Earnings summaries and quarterly performance for MYRIAD GENETICS.

Executive leadership at MYRIAD GENETICS.

Sam S. Raha

President and Chief Executive Officer

Ben R. Wheeler

Chief Financial Officer

Dale Muzzey

Chief Scientific Officer

Jennifer Fox

Chief Legal Officer

Kevin R. Haas

Chief Technology Officer

Margaret Ancona

Senior Vice President, Chief of Staff

Mark Verratti

Chief Operating Officer

Shereen Solaiman

Chief People Officer

Board of directors at MYRIAD GENETICS.

Colleen F. Reitan

Director

Daniel M. Skovronsky, M.D., Ph.D.

Director

Heiner Dreismann, Ph.D.

Director

Lee N. Newcomer, M.D.

Director

Mark S. Davis

Director

Paul M. Bisaro

Director

Rashmi Kumar

Director

S. Louise Phanstiel

Chair of the Board

Research analysts who have asked questions during MYRIAD GENETICS earnings calls.

Puneet Souda

Leerink Partners

6 questions for MYGN

Tycho Peterson

Jefferies

6 questions for MYGN

Mason Carrico

Stephens Inc.

4 questions for MYGN

Sung Ji Nam

Scotiabank

4 questions for MYGN

Andrew Cooper

Raymond James

3 questions for MYGN

Bill Bonello

Craig-Hallum Capital Group LLC

3 questions for MYGN

Dan Brennan

UBS

3 questions for MYGN

Doug Schenkel

Wolfe Research LLC

3 questions for MYGN

Lu Li

Scotiabank

3 questions for MYGN

Brandon Couillard

Wells Fargo & Company

2 questions for MYGN

David Westenberg

Piper Sandler

2 questions for MYGN

Douglas Schenkel

Wolfe Research, LLC

2 questions for MYGN

Michael Ryskin

Bank of America Merrill Lynch

2 questions for MYGN

Subbu Nambi

Guggenheim Securities

2 questions for MYGN

Tejas Savant

Morgan Stanley

2 questions for MYGN

Ben...

Stephens Inc.

1 question for MYGN

Jason Lai

Citigroup

1 question for MYGN

Kyle Boucher

TD Cowen

1 question for MYGN

Madison Pasterchick

Morgan Stanley

1 question for MYGN

Matt Sik

Goldman Sachs

1 question for MYGN

Prashant Kota

Goldman Sachs

1 question for MYGN

Rachel Vatnsdal Olson

JPMorgan

1 question for MYGN

Ricki Levitus

Guggenheim Securities, LLC

1 question for MYGN

Subhalaxmi Nambi

Guggenheim Securities

1 question for MYGN

Thomas...

Guggenheim Securities, LLC

1 question for MYGN

William Bonello

Craig-Hallum Capital Group

1 question for MYGN

Recent press releases and 8-K filings for MYGN.

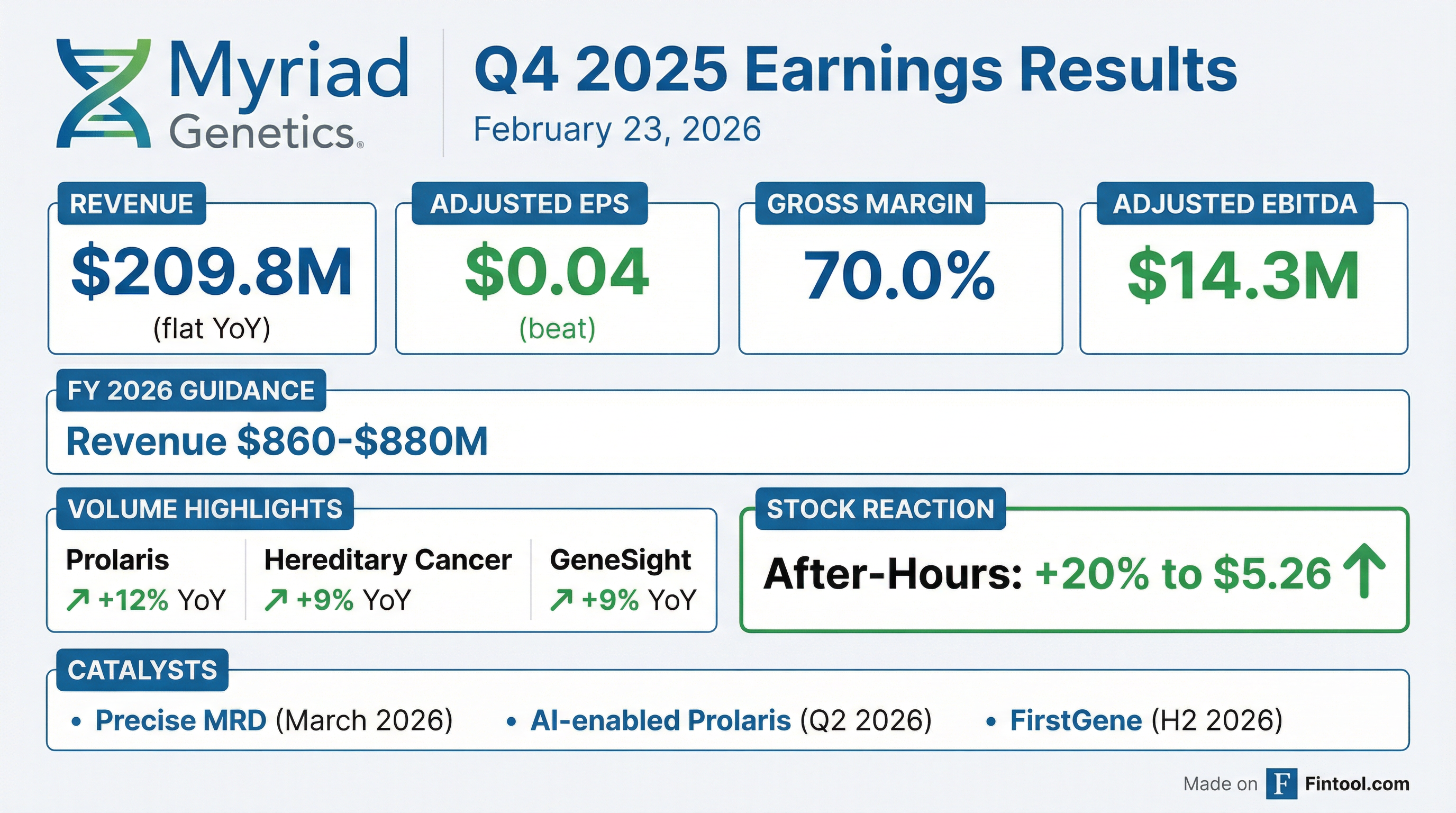

- Myriad Genetics reported Q4 2025 revenue of $210 million and full-year 2025 revenue of $824.5 million, with adjusted EPS of $0.04 and adjusted EBITDA of $14.3 million for Q4.

- The company issued full-year 2026 revenue guidance of $860 million to $880 million, with Q1 2026 revenue expected between $200 million and $203 million.

- Key product launches include the alpha launch of Precise MRD for breast cancer in Q1 2026, an AI-enhanced Prolaris prostate cancer test in Q2 2026, and the FirstGene multiple prenatal screen tests in H2 2026.

- MyRisk test volume grew 14% in the affected market and 11% in the unaffected market, and GeneSight volume increased 9% year-over-year in Q4 2025; however, prenatal volume declined in Q4 2025 and is expected to decline in Q1 2026 before recovering.

- Myriad Genetics reported Q4 2025 revenue of $209.8 million and adjusted EPS of $0.04.

- The company reaffirmed its full-year 2026 financial guidance, projecting revenue between $860 million and $880 million, adjusted gross margin of 68%-69%, and adjusted EBITDA of $37 million-$49 million.

- Several new products are slated for launch in 2026, including the AI-enhanced Prolaris prostate cancer test in Q2, the FirstGene multiple prenatal screen test in the second half, and the start of commercial testing for Precise MRD for breast cancer for select customers in Q1, though no revenue contribution from MRD is expected in 2026.

- Myriad plans to invest over $35 million over the next few years to enhance commercial capabilities and will reorganize its financial reporting into cancer care continuum, prenatal health, and mental health segments starting Q1 2026.

- Myriad Genetics reported Q4 2025 total revenue of $209.8 million and Adjusted EPS of $0.04.

- For the full year 2025, the company achieved total revenue of $824.5 million and Adjusted EBITDA of $38.9 million.

- The documents provide conflicting information regarding the Adjusted EPS for the full year 2025, with values of $0.15 , $0.51 , and $0.06.

- The company provided FY 2026 guidance, projecting total revenue between $850 million and $870 million and Adjusted EPS between $0.60 and $0.70.

- Myriad Genetics reported Q4 2025 revenue of $209.8 million and adjusted EPS of $0.04, with underlying revenue growth of 4% year-over-year (excluding UnitedHealthcare's GeneSight impact). Full year 2025 revenue reached $824.5 million.

- The company reaffirmed its full year 2026 financial guidance, expecting revenue between $860 million and $880 million, adjusted gross margin of 68% to 69%, and adjusted EBITDA of $37 million to $49 million.

- Key products demonstrated strong Q4 2025 year-over-year volume growth, including MyRisk in oncology (14%), MyRisk for unaffected (11%), Prolaris (12%), and GeneSight (9%). Prenatal volume declined in Q4 2025 but is anticipated to recover in 2026.

- Myriad Genetics is set to launch several new products in 2026, including the alpha phase of Precise MRD for breast cancer next week, an AI-enhanced Prolaris test in Q2, and FirstGene multiple prenatal screen tests in the second half of the year.

- The company plans to invest over $35 million over the next few years to boost organizational efficiency and commercial capabilities, including adding sales and medical headcount, and will restructure its reporting into cancer care continuum, prenatal health, and mental health segments.

- Myriad Genetics reported Q4 2025 revenue of $209.8 million and full-year 2025 revenue of $824.5 million.

- The company recorded a Q4 2025 GAAP net loss of $7.9 million, or $0.08 per share, with adjusted EPS at $0.04 per share and adjusted EBITDA at $14.3 million.

- Total test volumes for Q4 2025 increased 2% year-over-year to 382,000.

- Myriad Genetics reiterated its full-year 2026 financial guidance, expecting revenue between $860 million and $880 million and adjusted EBITDA between $37 million and $49 million.

- The company plans three significant new test launches in 2026, including Precise MRD (alpha launch in March), an AI-enabled Prolaris prostate cancer test (Q2), and FirstGene (H2).

- Myriad Genetics reported fourth quarter 2025 revenue of $209.8 million and full year 2025 revenue of $824.5 million.

- For Q4 2025, the company posted a GAAP net loss of $7.9 million ($0.08 per share) and adjusted EPS of $0.04 per share, with a gross margin of 70.0%.

- The company reaffirmed its full-year 2026 financial guidance, projecting revenue between $860 million and $880 million, an adjusted gross margin of 68% to 69%, and adjusted EBITDA of $37 million to $49 million.

- Key test volume growth in Q4 2025 year-over-year included Prolaris prostate cancer test at 12%, Hereditary cancer testing at 9%, and GeneSight at 9%.

- Myriad Genetics plans three significant new test launches in 2026: Precise MRD, an AI-enabled Prolaris prostate cancer test, and the multiple prenatal screen test, FirstGene.

- Myriad Genetics announced a commercialization roadmap for its Precise MRD™ assay, a tumor-informed circulating tumor DNA (ctDNA) test designed for ultrasensitive detection.

- The company plans to launch Precise MRD with select clinicians in March 2026 for breast cancer, followed by colorectal and renal cancers later in 2026, with potential expansion into ovarian and endometrial cancers in 2027 and beyond.

- Data from the MONITOR-Breast study showed 93% baseline sensitivity for Precise MRD in breast cancer, with early ctDNA clearance significantly associated with pathological complete response.

- Interim results from the MONSTAR-SCREEN-3 study for colorectal cancer demonstrated 100% baseline ctDNA detection and 100% sensitivity at one-month post-surgery in predicting recurrence.

- Myriad Genetics reported preliminary Q4 2025 revenue between $207 million and $209 million and full-year 2025 revenue between $822 million and $824 million, with overall volume growth of 1% for the year.

- For 2026, the company provided guidance of $860 million to $880 million in revenue, representing 6% growth at the midpoint, with gross margins of 68%-69% and adjusted EBITDA between $37 million and $49 million.

- The company plans to achieve high-single-digit to low-double-digit revenue growth over the next five years, starting in 2025, by focusing on the cancer care continuum and expanding its product portfolio.

- Key product developments for 2026 include the launch of an AI-enabled Prolaris test in the first half, initial testing and MolDX submissions for the Precise MRD test, and the full commercial launch of FirstGene in the second half.

- Myriad intends to invest over $35 million over the next few years to strengthen commercial capabilities, particularly in cancer care, with these expenses already factored into the 2026 guidance.

- Myriad Genetics reported preliminary Q4 2025 revenue between $207 million and $209 million and full-year 2025 revenue between $822 million and $824 million.

- For full-year 2026, the company projects revenue between $860 million and $880 million, gross margin of 68%-69%, and adjusted EBITDA between $37 million and $49 million.

- Myriad Genetics is undergoing a strategic shift, focusing on the cancer care continuum and expanding its product portfolio, including new AI-enabled tests and significant investment in Minimal Residual Disease (MRD).

- The company anticipates achieving high-single-digit to low-double-digit revenue growth over the next five years, starting in 2025, driven by new product launches and strategic partnerships.

- Myriad Genetics reported preliminary Q4 2025 revenue of $207-$209 million and FY 2025 revenue of $822-$824 million.

- The company provided 2026 financial guidance, projecting total revenue of $860-$880 million, an adjusted gross margin of 68%-69%, and adjusted EBITDA of $37-$49 million. The mid-point of 2026 revenue guidance reflects an approximate 6% increase over the preliminary 2025 revenue mid-point.

- Myriad is strategically focusing on the Cancer Care Continuum and plans to launch new products in H1 2026, including an AI-enhanced Prolaris test for prostate cancer and initiating clinical testing for Precise MRD for breast cancer.

- In 2025, the company served 55K+ healthcare providers and reported 1.5M+ patient tests.

- Myriad plans to invest over $35 million in its commercial organization to drive strategic growth.

Quarterly earnings call transcripts for MYRIAD GENETICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more