Earnings summaries and quarterly performance for FuboTV.

Executive leadership at FuboTV.

Board of directors at FuboTV.

Research analysts who have asked questions during FuboTV earnings calls.

David Joyce

Seaport Research Partners

4 questions for FUBO

Laura Martin

Needham & Company, LLC

4 questions for FUBO

Patrick Sholl

Barrington Research

4 questions for FUBO

Alicia Reese

Wedbush Securities

3 questions for FUBO

Clark Lampen

BTIG, LLC

3 questions for FUBO

Doug Arthur

Huber Research

2 questions for FUBO

Douglas Arthur

Huber Research Partners

2 questions for FUBO

Laura Martin

Needham & Company

2 questions for FUBO

Brent Penter

Raymond James Financial

1 question for FUBO

Brent Pinter

Raymond James

1 question for FUBO

Clark Lampin

BTIG

1 question for FUBO

Darren Aftahi

Roth Capital Partners

1 question for FUBO

Joseph Spiezio

BTIG

1 question for FUBO

Nikhil Aluru

JPMorgan Chase & Co.

1 question for FUBO

Recent press releases and 8-K filings for FUBO.

- On February 3, 2026, FuboTV Inc.'s board of directors recommended, and Hulu, LLC approved via written consent, amendments to the Company's certificate of incorporation to effect a reverse stock split of its Class A and Class B common stock.

- The reverse stock split ratio will range from 1-for-8 to 1-for-12, as determined by the Board.

- The Reverse Stock Split Amendment is not immediately effective and will be implemented on a future date determined by the Board, but no earlier than the 20th day after an Information Statement is mailed or furnished to stockholders of record as of February 3, 2026.

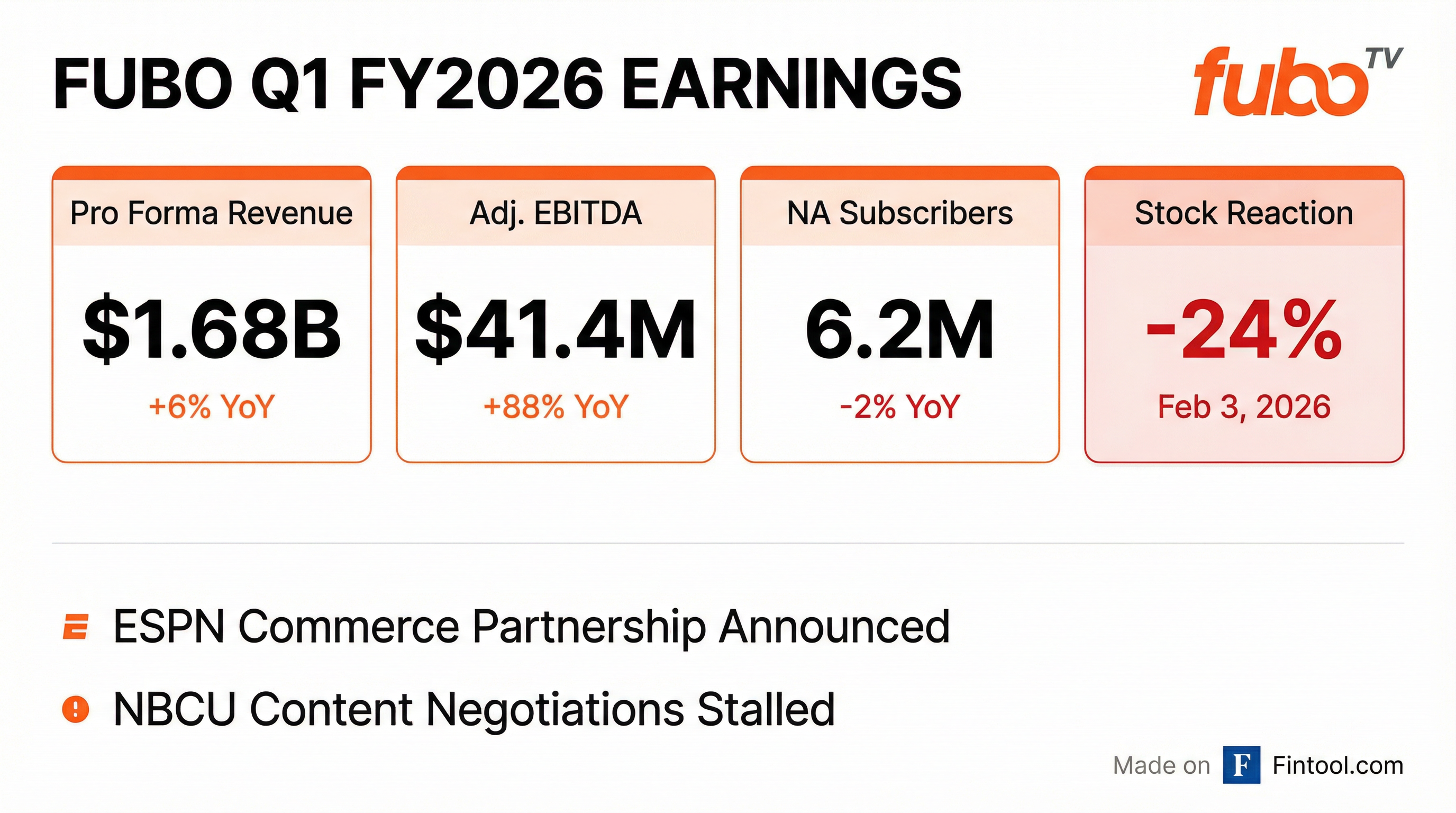

- Fubo reported Q1 2026 North America pro forma revenue of $1.68 billion, a 6% increase year-over-year, and achieved positive pro forma adjusted EBITDA of $41.4 million, nearly doubling from the prior year.

- The company ended the quarter with approximately 6.2 million North America subscribers on a combined basis.

- Strategic integration is underway, with Stage one nearing completion to migrate Fubo's ad tech into the Disney Ad Server, and a new partnership with ESPN to include Fubo Sports in ESPN's Commerce Flow is being developed to drive subscriber growth.

- A reverse stock split is planned by the end of fiscal 2Q26 to enhance stock accessibility and align with the company's scale.

- Comcast has ceased renewal discussions for NBCUniversal content on the Fubo side, though the subscriber impact has been modest.

- Fubo reported its first quarter as a combined company with Hulu Live in Q1 2026, with pro forma North America revenue of $1.68 billion, representing 6% growth year-over-year, and positive pro forma Adjusted EBITDA of $41.4 million, nearly doubling from the prior year.

- The company ended the quarter with approximately 6.2 million North America subscribers on a combined basis in North America.

- Strategic integration efforts include migrating Fubo's ad tech into the Disney Ad Server, expected to drive a meaningful uplift in CPM and fill rates, and a partnership with ESPN to include Fubo Sports in ESPN's Commerce Flow to drive subscriber growth.

- Fubo is planning a reverse stock split by the end of fiscal 2Q26 to make the stock more accessible and align with the company's size and scope.

- Comcast has ceased engagement in renewal discussions for NBCUniversal content on the Fubo side, though the subscriber impact to date has been modest.

- Fubo reported Q1 Fiscal 2026 North America revenue of $1.543 billion and pro forma revenue of $1.675 billion, with 6.2 million North America Total Subscribers.

- For Q1 Fiscal 2026, the company recorded a reported net loss of $19.1 million and a pro forma net loss of $46.4 million, alongside positive Pro Forma Adjusted EBITDA of $41.4 million.

- The company announced plans for a reseller and marketing arrangement with ESPN to expand the reach of Fubo services, pending definitive agreements.

- These results follow a transformative business combination with Hulu + Live TV completed in 2025, with Q1 2026 financials reflecting the combined entity.

- FuboTV reported Q1 FY 2026 North America revenue of $1.543 billion (or $1.675 billion on a pro forma basis) for the quarter ended December 31, 2025, following its business combination with Hulu + Live TV.

- For Q1 FY 2026, the company achieved Pro Forma Adjusted EBITDA of $41.4 million, alongside a reported net loss of $19.1 million and a reported EPS loss of $0.02.

- FuboTV ended the quarter with 6.2 million North America Total Subscribers.

- Fubo and ESPN announced plans for a reseller and marketing arrangement to expand the reach of Fubo services, and Fubo also announced a planned reverse stock split of its common stock at an exchange ratio between one-for-eight to one-for-twelve.

- FuboTV Inc. announced the repurchase of $140.2 million aggregate principal amount of its 3.25% Convertible Senior Notes due 2026.

- This repurchase was funded by proceeds from a $145 million term loan and resulted in no shareholder dilution.

- The remaining $4.5 million aggregate principal amount of the 2026 Notes will be repaid at maturity in February 2026.

- The repurchase was triggered by a fundamental change following Fubo's 2025 business combination with Hulu + Live TV.

- FuboTV announced that no holders of its Convertible Senior Secured Notes due 2029 tendered their notes for repurchase, with the offer expiring on January 6, 2026. Approximately $177.5 million of these notes remain outstanding.

- The company received a $145 million term loan from an affiliate of The Walt Disney Company.

- This term loan bears an interest rate of 4.2% per annum and matures on January 5, 2031.

- The proceeds from the term loan are expected to be used to repay the $144.765 million outstanding 3.25% Convertible Senior Notes due 2026, addressing a near-term maturity.

- FuboTV announced that no holders of its Convertible Senior Secured Notes due 2029 tendered their notes for repurchase, with the offer expiring on January 6, 2026.

- The aggregate principal amount of these 2029 Notes outstanding is approximately $177.5 million, which will mature on February 15, 2029.

- Fubo also received a $145 million term loan from an affiliate of The Walt Disney Company, which will be used to address its near-term 2026 notes maturity, preserve cash, and avoid shareholder dilution.

- FuboTV (NYSE: FUBO) launched the Fubo Channel Store, a new platform designed to provide a central, frictionless hub for premium standalone streaming plans.

- The Channel Store allows subscribers to access direct-to-consumer (DTC) services from various regional sports networks, DAZN One, Hallmark+, MGM+, Paramount+ with Showtime, and Starz directly within the Fubo app.

- These standalone plans do not require a base Fubo subscription and include Fubo Free, which offers nearly 200 free ad-supported streaming television (FAST) channels.

- FuboTV is estimated by UBS to be the sixth largest Pay TV company in the U.S. as of June 30, 2025, and is an affiliate of The Walt Disney Company.

- Q3 2025 standalone results for FuboTV included North America revenue of $368.6 million and 1,630,000 paid subscribers, with the company achieving positive adjusted EBITDA of $6.9 million for the second consecutive quarter.

- FuboTV completed its transformative business combination with Hulu + Live TV, creating a combined entity with nearly 6 million subscribers in North America, making it the sixth-largest pay TV company.

- The combination is expected to drive significant synergies, with The Walt Disney Company taking over advertising sales for the combined entity, targeting integration in Q1, and anticipated programming efficiencies due to the increased scale.

- Operational highlights for Q3 2025 included a 68% increase in net adds year-over-year while reducing marketing spend, and the Fubo Sports Skinny service demonstrated strong trial conversions and minimal cannibalization.

Quarterly earnings call transcripts for FuboTV.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more