Earnings summaries and quarterly performance for ArcelorMittal.

Research analysts who have asked questions during ArcelorMittal earnings calls.

Tristan Gresser

BNP Paribas

9 questions for MT

Alain Gabriel

Morgan Stanley

8 questions for MT

Bastian Synagowitz

Deutsche Bank AG

8 questions for MT

Ephrem Ravi

Citigroup

7 questions for MT

Boris Bourdet

Kepler Cheuvreux

6 questions for MT

Cole Hathorn

Jefferies Financial Group Inc.

6 questions for MT

Dominic O'Kane

JPMorgan Chase & Co.

6 questions for MT

Andrew Jones

UBS

5 questions for MT

Matt Greene

Goldman Sachs

5 questions for MT

Maxime Kogge

ODDO BHF

5 questions for MT

Timna Tanners

Wolfe Research

5 questions for MT

Tom Zhang

Barclays Capital

5 questions for MT

Max Kogge

ODDO

3 questions for MT

Patrick Mann

Bank of America

3 questions for MT

Philip Gibbs

KeyBanc Capital Markets

3 questions for MT

Reinhardt van der Walt

Bank of America Merrill Lynch

3 questions for MT

Andy Jones

UBS Group

2 questions for MT

Phil Gibbs

Keybanc Capital Markets

2 questions for MT

Alan

Morgan Stanley

1 question for MT

Bastian

Deutsche Bank

1 question for MT

Cole

Jefferies

1 question for MT

Max

Oddo BHF

1 question for MT

Reinhardt

Bank of America

1 question for MT

Tom

Deutsche Bank

1 question for MT

Recent press releases and 8-K filings for MT.

- EDF reported 2025 annual sales of €113.3 billion, EBITDA of €29.3 billion, and net income - Group share of €8.4 billion.

- The company's net financial debt decreased by €2.9 billion to €51.5 billion at year-end 2025, resulting in a NFD/EBITDA ratio of 1.8x.

- Operational performance was strong, driven by a 11.3TWh increase in nuclear power output in France to 373.0TWh in 2025.

- EDF's S&P rating was upgraded to BBB+ stable in January 2026, and the company confirmed its 2027 NFD/EBITDA target of ≤ 2.5x.

- A dividend of €1 billion is proposed for the 2025 financial year.

- ArcelorMittal confirmed a €1.3 billion investment for the construction of an electric arc furnace (EAF) at its Dunkirk steelmaking site in France, marking a significant step in the decarbonisation of its steel production.

- The EAF is scheduled to start operations in 2029 and is expected to produce steel with three times less CO2 compared to a blast furnace, with 50% of the investment supported by Energy Efficiency Certificates.

- The decision was influenced by confidence in recent European Commission regulatory proposals, including the Tariff Rate Quota and Carbon Border Adjustment Mechanism, and a long-term contract with EDF for low-carbon electricity supply.

- Additionally, ArcelorMittal is initiating a new electrical steel production unit in Mardyck, near Dunkirk, with a €500 million investment, which is the group's largest investment in Europe in the last 10 years, excluding decarbonisation projects.

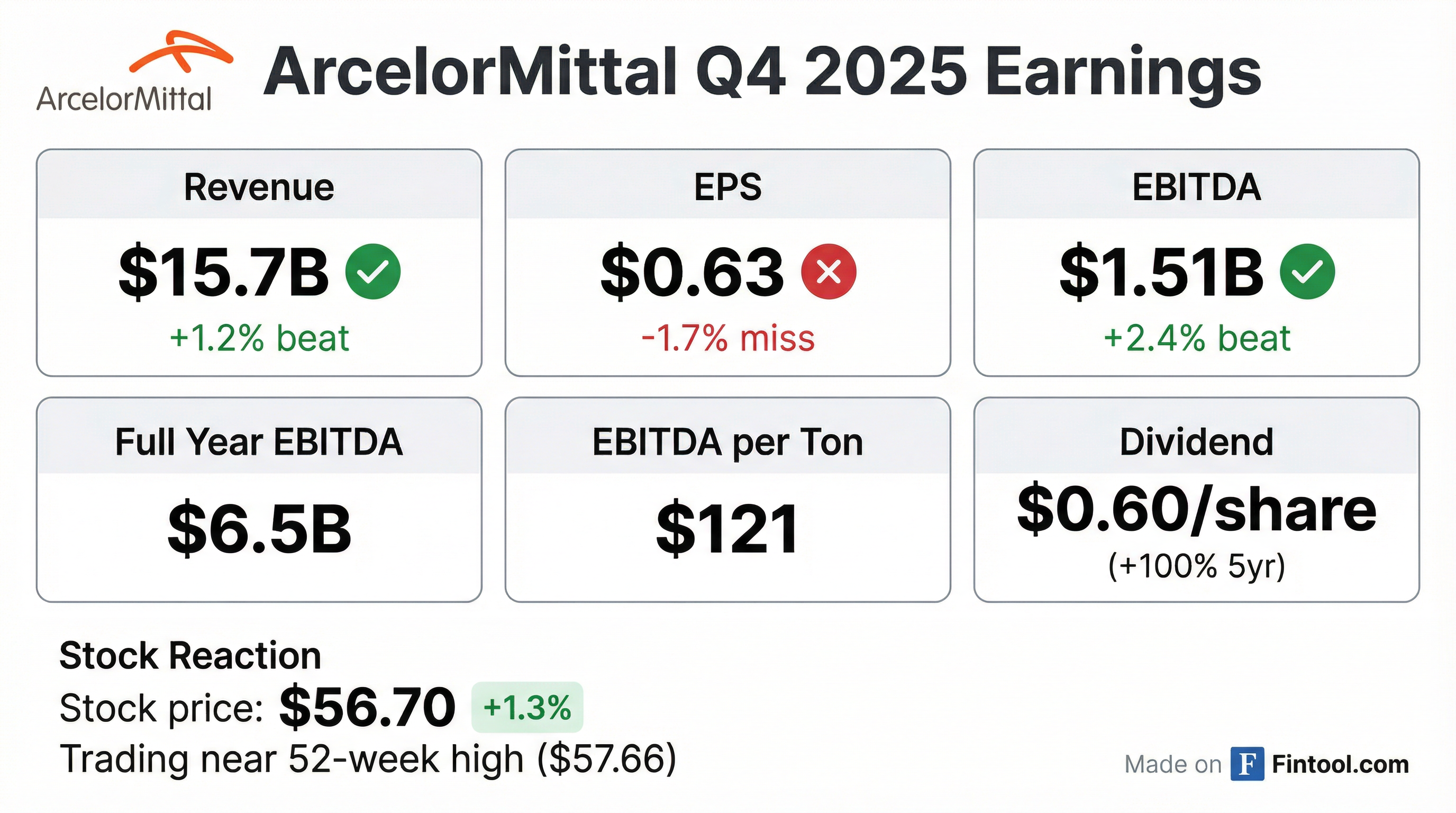

- ArcelorMittal reported $6.5 billion in EBITDA for 2025, equivalent to $121 EBITDA per ton shipped, and generated $1.9 billion in investable cash flow.

- The company allocated $1.1 billion to strategic growth projects and returned $0.7 billion to shareholders in 2025, proposing a base dividend of $0.60 per share and reducing its share count by 38% over five years.

- For 2026, management expects higher steel production and shipments across all regions, supported by operational improvements and strengthened trade protections, with strategic projects contributing $0.7 billion new EBITDA in 2025 and an additional $1.6 billion expected in the near future.

- ArcelorMittal reported $6.5 billion in EBITDA for 2025 and generated $1.9 billion in investable cash flow in 2025, following $2 billion in 2024.

- Strategic projects contributed $0.7 billion to new EBITDA in 2025 and are expected to add an additional $1.6 billion in the near future.

- The company proposed a base dividend of $0.60 per share for 2025, marking a doubling of its dividend over the past five years, and reduced its share count by 38% through buybacks.

- ArcelorMittal maintains its capital allocation framework of returning 50% of free cash flow to shareholders and allocating 50% to growth, with CapEx guidance of $4.5 billion-$5 billion.

- For 2026, the company expects higher steel production and shipments across all regions, supported by operational improvements and strengthened trade protections, including the Carbon Border Adjustment Mechanism (CBAM) in Europe.

- ArcelorMittal reported $6.5 billion in EBITDA and $1.9 billion in investable cash flow for 2025, with strategic projects contributing $0.7 billion in new EBITDA.

- The company proposed a $0.60 per share base dividend and has reduced its share count by 38% over the past five years, maintaining a capital allocation framework of 50% of free cash flow returned to shareholders and 50% for growth.

- A positive outlook for 2026 includes expectations for higher steel production and shipments, continued positive free cash flows, and an additional $1.6 billion of EBITDA from strategic projects in the near future.

- Significant trade policy changes, such as the Carbon Border Adjustment Mechanism (CBAM) and tariff rate quota (TRQ) in Europe, are expected to reset the outlook for the European steel industry, supported by similar efforts in Canada and Brazil. The company is also pursuing economic decarbonization projects in Europe and expanding capacity in India and Liberia.

- ArcelorMittal reported FY 2025 EBITDA of $6.5 billion and net income of $3.2 billion, resulting in basic EPS of $4.13.

- The company generated $1.9 billion in investable cash flow in FY 2025 and ended the year with net debt of $7.9 billion as of December 31, 2025, following credit rating upgrades from Moody's and S&P.

- ArcelorMittal returned $0.7 billion to shareholders in 2025, including the repurchase of 8.8 million shares for $262 million. The Board proposes to increase the annual base dividend to $0.60 per share for FY 2026, to be paid quarterly starting March 2026.

- Strategic growth projects are anticipated to add a further $1.6 billion of EBITDA potential from 2026 onward, with projected capex for 2026 between $4.5 billion and $5.0 billion.

- ArcelorMittal announced the publication of its fourth quarter and full year 2025 sell-side analyst consensus figures on February 3, 2026.

- For Q4 2025, consensus estimates include EBITDA of $1,531 million, net income of $390 million, and earnings per share of $0.51.

- For Full Year 2025, analysts project EBITDA of $6,466 million, net income of $3,321 million, and earnings per share of $4.36.

- These consensus figures are based on estimates from approximately 14 sell-side analysts aggregated by Visible Alpha, and ArcelorMittal is not responsible for their views.

- ArcelorMittal and the Government of Liberia signed an amendment to the Mineral Development Agreement, extending its duration to 2050 with a right to renew for a further 25 years.

- This agreement solidifies ArcelorMittal's long-term mining expansion in Liberia, involving a $1.8 billion expansion project that brings total investment to $3.5 billion.

- The expansion is projected to increase iron ore shipments from approximately 5 million tonnes per annum (mtpa) to 20 mtpa in 2026, with further expansion beyond 20 mtpa under feasibility study.

- ArcelorMittal will pay $200 million to the Government of Liberia for mining rights extension and reserved access to railroad capacity, which is expected to significantly boost Liberia's economy.

- ArcelorMittal (MT) announced on January 29, 2026, that it has been served with a writ of summons by Acciaierie d'Italia S.p.A. (ADI) to appear before the Court of Milan, facing claims of approximately €7 billion in damages.

- ArcelorMittal categorically rejects all allegations, including claims of mismanagement, stating there is no factual or legal basis for the claim and that it invested approximately €2 billion to rehabilitate the business.

- The company attributes ADI's issues to actions by Invitalia and the Italian Government, including the removal of legal protections in 2019 and placing ADI into extraordinary administration in February 2024, which ArcelorMittal views as an expropriation of its investment.

- ArcelorMittal initiated an international arbitration against the Republic of Italy in June 2025, seeking damages exceeding €1.8 billion for alleged unlawful expropriation and other harmful measures.

- The global coated steel market volume is projected to reach 421.7 million metric tons by 2035, growing from 310.1 million metric tons in 2025.

- The market size was estimated at USD 309.85 billion in 2025 and is expected to increase to USD 606.68 billion by 2035, growing at a CAGR of 6.95% from 2026 to 2035.

- Asia Pacific dominated the global coated steel market with the largest volume share of 61.50% in 2025.

- Market growth is driven by factors such as urbanization, sustainability initiatives, technological advancement, and increasing demand in end-use industry applications.

- ArcelorMittal Nippon Steel (AM/NS) India is investing approximately US$6.76 billion to expand its Hazira plant's capacity to 15 million tonnes per annum by FY27, focusing on green steel production.

Quarterly earnings call transcripts for ArcelorMittal.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more