Earnings summaries and quarterly performance for IOVANCE BIOTHERAPEUTICS.

Executive leadership at IOVANCE BIOTHERAPEUTICS.

Frederick Vogt

Interim Chief Executive Officer and President

Corleen Roche

Chief Financial Officer

Daniel Kirby

Chief Commercial Officer

Friedrich Graf Finckenstein

Chief Medical Officer

Igor Bilinsky

Chief Operating Officer

Raj Puri

Chief Regulatory Officer

Board of directors at IOVANCE BIOTHERAPEUTICS.

Research analysts who have asked questions during IOVANCE BIOTHERAPEUTICS earnings calls.

Asthika Goonewardene

Truist Securities

5 questions for IOVA

David Dai

UBS Group AG

5 questions for IOVA

Reni Benjamin

Citizens JMP Securities

5 questions for IOVA

Tyler Van Buren

TD Cowen

5 questions for IOVA

Yanan Zhu

Wells Fargo Securities

5 questions for IOVA

Andrew Tsai

Jefferies

4 questions for IOVA

Colleen Kusy

Robert W. Baird & Co.

4 questions for IOVA

Peter Lawson

Barclays PLC

4 questions for IOVA

Salim Syed

Mizuho Securities

4 questions for IOVA

Andrea Newkirk

Goldman Sachs

3 questions for IOVA

Benjamin Burnett

Stifel, Nicolaus & Company, Incorporated

2 questions for IOVA

Etzer Darout

BMO Capital Markets

2 questions for IOVA

Linda Tsai

Jefferies

1 question for IOVA

Mara Goldstein

Mizuho

1 question for IOVA

Michael Yee

Jefferies

1 question for IOVA

Nick

Virtue Capital

1 question for IOVA

Nick Lorusso

TD Cowen

1 question for IOVA

Yanan Xu

Wells Fargo

1 question for IOVA

Recent press releases and 8-K filings for IOVA.

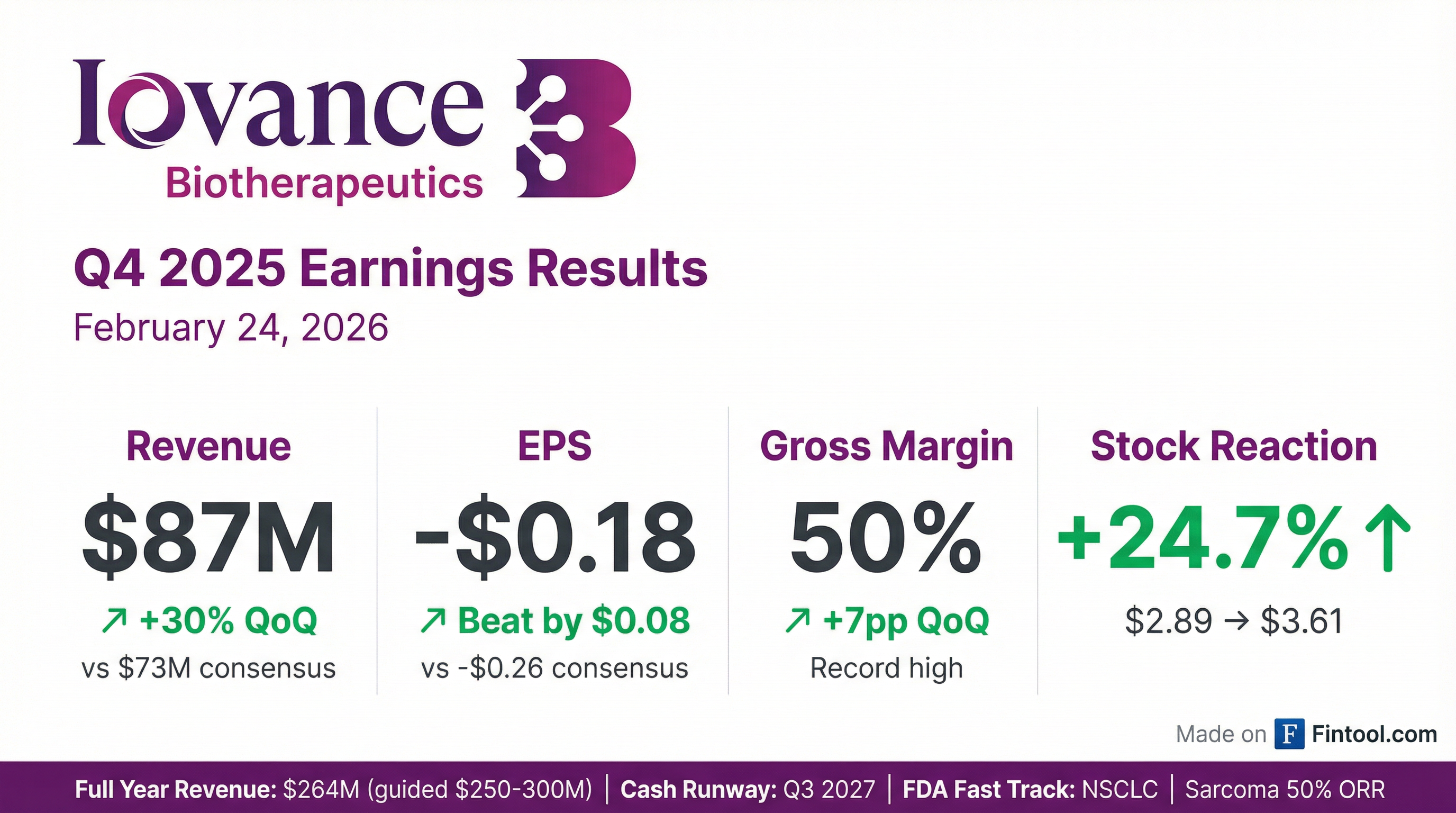

- Iovance Biotherapeutics reported total revenue of $264 million for the full year 2025, achieving 30% revenue growth in Q4 2025, driven by Amtagvi.

- The company improved its gross margin from cost of sales to 50% in Q4 2025 and extended its cash runway into the third quarter of 2027.

- Amtagvi is gaining positive commercial traction, with increasing demand, and is expected to reach $1 billion-plus U.S. sales at peak in melanoma alone.

- Lifileucel received Fast Track designation for non-small cell lung cancer, with a potential launch in H2 2027, and demonstrated an unprecedented 50% confirmed response rate in advanced soft tissue sarcomas, with a registrational trial planned.

- Iovance Biotherapeutics reported full year 2025 total revenue of $264 million, a 61% increase over the prior year, driven by 112% year-over-year Amtagvi revenue growth, and ended 2025 with approximately $303 million in cash, extending its cash runway into the third quarter of 2027.

- The company achieved a 50% margin from cost of sales in Q4 2025 and anticipates remarkable revenue growth in 2026, with Amtagvi and Proleukin having the potential to reach $1 billion-plus U.S. sales at peak.

- The FDA granted Fast Track designation for lifileucel in previously treated non-squamous non-small cell lung cancer, with a potential accelerated approval and launch in the second half of 2027.

- Positive early data for lifileucel in previously treated advanced soft tissue sarcomas demonstrated an unprecedented 50% confirmed response rate, leading to plans for a single-arm registrational trial.

- Iovance Biotherapeutics reported total revenue of $264 million for the full year 2025, within guidance, with Q4 2025 product revenue at $87 million, marking approximately 30% growth from the prior quarter, primarily driven by AMTAGVI. The company also achieved a 50% gross margin from cost of sales in Q4 2025 and extended its cash runway into Q3 2027 with approximately $303 million cash at year-end 2025.

- AMTAGVI is projected to reach over $1 billion in peak U.S. sales for melanoma alone, with the non-small cell lung cancer opportunity being seven times larger and soft tissue sarcoma offering significant additional potential. The FDA granted Fast Track designation for lifileucel in non-squamous non-small cell lung cancer, targeting a potential accelerated approval and launch in H2 2027, and positive early data showed an unprecedented 50% confirmed response rate for lifileucel in advanced soft tissue sarcomas.

- Iovance Biotherapeutics reported Q4 2025 total product revenue of ~$87 million, reflecting ~30% quarterly revenue growth over the prior quarter, and achieved its full year 2025 revenue guidance of ~$264 million.

- The company's gross margin increased to ~50% in Q4 2025.

- As of December 31, 2025, Iovance held a cash position of ~$303 million, which is expected to fund operations into the third quarter of 2027.

- The U.S. FDA granted Fast Track Designation for lifileucel for second-line advanced non-small cell lung cancer, with a potential launch in the second half of 2027.

- Amtagvi received approval in Canada in August 2025, and regulatory submissions are currently under review in the United Kingdom, Australia, and Switzerland.

- IOVANCE BIOTHERAPEUTICS achieved Full Year 2025 revenue of ~$264M, meeting its guidance of $250M-$300M, with a Q4 2025 gross margin of 50%.

- The company reported a cash position of $303M as of December 31, 2025, providing a cash runway into Q3 2027.

- AMTAGVI (lifileucel), the first and only approved treatment in 2L+ advanced melanoma, demonstrated ~30% quarterly revenue growth in Q4 2025 and showed a 44% objective response rate (ORR) in real-world data.

- The company's pipeline includes lifileucel for NSCLC, which has Fast Track Designation from the U.S. FDA with a potential launch in 2H27, and a Phase 2 registrational trial for advanced soft tissue sarcomas is set to commence in 2Q 2026.

- Iovance Biotherapeutics announced positive early data from a pilot clinical trial of lifileucel in patients with advanced undifferentiated pleomorphic sarcoma (UPS) or dedifferentiated liposarcoma (DDLPS).

- The trial demonstrated a 50% Objective Response Rate (ORR) by RECIST v1.1 among the first six evaluable patients, who had advanced disease and were refractory to prior therapy.

- Based on these results, Iovance plans to commence a single arm registrational trial in second-line advanced UPS and DDLPS in the second quarter of 2026 and will engage with the FDA for an accelerated approval path.

- UPS and DDLPS are aggressive soft tissue sarcomas impacting more than 8,000 patients annually in the U.S. and Europe, representing a significant unmet medical need.

- AlphaTON Capital Corp. (ATON) has executed a binding call option agreement with Immunova, LLC, granting Immunova the option to acquire iOx Therapeutics Limited, a wholly owned subsidiary of AlphaTON.

- Upon exercise of the option, AlphaTON would be entitled to an upfront cash payment, 10% equity of the acquiring entity, milestone payments potentially exceeding $100 million, and single-digit royalties on future net sales.

- iOx's lead candidate, PORT-2 (IMM60), a liposomal iNKT cell agonist, has been evaluated in advanced melanoma and metastatic NSCLC patients in Phase 1/2 studies, showing biomarker evidence of immune activation and preliminary anti-tumor activity.

- AlphaTON Capital plans to continue advancing its mesothelioma program (TT-4) and is progressing a new Telegram-oriented, AI-driven biotech initiative for rare cancers.

- Iovance Biotherapeutics announced real-world data for its commercial product Amtagvi® (lifileucel), the first one-time T cell therapy for solid tumor cancer, demonstrating a best-in-class profile in patients with advanced melanoma.

- In a real-world retrospective study of 41 evaluable patients, Amtagvi achieved a physician-assessed confirmed objective response rate (ORR) of 44% and a disease control rate of 73%.

- The real-world ORR of 44% improved upon the 31% ORR from the C-144-01 clinical trial that supported its February 2024 FDA accelerated approval, with a 52% ORR observed in patients treated earlier (two or fewer lines of therapy).

- The global autologous cell therapy market was valued at $10.12 billion in 2024 and is projected to reach $44.55 billion by 2033, growing at a CAGR of 17.90% from 2025 to 2033.

- In February 2024, the FDA approved Iovance Biotherapeutics' Amtagvi (lifileucel) for advanced melanoma, marking the first autologous cell therapy supported for a solid tumor.

- North America accounts for over 44% of the global autologous cell therapy market, with the U.S. market alone projected to surpass $17.14 billion by 2034.

- Hospitals and clinics are central to the market, capturing over 47% and expected to administer more than 60% of autologous cell therapies by 2025.

- Iovance Biotherapeutics, Inc. expects to achieve its full-year 2025 revenue guidance range of $250 to $300 million in the first full calendar year of Amtagvi sales.

- As of September 30, 2025, the company reported a cash position of $307 million, which is expected to fund operations into Q2 2027.

- Amtagvi, the first FDA-approved one-time T-cell therapy for a solid tumor cancer, has demonstrated a ~50% response rate in real-world patients with previously treated advanced melanoma.

- Clinical trials for Lifileucel in non-small cell lung cancer (NSCLC) showed an Objective Response Rate (ORR) of 25.6% in the IOV-LUN-202 study and 64.3% ORR in the IOV-COM-202 Cohort 3A for ICI-naïve NSCLC, with median Duration of Response (mDOR) not reached in either study.

Quarterly earnings call transcripts for IOVANCE BIOTHERAPEUTICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more