Westfield acquisition, contributing to 4% annualized organic loan growth. Total average deposit balances increased $1.4 billion, with $1.2 billion from Westfield.

- The company provided Q1 2026 guidance, expecting net interest margin between 3.94% and 3.99%, fee income between $71-$73 million, and non-interest expenses between $156-$158 million. Full-year 2026 organic loan growth is projected to be in the 6%-8% range.

- Asset quality remained relatively stable, with non-performing assets at 0.48% of assets and net charge-offs at 27 basis points for Q4 2025.

- First Financial Bancorp announced record fourth quarter and full year 2025 financial results, with adjusted earnings per diluted share of $0.80 and record adjusted revenue of $251.3 million for Q4 2025.

- The company completed the Westfield acquisition on November 1, 2025, and obtained regulatory approval for the BankFinancial acquisition, which closed on January 1, 2026.

- During the fourth quarter of 2025, First Financial Bancorp issued $300 million of 6.375% subordinated debt.

- The Board of Directors approved a quarterly dividend of $0.25 per common share.

- First Financial Bancorp. reported record adjusted revenue of $251.3 million and adjusted noninterest income of $77.3 million for the fourth quarter of 2025.

- For the full year 2025, the company achieved record adjusted revenue of $921.8 million, an 8% increase over 2024, and adjusted net income of $281.1 million, or $2.92 per share.

- Diluted earnings per share for Q4 2025 were $0.64, or $0.80 on an adjusted basis, and $2.66 for the full year 2025.

- The company completed the Westfield acquisition on November 1, 2025, and received regulatory approval for the BankFinancial acquisition, which closed on January 1, 2026.

- The Board of Directors approved a quarterly dividend of $0.25 per common share, payable on March 16, 2026.

- First Financial Bancorp. completed its all-stock acquisition of Chicago-based BankFinancial Corporation on January 1, 2026.

- This acquisition expands First Financial's presence in the Chicago market and increases its total assets to $22 billion.

- BankFinancial locations will continue to operate under their current name until the anticipated conversion process completion in June 2026.

- Each share of BankFinancial common stock was converted into the right to receive 0.480 of a share of common stock of First Financial Bancorp.

- First Financial Bancorp. (FFBC) announced the closing of its all-stock acquisition of Chicago-based BankFinancial Corporation on January 1, 2026.

- This acquisition expands First Financial's presence in the Chicago market, adding 18 financial centers and a strong core deposit franchise.

- Following the completion of this acquisition, First Financial will now have $22 billion in assets.

- The conversion process, which will consolidate the two banks' products and operating systems, is anticipated to be completed in June 2026.

- This acquisition continues First Financial's recent growth in the Midwest, including the acquisition of Westfield Bank in November 2025.

- First Financial Bancorp. has secured regulatory approval from the Federal Reserve and the Ohio Department of Financial Institutions for its acquisition of BankFinancial Corporation.

- The closing of the all-stock transaction, valued at approximately $142 million as of August 2025, is anticipated to occur on or around January 1, 2026.

- As of September 30, 2025, First Financial Bancorp. reported $18.6 billion in assets.

- First Financial Bancorp. (FFBC) has secured regulatory approval from the Federal Reserve and the Ohio Department of Financial Institutions for its acquisition of Chicago-based BankFinancial Corporation.

- The acquisition, an all-stock transaction valued at approximately $142 million as of August 2025, is anticipated to close on or around January 1, 2026.

Quarterly earnings call transcripts for FIRST FINANCIAL BANCORP /OH/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more