Earnings summaries and quarterly performance for Nextpower.

Executive leadership at Nextpower.

Board of directors at Nextpower.

Research analysts who have asked questions during Nextpower earnings calls.

Brian Lee

Goldman Sachs Group, Inc.

8 questions for NXT

Dimple Gosai

Bank of America

8 questions for NXT

Philip Shen

ROTH MKM

8 questions for NXT

Praneeth Satish

Wells Fargo

8 questions for NXT

Ben Kallo

Robert W. Baird & Co.

7 questions for NXT

Mark W. Strouse

J.P. Morgan Chase & Co.

7 questions for NXT

Dylan Nassano

Wolfe Research

6 questions for NXT

Julien Dumoulin-Smith

Jefferies

5 questions for NXT

Joseph Osha

Guggenheim Partners

3 questions for NXT

Kashy Harrison

Piper Sandler

3 questions for NXT

Vikram Bagri

Citigroup Inc.

3 questions for NXT

Corinne Blanchard

Deutsche Bank

2 questions for NXT

Jon Windham

UBS Group AG

2 questions for NXT

Jordan Levy

Truist Securities

2 questions for NXT

Sean Milligan

Gen

2 questions for NXT

Ajith Madeley

Mizuho Financial Group

1 question for NXT

Ameet Thakkar

BMO Capital Markets

1 question for NXT

Benjamin Kallo

Robert W. Baird & Co.

1 question for NXT

Chantal

Jefferies

1 question for NXT

Christine Cho

Goldman Sachs Group

1 question for NXT

Jonathan Kees

Daiwa Capital Markets

1 question for NXT

Jonathan Windham

UBS

1 question for NXT

Maheep Mandloi

Mizuho Financial Group

1 question for NXT

Moses Sutton

BNP Paribas

1 question for NXT

Sean McLoughlin

HSBC

1 question for NXT

Steven Fox

Fox Research

1 question for NXT

Recent press releases and 8-K filings for NXT.

- Nextpower (NXT) has entered into a multi-year supply agreement with Jinko Solar (U.S.) Industries Inc. (JKS) to provide more than one gigawatt (GW) of steel frames, scalable up to 3 GW over a three-year period.

- The steel frames will support module manufacturing at Jinko Solar's Jacksonville, Fla. facility, with production expected to begin mid-2026.

- This agreement underscores the market adoption of steel frames as a structurally durable and cost-effective solution for solar modules, while also strengthening the U.S. supply chain and adding six percent to a tracker project's domestic content calculation.

- Nextpower plans to expand its steel frame manufacturing presence in the Southeastern United States to facilitate direct supply to Jinko Solar's U.S. facility.

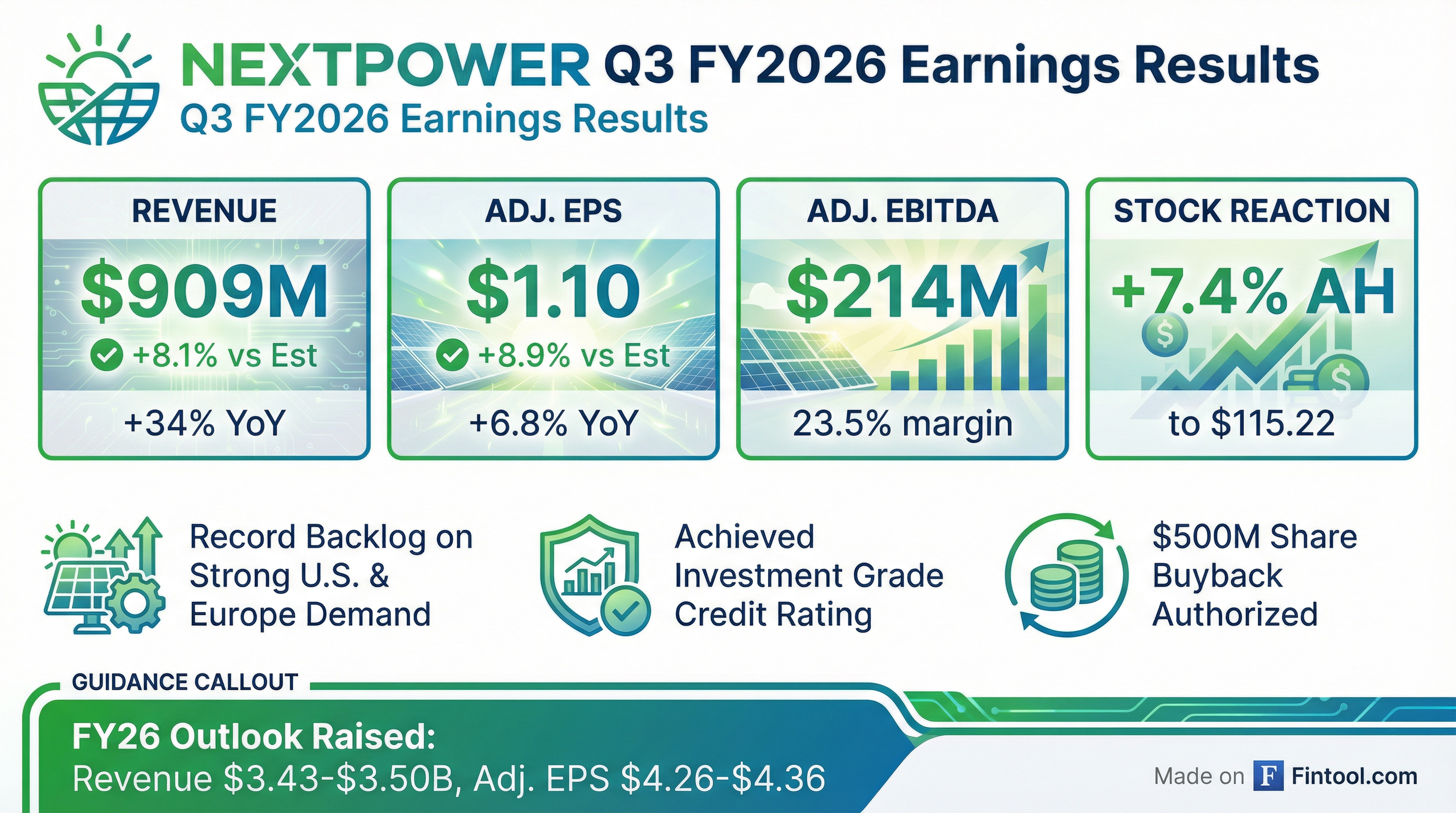

- Nextpower reported strong fiscal Q3 revenue of approximately $909 million, representing a ~34% year-over-year increase, with adjusted EPS of $1.10 and GAAP net income of $131 million.

- The company raised its full-year 2026 revenue outlook to a range of $3.425 billion to $3.5 billion and authorized up to $500 million in share repurchases over three years.

- Nextpower is effectively debt-free with approximately $953 million in cash, and Fitch granted an investment-grade rating.

- Following the results, several analysts, including Mizuho, BofA, and Northland, raised price targets and ratings for Nextpower.

- Nextpower reported strong financial results for Q3 fiscal year 2026, with revenue growing 34% year-over-year to $909 million and adjusted EBITDA increasing 15% to $214 million.

- The company raised its fiscal year 2026 financial outlook, now expecting revenue between $3.425 billion and $3.5 billion, adjusted EBITDA between $810 million and $830 million, and adjusted diluted EPS in the range of $4.26 to $4.36.

- Nextpower announced the formation of Nextpower Arabia, a joint venture in the Middle East, which will supply 2.25 gigawatts of advanced tracking systems to a large solar project. The company also achieved a formal investment-grade credit rating and authorized a share repurchase program of up to $500 million over three years.

- The company reported record customer bookings and an increased backlog of over $5 billion.

- Nextpower delivered strong financial results for Q3 2026, with revenue growing 34% year-over-year to $909 million and adjusted EBITDA increasing 15% to $214 million.

- The company raised its fiscal year 2026 financial outlook, now expecting revenue between $3.425 billion and $3.5 billion, adjusted EBITDA between $810 million and $830 million, and adjusted diluted EPS in the range of $4.26 to $4.36.

- Nextpower achieved a formal investment-grade credit rating and announced that its board authorized a share repurchase program of up to $500 million over three years.

- The formation of Nextpower Arabia, a joint venture with Abunayyan Holding, was completed, and it will supply 2.25 gigawatts of tracking systems to a major project, with the potential to support up to 12 gigawatts of solar capacity annually.

- The company's backlog reached a new record, exceeding $5 billion, driven by strong bookings, and U.S. revenue increased 63% year-over-year.

- Nextpower reported strong financial results for Q3 fiscal year 2026, with revenue growing 34% year-over-year to $909 million and adjusted EBITDA increasing 15% to $214 million.

- The company raised its fiscal year 2026 financial outlook, now expecting revenue between $3.425 billion and $3.5 billion, adjusted EBITDA between $810 million and $830 million, and adjusted diluted EPS in the range of $4.26 to $4.36.

- Nextpower achieved a formal investment-grade credit rating and announced a share repurchase program of up to $500 million over three years.

- The company reported record backlog greater than $5 billion and formed the Nextpower Arabia joint venture in the Middle East, which will supply 2.25 GW of tracking systems.

- Nextpower reported Q3 FY26 revenue of $909 million, a 34% year-over-year increase, with GAAP diluted EPS of $0.85 and Adjusted diluted EPS of $1.10.

- The company raised its FY26 financial outlook, now expecting revenue between $3.425 billion and $3.500 billion, GAAP Net Income between $525 million and $540 million, and Adjusted EBITDA between $810 million and $830 million.

- Nextpower achieved an investment grade credit rating from Fitch and authorized a share repurchase program of up to $500 million of common stock over a three-year period.

- Business highlights include rebranding to Nextpower, expanding U.S. operations, achieving a record backlog, and forming the Nextpower Arabia joint venture to address the Middle East and North Africa solar market.

- Nextpower reported revenue of $909 million and adjusted diluted EPS of $1.10 for the third quarter of fiscal year 2026, which ended December 31, 2025.

- The company raised its financial outlook for FY26, now expecting revenue between $3.425 billion and $3.500 billion and adjusted diluted EPS between $4.26 and $4.36.

- Nextpower achieved an investment grade credit rating from Fitch and authorized a share repurchase program for up to $500 million of common stock over a three-year period.

- The company achieved a record backlog and completed the formation of its Nextpower Arabia joint venture in January 2026, securing a 2.25 GW supply commitment for the Bisha Solar Project.

- Nextpower Inc. and Saudi Arabia’s Abunayyan Holding have formed Nextpower Arabia, a Riyadh-headquartered joint venture, to accelerate the deployment of utility-scale solar across the Middle East and North Africa (MENA) region.

- The partners plan to invest approximately $88 million (or 330 million Saudi Riyals) in equity and debt over the next two years to build a 42,000-square-meter advanced manufacturing facility in Jeddah. This facility will produce solar tracking systems with an annual capacity of up to 12 GW, with operations expected to start in Q2 2026.

- The new facility is projected to create up to 2,000 jobs and will source core materials like Saudi-produced steel to strengthen the regional supply chain.

- Nextpower rebranded from 'Nextracker' to 'Nextpower' in November 2025 as part of its evolution into a broader, full-scale solar technology company.

- Nextpower and Abunayyan Holding have completed the incorporation of their joint venture, Nextpower Arabia, headquartered in Riyadh, Saudi Arabia, to accelerate utility-scale solar power plant deployment in the Middle East and North Africa (MENA) region.

- A new advanced manufacturing facility in Jeddah, Saudi Arabia, is under construction, anticipated to open in Q2 2026, and will have a projected capacity of up to 12 GW per year for solar tracking systems.

- The joint venture is expected to create up to 2,000 jobs and will be funded with approximately $88 million in equity and debt over the next two years.

- The company is rebranding from Next Tracker to NextPower and projects its non-tracker business to grow at a 40% Compound Annual Growth Rate (CAGR), contributing one-third of total revenue by fiscal year 2030.

- Key product launches include PowerMerge (eBOS, shipping summer FY 2025) and a Power Conversion product (inverter, Beta this summer, GA shortly after), with a strategic focus on Made in America manufacturing to capitalize on domestic content benefits and 45X credits.

- The non-tracker market opportunity is estimated to be two times the size of the tracker market, with the US steel frames market alone representing a $750 million to $1 billion Total Addressable Market (TAM).

- The company notes a favorable US policy environment and robust demand for solar, driven by the country's power deficit, and expects solar to be the dominant form of electricity long-term.

Quarterly earnings call transcripts for Nextpower.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more