Earnings summaries and quarterly performance for nVent Electric.

Executive leadership at nVent Electric.

Beth Wozniak

Chief Executive Officer

Aravind Padmanabhan

Executive Vice President, Chief Technology Officer

Jon Lammers

Executive Vice President, General Counsel and Secretary

Martha Bennett

Executive Vice President, Chief Marketing Officer

Sara Zawoyski

President, Systems Protection

Board of directors at nVent Electric.

Research analysts who have asked questions during nVent Electric earnings calls.

Brian Drab

William Blair & Company

6 questions for NVT

Deane Dray

RBC Capital Markets

6 questions for NVT

Julian Mitchell

Barclays Investment Bank

6 questions for NVT

Scott Graham

Seaport Research Partners

5 questions for NVT

Jeffrey Sprague

Vertical Research Partners

4 questions for NVT

Nicole DeBlase

BofA Securities

4 questions for NVT

Nigel Coe

Wolfe Research, LLC

4 questions for NVT

Vladimir Bystricky

Citigroup

4 questions for NVT

Jeffrey Hammond

KeyBanc Capital Markets

3 questions for NVT

Joseph Ritchie

Goldman Sachs

3 questions for NVT

Anvi Sarbhai

Goldman Sachs

2 questions for NVT

David Tarantino

Robert W. Baird & Co.

2 questions for NVT

Neal Burk

UBS Group AG

2 questions for NVT

Nicole DeBlase

Deutsche Bank

2 questions for NVT

Vlad Bystricki

Citi

2 questions for NVT

Will Branco

Wolfe Research

2 questions for NVT

David Silver

CL King & Associates

1 question for NVT

Joe Ritchie

Goldman Sachs

1 question for NVT

Recent press releases and 8-K filings for NVT.

- nVent Finance S.à R.L., a subsidiary of nVent Electric plc, and Hoffman Schroff Holdings, Inc. (HSHI) entered into an Amendment No. 1 to their Second Amended and Restated Credit Agreement on February 16, 2026.

- A Sixth Supplemental Indenture was also executed on February 16, 2026, involving Nvent Finance S.à R.L., NVENT ELECTRIC PLC, and Hoffman Schroff Holdings, Inc., which is designated as a New Guarantor.

- The amendment modifies the Credit Agreement and defines Hoffman Schroff Holdings, Inc. as a "Primary Borrower" alongside nVent Finance S.à r.l..

- nVent Electric achieved record full-year 2025 sales of $3.9 billion, representing a 30% increase (13% organically), and record free cash flow of $561 million, up 31%. Adjusted EPS grew 35%.

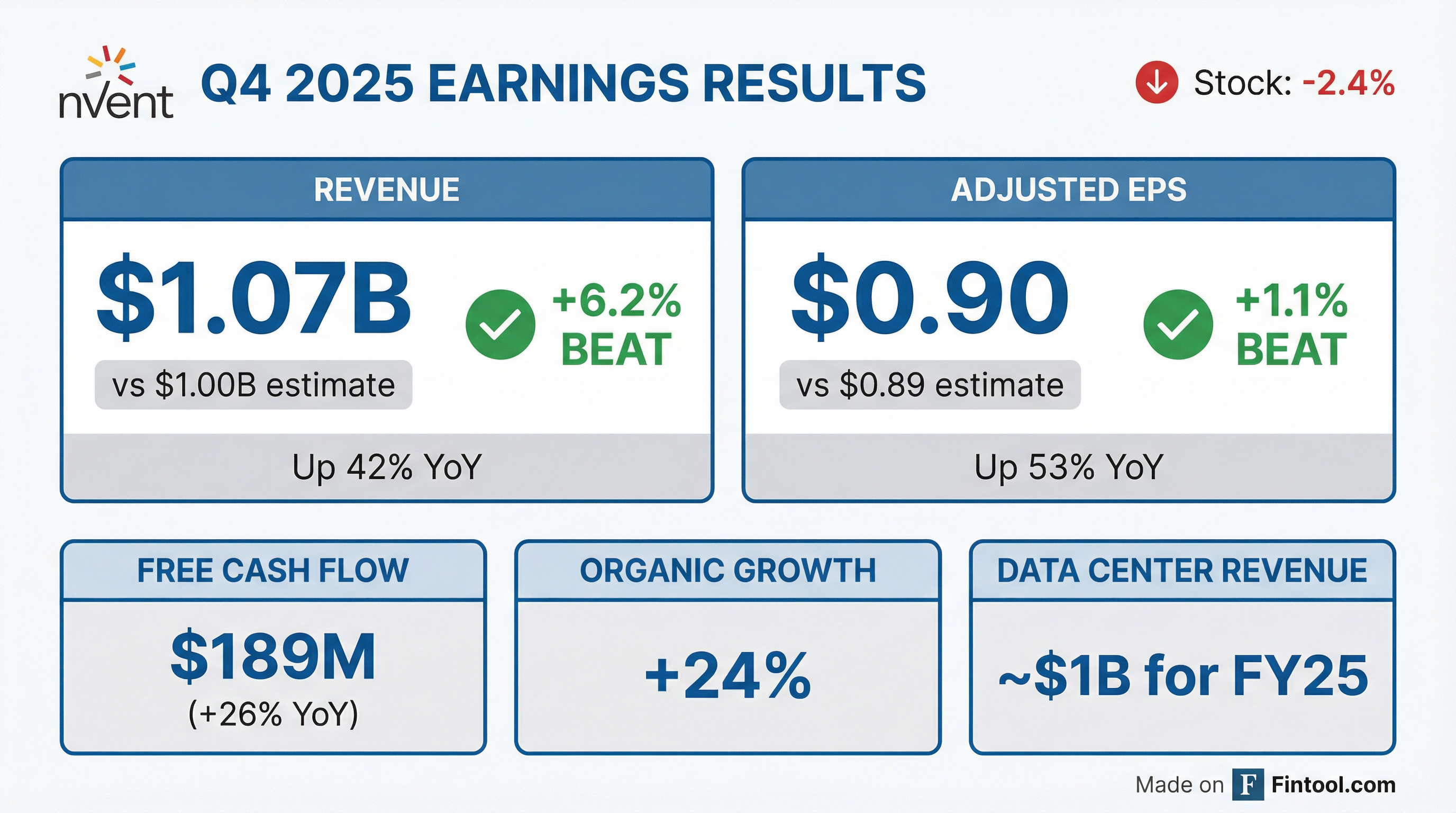

- In Q4 2025, sales reached $1.067 billion, a 42% increase (24% organically), with adjusted EPS growing 53% to $0.90.

- The company's portfolio transformation has significantly increased its focus on the high-growth infrastructure vertical, which now accounts for 45% of sales, with data center sales reaching approximately $1 billion in 2025. Organic orders surged approximately 30% in Q4, primarily due to AI data center buildout, resulting in a year-end backlog of $2.3 billion.

- For full-year 2026, nVent forecasts reported sales growth of 15%-18% (10%-13% organically) and adjusted EPS growth of 20%-24%, with an expected range of $4.00-$4.15. Free cash flow conversion is projected at 90%-95% of adjusted net income.

- Strategic investments continue in new products and capacity, particularly for data centers and liquid cooling, including a new facility in Blaine, Minnesota, to expand liquid cooling production.

- nVent Electric delivered record quarterly sales of $1.1 billion, an increase of 42% (24% organically), and adjusted EPS of $0.90, up 53% year-over-year for Q4 2025.

- For the full year 2025, sales grew 30% to $3.9 billion, adjusted EPS increased 35% to $3.35, and free cash flow rose 31% to $561 million.

- The company initiated 2026 guidance, projecting sales growth of 15% to 18% and adjusted EPS growth of 20% to 24%, with Q1 2026 adjusted EPS expected to be between $0.90 and $0.93.

- Infrastructure now represents approximately 45% of revenue, including ~$1 billion from data centers, reflecting a portfolio transformation that included the acquisition of EPG and the divestiture of Thermal Management.

- nVent maintained a strong balance sheet with a net debt to adjusted EBITDA ratio of 1.6X and returned $383 million to shareholders in 2025, including $253 million in share repurchases and a 5% increase in the quarterly dividend.

- nVent Electric achieved record sales, EPS, and free cash flow for both Q4 and full-year 2025, with full-year sales reaching $3.9 billion (up 30% reported, 13% organically) and adjusted EPS increasing 35%.

- The company's portfolio transformation has increased its exposure to the high-growth infrastructure vertical, which now accounts for 45% of annual sales, with data center sales reaching approximately $1 billion in 2025.

- Organic orders grew approximately 30% in Q4 2025, primarily driven by large orders for AI data center buildout, resulting in a year-end backlog of $2.3 billion, which is triple the amount from a year ago.

- For 2026, nVent anticipates reported sales growth of 15%-18% (10%-13% organic) and adjusted EPS growth of 20%-24%, with infrastructure sales expected to grow approximately 20% driven by AI data center CapEx acceleration.

- In 2025, nVent invested $93 million in CapEx (up 26%) for new capacity to support growth in data centers and power utilities, and returned $383 million to shareholders.

- nVent Electric reported record fourth quarter sales of $1.067 billion, a 42% increase year-over-year and 24% organically, with adjusted EPS growing 53% to $0.90. For the full year 2025, sales reached $3.9 billion (up 30%, 13% organically), adjusted EPS grew 35%, and free cash flow was a record $561 million (up 31%).

- The company anticipates another year of record performance in 2026, forecasting reported sales growth of 15%-18% and adjusted EPS growth of 20%-24%.

- The portfolio transformation, including the divestiture of the thermal management business and the acquisition of EPG, increased exposure to the high-growth infrastructure vertical, which now makes up 45% of annual sales. Data center sales reached approximately $1 billion in 2025, growing over 50% for the year.

- Organic orders in Q4 2025 were up approximately 30%, primarily driven by large AI data center buildout orders, leading to a year-end backlog of $2.3 billion, triple the prior year.

- In 2025, nVent launched 86 new products, contributing approximately 10 points to sales growth, with new product vitality at 27%.

- nVent Electric plc reported Q4 2025 sales of $1.1 billion, marking a 42% increase (24% organically), and adjusted EPS of $0.90, up 53% compared to the prior year quarter.

- For the full-year 2025, the company achieved sales of $3.9 billion, a 30% increase (13% organically), with adjusted EPS of $3.35, up 35% from the prior year.

- Full-year 2025 Free Cash Flow from continuing operations was $561 million, representing a 31% increase.

- The company issued full-year 2026 guidance, projecting reported sales growth of 15% to 18% (10% to 13% organically) and adjusted EPS in the range of $4.00 to $4.15.

- For Q1 2026, nVent anticipates reported sales growth of 34% to 36% (17% to 19% organically) and adjusted EPS between $0.90 and $0.93.

- nVent reported strong year-to-date performance with 25% net sales growth, almost 30% EPS growth, and 34% free cash flow growth, anticipating mid-teens organic growth for the second half of the year and almost 50% EPS growth in Q4.

- The company's strategic portfolio transformation has resulted in infrastructure now comprising over 40% of its nearly $4 billion business, primarily driven by data centers and power utilities, a significant increase from 12% in 2017.

- To meet surging demand, nVent is significantly expanding its liquid cooling capacity, including a 117,000 sq ft expansion in Blaine scheduled to open in Q1 2026, following a +65% organic order growth in the most recent quarter.

- The power utility business, bolstered by acquisitions like Trachte and Avail EPG, is experiencing double-digit growth and now accounts for approximately 20% of the company's total revenue, with orders extending into 2027.

- nVent has actively managed its capital allocation, including buying back approximately $250 million of stock this year and pursuing "chunky deals" focused on expanding its infrastructure business, while maintaining a leverage ratio below its target.

- nVent reported significant year-to-date acceleration in 2025, with 25% net sales growth and almost 30% EPS growth in the first three quarters, and projects mid-teens organic growth for the second half and nearly 50% EPS growth in Q4.

- The company's portfolio has transformed since 2017, with infrastructure (data centers and power utilities) now comprising over 40% of its nearly $4 billion business, driving a balance between short and long-cycle segments.

- Demand for nVent's liquid cooling solutions is robust, evidenced by 65% organic order growth in Q3 2025, leading to a doubling of manufacturing capacity in Blaine, expected to open in Q1 2026.

- nVent has been active in capital allocation, executing approximately $250 million in stock buybacks in 2025 and focusing M&A on expanding its infrastructure business, particularly power utilities and data centers.

- nVent reported 25% net sales growth and almost 30% EPS growth year-to-date, with a Q3 guide for mid-teens organic growth in the second half and almost 50% EPS growth in Q4.

- The company's portfolio transformation has driven accelerated growth, with infrastructure now over 40% of its portfolio (up from 12% in 2017), and a focus on data centers and power utilities.

- The liquid cooling business is a significant growth driver, with record orders in backlog, a doubling of manufacturing square footage in Blaine on track for Q1 2026 opening, and the launch of 14 new products. Market penetration for liquid cooling is estimated to be in the single digits.

- nVent achieved 65% organic order growth in Q3, marking four consecutive quarters of double-digit order growth.

- The company has executed eight acquisitions since its spin-off and repurchased approximately $250 million of stock this year, with an upcoming Capital Markets Day in late February to provide more detailed growth targets.

- nVent Electric reported strong Q3 adjusted earnings of 91 cents per share and net sales of $1.05 billion, a 35% increase, primarily driven by robust data center growth.

- The company raised its full-year guidance, now expecting sales growth of 27% to 28% and adjusted earnings per share between $3.31 and $3.33.

- For Q4, nVent projects reported sales growth of 31% to 33% and adjusted EPS of 87 to 89 cents.

- Free cash flow for Q3 totaled $253 million, a significant increase from $143 million in Q3 2024, and the board approved a quarterly cash dividend of 20 cents per share.

Quarterly earnings call transcripts for nVent Electric.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more