Earnings summaries and quarterly performance for OLD DOMINION FREIGHT LINE.

Executive leadership at OLD DOMINION FREIGHT LINE.

Kevin Freeman

President and Chief Executive Officer

Adam Satterfield

Executive Vice President, Chief Financial Officer and Assistant Secretary

Cecil Overbey Jr.

Senior Vice President - Strategic Development

Christopher Brooks

Senior Vice President - Human Resources & Safety

Christopher Kelley

Senior Vice President – Operations

David Congdon

Executive Chairman

Gregory Plemmons

Executive Vice President and Chief Operating Officer

Ross Parr

Senior Vice President - Legal Affairs, General Counsel and Secretary

Steven Hartsell

Senior Vice President – Sales

Board of directors at OLD DOMINION FREIGHT LINE.

Andrew Davis

Director

Bradley Gabosch

Director

Cheryl Miller

Director

Debra King

Director

Greg Gantt

Director

John Congdon Jr.

Director

John Kasarda

Lead Independent Director

Sherry Aaholm

Director

Thomas Stith III

Director

Wendy Stallings

Director

Research analysts who have asked questions during OLD DOMINION FREIGHT LINE earnings calls.

Jason Seidl

TD Cowen

10 questions for ODFL

Jonathan Chappell

Evercore ISI

10 questions for ODFL

Jordan Alliger

Goldman Sachs

10 questions for ODFL

Ken Hoexter

BofA Securities

10 questions for ODFL

Ravi Shanker

Morgan Stanley

10 questions for ODFL

Scott Group

Wolfe Research

10 questions for ODFL

Bascome Majors

Susquehanna Financial Group

8 questions for ODFL

Christian Wetherbee

Wells Fargo

8 questions for ODFL

Eric Morgan

Barclays

8 questions for ODFL

Richa Harnain

Deutsche Bank

8 questions for ODFL

Stephanie Moore

Jefferies

8 questions for ODFL

Tom Wadewitz

UBS Group

7 questions for ODFL

Ariel Rosa

Citigroup

6 questions for ODFL

Brian Ossenbeck

JPMorgan Chase & Co.

6 questions for ODFL

Daniel Imbro

Stephens Inc.

6 questions for ODFL

J. Bruce Chan

Stifel

6 questions for ODFL

Reed Seay

Stephens Inc.

4 questions for ODFL

Jeffrey Kauffman

Vertical Research Partners

3 questions for ODFL

Thomas Wadewitz

UBS

3 questions for ODFL

Ari Rosa

Citigroup Inc.

2 questions for ODFL

Brandon Oglenski

Barclays

2 questions for ODFL

Bruce Chan

Stifel Financial Corp.

2 questions for ODFL

Christopher Kuhn

The Benchmark Company

2 questions for ODFL

Jeff Kauffman

Vertical Research

2 questions for ODFL

Chris Wetherbee

Wells Fargo & Company

1 question for ODFL

Chris Wetherby

Wells Fargo

1 question for ODFL

Joe Hafling

Jefferies

1 question for ODFL

Tyler Brown

Raymond James Financial, Inc.

1 question for ODFL

Recent press releases and 8-K filings for ODFL.

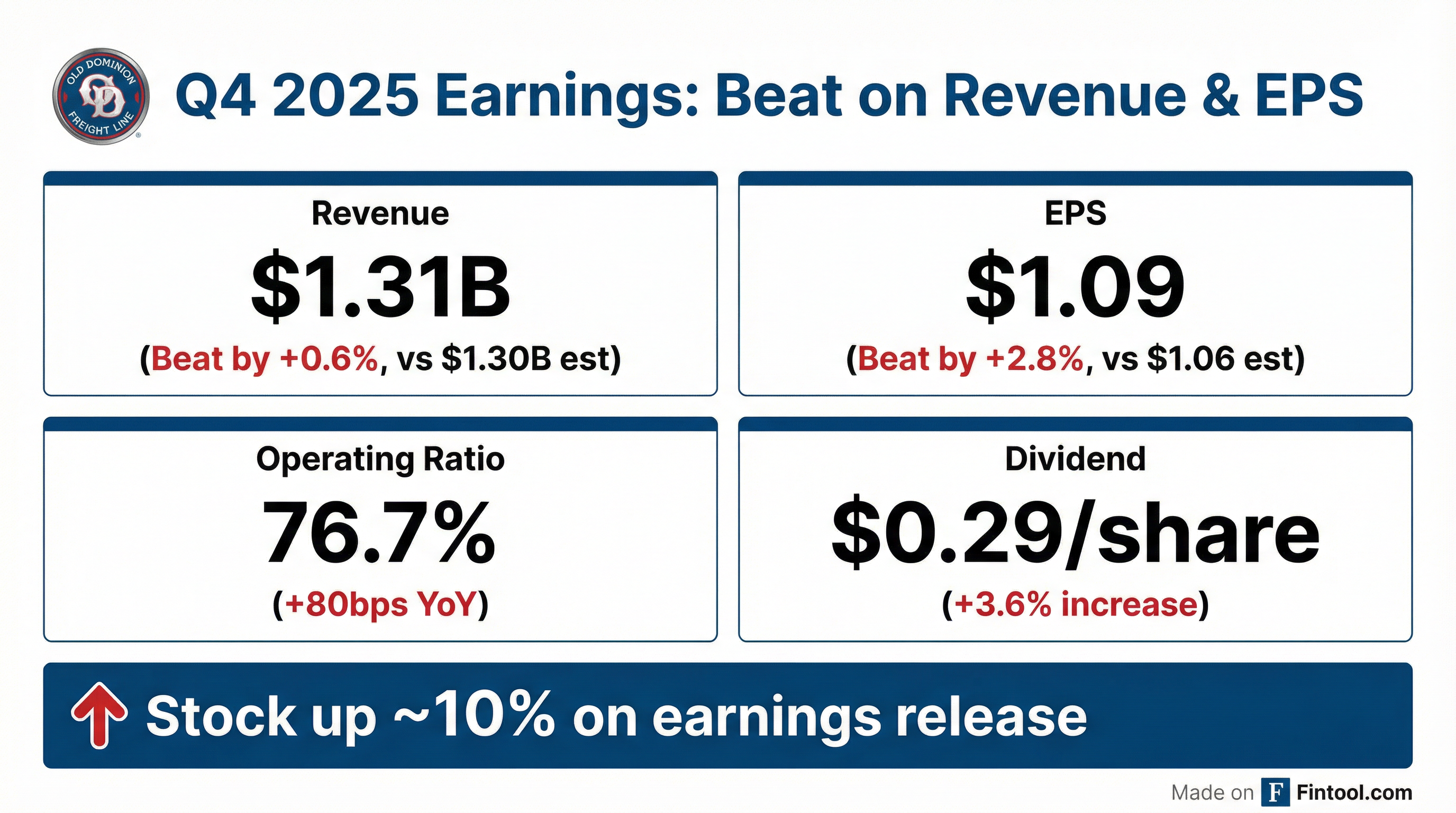

- Revenue of $1.31 billion in Q4 2025, down 5.7% year-over-year, driven by a 10.7% decline in LTL tons per day partially offset by a 5.6% increase in LTL revenue per hundredweight (4.9% ex-fuel); operating ratio widened to 76.7% (+80 bps).

- Maintained best-in-class service with 99% on-time performance and a 0.1% cargo claims ratio, while leveraging technology and cost discipline to keep direct operating costs at 53% of revenue despite lower network density.

- Generated $310.2 million of cash from operations in Q4; deployed $124.9 million to share repurchases and $58.4 million to dividends, with the Q1 2026 dividend raised 3.6% to $0.29 per share.

- Provided Q1 2026 guidance of $1.25–1.30 billion in revenue and a sequential operating ratio increase of ~150 bps, expressing cautious optimism about demand recovery amid capacity readiness.

- Revenue of $1.31 billion, down 5.7% year-over-year; operating ratio increased to 76.7%

- Delivered 99% on-time service and 0.1% cargo claims ratio, underscoring service quality

- Generated $310.2 million cash from operations in Q4; capex of $45.7 million; share repurchases of $124.9 million; dividends paid of $58.4 million

- Declared a $0.29 per share dividend for Q1 2026 (up 3.6%); effective tax rate was 24.8% in Q4

- Revenue of $1.31 billion, down 5.7% y/y, driven by a 10.7% decline in LTL tons/day partially offset by a 5.6% increase in LTL revenue per hundredweight.

- Operating ratio of 76.7%, up 80 bps y/y, with direct operating costs at 53% of revenue and overhead costs rising 140 bps due to deleveraging and increased depreciation.

- Cash flow from operations of $310.2 million; capex of $45.7 million; returned $124.9 million to shareholders via share repurchases and paid $58.4 million in dividends in Q4 2025.

- Q1 2026 guidance: revenue expected between $1.25 billion and $1.30 billion, operating ratio to rise ~150 bps, and quarterly dividend set at $0.29 per share (+3.6% y/y).

- Reported Q4 2025 revenue of $1.307 B (down 5.7% YoY) and EPS of $1.09, with net income of $229.5 M (12.8% decrease).

- Declared a Q1 2026 cash dividend of $0.29 per share, a 3.6% increase from Q1 2025.

- Operating ratio rose to 76.7% in Q4 2025 from 75.9% a year ago.

- Generated $310.2 M of net cash from operations in Q4 and incurred $45.7 M in capital expenditures; 2026 capex guidance approx $265 M.

- Returned capital via $730.3 M of share repurchases and $235.6 M in dividends during 2025.

- Old Dominion posted a 4.4% decline in November 2025 revenue per day, driven by a 10.0% drop in LTL tons per day amid economic softness.

- LTL volume pressures stemmed from a 9.4% decrease in daily shipments and a 0.6% decline in weight per shipment.

- Effective yield management drove a 5.9% increase in LTL revenue per hundredweight quarter-to-date (5.2% ex-fuel), highlighting pricing resilience.

- The company maintains strong profitability, over 250 service centers and 11,000 tractors, and retains a Buy rating with a $170 target despite revenue headwinds.

- November 2025 revenue per day fell 4.4% year-over-year, driven by a 10.0% decline in LTL tons per day.

- The drop in tons per day was due to a 9.4% decrease in shipments per day and a 0.6% decrease in weight per shipment.

- Through the quarter-to-date, LTL revenue per hundredweight increased 5.9%, and excluding fuel surcharges rose 5.2%, year-over-year.

- CEO Marty Freeman cited domestic economic softness for lower volumes while emphasizing yield management and service quality as strategic priorities.

- The release contains a forward-looking statements disclaimer under the Private Securities Litigation Reform Act.

- Revenue was $1.41 billion, down 4.3% YoY, driven by a 9.0% drop in LTL tons/day partly offset by a 4.7% rise in revenue per hundredweight.

- Operating ratio rose 160 bps to 74.3% as lower volumes deleveraged fixed overhead and increased depreciation costs.

- Cash flow from operations was $437.5 million; capital expenditures totaled $94 million; share repurchases were $180.8 million; dividends paid amounted to $58.7 million in Q3.

- Early October trends show revenue/day down 6.5%–7% and LTL tons/day down 11.6%, implying a 250–350 bps sequential increase in operating ratio for Q4 if current trends persist.

- Q3 revenue of $1.41 billion, down 4.3% year-over-year; LTL tons/day –9.0%, partially offset by a 4.7% increase in yield per hundredweight.

- Operating ratio of 74.3%, a 160 bps increase year-over-year due to deleveraging from lower revenue and higher overhead and depreciation costs.

- Q3 operating cash flow of $437.5 million; capital expenditures of $94 million; share repurchases of $180.8 million; dividends of $58.7 million.

- Early-quarter demand remains weak: October revenue per day down 6.5–7%, LTL tons per day down 11.6%, reflecting continued softness.

- Revenue of $1.41 billion, down 4.3% YoY, reflecting a 9.0% decline in LTL tons/day partially offset by a 4.7% increase in yield.

- Operating ratio rose to 74.3% (+160 bps) due to deleveraging from lower revenue and increased overhead; direct costs were flat YoY.

- Cash flow from operations of $437.5 million, CapEx of $94 million, share repurchases of $180.8 million, and dividends of $58.7 million in Q3.

- Maintained 99% on-time service and 0.1% cargo claims, earning #1 national LTL provider designation for the 16th consecutive year and top rankings in 23 of 28 surveyed categories.

- Diluted EPS of $1.28, down 10.5% year-over-year in Q3 2025

- Total revenue of $1.406 billion, a 4.3% decrease from Q3 2024

- Operating income of $360.8 million with an operating ratio of 74.3%, up 160 bps year-over-year

- LTL tons per day fell 9.0%, while LTL revenue per hundredweight increased 4.7%, reflecting yield improvements amid volume softness

- YTD diluted EPS of $3.74 on $4.189 billion revenue, down 12.0% and 5.4%, respectively

Quarterly earnings call transcripts for OLD DOMINION FREIGHT LINE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more