Earnings summaries and quarterly performance for LANDSTAR SYSTEM.

Executive leadership at LANDSTAR SYSTEM.

Frank A. Lonegro

President and Chief Executive Officer

Aimee M. Cooper

Vice President and Chief Administrative Officer

James M. Applegate

Vice President and Chief Corporate Sales, Strategy and Specialized Freight Officer

James P. Todd

Vice President and Chief Financial Officer

Joseph J. Beacom

President, Landstar System Holdings, Inc. and Agent-Based Operating Subsidiaries

Matthew M. Dannegger

Vice President and Chief Field Sales Officer

Matthew Miller

Vice President and Chief Safety and Operations Officer

Michael K. Kneller

Vice President, General Counsel and Secretary

Ricardo S. Coro

Vice President and Chief Information Officer

Board of directors at LANDSTAR SYSTEM.

Anthony J. Orlando

Director

Barr Blanton

Director

David G. Bannister

Director

Diana M. Murphy

Non-Executive Chair of the Board

George P. Scanlon

Director

Homaira Akbari

Director

James L. Liang

Director

Melanie Housey Hart

Director

Teresa L. White

Director

Research analysts who have asked questions during LANDSTAR SYSTEM earnings calls.

Scott Group

Wolfe Research

6 questions for LSTR

Jonathan Chappell

Evercore ISI

5 questions for LSTR

Stephanie Moore

Jefferies

5 questions for LSTR

Jason Seidl

TD Cowen

4 questions for LSTR

Brian Ossenbeck

JPMorgan Chase & Co.

3 questions for LSTR

Daniel Imbro

Stephens Inc.

3 questions for LSTR

Elliot Alper

TD Cowen

3 questions for LSTR

Andrew Cox

Stifel

2 questions for LSTR

Bascome Majors

Susquehanna Financial Group

2 questions for LSTR

Brandon Oglenski

Barclays

2 questions for LSTR

J. Bruce Chan

Stifel

2 questions for LSTR

Jizong Chan

Stifel

2 questions for LSTR

Jordan Alliger

Goldman Sachs

2 questions for LSTR

Paul Stoddard

Goldman Sachs

2 questions for LSTR

Reed Seay

Stephens Inc.

2 questions for LSTR

Andrew Baxter Cox

Stifel, Nicolaus & Company, Incorporated

1 question for LSTR

Bascomee Majors

Susquehanna

1 question for LSTR

David Hicks

Raymond James

1 question for LSTR

David Zazula

Barclays

1 question for LSTR

Madison

Morgan Stanley

1 question for LSTR

Paul Stauder

Goldman Sachs

1 question for LSTR

Peter Sullivan

Jefferies

1 question for LSTR

Ravi Shanker

Morgan Stanley

1 question for LSTR

Thomas Wadewitz

UBS

1 question for LSTR

Recent press releases and 8-K filings for LSTR.

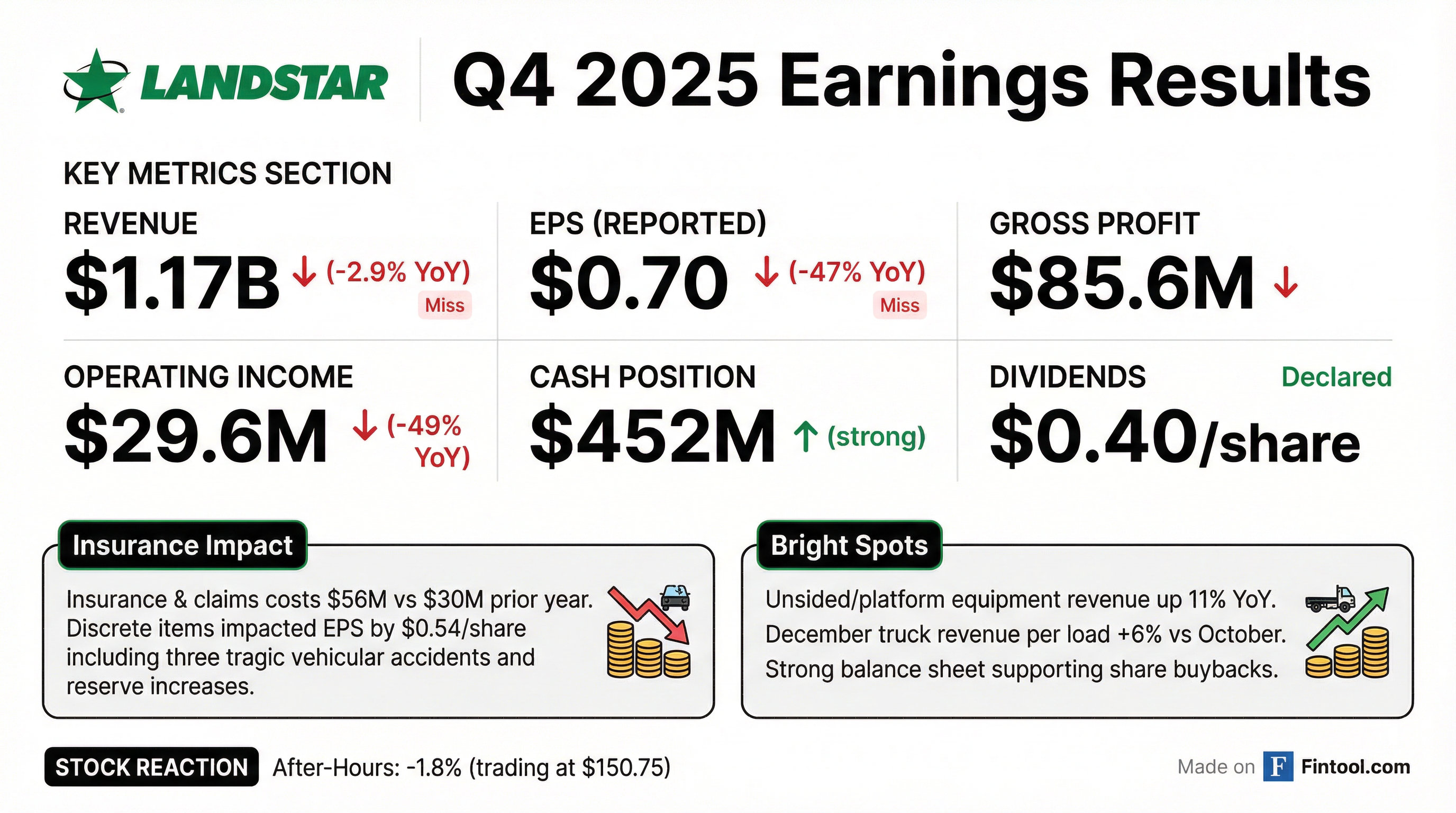

- Landstar's transportation logistics segment revenue for Q4 2025 decreased 2.9% year-over-year, with gross profit falling to $85.6 million from $109.4 million in Q4 2024.

- Insurance and claim costs significantly impacted Q4 2025, rising to $56.1 million from $30.1 million in Q4 2024, primarily due to vehicular accidents, a broker liability judgment, and increased IBNR reserves.

- Heavy haul revenue was a strong performer, increasing 23% year-over-year in Q4 2025 and setting a new annual record of $569 million for fiscal year 2025.

- The company returned approximately $261 million through share repurchases and $245 million in cash dividends over the last two years.

- Landstar is heavily investing in AI, dedicating approximately 50% of its 2026 IT CapEx budget to AI enablement and solutions to enhance agent and BCO efficiency and support.

- Landstar reported Q4 2025 gross profit of $85.6 million with a 7.3% gross profit margin, compared to $109.4 million and 9% in Q4 2024, respectively. Total revenue for Q4 2025 decreased approximately 1% year-over-year, excluding the sale of Landstar Metro and a prior agent fraud matter.

- Heavy haul revenue grew 23% year-over-year to $170 million in Q4 2025, contributing to a record $569 million for fiscal year 2025.

- Insurance and claim costs significantly increased to $56.1 million in Q4 2025 from $30.1 million in Q4 2024, driven by $11 million from vehicular accidents, a $5.7 million broker liability judgment, and a $5.3 million increase in claim reserves.

- Approximately 50% of the IT CapEx budget for 2026 is allocated to AI enablement and solutions, with AI being integrated into pricing, BCO retention, and fraud detection.

- Over the last two years, Landstar returned approximately $261 million to shareholders via share repurchases and $245 million in cash dividends.

- For Q4 2025, Landstar's total revenue decreased approximately 1% year-over-year (excluding the sale of Landstar Metro and a previously disclosed agent fraud matter), with truck transportation revenue remaining nearly flat. Gross profit was $85.6 million, down from $109.4 million in Q4 2024, resulting in a gross profit margin of 7.3%.

- Insurance and claim costs significantly impacted Q4 2025 results, rising to $56.1 million from $30.1 million in Q4 2024, primarily due to $11 million for vehicular accidents, a $5.7 million broker liability judgment, and a $5.3 million increase in actuarially determined claim reserves.

- Landstar is making a significant strategic investment in technology, dedicating approximately 50% of its IT CapEx budget for 2026 to AI enablement and solutions to enhance support for its network and drive efficiency.

- The company saw an eighth consecutive quarter of improvement in BCO (Business Capacity Owner) turnover, which dropped from 34.5% at fiscal year-end 2024 to 31.4% at the end of Q4 2025. BCO utilization also increased 8% in Q4 2025 compared to Q4 2024.

- Landstar continued its strong capital return program, with approximately $261 million returned to shareholders through share repurchases and $245 million in cash dividends over the last two years. In fiscal 2025, $125 million was paid in dividends and approximately $180 million in share repurchases.

- Landstar reported Q4 2025 revenue of $1,174.5 million, a 2.9% decrease from Q4 2024, with earnings per share of $0.70, down 46.6%.

- Operating income and EPS were negatively impacted by a challenging insurance and claims environment, including discrete insurance items of $0.49 per share, and an additional Metro impairment of $0.05 per share.

- The company continued to return capital to stockholders, with year-to-date share repurchases of $179.9 million and dividends paid of $124.8 million as of Q4 2025.

- Landstar is significantly investing in AI, with AI-related projects accounting for half of its 2026 IT capital budget, aimed at improving productivity, agent and BCO growth, and network retention.

- Landstar System reported total revenue of $1,174 million and basic and diluted earnings per share (EPS) of $0.70 for the 2025 fourth quarter, compared to $1,209 million in revenue and $1.31 in EPS for the 2024 fourth quarter.

- The 2025 fourth quarter EPS was significantly impacted by highly elevated insurance and claims costs of $56 million, an increase from approximately $30 million in the 2024 fourth quarter, reflecting $0.37 per share from three vehicular accidents and $0.12 per share from increased actuarially determined claim reserves.

- The company also recorded $2.1 million of additional non-cash impairment charges, or $0.05 per share, related to the sale process of its Mexican operating subsidiary, Landstar Metro.

- Landstar returned capital to stockholders by purchasing 286,695 shares of common stock at an aggregate cost of $37.0 million during the 2025 fourth quarter and declared a quarterly dividend of $0.40 per share.

- Landstar System reported total revenue of $1,174 million and basic and diluted earnings per share (EPS) of $0.70 for the 2025 fourth quarter, compared to $1,209 million and $1.31, respectively, in the 2024 fourth quarter.

- The 2025 fourth quarter EPS reflected highly elevated insurance and claims costs of $56 million, an increase from approximately $30 million in the 2024 fourth quarter, and $2.1 million of additional non-cash impairment charges.

- Despite continued tough macro demand conditions in the freight transportation market, fourth quarter truck transportation revenue was nearly flat year over year, though the decrease in total revenue was primarily attributable to decreased ocean revenue.

- The company returned capital to stockholders, purchasing 286,695 shares of its common stock at an aggregate cost of $37.0 million during the 2025 fourth quarter and declaring a quarterly dividend of $0.40 per share payable on March 11, 2026.

- Landstar System, Inc. (LSTR) reported preliminary Q4 2025 total revenue of $1,174 million and basic and diluted earnings per share (EPS) of $0.70, compared to $1,209 million revenue and $1.31 EPS in Q4 2024.

- The Q4 2025 results were adversely impacted by highly elevated insurance and claims costs totaling $56 million, which included $22.0 million ($0.49 per share) of discrete items.

- These discrete items comprise $11.0 million ($0.24 per share) for two vehicular accidents, $5.7 million ($0.13 per share) due to adverse development in the Cabral Matter, and $5.3 million ($0.12 per share) from increased actuarially determined claim reserves.

- The company also recorded $2.1 million ($0.05 per share) in non-cash impairment charges related to the sale of its Mexican operating subsidiary.

- Landstar expects to report Q4 2025 operating income of $30 million and held approximately $452 million in cash and short-term investments as of December 27, 2025.

- Landstar reported Q3 2025 revenue of $1,205.4 million, a 0.7% decrease compared to Q3 2024.

- GAAP operating income for Q3 2025 was $26.3 million, down 58.3% year-over-year. Adjusted operating income, which excludes non-cash impairment charges, was $56.4 million, representing a 10.6% decrease from Q3 2024.

- GAAP earnings per share (EPS) for Q3 2025 were $0.56, a 60.3% decline from Q3 2024. Adjusted EPS, excluding non-cash impairment charges, was $1.22, down 13.5%.

- Year-to-date Q3 2025, the company generated $152.2 million in cash flow from operations and $144.5 million in free cash flow. Landstar returned capital to stockholders through $143.2 million in share repurchases and $111.1 million in dividends paid.

- The company highlighted strong performance in services hauled by unsided/platform equipment and reported sequential growth in BCO truck count, marking the best performance since Q1 2022.

- Landstar System Incorporated (LSTR) reported Q3 2025 revenue decreased approximately 1% year over year, but increased approximately 1% when adjusted for the planned sale of Landstar Metro and a prior agent fraud matter.

- Q3 2025 financial results included $30.1 million in discrete, non-cash, non-recurring charges, or $0.66 per basic and diluted share, primarily due to the decision to actively market Landstar Metro for sale.

- The heavy haul service offering posted a strong quarter with revenue increasing 17% year over year to approximately $147 million in Q3 2025.

- The number of trucks provided by BCO independent contractors saw its first sequential growth since Q1 2022 in Q3 2025, increasing by seven trucks, despite a 5% year-over-year decrease in BCO truck count.

- For Q4 2025, October truck volumes were approximately 3% below October 2024, and revenue per load was approximately equal to 2024, both trending below normal seasonality.

- Landstar System Incorporated reported Q3 2025 GAAP EPS of $0.56 and adjusted EPS of $1.22, after accounting for $30.1 million in non-cash, non-recurring impairment charges.

- Overall company revenue decreased 1% year over year; however, excluding the revenue contribution from Landstar Metro and a prior agent fraud matter, total revenue increased approximately 1% year over year.

- The company experienced strong performance in its unsighted platform equipment business, with heavy haul revenue increasing 17% year over year to $147 million in Q3 2025.

- Despite challenging freight conditions, the number of BCO independent contractors increased sequentially in Q3 2025 for the first time since Q1 2022, and the trailing 12-month truck turnover rate dropped to 31.5%.

- Landstar continued its capital allocation strategy, deploying approximately $143 million for share repurchases and declaring a $0.40 dividend during the first nine months of 2025.

Quarterly earnings call transcripts for LANDSTAR SYSTEM.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more