Earnings summaries and quarterly performance for ManpowerGroup.

Executive leadership at ManpowerGroup.

Board of directors at ManpowerGroup.

Elizabeth P. Sartain

Director

Jean-Philippe Courtois

Director

John F. Ferraro

Director

Julie M. Howard

Director

Michael J. Van Handel

Director

Muriel Pénicaud

Director

Paul Read

Director

Ulice Payne, Jr.

Director

William P. Gipson

Director

Research analysts who have asked questions during ManpowerGroup earnings calls.

Joshua Chan

UBS Group AG

6 questions for MAN

Kartik Mehta

Northcoast Research

6 questions for MAN

Mark Marcon

Baird

6 questions for MAN

Trevor Romeo

William Blair

6 questions for MAN

Andrew Steinerman

JPMorgan Chase & Co.

5 questions for MAN

Tobey Sommer

Truist Securities, Inc.

5 questions for MAN

Stephanie Moore

Jefferies

4 questions for MAN

George Tong

Goldman Sachs

3 questions for MAN

Keen Fai Tong

Goldman Sachs Group Inc.

3 questions for MAN

Princy Thomas

Barclays

3 questions for MAN

Ronan Kennedy

Barclays

2 questions for MAN

Andy Grobler

BNP Paribas

1 question for MAN

Manav Patnaik

Barclays

1 question for MAN

Ryan Griffin

BMO Capital Markets

1 question for MAN

Tyler Barishaw

Truist Securities

1 question for MAN

Recent press releases and 8-K filings for MAN.

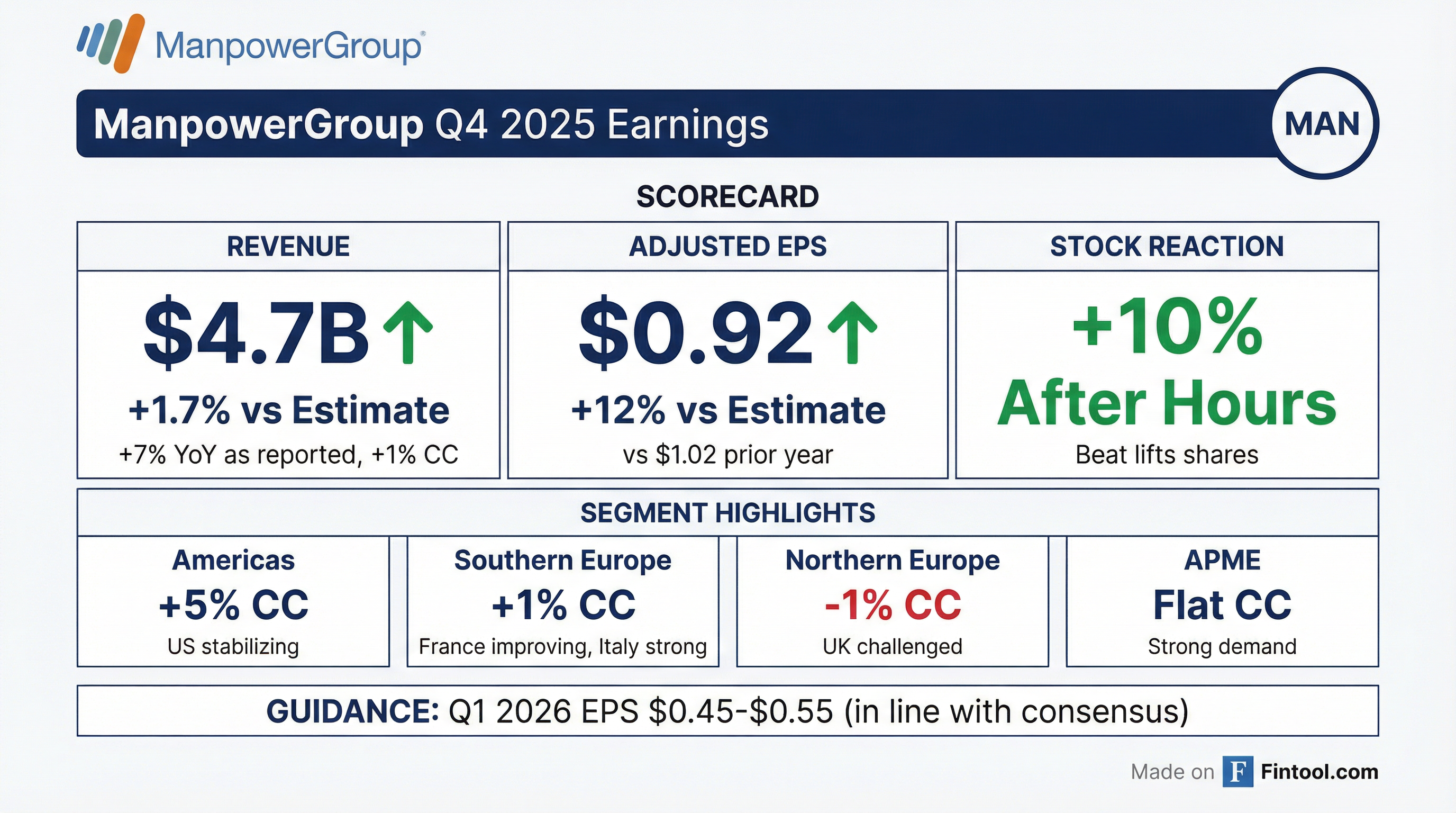

- ManpowerGroup reported Q4 2025 revenue of $4.7 billion (systemwide $5.1 billion) and adjusted EPS of $0.92.

- For the full year 2025, the company achieved revenue of $18.0 billion (systemwide $19.5 billion) and adjusted EPS of $2.97.

- The company noted solid Q4 performance driven by broad-based market stabilization and achieved sequential improvement in revenue growth and profitability throughout 2025.

- Cost-out initiatives led to a 4% constant currency year-over-year reduction in SG&A during Q4 2025.

- For Q1 2026, ManpowerGroup expects total revenue to be up 6-10% (down 1% / up 3% CC) and projects EPS between $0.45 and $0.55.

- ManpowerGroup reported Q4 2025 revenues of $4.7 billion with 2% Organic Constant Currency growth and an Adjusted EBITDA margin of 2.1%. Full-year adjusted EPS was $2.97, a 38% constant currency decrease.

- The company noted a clear shift to stabilization in Q4, with sequential improvement in demand across key markets, including 1% growth in Southern Europe after 13 consecutive quarters of decline.

- ManpowerGroup maintained cost discipline, achieving a 4% constant currency reduction in SG&A in Q4, and reiterated its long-term EBITDA margin goal of 4.5%-5%.

- Strategic initiatives include leveraging AI and completing 87% of PowerSuite front office revenue implementation to drive productivity and enhance client/candidate experience.

- ManpowerGroup reported Q4 2025 revenues of $4.7 billion, a 7% increase from the prior year, with net earnings of $0.64 per diluted share and adjusted earnings per share of $0.92.

- For the full year 2025, revenues reached $18.0 billion, a 0.6% increase, resulting in a net loss of $0.29 per diluted share, but adjusted earnings per share of $2.97.

- The company anticipates Q1 2026 diluted earnings per share to be between $0.45 and $0.55.

- Operational improvements include ongoing market stabilization in North America and Europe, strong demand in Latin America and Asia Pacific, and cost actions leading to a 4% constant currency year-over-year reduction in SG&A during Q4.

- ManpowerGroup refinanced a €500 million Euro Note and reset its revolving credit facility, maintaining a net Debt-to-EBITDA ratio of 2.78 to 1 as of December 31, 2025.

- ManpowerGroup reported Q4 2025 revenues of $4.7 billion, a 7% increase year-over-year, with diluted earnings per share of $0.64 and adjusted diluted earnings per share of $0.92. For the full year 2025, revenues were $18.0 billion, a 1% increase, resulting in a net loss of $13.3 million and adjusted diluted EPS of $2.97.

- The company observed ongoing stabilization across North America and Europe, including sequential improvement in France and market-leading growth in Italy, while Latin America and Asia Pacific showed continued strong demand.

- In Q4 2025, the gross profit margin was 16.3%, and cost actions drove sequential improvement in the year-over-year selling, general, and administrative (SG&A) expense decrease.

- ManpowerGroup generated $179 million in cash provided by operating activities during Q4 2025 and refinanced its €500 million Euro Note and reset its revolving credit facility for a new 5-year period.

- For Q1 2026, diluted earnings per share are anticipated to be between $0.45 and $0.55.

- On December 15, 2025, ManpowerGroup Inc. issued €500 million aggregate principal amount of 3.750% notes due December 13, 2030.

- The net proceeds of approximately €497.395 million from these new notes will be used to redeem its €500 million 1.750% notes due June 22, 2026.

- The new notes are senior unsecured obligations, offered at an issue price of 99.839% of the aggregate principal amount, with interest payable annually on December 13th.

- The company also entered into a Credit Agreement with an initial Aggregate Commitment of $600,000,000.

- ManpowerGroup's latest Employment Outlook Survey for Q1 2026 indicates a global Net Employment Outlook (NEO) of 24%, which is a 4% decrease year-over-year but a 4% increase from the previous quarter.

- 40% of organizations plan to increase staff, while an equal 40% intend to maintain current headcount, and 16% expect workforce reductions.

- Economic conditions are the primary driver for hiring caution, with 29% of employers citing economic challenges for headcount reductions, rather than automation.

- The weakest Outlook of 21% is reported by organizations with 5,000+ employees, while mid-sized companies (250–999 employees) are the most optimistic at 28%.

- Regionally, Asia Pacific leads with a 30% Outlook, and the Finance & Insurance sector reports the most optimistic hiring plans at 32%.

- ManpowerGroup Inc. reported Q3 2025 revenue of $4.6 billion, EPS of $0.83, and an EBITA margin of 2.1%, while experiencing a challenging environment across Europe and North America since 2023.

- As of September 30, 2025, the company maintained a solid balance sheet with $275 million in cash, $2,011 million in total debt, and a total debt-to-total capitalization of 38%.

- The semi-annual dividend was reduced to $0.72 per share (declared May 2, 2025) in 2025 to reflect the current staffing services environment, with a current yield of 4.1% based on the October 16, 2025 price.

- The company repurchased 0.7 million shares in 2025 and has 1.9 million shares remaining authorized for repurchase under the August 2023 authorization.

- ManpowerGroup targets an EBITA margin of 4.5% - 5.0% and a Return on Invested Capital (ROIC) of 15%, with anticipated elevated restructuring charges over the next two years to drive significant cost reductions.

- ManpowerGroup reported Q3 2025 revenue of $4.6 billion, a 2% decrease year over year in constant currency, but achieved a return to organic constant currency revenue growth after 11 consecutive quarters of declines.

- Adjusted earnings per diluted share was $0.83, a 39% decrease year over year in constant currency, with adjusted EBITDA at $96 million and an adjusted EBITDA margin of 2.1%.

- The company observed stabilization in demand across North America and Europe, with the Manpower brand showing growth in several regions and early signs of stabilization in Experis's professional and IT hiring. Talent Solutions' managed service provider offering also saw strong revenue growth.

- Geographically, the Americas segment revenue increased 6% in constant currency, and the Asia-Pacific Middle East (APME) segment revenue increased 8% in organic constant currency, driven by strong performance in Japan. AI investments, particularly Sophy AI, are contributing to new client revenue, with approximately 30% of new client revenue derived from AI-rated probability.

- For Q4 2025, ManpowerGroup anticipates SG&A leverage to significantly impact EBITDA, reflecting disciplined cost control and efficiency improvements, aiming for a relatively stable EBITDA level from Q3 to Q4.

- ManpowerGroup reported Q3 2025 revenue of $4.6 billion, a 2% decrease year-over-year in constant currency. However, the company achieved 0.5% organic days adjusted constant currency revenue growth, marking a return to growth after eleven consecutive quarters of declines.

- Adjusted EBITDA for Q3 2025 was $96 million (2.1% margin), a 22% decrease in constant currency, and adjusted diluted EPS was $0.83, down 39% year-over-year in constant currency.

- For Q4 2025, the company forecasts EPS between $0.78 and $0.88 and expects constant currency revenue to range from a 2% decrease to a 2% increase, with the midpoint being flat.

- The Manpower brand grew 3% organically in constant currency, driven by stabilization in North America and Europe. The company's AI-enabled data insights are contributing to new client revenue, with approximately 30% derived from AI-rated probability, and it anticipates SG&A leverage to positively impact Q4 EBITDA due to cost control actions.

- ManpowerGroup reported Q3 2025 revenue of $4.6 billion, an increase of 2% as reported, but a decrease of 2% in constant currency.

- Adjusted diluted earnings per share (EPS) for Q3 2025 was $0.83, a 36% decrease from the prior year.

- The company returned to organic constant currency revenue growth in Q3 2025, ending a streak of 11 consecutive quarters of declines.

- For Q4 2025, ManpowerGroup anticipates EPS between $0.78 and $0.88, with total revenue projected to be up 3-7% (down 2% / up 2% CC).

- As of September 30, 2025, total debt was $1,216 million and net debt was $941 million, with a Net Debt-to-EBITDA ratio of 3.18 to 1.

Quarterly earnings call transcripts for ManpowerGroup.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more