Earnings summaries and quarterly performance for Knife River.

Executive leadership at Knife River.

Board of directors at Knife River.

Research analysts who have asked questions during Knife River earnings calls.

Garik Shmois

Loop Capital Markets

6 questions for KNF

Kathryn Thompson

Thompson Research Group

6 questions for KNF

Brent Thielman

D.A. Davidson

5 questions for KNF

Ian Zaffino

Oppenheimer & Co. Inc.

5 questions for KNF

Trey Grooms

Stephens Inc.

4 questions for KNF

Ivan Yi

Wolfe Research, LLC

3 questions for KNF

Ethan

JPMorgan Chase & Co.

2 questions for KNF

Gabe Hajde

Wells Fargo & Company

2 questions for KNF

Garrett Greenblatt

JPMorgan Chase & Co.

2 questions for KNF

Chris Ellinghaus

Siebert Williams Shank

1 question for KNF

Christopher Ellinghaus

Siebert Williams Shank & Co., LLC

1 question for KNF

Isaac Sellhausen

Oppenheimer & Co. Inc.

1 question for KNF

Jean Paul Ramirez

D.A. Davidson & Co.

1 question for KNF

Sherif El-Sabbahy

Bank of America

1 question for KNF

Recent press releases and 8-K filings for KNF.

- Knife River Corporation (NYSE: KNF) has acquired Morgan Asphalt Inc., an aggregates-based asphalt paving company in the Salt Lake City, Utah, area.

- This acquisition represents a strategic expansion for Knife River, establishing a footprint in Utah and enhancing its Mountain Region operations.

- Morgan Asphalt's operations include aggregate crushing and production, with over 30 years of proven reserves, asphalt production, and contracting services.

- The acquisition provides Knife River with a growth platform that will be integrated into its existing regional operations ahead of the 2026 construction season.

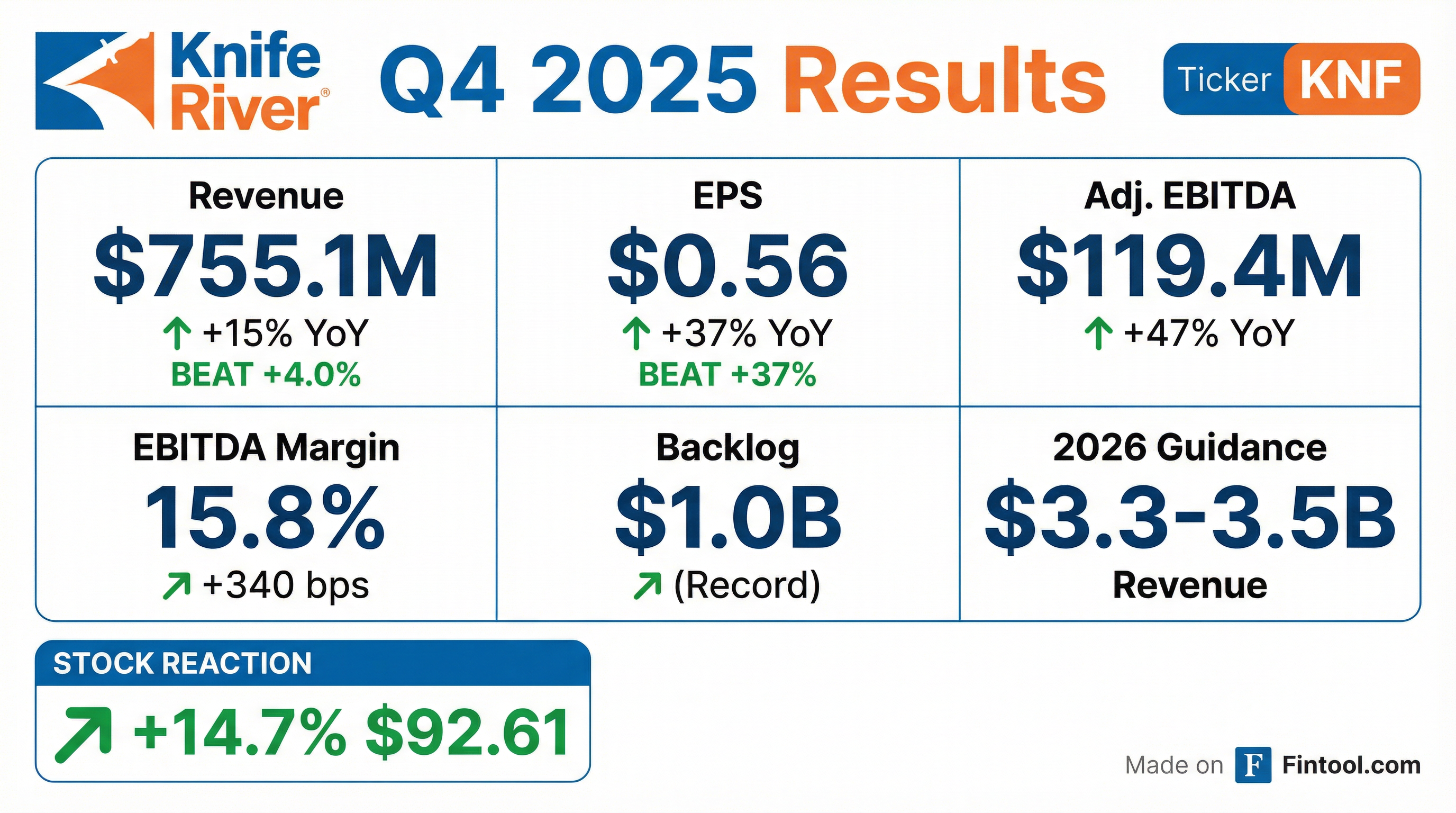

- Knife River reported FY 2025 revenue of $3,146 million and Adjusted EBITDA of $497 million, achieving an Adjusted EBITDA margin of 15.8%.

- For Q4 2025, the company's revenue reached $755 million and Adjusted EBITDA was $119 million, with an Adjusted EBITDA margin of 15.8%.

- The company issued FY 2026 guidance, forecasting revenue between $3,300 million and $3,500 million and Adjusted EBITDA between $520 million and $560 million.

- Key operational achievements in FY 2025 included five aggregates-based acquisitions, a 9% year-over-year increase in aggregate pricing, and a record year-end backlog of $1.0 billion.

- As of Q4 2025, Knife River's Net Debt stood at $1,107.3 million, resulting in a Net Leverage ratio of 2.2x.

- Knife River concluded 2025 with a strong fourth quarter, reporting 47% higher Adjusted EBITDA and a 340 basis point improvement in Adjusted EBITDA margin.

- For the full year 2025, the company achieved its most profitable year ever, with Adjusted EBITDA growing 7% to $497 million, and completed five acquisitions.

- The company issued 2026 guidance, projecting consolidated revenue between $3.3 billion and $3.5 billion and Adjusted EBITDA between $520 million and $560 million, implying an Adjusted EBITDA margin of approximately 16% at the midpoint.

- Knife River enters 2026 with a record backlog of $1 billion, marking a 38% increase from the prior year, with 75% anticipated for completion in 2026.

- The company invested $789 million in growth initiatives, including acquisitions, in 2025 and maintains a strong financial position with $75 million in unrestricted cash and a net leverage of 2.2 times.

- Knife River concluded 2025 with a strong fourth quarter, reporting 47% higher Adjusted EBITDA and a 340 basis point improvement in Adjusted EBITDA margin, contributing to FY 2025 Adjusted EBITDA growth of 7% to $497 million.

- The company provided 2026 guidance, projecting consolidated revenue between $3.3 billion and $3.5 billion and Adjusted EBITDA between $520 million and $560 million, which implies an Adjusted EBITDA margin of approximately 16% at the midpoint.

- Knife River enters 2026 with a record backlog of $1 billion, representing a 38% increase from the previous year, with 75% of this backlog expected to be completed in 2026.

- Strategic growth initiatives in 2025 included completing five acquisitions and expanding aggregates reserves, with expectations for another active M&A year in 2026.

- The company maintains a strong financial position with $75 million of unrestricted cash, approximately $475 million available on its revolving credit facility, and a net leverage of 2.2x, which is below its long-term target of 2.5x.

- Knife River reported Adjusted EBITDA growth of 7% to $497 million for 2025, concluding the year with a 47% higher Adjusted EBITDA and a 340 basis point improvement in Adjusted EBITDA margin in Q4 2025.

- The company completed 5 acquisitions in 2025 and anticipates another active year in 2026, supported by a robust M&A pipeline and a strong financial position including $75 million cash on hand and $475 million available on its revolver.

- For 2026, Knife River expects mid-single digit growth in aggregates volumes and pricing, mid-teens improvement in Ready Mix volumes, and mid-single digit increases in asphalt volumes.

- The company projects continued aggregates margin expansion of approximately 200 basis points and higher gross margin in contracting services in 2026, with an Adjusted EBITDA guidance midpoint of $540 million (implying 9% organic growth) and a record $1 billion backlog.

- Knife River Corporation reported record fourth quarter 2025 revenue of $755.1 million, a 15% increase year-over-year, and full-year 2025 revenue of $3,146.0 million, up 9%.

- For full-year 2025, Adjusted EBITDA increased 7% to $496.5 million, while net income decreased 22% to $157.1 million.

- The company completed five aggregates-based acquisitions in 2025 and achieved a record year-end backlog of $1 billion.

- Knife River initiated full-year 2026 guidance, projecting revenue between $3,300.0 million and $3,500.0 million and Adjusted EBITDA between $520.0 million and $560.0 million.

- Knife River Corporation reported record fourth quarter 2025 revenue of $755.1 million, a 15% increase year-over-year, and Adjusted EBITDA of $119.4 million, up 47%. For the full-year 2025, revenue increased 9% to $3,146.0 million, and Adjusted EBITDA grew 7% to $496.5 million.

- The company completed five aggregates-based acquisitions in 2025 and entered 2026 with a record year-end backlog of $1 billion.

- For full-year 2026, Knife River expects revenue between $3,300.0 million and $3,500.0 million and Adjusted EBITDA between $520.0 million and $560.0 million.

- As of December 31, 2025, the company had $73.8 million in unrestricted cash and a net leverage ratio of 2.2x.

- Knife River Corporation (KNF) has acquired Texcrete Operations LLC and TexAgg LLC, expanding its presence in the Texas Triangle.

- The acquisition includes six ready-mix plants, 85 ready-mix trucks, and a sand and gravel site with 20-plus years of aggregate reserves in the Bryan/College Station market.

- This strategic move aligns with Knife River's focus on materials-based, vertically integrated operations in high-growth markets and is expected to help balance seasonality in its northern markets.

- Approximately 100 Texcrete employees have joined Knife River's Texas team.

- Knife River (KNF) achieved record financial results in Q3 2025, with revenue of $1.2 billion and adjusted EBITDA of $273 million, largely due to strong contributions from recent acquisitions.

- The company narrowed its full-year 2025 guidance, projecting consolidated revenue between $3.1 billion and $3.15 billion and adjusted EBITDA between $475 million and $500 million.

- Backlog reached a record high in Q3 2025, increasing 32% year-over-year, with a significant increase in higher-margin asphalt paving work secured for upcoming periods.

- The "EDGE" strategy, which includes M&A, dynamic pricing, and cost control, is driving improved gross margins across all product lines and is expected to help achieve a long-term goal of 20% adjusted EBITDA margin.

- Knife River Corporation reported record revenue of $1,203.7 million and record Adjusted EBITDA of $272.8 million for the third quarter ended September 30, 2025, representing increases of 9% and 11% respectively, compared to the prior year.

- Net income for Q3 2025 was $143.2 million, or $2.52 per share, a 3% decrease from the same period last year.

- The company achieved a record backlog of $995 million, which is 32% higher than the same period last year, with 87% of the backlog being public work.

- Strategic acquisitions and a focus on price optimization and cost controls led to a 50 basis point improvement in Adjusted EBITDA margin.

- Management narrowed its full-year 2025 guidance.

Quarterly earnings call transcripts for Knife River.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more