Earnings summaries and quarterly performance for Helmerich & Payne.

Executive leadership at Helmerich & Payne.

John W. Lindsay

Chief Executive Officer

Cara M. Hair

Senior Vice President, Corporate Services and Chief Legal and Compliance Officer

J. Kevin Vann

Senior Vice President and Chief Financial Officer

John R. Bell

Executive Vice President, Eastern Hemisphere Land

Michael P. Lennox

Executive Vice President, Western Hemisphere Land

Raymond John (“Trey”) Adams III

President

Board of directors at Helmerich & Payne.

Belgacem Chariag

Director

Delaney M. Bellinger

Director

Donald F. Robillard, Jr.

Director

Elizabeth R. Killinger

Director

Hans Helmerich

Chairman of the Board

John D. Zeglis

Director

José R. Mas

Director

Kevin G. Cramton

Director

Randy A. Foutch

Lead Independent Director

Research analysts who have asked questions during Helmerich & Payne earnings calls.

Doug Becker

Capital One

5 questions for HP

Eddie Kim

Barclays

5 questions for HP

Keith MacKey

RBC Capital Markets

5 questions for HP

Saurabh Pant

Bank of America

5 questions for HP

Arun Jayaram

JPMorgan Chase & Co.

3 questions for HP

Ati Modak

Goldman Sachs

3 questions for HP

David Smith

Truist Securities

3 questions for HP

Derek Podhaizer

Piper Sandler Companies

3 questions for HP

Scott Gruber

Citigroup

3 questions for HP

Daniel Kutz

Morgan Stanley

2 questions for HP

Don Crist

Johnson Rice & Company L.L.C.

2 questions for HP

Edward Kim

TD Cowen

2 questions for HP

Jeffrey LeBlanc

Tudor, Pickering, Holt & Co.

2 questions for HP

John Daniel

Daniel Energy Partners

2 questions for HP

Kurt Hallead

The Benchmark Company

2 questions for HP

Marc Bianchi

TD Cowen

2 questions for HP

Tom Curran

Seaport Research Partners

2 questions for HP

Waqar Syed

ATB Capital Markets

2 questions for HP

Blake McLean

Daniel Energy Partners

1 question for HP

Douglas Becker

Capital One

1 question for HP

Grant Hynes

JPMorgan Chase & Co.

1 question for HP

Jeff LeBlanc

TPH&Co.

1 question for HP

Thomas Patrick Curran

Seaport Research Partners

1 question for HP

Recent press releases and 8-K filings for HP.

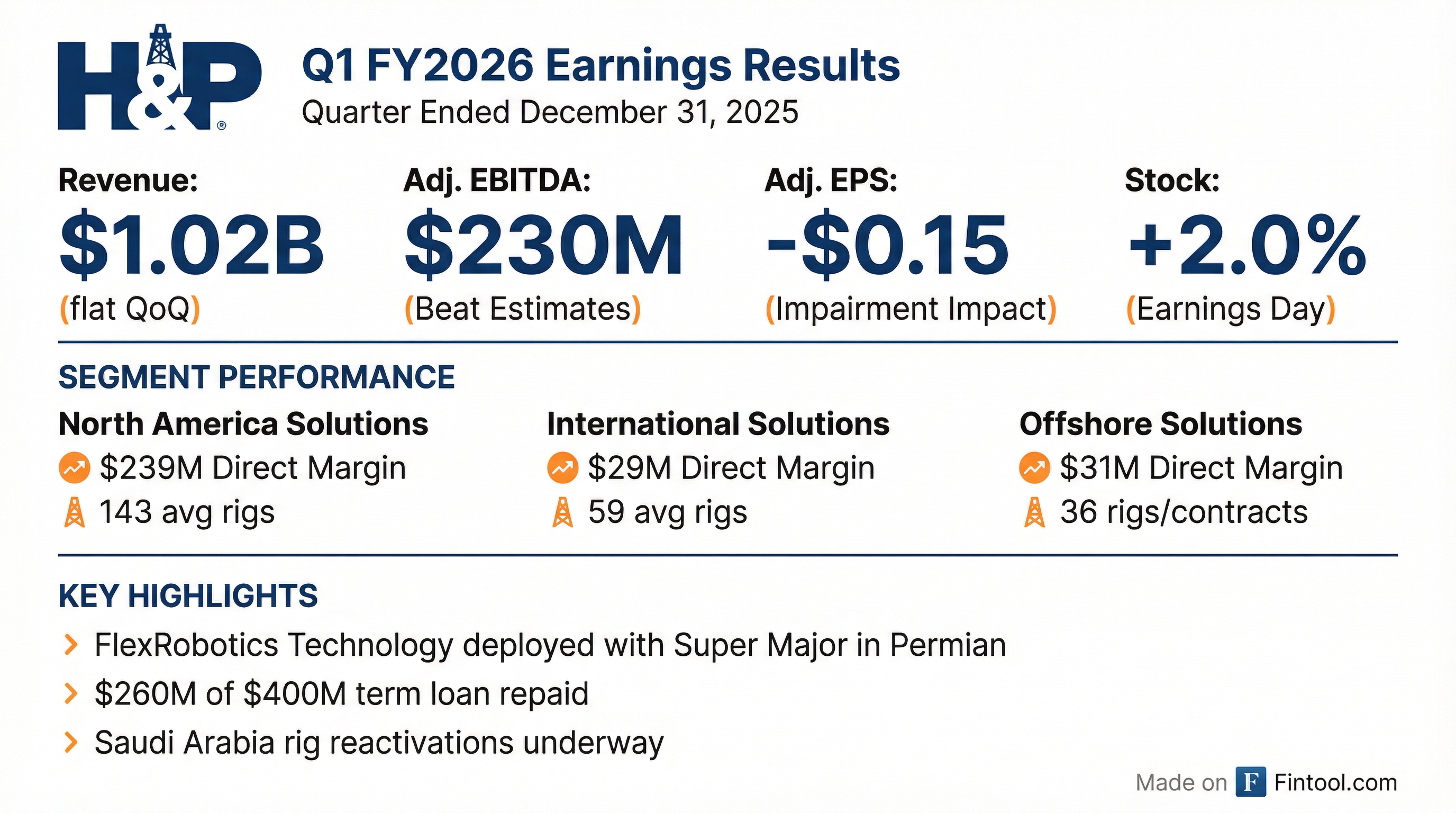

- H&P reported Q1 2026 Adjusted EBITDA of $230 million and revenues of $1 billion, with an adjusted loss of $0.15 per share after excluding non-cash impairment charges and unusual items.

- The company made significant progress on deleveraging, paying off $260 million of its term loan and anticipates repaying the remaining $140 million by the end of Q3 2026 or around the fiscal year-end.

- North America Solutions averaged 143 rigs working with average margins over $18,000 per day, while International Solutions generated $29 million in direct margins, exceeding guidance due to the timing of Saudi rig reactivation costs.

- For Q2 2026, North America Solutions is expected to average 132-138 active rigs, and International Solutions direct margins are projected to be $12 million-$22 million as the previously delayed reactivation costs are incurred.

- The full-year 2026 gross capital expenditure budget was trimmed slightly to $270 million-$310 million, with management expressing optimism for activity and direct margin progression in the second half of the fiscal year.

- For Q1 2026, HP reported revenue of $1,017 million and Adjusted EBITDA of $230 million, with an Adjusted EBITDA Margin of 23%, which was ahead of consensus expectations.

- The company generated $126 million in Free Cash Flow with a 55% Free Cash Flow Conversion during Q1 2026.

- As part of its capital allocation strategy, HP repaid $260 million of its $400 million term-loan as of January 31, 2026.

- For Q2 2026, HP anticipates North America Solutions Direct Margin between $205-$230 million, International Solutions Direct Margin between $12-$22 million, and Offshore Solutions Direct Margin between $20-$30 million.

- The full-year 2026 guidance includes gross capital expenditures of $270-$310 million and Selling, General & Administrative expenses of $265-$285 million.

- Helmerich & Payne reported Q1 2026 Adjusted EBITDA of $230 million and revenues of $1 billion, marking the third consecutive quarter at this revenue level. The company also generated $126 million in free cash flow and paid down $260 million on its term loan.

- For Q1 2026, North America Solutions averaged 143 rigs working with segment direct margins of $239 million, while International Solutions generated $29 million in direct margins, exceeding guidance due to delayed reactivation costs.

- The company provided Q2 2026 guidance, expecting North America Solutions to average 132 to 138 active rigs and International Solutions direct margins to be between $12 million and $22 million, reflecting the timing of reactivation expenses. The full-year 2026 gross capital expenditure budget was slightly trimmed to $270 million-$310 million.

- John Lindsay will retire as CEO, with Trey Adams stepping into the role next month. Strategic priorities include international growth, particularly in the Middle East and North Africa, continued North American leadership with innovations like FlexRobotics, and deleveraging to one turn of leverage.

- Helmerich & Payne reported Q1 2026 Adjusted EBITDA of $230 million and revenues of $1 billion, with a net loss of $0.98 per diluted share.

- The company made significant progress on deleveraging, having paid off $260 million on its $400 million term loan as of the end of January 2026.

- North America Solutions averaged 143 rigs working with average margins over $18,000 per day in Q1 2026. International Solutions' direct margins of $29 million exceeded guidance due to the timing of rig reactivation costs in Saudi Arabia, which are now expected to be reflected more heavily in Q2 2026.

- For Q2 2026, Helmerich & Payne anticipates North American Solutions direct margins to range between $205 million-$230 million based on an expected 132-138 active rigs, reflecting typical seasonality and ongoing softness. This earnings call also marked John Lindsay's final earnings call as CEO, with Trey Adams set to take over.

- Helmerich & Payne, Inc. reported a consolidated net loss of $(97) million, or $(0.98) per share, for the first fiscal quarter ended December 31, 2025, which included a $103 million non-cash impairment charge. Adjusted earnings were $(14) million, or $(0.15) per share, and consolidated adjusted EBITDA totaled $230 million.

- The North America Solutions (NAS) segment reported operating income of $36 million, including a $98 million one-time impairment, while the International Solutions segment's operating loss improved to $(55) million from $(76) million in the prior quarter.

- The company repaid $260 million on its $400 million term loan as of the end of January and anticipates full repayment by the end of the third fiscal quarter of 2026. Approximately $25 million was returned to shareholders through the dividend program.

- For the second fiscal quarter of 2026, North America Solutions direct margin is guided between $205 million and $230 million, International Solutions between $12 million and $22 million, and Offshore Solutions between $20 million and $30 million.

- CEO John Lindsay plans to retire in March, with a leadership transition underway.

- Helmerich & Payne, Inc. reported a consolidated net loss of $(97) million, or $(0.98) per share, for the fiscal first quarter ended December 31, 2025, which included a $103 million non-cash impairment charge. Adjusted earnings were $(14) million, or $(0.15) per share, and consolidated adjusted EBITDA totaled $230 million.

- The North America Solutions (NAS) segment generated direct margins of $239 million and operating income of $36 million (including a $98 million impairment), while International Solutions reported an operating loss of $(55) million with direct margins of $29 million for the quarter.

- The company has repaid $260 million on its $400 million term loan and expects full repayment by the end of the third fiscal quarter of 2026, also returning approximately $25 million to shareholders through its dividend program.

- For the second fiscal quarter of 2026, North America Solutions direct margin is projected between $205 million and $230 million, International Solutions between $12 million and $22 million, and Offshore Solutions between $20 million and $30 million.

- Helmerich & Payne reported Q4 2025 revenues of over $1 billion and generated $207 million in operating cash flow, despite a net loss of $0.58 per diluted share. The company made significant progress on debt reduction, paying off $210 million on its term loan, with $190 million outstanding and a target to pay it off by June 2026.

- The company announced the reactivation of seven suspended rigs in Saudi Arabia in the coming months, with reactivations expected to conclude by mid-2026. This strategic move contributes to a full year 2026 International rig count forecast of 56-68 rigs.

- For fiscal 2026, Helmerich & Payne projects gross capital expenditures of $280-$320 million and sales, general, and administrative expenses between $265 million and $285 million, which includes $50 million in savings. North America Solutions direct margins are anticipated to be $225-$250 million in Q1 2026.

- Key management promotions were announced, including Trey Adams to President, Mike Lennox to EVP of Western Hemisphere, and John Bell to EVP of Eastern Hemisphere.

- H&P reported Q4 2025 consolidated adjusted EBITDA of $225 million and generated Free Cash Flow of approximately $154 million.

- North America Solutions achieved a direct margin of $242 million with a daily direct margin of $18,620, while International and Offshore Solutions segments delivered over $64 million in direct margin, exceeding guidance.

- The company repaid $210 million of its term loan through October and anticipates repaying the entire term loan by the end of Q3 FY26. Fiscal Year 2026 Gross Capital Expenditures are projected to be between $280 million and $320 million, a notable decrease from prior years.

- H&P plans to increase its active rig count in Saudi Arabia to 24 by mid-2026, with seven rigs scheduled to resume operations in 2026.

- For Q4 2025, H&P reported revenues of a little over $1 billion and a net loss of $0.58 per diluted share, contributing to a full-year 2025 net loss of $1.66 per share.

- The company made significant progress on its deleveraging efforts, paying off $210 million of its term loan, with $190 million currently outstanding and a goal to pay it off completely by June 2026.

- H&P provided its fiscal year 2026 outlook, projecting gross capital expenditures between $280 million and $320 million and sales, general, and administrative expenses between $265 million and $285 million.

- Operationally, H&P announced the reactivation of seven suspended rigs in Saudi Arabia and expects its International Solutions segment to average between 56-68 rigs for fiscal 2026.

- Key management promotions were announced, including Trey Adams to President, Mike Lennox to EVP Western Hemisphere, and John Bell to EVP Eastern Hemisphere.

- Helmerich & Payne (H&P) reported Q4 2025 revenues of over $1 billion and a net loss of $0.58 per diluted share, or a net loss of $0.01 per share when normalizing for unusual and non-cash items.

- The company is reactivating seven suspended rigs in Saudi Arabia in fiscal 2026, with operations resuming in the second and third fiscal quarters, which will increase active international rigs from 17 to 24. International direct margins are expected to improve materially after the first half of 2026 as reactivation costs abate.

- For fiscal year 2026, H&P expects gross capital expenditures to be approximately $280 million-$320 million and sales, general, and administrative expenses to range between $265 million and $285 million.

- H&P made significant progress on its deleveraging efforts, having paid off $210 million on its term loan, with $190 million currently outstanding, and is on track to pay it off completely by June 2026.

Quarterly earnings call transcripts for Helmerich & Payne.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more