Earnings summaries and quarterly performance for COCA COLA FEMSA SAB DE CV.

Research analysts who have asked questions during COCA COLA FEMSA SAB DE CV earnings calls.

Rodrigo Alcantara

UBS

8 questions for KOF

Alvaro Garcia

BTG Pactual

6 questions for KOF

Lucas Ferreira

JPMorgan Chase & Co.

6 questions for KOF

Renata Cabral

Citigroup

6 questions for KOF

Alejandro Fuchs

Itaú BBA

5 questions for KOF

Antonio Hernandez

Actinver

5 questions for KOF

Felipe Ucros Nunez

Scotiabank

5 questions for KOF

Benjamin Theurer

Barclays Corporate & Investment Bank

4 questions for KOF

Fernando Olvera

Bank of America Merrill Lynch

4 questions for KOF

Ricardo Alves

Morgan Stanley

4 questions for KOF

Thiago Bortoluci

Goldman Sachs

4 questions for KOF

Ulises Argote Bolio

Banco Santander, S.A.

3 questions for KOF

Antonio Hernández Vélez

Actinver

2 questions for KOF

Froylan Mendez

JPMorgan Chase & Co.

2 questions for KOF

Gabriela Martinez

Banorte

2 questions for KOF

Henrique Morello

Morgan Stanley

2 questions for KOF

Rahi Parikh

Barclays

2 questions for KOF

Renata Fonseca Cabral Sturani

Citibank

2 questions for KOF

Thiago Bertolucci

The Goldman Sachs Group, Inc.

2 questions for KOF

Ulises Argote

Santander

2 questions for KOF

Benjamine Theurer

Barclays

1 question for KOF

Carlos Laboy

HSBC

1 question for KOF

Enrique Morillo

Morgan Stanley

1 question for KOF

Fernando Olvera Espinosa de los Monteros

Bank of America

1 question for KOF

Recent press releases and 8-K filings for KOF.

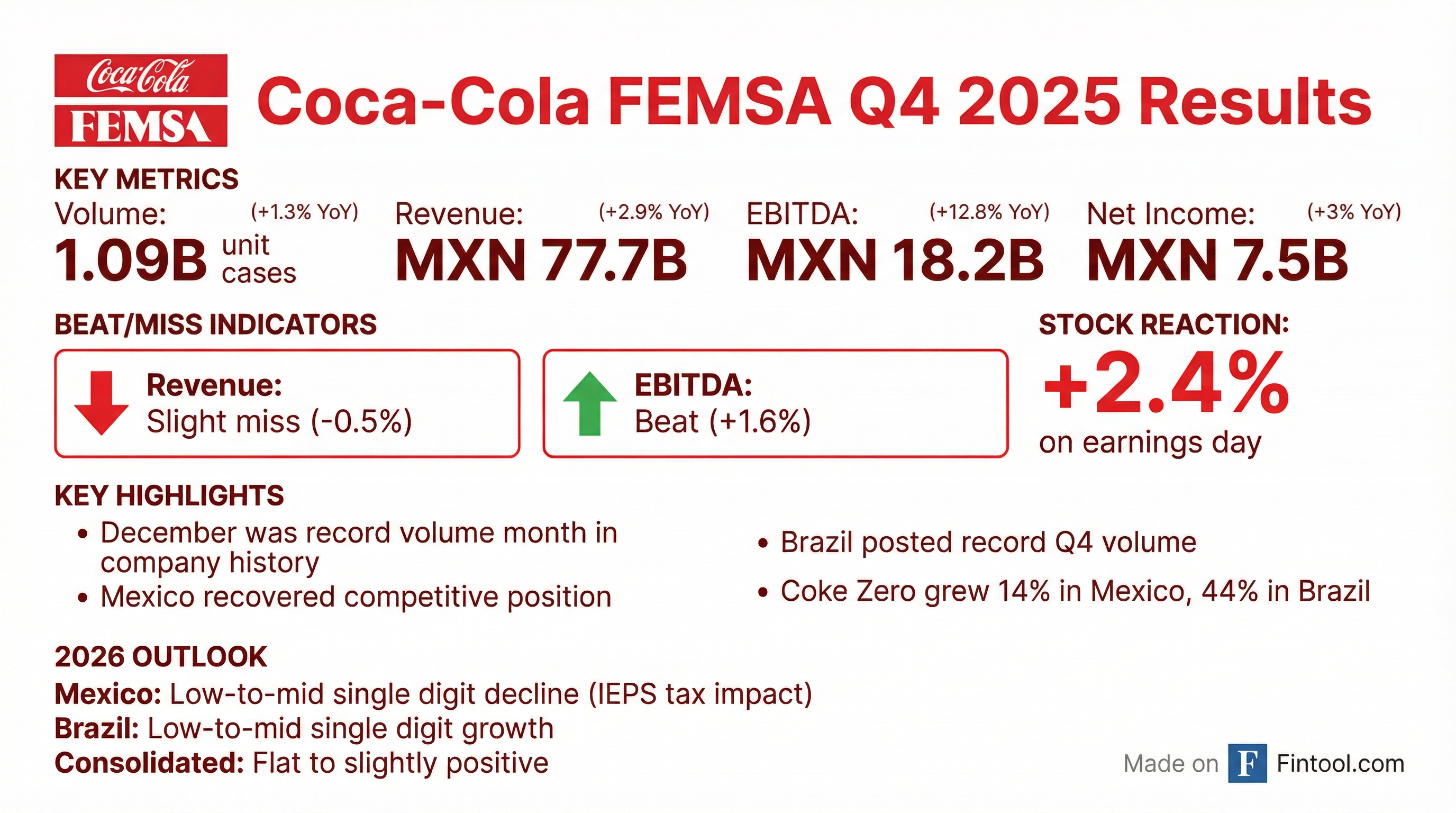

- Coca-Cola FEMSA reported a 1.3% increase in consolidated volume to 1.09 billion unit cases and a 2.9% rise in total revenues to MXN 77.7 billion for Q4 2025. Normalized Adjusted EBITDA grew 4.4% with a 30 basis point margin expansion to 21.9%.

- Mexico's volumes contracted 0.9% in Q4 2025 but showed sequential improvement, with December marking the strongest month in the company's history for volume. However, the company anticipates a low to mid-single-digit decline in Mexico volumes for 2026 due to the excise tax increase.

- South America volumes increased 3% in Q4 2025 , and Brazil expects positive volumes in the low to mid-single digits for 2026.

- The company successfully priced a MXN 10 billion bond issuance in the Mexican market on February 12, 2026, consisting of two tranches to strengthen its financial position and extend debt maturity.

- Strategic priorities for 2026 include growing the core business, leveraging Juntos+ AI capabilities, and managing the impact of the excise tax in Mexico, with CapEx to revenues expected to be in the range of 7% to 7.5%.

- Coca-Cola FEMSA (KOF) reported Q4 2025 consolidated volume growth of 1.3% to 1.09 billion unit cases and total revenues increased 2.9% to MXN 77.7 billion, or 6% on a currency-neutral basis.

- Operating income grew 13.3% to MXN 13.7 billion (17.6% margin) and Adjusted EBITDA increased 12.8% to MXN 18.2 billion (23.4% margin) in Q4 2025, with both metrics positively impacted by insurance recoveries.

- The company expects to face challenges in 2026 due to an excise tax increase in Mexico but anticipates working capital normalization starting Q1 2026. CapEx is projected to decrease to approximately 6.5% of revenues in the coming years.

- KOF successfully priced a MXN 10 billion bond issuance in the Mexican market on February 12 to reinforce its balance sheet and extend its debt maturity profile.

- Coca-Cola FEMSA reported Q4 2025 consolidated volume growth of 1.3% to 1.09 billion unit cases and total revenue growth of 2.9% to MXN 77.7 billion. Normalized Adjusted EBITDA, excluding insurance effects, grew 4.4% with a 30 basis point margin expansion to 21.9%.

- Performance was driven by solid volume growth in South America, with Brazil achieving its highest fourth-quarter volume on record and significant growth in Coca-Cola Zero (44% in 2025) and Sprite Zero (93% in 2025). Mexico saw sequential volume improvements, despite a 0.9% contraction year-on-year, and fully recovered its competitive position.

- For 2026, the company anticipates a flattish to slightly positive consolidated volume outlook, navigating challenges such as the excise tax increase in Mexico.

- The company successfully priced a MXN 10 billion bond issuance in February 2026 to strengthen its financial position and extend its debt maturity profile.

- Working capital is expected to normalize from Q1 2026, following a significant outflow in Q4 2025 due to accounts payable related to ERP implementation delays in Q4 2024.

- Coca-Cola FEMSA reported Q4 2025 consolidated total revenues of Ps. 77,750 million, a 2.9% increase year-over-year, with operating income growing 13.3% to Ps. 13,702 million and Adjusted EBITDA increasing 12.8% to Ps. 18,169 million.

- For Q4 2025, consolidated volume increased by 1.3% to 1,093.6 million unit cases and transactions grew 1.9% to 6,566.5 million.

- The company successfully priced Ps. 10,000 million in bonds in the Mexican market on February 12, 2026, including a Ps. 7,000 million 10-year fixed-rate tranche at 9.12% and a Ps. 3,000 million 3-year variable-rate tranche at Funding TIIE + 0.38%.

- Coca-Cola FEMSA paid the fourth installment of its ordinary dividend on December 9, 2025, amounting to Ps. 0.23 per share for a total cash distribution of Ps. 3,819.6 million.

- The company achieved strong sustainability performance in 2025, with its S&P Global Corporate Sustainability Assessment score increasing by 11 points to an all-time high of 81, resulting in its inclusion in the 2026 Sustainability Yearbook as the highest-scoring company in its sector in the Americas.

- Coca-Cola FEMSA successfully priced Ps. $10,000 million in bonds in the Mexican market on February 12, 2026.

- The issuance included a Ps. $7,000 million 10-year fixed-rate tranche at 9.12% and a Ps. $3,000 million 3-year variable-rate tranche at Funding TIIE + 0.38%.

- The transaction was 3.84x oversubscribed and received the highest national credit ratings of ‘mxAAA’ from S&P Global Ratings and ‘AAA.mx’ from Moody’s Local MX.

- Proceeds from the bond placement will be used for general corporate purposes, including debt refinancing.

- Coca-Cola FEMSA reported Q3 2025 consolidated revenues grew 3.3% to MXN 71.9 billion (4.7% currency-neutral), with operating income increasing 6.8% to MXN 10.3 billion and adjusted EBITDA up 3.2% to MXN 14.4 billion. Consolidated volume declined 0.6% to 1,040 million unit cases.

- Mexico's volumes declined 3.7% in Q3 2025, and the company anticipates a challenging 2026 for volume performance in Mexico due to an approved 87% increase in the excise tax on soft drinks and a new tax on non-caloric formulas, effective January 2026.

- In response to the expected volume decline in Mexico and to navigate challenging conditions, Coca-Cola FEMSA is revising its CapEx investment levels, specifically pushing out some projects like new distribution centers by two years.

- The company has proactively hedged over 90% of its sweetener needs and 40% of PET for 2026, and has also hedged currencies in Colombia (70%), Mexico (40%), and Brazil (20%) for the same period.

- Coca-Cola FEMSA reported Q3 2025 adjusted EBITDA increased 3.2% to MXN 14.4 billion, with majority net income rising to MXN 5.9 billion.

- In Mexico, Q3 2025 volumes declined 2.7% to 612.1 million unit cases and revenues decreased 0.2% to MXN 42.5 billion, attributed to a soft macroeconomic backdrop.

- The Mexican House of Representatives approved an 87% increase in the excise tax on sugary soft drinks (from MXN 1.64 to MXN 3.08 per liter) and a new MXN 1.50 per liter tax on non-caloric formulas, effective January 2026, which is expected to lead to a challenging year for volume performance in Mexico in 2026.

- South America volumes grew 2.6% to 423 million unit cases in Q3 2025, with revenues increasing 8.7% to MXN 29.4 billion.

- The company is delaying CapEx for distribution centers in Mexico by two years due to the anticipated volume contraction from the new excise tax.

- For Q3 2025, Coca-Cola FEMSA's Adjusted EBITDA increased 3.2% to $14.4 billion pesos, with the EBITDA margin remaining flat at 20.1%. Majority net income slightly increased to $5.9 billion pesos, partially driven by a one-time income of $218 million pesos from insurance claims recovered in Brazil.

- The Mexican House of Representatives approved an 87% increase in the excise tax on soft drinks (from $1.64 to $3.08 per liter) and a new excise tax on non-caloric formulas of $1.50 per liter, effective January 2026, pending Senate approval. This is expected to result in a low to mid-single-digit volume decline in Mexico for 2026, even after accounting for factors like the World Cup.

- While Mexico volumes declined 3.7% , other key markets showed growth: Guatemala volumes increased 3.2% , Brazil volumes grew 2.6% , Colombia volumes grew 2.9% , and Argentina volumes increased 2.9%. The company is leveraging affordability initiatives, price-pack architecture adjustments, and digital enablers like Juntos Plus to drive share and volume, particularly for non-caloric options such as Coca-Cola Zero, which saw significant growth across regions.

- Coca-Cola FEMSA is rethinking its CAPEX for 2026, delaying some investments, particularly in Mexico, due to anticipated volume declines from the new excise tax. The company also plans to address its inefficient capital structure in 2026, evaluating the tax's implications on cash flow projections.

- Coca-Cola FEMSA reported a 3.2% increase in adjusted EBITDA to $14.4 billion pesos and a slight increase in majority net income to $5.9 billion pesos for Q3 2025, which included a $218 million pesos one-time income from insurance claims recovered in Brazil.

- In Mexico, volumes declined 3.7% in Q3 2025, contributing to a 0.2% decrease in revenues to $42.5 billion pesos and a 1.4% decline in adjusted EBITDA for the division.

- South America volumes increased 2.6% to 423 million unit cases, with revenues growing 8.7% to $29.4 billion pesos and adjusted EBITDA increasing 12.6%.

- The Mexican House of Representatives approved an 87% increase in the excise tax on soft drinks and a new excise tax on non-caloric formulas, effective January 2026, which is expected to lead to a low to mid-single-digit volume decline in Mexico for 2026.

- In response to the anticipated volume decline, the company is adjusting its CAPEX investment levels, delaying projects like new distribution centers, and expects a 5% uplift in relative volumes during the 2026 World Cup months.

- For the third quarter of 2025, Coca-Cola FEMSA reported a 3.3% increase in total revenues to Ps. 71,884 million and a 6.8% increase in operating income to Ps. 10,291 million. Majority net income grew by 0.7%, resulting in Ps. 0.35 earnings per share.

- Volume declined 0.6% to 1,035.0 million unit cases in Q3 2025, primarily driven by decreases in Mexico and Panama, though partially offset by growth in several South American and Central American territories.

- The company highlighted a challenging operating environment, particularly in Mexico, and noted the Mexican House of Representatives' approval of an increase in the excise tax on sugar-sweetened beverages and a new tax on non-caloric sweeteners, which is awaiting Senate approval.

- On October 15, 2025, Coca-Cola FEMSA paid the third installment of its ordinary dividend, totaling Ps. 0.23 per share.

Quarterly earnings call transcripts for COCA COLA FEMSA SAB DE CV.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more