Earnings summaries and quarterly performance for MONRO.

Executive leadership at MONRO.

Peter Fitzsimmons

President and Chief Executive Officer

Brian D’Ambrosia

Executive Vice President — Finance, Chief Financial Officer, Treasurer and Assistant Secretary

Cindy Donovan

Senior Vice President — Chief Information Officer

Maureen Mulholland

Executive Vice President — Chief Legal Officer and Secretary

Nicholas Hawryschuk

Senior Vice President — Operations

Board of directors at MONRO.

Research analysts who have asked questions during MONRO earnings calls.

Bret Jordan

Jefferies

6 questions for MNRO

David Lantz

Wells Fargo & Company

6 questions for MNRO

Brian Nagel

Oppenheimer & Co. Inc.

5 questions for MNRO

Thomas Wendler

Stephens Inc.

4 questions for MNRO

Tom Wendler

Stephens Inc.

2 questions for MNRO

John Healy

Northcoast Research

1 question for MNRO

Seth Basham

Wedbush Securities

1 question for MNRO

Recent press releases and 8-K filings for MNRO.

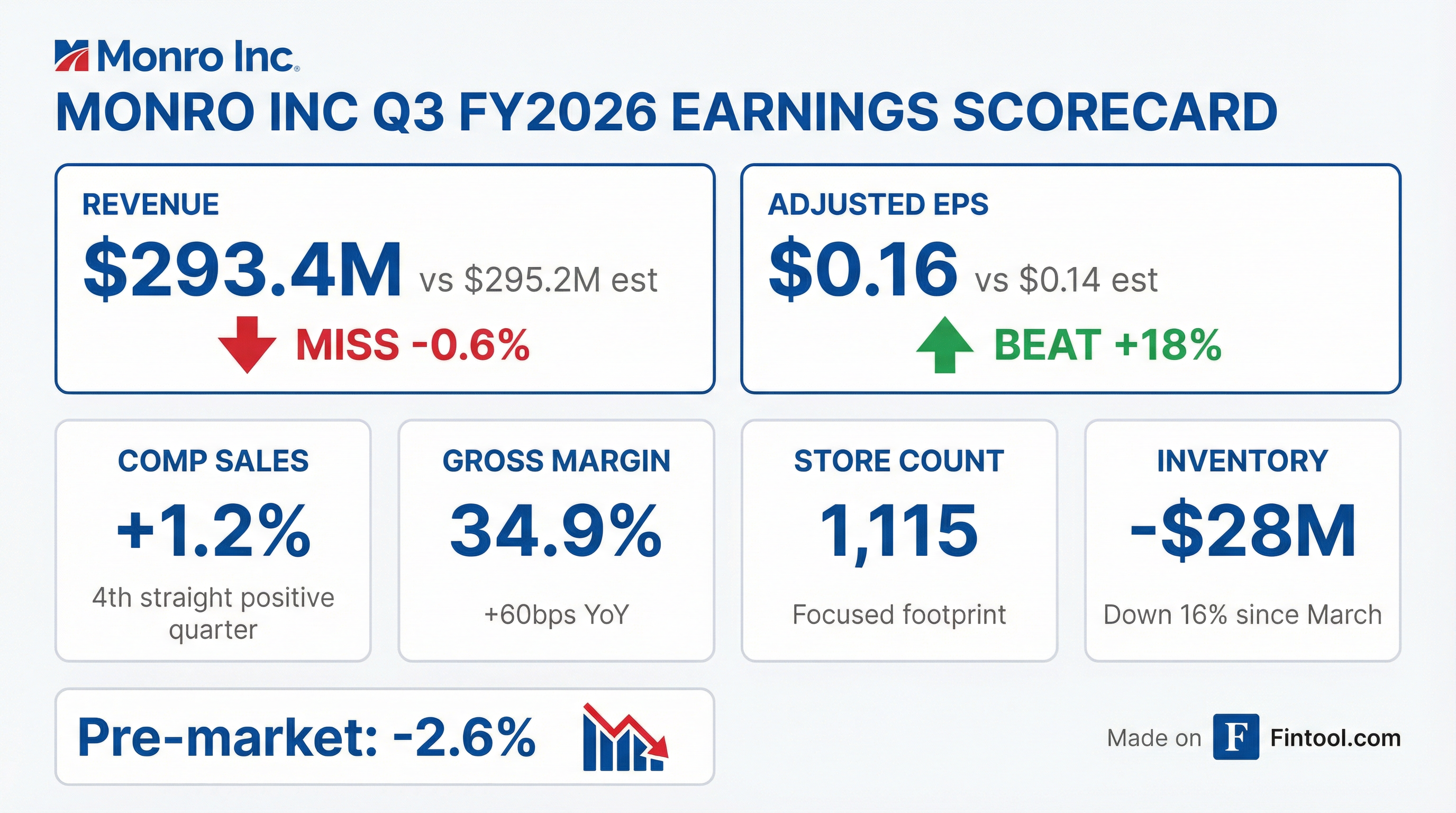

- Monro Inc. reported Q3 Fiscal 2026 sales of $293.4 million, a 4% decrease year-over-year, primarily due to the closure of 145 underperforming stores. However, comparable store sales from continuing locations increased by 1.2%, marking the fourth consecutive quarter of positive comps.

- The company achieved a 60 basis point expansion in gross margin year-over-year, reaching 34.9% in Q3 2026, driven by lower material and occupancy costs. Net income for the quarter was $11.1 million, with diluted earnings per share of $0.35.

- Monro generated $17.3 million in proceeds during Q3 2026 from exiting 32 leases and selling 20 owned locations as part of its real estate disposition plan, bringing the fiscal year-to-date total to $22.8 million.

- For the full fiscal year 2026, the company anticipates year-over-year comparable store sales growth and expects its gross margin to be consistent with fiscal 2025.

- Monro Inc. reported Q3 fiscal 2026 sales of $293.4 million, a 4% decrease primarily due to store closures, but achieved a 1.2% increase in comparable store sales from continuing locations.

- The company's gross margin expanded 60 basis points year-over-year to 34.9%, and diluted earnings per share (EPS) rose to $0.35 for the quarter.

- Monro generated $17.3 million in Q3 from the disposition of 32 leases and 20 owned locations, bringing fiscal year-to-date cumulative proceeds to $22.8 million from 57 leases and 25 locations.

- For fiscal 2026, the company continues to expect year-over-year comparable store sales growth and a full-year gross margin consistent with fiscal 2025.

- Monro reported Q3 Fiscal 2026 sales of $293.4 million and adjusted diluted EPS of $0.16.

- The company achieved 1.2% comparable store sales growth in Q3 FY26, marking its fourth consecutive quarter of positive comparable sales.

- Gross margin expanded 60 basis points year-over-year to 34.9% in Q3 FY26.

- Year-to-date fiscal 2026, Monro received $22.8 million in cumulative proceeds from exiting 57 leases and selling 25 owned locations, following the closure of 145 underperforming stores.

- For fiscal 2026, the company continues to expect year-over-year comparable store sales growth and anticipates the store optimization plan will reduce total sales by approximately $45 million.

- Monro Inc. reported Q3 Fiscal 2026 sales decreased 4% to $293.4 million, primarily due to the closure of 145 underperforming stores, but achieved a 1.2% increase in comparable store sales from continuing locations, marking its fourth consecutive quarter of positive comps.

- The company's gross margin expanded 60 basis points year-over-year to 34.9%, while net income rose to $11.1 million and diluted earnings per share reached $0.35.

- Monro continued its real estate disposition efforts, exiting 32 leases and selling 20 owned locations in Q3, generating $17.3 million in proceeds, contributing to fiscal year-to-date cumulative proceeds of $22.8 million.

- Inventory levels were reduced by over $7 million in Q3, resulting in an overall reduction of more than $28 million (16%) since the end of March.

- For the full fiscal year 2026, Monro anticipates year-over-year comparable store sales growth and a gross margin consistent with fiscal 2025.

- For the third quarter ended December 27, 2025, Monro, Inc. reported a 4.0% decrease in sales to $293.4 million, though comparable store sales increased 1.2%.

- Net income increased 143.1% to $11.1 million, and diluted earnings per share rose to $.35 for the third quarter of fiscal 2026.

- For the first nine months of fiscal 2026, sales decreased 1.9% to $883.3 million, while comparable store sales increased 2.6%.

- The company distributed a cash dividend of $.28 per share for the third quarter of fiscal 2026.

- Monro, Inc. is not providing fiscal 2026 financial guidance at this time.

- Monro, Inc. reported a 4.0% decrease in sales to $293.4 million for the third quarter of fiscal 2026, primarily due to the closure of 145 underperforming stores, partially offset by a 1.2% increase in comparable store sales.

- Diluted earnings per share for the third quarter of fiscal 2026 was $.35, while adjusted diluted earnings per share was $.16.

- Gross margin expanded 60 basis points year-over-year to 34.9% in the third quarter of fiscal 2026, mainly due to lower material and occupancy costs.

- The company distributed a cash dividend of $.28 per share for the third quarter of fiscal 2026.

- Monro closed 145 underperforming stores by the end of May, with inventory moved by the end of June. The monetization of real estate from 24 locations (21 lease, 3 owned) generated approximately $5.5 million in proceeds.

- The company implemented a new digital marketing approach starting in July, which has been rolled out to approximately two-thirds of its stores by November. This strategy has driven incremental calls, revenue, and positive comparable store sales, with incremental marketing spend in the back half of FY26 expected to be EPS and net income accretive.

- Monro made key leadership hires, including Kathy Chang as SVP of Merchandising in June and Tim Ferrell as head of marketing in September, to strengthen its merchandising and marketing capabilities.

- A new machine learning-based pricing tool has been developed and implemented to tactically adjust prices by market, resulting in increased unit sales and gross margin dollars.

- The company expects its FY26 gross margin to be consistent with the prior year, with Q2, Q3, and Q4 projected to be higher than the prior year to achieve this full-year target. The focus is on driving gross margin dollars rather than rate.

- MNRO completed the closure of 145 underperforming stores by the end of May and divested 24 locations (21 lease, 3 owned) for $5.5 million in proceeds during the quarter, with the goal of achieving cash flow positive monetization from these closures.

- The company reported its Q2 gross margin rate was approximately 40 basis points higher than the prior year and expects gross margin rates in the mid-30s going forward, anticipating FY26 gross margins to be consistent with the prior year.

- MNRO reduced its overall inventory levels by approximately $21 million, from $180 million to $160 million, over the last two quarters through assortment narrowing and improved vendor relationships. Kathy Chang was hired as SVP of merchandising in early June to lead these efforts.

- A digital marketing approach, launched in July and now covering approximately two-thirds of stores, has driven incremental calls, revenue, positive comparable store sales, and gross margin dollars. Additionally, a new machine learning-based pricing tool has led to increased unit sales and gross margin dollars by tactically adjusting prices across markets.

- Monro (MNRO) closed 145 underperforming stores by the end of May 2025 to improve operating income, divesting 24 locations for approximately $5.5 million in proceeds.

- The company has reduced overall inventory by about $21 million in the last two quarters and expects FY26 gross margin to be consistent with the prior year, with a focus on driving gross margin dollars.

- Monro implemented a new digital marketing approach across approximately two-thirds of its stores, which has resulted in incremental calls, revenue, positive comparable store sales, and increased gross margin dollars.

- A new machine learning-based pricing tool has been developed and implemented, leading to an increase in unit sales and gross margin dollars by tactically adjusting prices based on competitive analysis and elasticity.

- The company anticipates industry tailwinds due to an aging vehicle fleet (average age 12.5 years) and high new car prices, encouraging vehicle maintenance.

- Monro, Inc. (MNRO) approved a limited-duration shareholder rights plan on November 10, 2025, which is set to expire on November 6, 2026.

- This plan was adopted in response to Icahn Enterprises L.P. accumulating nearly 17% beneficial ownership of the Company.

- The rights generally become exercisable if an entity, person, or group acquires 17.5% or more of Monro's outstanding shares.

- Each right entitles the holder to purchase one one-thousandth of a share of Series D Junior Participating Serial Preferred Stock for a purchase price of $90.00.

- The Board retains the option to redeem the rights for $0.01 per right or exchange them for one share of Common Stock per right under specific conditions.

Quarterly earnings call transcripts for MONRO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more