Earnings summaries and quarterly performance for Meritage Homes.

Executive leadership at Meritage Homes.

Phillippe Lord

Chief Executive Officer

Hilla Sferruzza

Executive Vice President and Chief Financial Officer

Javier Feliciano

Executive Vice President and Chief People Officer

Malissia Clinton

Executive Vice President, General Counsel and Secretary

Steven J. Hilton

Executive Chairman

Board of directors at Meritage Homes.

Dana C. Bradford

Director

Deb Henretta

Director

Dennis V. Arriola

Director

Erin Lantz

Director

Geisha Williams

Director

Joseph Keough

Director

Louis E. Caldera

Director

Michael R. Odell

Director

P. Kelly Mooney

Director

Peter L. Ax

Lead Independent Director

Research analysts who have asked questions during Meritage Homes earnings calls.

Alan Ratner

Zelman & Associates

8 questions for MTH

John Lovallo

UBS Group AG

8 questions for MTH

Michael Rehaut

JPMorgan Chase & Co.

8 questions for MTH

Trevor Allinson

Wolfe Research, LLC

8 questions for MTH

Stephen Kim

Evercore ISI

7 questions for MTH

Alex Barron

Housing Research Center

5 questions for MTH

Rafe Jadrosich

Bank of America

5 questions for MTH

Carl Reichardt

BTIG, LLC

3 questions for MTH

Charles Perron-Piché

Goldman Sachs

3 questions for MTH

Susan Maklari

Goldman Sachs Group Inc.

3 questions for MTH

Jason Sabshon

Keefe, Bruyette & Woods (KBW)

2 questions for MTH

Jay McCanless

Wedbush Securities

2 questions for MTH

Jade Rahmani

Keefe, Bruyette & Woods

1 question for MTH

Steven Kim

Evercore ISI

1 question for MTH

Trevor Allison

Wolfe Research LLC

1 question for MTH

Recent press releases and 8-K filings for MTH.

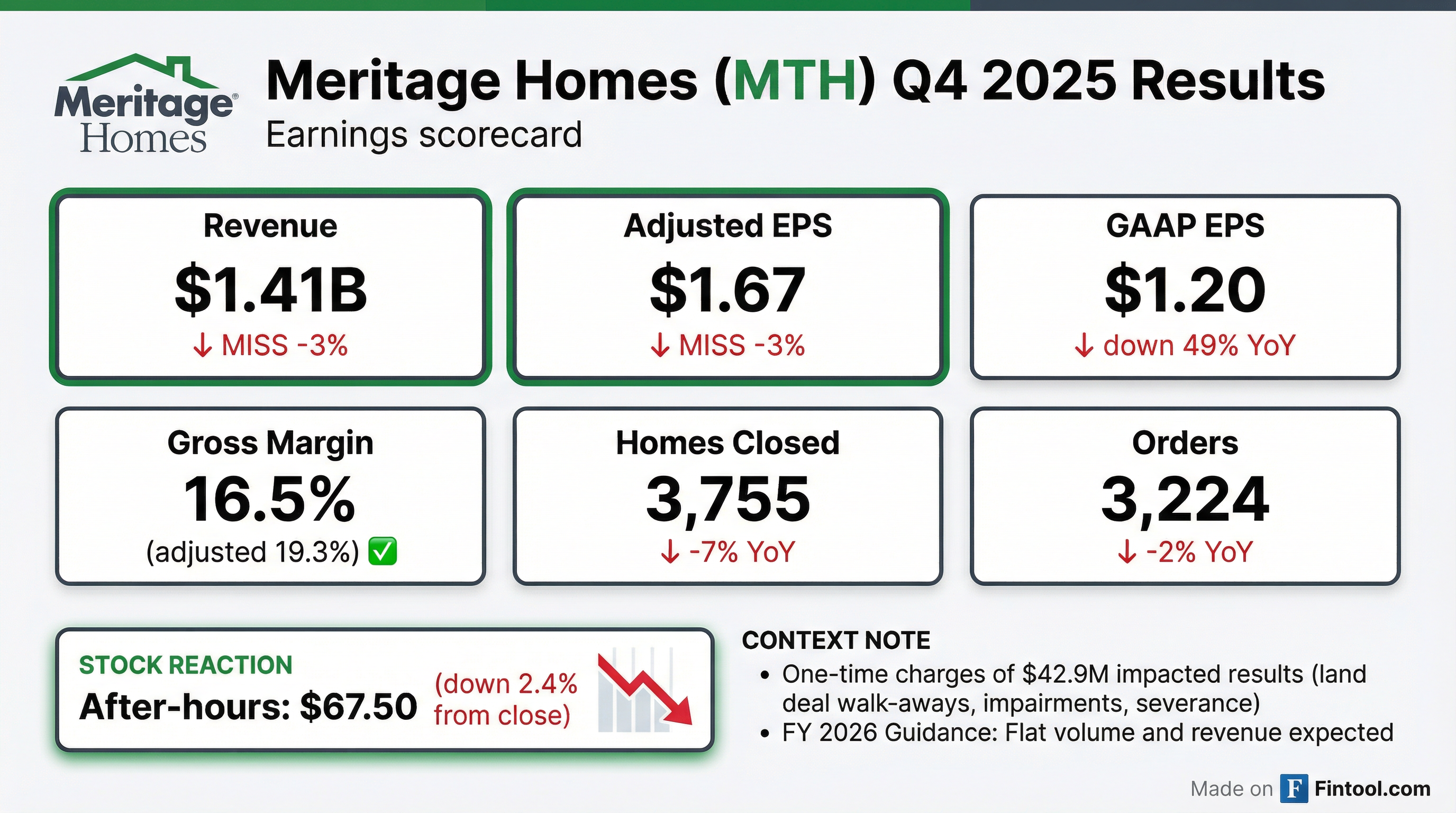

- Meritage Homes reported Q4 2025 home closing revenue of $1.4 billion, a 12% decrease year-over-year, and adjusted diluted EPS of $1.67, down 30% from Q4 2024. For the full year 2025, home closing revenue decreased 9% to $5.8 billion, with adjusted diluted EPS at $7.05.

- Operationally, Q4 2025 orders were 2% lower year-over-year, while the ending community count reached an all-time high of 336, up 15% from December 31, 2024. The ending backlog declined 24% year-over-year to approximately 1,200 homes.

- The company returned $179 million to shareholders in Q4 2025 and repurchased $295 million worth of shares for the full year, reducing outstanding shares by 6%. Meritage Homes committed to $400 million in share buybacks for 2026, with plans to buy back $100 million each quarter.

- For Q1 2026, the company projects home closings between 3,000 and 3,300 units, revenue of $1.13 billion-$1.24 billion, and diluted EPS of $0.87-$1.13. Full year 2026 closings and home closing revenue are expected to be in line with 2025 performance, with anticipated 5%-10% community count growth.

- Meritage Homes reported Q4 2025 home closing revenue of $1,406 million, a 12% decrease compared to Q4 2024, with net earnings of $84 million and diluted EPS of $1.20, representing 51% and 49% declines year-over-year, respectively.

- Net sales orders for Q4 2025 were down 2% year-over-year, while the ending community count grew 15% to 336 communities at December 31, 2025.

- The company returned $179 million of cash to shareholders in Q4 2025, with 25% allocated to share repurchases and 5% to cash dividends.

- For Q1 2026, Meritage Homes projects home closings between 3,000-3,300 units, home closing revenue of $1.13-1.24 billion, and diluted EPS of $0.87-1.13. Full year 2026 home closing volume and revenue are expected to be consistent with full year 2025.

- Meritage Homes reported Q4 2025 home closing revenue of $1.4 billion, a 12% decrease year-over-year, and adjusted diluted EPS of $1.67, down 30% from Q4 2024. For the full year 2025, home closing revenue decreased 9% to $5.8 billion, with adjusted diluted EPS at $7.05.

- The company's Q4 2025 adjusted gross margin was 19.3%, impacted by increased incentives and geographic mix shift, compared to 23.3% in Q4 2024. They incurred $27.9 million in terminated land deal walkaway charges and $7.8 million in real estate inventory impairments as part of efforts to enhance their land portfolio.

- Meritage Homes repurchased approximately 2.2 million shares in Q4 2025 and 6% of outstanding shares for the full year 2025. The company committed to redeploying $400 million towards share buybacks in 2026, with a plan to buy back $100 million quarterly. The quarterly dividend was increased by 15% to $0.43 per share in 2025.

- For Q1 2026, the company projects home closings between 3,000 and 3,300 units, home closing revenue of $1.13 billion-$1.24 billion, and diluted EPS in the range of $0.87-$1.13. Full-year 2026 closings and home closing revenue are expected to be in line with 2025 performance, assuming no changes in market conditions.

- Community count reached an all-time high of 336 at December 31, 2025, up 15% year-over-year, with an expectation of another 5%-10% growth in 2026. The average absorption pace in Q4 2025 was 3.2, down from 3.9 in the prior year.

- Meritage Homes reported Q4 2025 adjusted diluted EPS of $1.67 and home closing revenue of $1.4 billion, with an adjusted home closing gross margin of 19.3%.

- For the full year 2025, the company achieved adjusted diluted EPS of $7.05 on home closing revenue of $5.8 billion, and an adjusted gross margin of 20.8%.

- The company provided Q1 2026 guidance, projecting diluted EPS between $0.87 and $1.13 and home closing revenue of $1.13 billion to $1.24 billion. Full year 2026 closings are expected to be in line with 2025 performance.

- Meritage Homes returned $179 million to shareholders in Q4 2025 through buybacks and dividends, and plans to programmatically buy back $100 million of shares each quarter in 2026.

- Despite softer market conditions in Q4 2025, the company observed improved selling conditions in January and anticipates 5% to 10% community count growth in 2026.

- Meritage Homes reported Q4 2025 net earnings of $84.0 million and diluted EPS of $1.20, representing a 51% and 49% decrease, respectively, compared to Q4 2024. For the full year 2025, net earnings were $453.0 million and diluted EPS was $6.35, a 42% and 41% decrease, respectively, from full year 2024.

- Home closing revenue decreased 12% year-over-year to $1.4 billion in Q4 2025 and 9% to $5.8 billion for the full year 2025.

- The company's home closing gross margin was 16.5% in Q4 2025 and 19.7% for the full year 2025, impacted by non-recurring charges, increased incentives, and higher lot costs.

- Meritage Homes returned $179 million to shareholders in Q4 2025 through cash dividends and share repurchases, with $295 million in share repurchases for the full year. The company ended 2025 with $775 million in cash and a net debt-to-capital ratio of 16.9%.

- Management anticipates full year 2026 home closing volume and revenue to be consistent with full year 2025 results, assuming no further market deterioration.

- Meritage Homes reported diluted EPS of $1.20 for the fourth quarter of 2025, a 49% decrease from Q4 2024, and $6.35 for the full year 2025, a 41% decrease from the prior year.

- Home closing revenue for Q4 2025 was $1.4 billion, down 12% year-over-year, and $5.8 billion for the full year 2025, a 9% decrease.

- The company's home closing gross margin declined to 16.5% in Q4 2025 and 19.7% for the full year 2025, primarily due to non-recurring charges, increased incentives, and higher lot costs.

- Meritage Homes achieved 14,650 sales orders for full year 2025, consistent with the prior year, supported by a 15% year-over-year community count growth.

- The company returned $179 million of capital to shareholders in Q4 2025 through dividends and share repurchases, ending the year with a cash balance of $775 million and a net debt-to-capital ratio of 16.9% as of December 31, 2025.

- Meritage Hospitality, a Wendy's franchisee, reported a negative $6.8 million EBITDA in 2025, a significant decline from its normal run rate of approximately $42 million, attributed to severe winter weather, Wendy's app discounting, and increased beef costs.

- The company is currently under loan forbearance with its primary lenders and anticipates a $9.1 million cash shortfall in 2026 due to a change in the Coca-Cola marketing allowance payment schedule.

- For 2026, Meritage Hospitality projects a recovery with sales between $610 million and $620 million and EBITDA between $18 million and $20 million.

- This recovery is expected from Wendy's policy changes, including allowing closure of money-losing stores and opting out of breakfast in 51 stores, as well as Meritage's $7.5 million G&A cut and 20 store closures.

- Wendy's is currently seeking its fourth CEO in 18 months, and new chicken products and promotions are expected to address the current 80% beef, 20% chicken protein sales mix.

- Meritage Hospitality Group (MTH) experienced a "black swan event" in 2025, leading to a negative $6.8 million EBITDA for the year, primarily due to severe winter weather, aggressive discounting by Wendy's through its mobile app, and a 40% tariff on beef imports.

- The company is currently operating under a loan forbearance agreement with its primary lenders and began 2026 with $11 million in cash, facing a $9.1 million cash shortfall in 2026 due to a change in the Coca-Cola marketing contract.

- For 2026, Meritage anticipates a significant financial recovery, projecting EBITDA between $18 million and $20 million and sales between $610 million and $620 million.

- This expected improvement is supported by Wendy's policy changes, including allowing franchisees to close money-losing stores without replacement and opting out of unprofitable breakfast operations (Meritage has ceased breakfast service in 51 stores), as well as Meritage's internal $7.5 million G&A reduction and the closure of 20 stores in Q4 2025.

- Meritage Hospitality Group (MHGU), a 359-store Wendy's franchisee, reported a -$6.8 million EBITDA in 2025 due to a "black swan event" involving severe winter weather, aggressive Wendy's mobile app discounting, and a 40% tariff on beef imports.

- The company is currently in loan forbearance with its primary lenders and faces significant liquidity challenges in 2026, starting the year with $11 million in cash and a $9.1 million cash shortfall from a revised Coca-Cola marketing contract.

- Meritage projects a substantial recovery in 2026, with anticipated EBITDA between $18 million and $20 million and sales between $610 million and $620 million.

- This recovery is driven by Wendy's policy changes, including allowing closure of money-losing stores and reversing aggressive digital discounting, alongside Meritage's internal actions such as $7.5 million in G&A cuts and 20 store closures in Q4 2025.

- Meritage Homes reported a significant decline in Q3 2025 financial performance, with home closing revenue decreasing 12% to $1,399 million and diluted EPS falling 48% to $1.39 compared to Q3 2024.

- Despite a 4% year-over-year increase in net sales orders to 3,636 and an ending community count of 334 (the highest in company history), the average selling price (ASP) on closings declined 5% to $380K due to greater incentive use. This also contributed to a 570 basis point drop in home closing gross margin to 19.1%.

- The company is implementing strategic adjustments, including an intentional slowdown in net new lot acquisition, reducing land spend to $528 million in Q3 2025, and returned $85 million of cash to shareholders during the quarter.

- For Q4 2025, Meritage Homes provided guidance projecting home closings between 3,800-4,000 units, home closing revenue of $1.46-1.54 billion, and diluted EPS of $1.51-1.70.

Quarterly earnings call transcripts for Meritage Homes.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more