Earnings summaries and quarterly performance for Huntsman.

Executive leadership at Huntsman.

Peter Huntsman

Chairman, President and Chief Executive Officer

David Stryker

Executive Vice President, Strategic Initiatives

Julia Wright

Executive Vice President, General Counsel and Secretary

Philip Lister

Executive Vice President and Chief Financial Officer

Steen Weien Hansen

Division President, Polyurethanes

Wade Rogers

Senior Vice President, Global Human Resources and Chief Compliance Officer

Board of directors at Huntsman.

Curtis Espeland

Director

Cynthia Egan

Lead Independent Director and Non-Executive Vice Chair

Daniele Ferrari

Director

David Sewell

Director

Jan Tighe

Director

Jeanne McGovern

Director

José Muñoz

Director

Mary Beckerle

Director

Sonia Dulá

Director

Research analysts who have asked questions during Huntsman earnings calls.

Frank Mitsch

Fermium Research

6 questions for HUN

Hassan Ahmed

Alembic Global Advisors

6 questions for HUN

John Ezekiel Roberts

Mizuho Securities

6 questions for HUN

Kevin McCarthy

Vertical Research Partners

6 questions for HUN

Patrick Cunningham

Citigroup

6 questions for HUN

Salvator Tiano

Bank of America

6 questions for HUN

David Begleiter

Deutsche Bank

5 questions for HUN

Aleksey Yefremov

KeyBanc Capital Markets

4 questions for HUN

Arun Viswanathan

RBC Capital Markets

4 questions for HUN

Jeffrey Zekauskas

JPMorgan Chase & Co.

4 questions for HUN

Matthew Blair

Tudor, Pickering, Holt & Co.

4 questions for HUN

Michael Sison

Wells Fargo

4 questions for HUN

Josh Spector

UBS Group

3 questions for HUN

Joshua Spector

UBS

3 questions for HUN

Mike Harrison

Seaport Research Partners

3 questions for HUN

Vincent Andrews

Morgan Stanley

3 questions for HUN

Adam Trigg

RBC Capital Markets

2 questions for HUN

Dan Rizzo

Jefferies Financial Group Inc.

2 questions for HUN

Jeff Zekauskas

JPMorgan

2 questions for HUN

Michael Harrison

Seaport Research Partners

2 questions for HUN

Mike Sison

Wells Fargo

2 questions for HUN

Ryan Pirnat

KeyBanc Capital Markets

2 questions for HUN

Turner Hinrichs

Morgan Stanley

2 questions for HUN

Aaron Rosenthal

JPMorgan Chase & Co.

1 question for HUN

Daniel Rizzo

Jefferies

1 question for HUN

Elon

JPMorgan Chase & Co.

1 question for HUN

Emily Fusco

Deutsche Bank

1 question for HUN

Kevin Estok

Jefferies

1 question for HUN

Laurence Alexander

Jefferies

1 question for HUN

Recent press releases and 8-K filings for HUN.

- Huntsman experienced a challenging 2025 due to struggles in North American housing and durable goods, a slowing Chinese domestic market, and record chemical production loss in Europe, yet managed to convert 45% of its EBITDA to free cash flow.

- For 2026, the company anticipates a gradual recovery in North American home building and durable goods, and an improvement in Chinese domestic markets, while expecting $45 million of in-year cost savings from prior restructuring efforts.

- Management foresees 2026 as a year for potential mergers, joint ventures, and industry consolidation, with a primary focus on expanding its Advanced Materials footprint in applications like aerospace and adhesives.

- The CFO expressed no concern regarding debt leverage ratios for 2026, noting that the credit agreement's EBITDA definition includes over $200 million in adders.

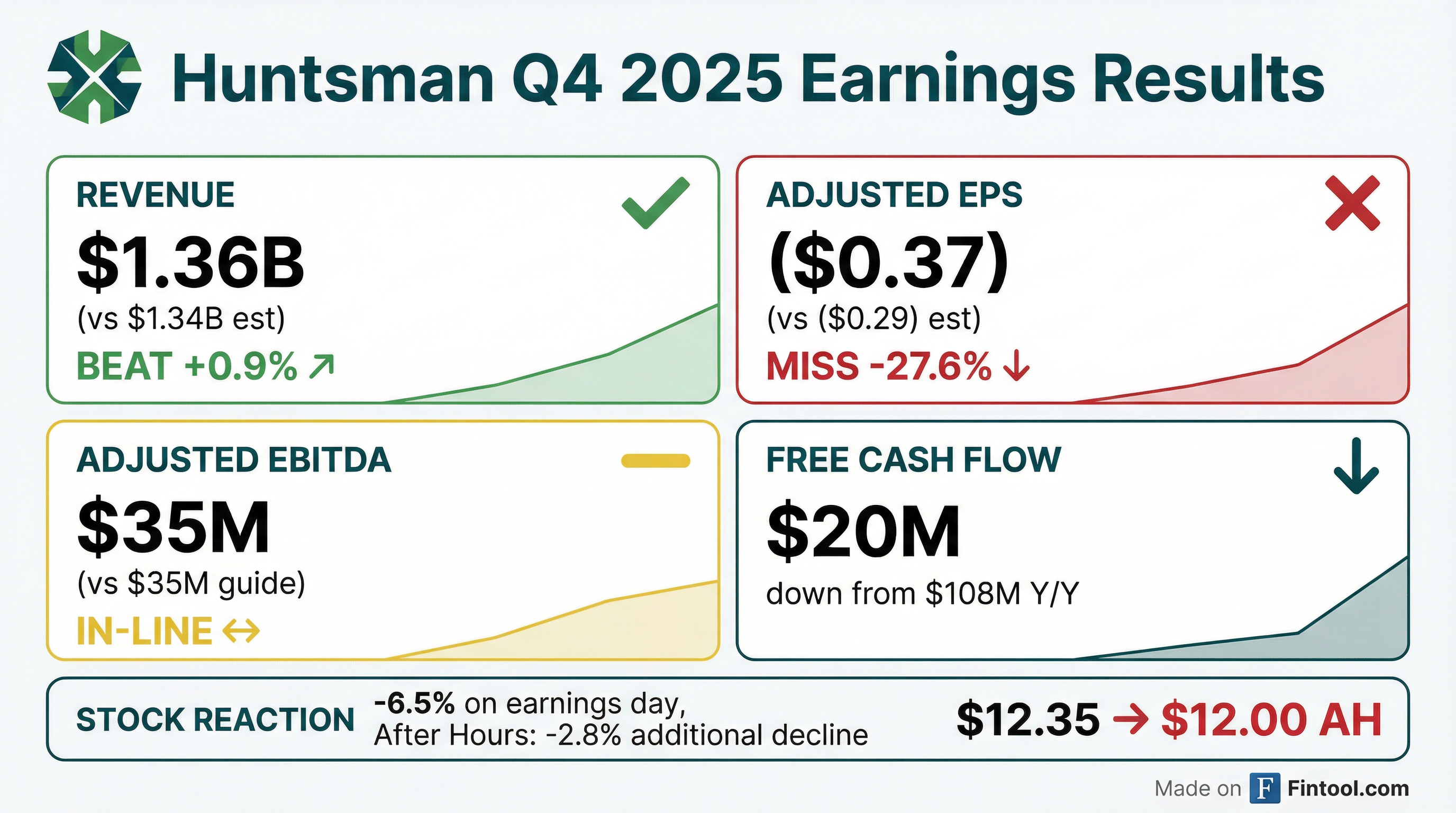

- Huntsman reported Q4 2025 revenues of $1,355 million and a net loss attributable to Huntsman Corporation of ($96) million, with Adjusted EBITDA of $35 million. For the full year 2025, revenues were $5,683 million, and the company posted a net loss of ($284) million.

- The company's liquidity stood at $1,323 million at the end of Q4 2025, with net debt of $1,582 million and a net debt leverage of 5.8x.

- Huntsman's cost realignment program is targeting ~$100 million in run rate benefits, with ~$55 million in-year savings realized in 2025 and ~$100 million expected in 2026. Approximately 80% of the ~500 target headcount reduction was complete by year-end 2025.

- For Q1 2026, Huntsman projects total Adjusted EBITDA to range from ~$45 million to $75 million.

- Huntsman converted 45% of its EBITDA to free cash flow in 2025, a higher percentage than many in the industry.

- The company achieved an annualized run rate of $100 million in cost savings by the end of 2025, resulting from 500 headcount reductions and the closure of 7 facilities. An additional $45 million in-year savings is expected in 2026.

- For Q1 2026, Huntsman projects Polyurethanes EBITDA to be between $25 million and $40 million, compared to $42 million in Q1 2025, partly due to rising natural gas costs.

- Huntsman anticipates a gradual recovery in North American home building and durable goods and an improvement in Chinese domestic markets in 2026, with early signs of improved volumes and pricing in Europe.

- The company secured a new $800 million revolver and extended its $300 million securitization program capacity, holding over $400 million in cash at year-end 2025, resulting in approximately $1 billion net liquidity moving forward.

- Huntsman Corporation reported Q4 2025 revenues of $1,355 million, a decrease from $1,452 million in the prior year period, and a net loss attributable to Huntsman of $96 million.

- Adjusted EBITDA for Q4 2025 was $35 million, down from $71 million in the prior year period, with an adjusted diluted loss per share of $0.37.

- For the full year 2025, the company generated $298 million in net cash provided by operating activities from continuing operations and $125 million in free cash flow from continuing operations.

- Management emphasized the company's focus on restructuring and cash generation during 2025, committing to disciplined cash management, balance sheet, and cost control for 2026, with similar capital expenditure levels expected.

- Huntsman reported Q4 2025 revenues of $1,355 million and a net loss attributable to Huntsman of $96 million, with full-year 2025 revenues of $5,683 million and a net loss of $284 million.

- Adjusted EBITDA for Q4 2025 was $35 million, a decrease from $71 million in the prior year, and full-year 2025 adjusted EBITDA was $275 million.

- The company generated $20 million in free cash flow from continuing operations for Q4 2025 and $125 million for the full year 2025.

- As of December 31, 2025, Huntsman maintained approximately $1.3 billion in combined cash and unused borrowing capacity.

- Management expects similar capital expenditure levels in 2026 as in 2025 , and the CEO noted generating close to $300 million of cash flow from operations in 2025 despite a challenging market.

- Huntsman International LLC (HI), a wholly-owned subsidiary of Huntsman Corporation, entered into an $800 million senior secured revolving credit facility on February 9, 2026.

- The credit facility will mature on February 9, 2031, and HI has the option to increase commitments by up to $400 million.

- Borrowings under the agreement will bear interest with applicable margins ranging from 0.50% to 1.00% per annum for Alternate Base Rate borrowings and 1.50% to 2.00% per annum for Term Benchmark and SONIA borrowings, based on HI's leverage ratio.

- The Credit Agreement includes financial covenants, such as a maximum Total Net Leverage Ratio starting at 6.25 to 1.00 for March 31, 2026, and a minimum Fixed Charge Coverage Ratio of 2.50 to 1.00 commencing March 31, 2026.

- Huntsman Corporation is experiencing an unplanned outage at its Polyurethanes facility in Rotterdam, Netherlands, impacting the larger of its two MDI lines.

- This outage is expected to negatively affect fourth quarter 2025 adjusted EBITDA by approximately $10 million.

- As a result, management anticipates Q4 2025 adjusted EBITDA will be at the low end of the previously communicated $25 million to $50 million range.

- Production at the affected facility is projected to resume by mid-December.

- Huntsman reported revenues of $1,460 million and Adjusted EBITDA of $94 million for Q3 2025, alongside a net loss attributable to Huntsman Corporation of $(25) million and an adjusted diluted loss per share of $(0.03).

- For Q4 2025, the company projects Adjusted EBITDA to be between $25 million and $50 million , citing challenged market conditions, seasonal volume decline, and no improvement in global construction markets.

- Huntsman announced cost realignment plans targeting ~$100 million in run rate benefits by the end of 2026, which include a headcount reduction of ~500.

- The quarterly dividend was reset to $0.0875 per share, representing a 65% reduction.

- Huntsman is on track to complete its $100 million cost reduction program by 2026, which includes the elimination or relocation of over 600 positions and the closure of seven sites, primarily in Europe.

- The company delivered $200 million of operating cash in Q3 2025 and over $100 million in year-to-date free cash flow, attributing this to aggressive working capital management.

- The industry is facing significant challenges, including the effects of high inflation and rising interest rates in the U.S. impacting consumer durables and home building, lack of consumer confidence and spending in China, and the deindustrialization of Europe.

- Huntsman is prioritizing inventory reduction and cash generation, aiming to enter 2026 with lower than average inventories to calibrate production to actual demand, and anticipates a modest recovery starting in 2026.

- The electronics business now accounts for 40% of the company's earnings and has doubled over the last seven years, with MDI growth projected at 1.5 times GDP over the cycle.

Quarterly earnings call transcripts for Huntsman.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more