Earnings summaries and quarterly performance for Orion.

Executive leadership at Orion.

Corning Painter

Chief Executive Officer

Carlos Quinones

Senior Vice President, Global Operations

Jonathan Puckett

Chief Financial Officer

Pedro Riveros

Senior Vice President, Global Rubber Carbon Black and Americas Region

Sandra Niewiem

Senior Vice President, Global Specialty Carbon Black and EMEA Region

Board of directors at Orion.

Research analysts who have asked questions during Orion earnings calls.

John Ezekiel Roberts

Mizuho Securities

7 questions for OEC

Jonathan Tanwanteng

CJS Securities

6 questions for OEC

Joshua Spector

UBS

3 questions for OEC

Christopher Perrella

UBS Group AG

2 questions for OEC

Daniel Rizzo

Jefferies

2 questions for OEC

Jeff Zekauskas

JPMorgan

2 questions for OEC

Josh Spector

UBS Group

2 questions for OEC

Kevin Estok

Jefferies

2 questions for OEC

Laurence Alexander

Jefferies

2 questions for OEC

Dan Rizzo

Jefferies Financial Group Inc.

1 question for OEC

Jeffrey Zekauskas

JPMorgan Chase & Co.

1 question for OEC

Recent press releases and 8-K filings for OEC.

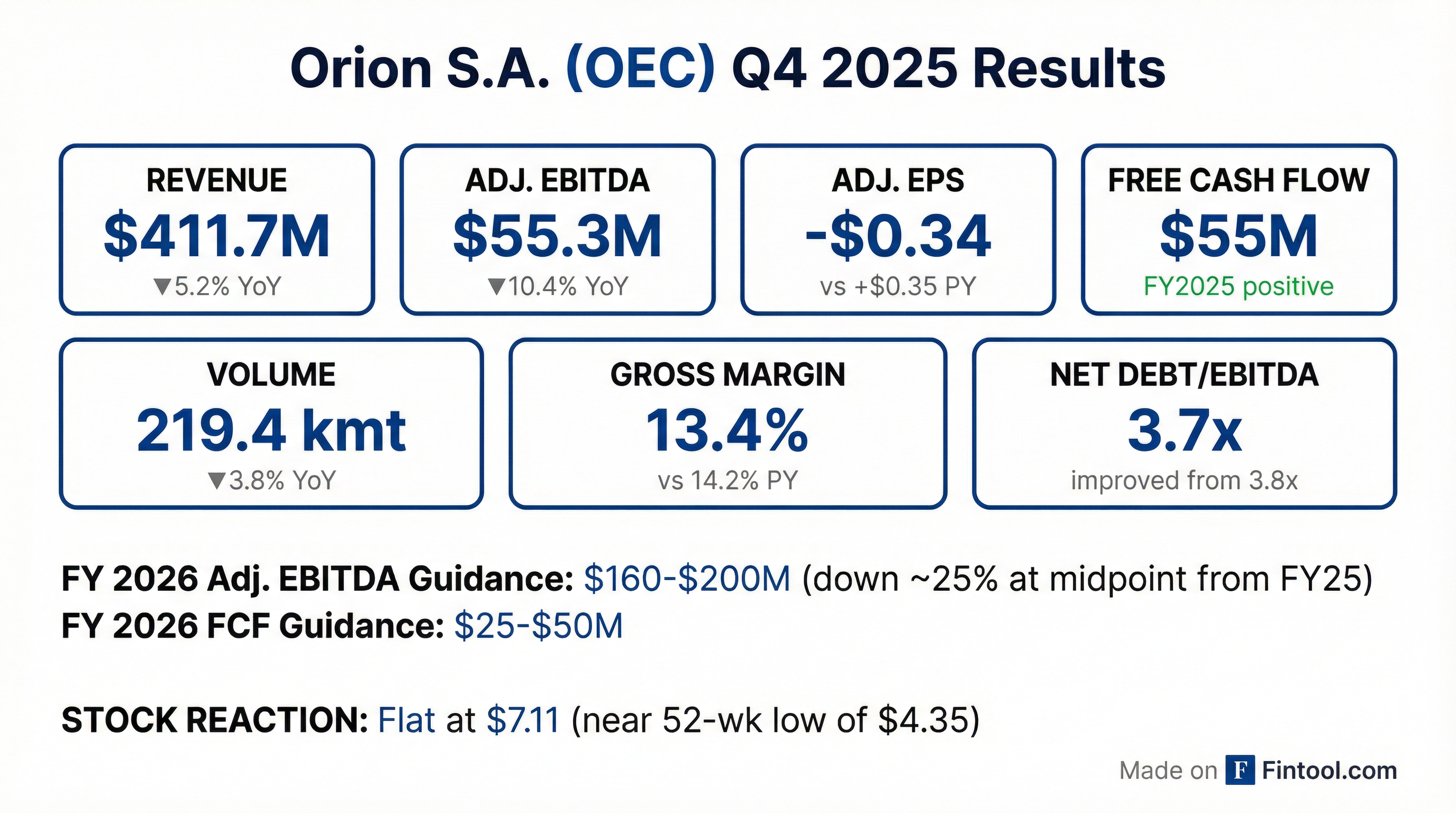

- Orion S.A. reported full year 2025 Net sales of $1.8 billion, a 4% decrease from the prior year, and a Net loss of $70 million (including an $81 million goodwill impairment charge), with Adjusted EBITDA of $248 million. For the fourth quarter of 2025, Net sales were $412 million, a 5% year-over-year decline, and the company reported a Net loss of $21 million and Adjusted EBITDA of $55 million.

- The company generated $216 million in operating cash flow and $55 million in free cash flow for the full year 2025.

- Orion S.A. issued full year 2026 guidance, projecting Adjusted EBITDA between $160 million and $200 million and free cash flow between $25 million and $50 million.

- The company concluded 2025 with net debt of $921 million and a net debt-to-Adjusted EBITDA ratio of 3.7x.

- Orion S.A. reported strong Q4 2025 results, with full-year Adjusted EBITDA and free cash flow exceeding expectations.

- The company provided 2026 guidance, anticipating a lower Adjusted EBITDA range but continued positive free cash flow, as detailed in the table below.

- Jon Puckett was introduced as the new Chief Financial Officer, having joined in early December 2025.

- Orion has implemented aggressive measures to navigate challenging industry conditions, including cost reductions, significant CapEx reduction, and the rationalization of 3-5 production lines.

- The La Porte plant project for conductive carbons has been slowed, with completion and startup now projected for 2027.

| Metric | FY 2025 | FY 2026 (Guidance) | H1 2026 (Guidance) |

|---|---|---|---|

| Adjusted EBITDA ($USD Millions) | 248 | 160 - 200 | 90 - 110 |

| Free Cash Flow ($USD Millions) | 55 | 25 - 50 | N/A |

| Capital Expenditures ($USD Millions) | 160 | 90 | N/A |

| Net Debt ($USD Millions) | 920 | N/A | N/A |

| Leverage Ratio (x) | 3.7 | N/A | N/A |

- For the full year 2025, Orion reported a Total Adjusted EBITDA of $248 million, an 18% decrease year-over-year, and Free Cash Flow of $55 million.

- In Q4 2025, the company's Adjusted EBITDA was $55.3 million on Net Sales of $411.7 million, resulting in an Adjusted Diluted Loss per share of $(0.34).

- The company faced a challenging 2025 backdrop due to surging tire imports, consumers trading down, and soft specialty demand, which led to difficult 2026 supply agreement negotiations.

- For the full year 2026, Orion provides guidance of Adjusted EBITDA between $160 million and $200 million and Free Cash Flow between $25 million and $50 million.

- Net Debt was reduced by approximately $40 million sequentially in Q4 2025 to ~$920 million, with the net debt-to-TTM Adjusted EBITDA ratio declining to 3.7x.

- Orion reported full-year 2025 adjusted EBITDA of $248 million and generated $55 million in free cash flow, exceeding its most recent outlook.

- For 2026, the company expects adjusted EBITDA to be between $160 million and $200 million and free cash flow between $25 million and $50 million, with capital expenditures reduced to $90 million.

- Strategic measures for 2026 include $20 million in cost reductions and the rationalization of 3-5 production lines to navigate challenging market conditions.

- Jonathan Puckett was introduced as the new Chief Financial Officer, having joined Orion in early December.

- The La Porte plant project for conductive carbons has been slowed, with completion and startup now anticipated in 2027.

- Orion S.A. reported full-year 2025 adjusted EBITDA of $248 million and free cash flow of $55 million, with Q4 2025 results exceeding expectations primarily due to higher volumes in the specialty segment.

- For 2026, the company forecasts adjusted EBITDA between $160 million and $200 million and free cash flow between $25 million and $50 million, supported by $90 million in capital expenditures.

- The company has implemented aggressive actions, including $20 million in cost reductions for 2026, rationalizing 3-5 production lines, and amending its credit agreement to navigate challenging market conditions.

- Jonathan Puckett joined Orion as the new Chief Financial Officer in early December.

- Orion Engineered Carbons reported a non-GAAP EPS of -$0.34 for Q4, missing estimates, while revenue of $411.7 million materially beat expectations despite a 5% year-over-year decline driven by volume and pricing weakness.

- For fiscal year 2025, the company generated $1.8 billion in net sales, $55 million in free cash flow, and $248 million in adjusted EBITDA, but recorded a $70.1 million net loss including an $81 million goodwill impairment.

- Management guided for 2026 adjusted EBITDA of $160–$200 million and free cash flow of $25–$50 million, with plans to stabilize earnings and reduce debt through operational discipline and working-capital actions, though near-term profitability and leverage remain a concern.

- Third-party data highlighted weaker balance sheet and liquidity metrics, including a debt-to-equity ratio of approximately 2.51, a current ratio of ~1.08, and a quick ratio of ~0.64.

- Orion S.A. reported full year 2025 Net sales of $1.8 billion, a 4% decrease from the prior year, and a Net loss of $70 million, which included an $81 million non-cash goodwill impairment charge.

- For the fourth quarter of 2025, Net sales were $412 million, representing a 5% year-over-year decline, with a Net loss of $21 million and Adjusted EBITDA of $55 million.

- The company generated operating cash flow of $216 million and free cash flow of $55 million for 2025, partly due to $69 million of cash extracted from working capital.

- Performance was impacted by historically high levels of lower-tier tire imports and soft demand in key industrial end-markets; in response, Orion is implementing mitigation actions such as cost rationalization, inventory reduction, reducing growth capital expenditures, and focusing on debt reduction.

- Francisco Partners has agreed to acquire a majority stake in OEConnection LLC (OEC) from Genstar Capital.

- OEC is a leading end-to-end technology platform for the global automotive aftersales ecosystem, serving 45 manufacturers, 30,000 auto dealers, and 135,000 wholesale customers across six countries.

- The financial terms of the transaction were not disclosed.

- Genstar, Ford, and General Motors will remain minority investors in OEC.

- Orion S.A. reported Adjusted EBITDA of approximately $58 million for Q3 2025, which was slightly better than their mid-October pre-announcement but still below expectations.

- The company expects full-year 2025 free cash flow to be in the range of $25 million to $40 million.

- Jeff Glajch, CFO, is retiring, and a new CFO with 30+ years of financial and business leadership experience, including 15 years in the chemical industry, will start on December 1.

- Orion is addressing soft demand in key markets, with U.S. tire production down 29% and European production down 20% (Western Europe 35%) compared to normalized levels. The company is implementing cost rationalization efforts, including rationalizing 3 to 5 underperforming production lines by year-end, and anticipates working capital to be a source of cash by approximately $50 million in 2025.

- Orion Engineered Carbons reported Q3 2025 Net Sales of $450.9 million, a 2.7% decrease year-over-year, and Adjusted EBITDA of $57.7 million, a 28.0% decrease year-over-year.

- Adjusted Diluted Earnings per share for Q3 2025 was $0.29, a decline from $0.47 in Q3 2024.

- The company's performance was affected by a difficult macro backdrop, soft premium specialty markets, and volumes skewed towards lower-margin APAC regions.

- Orion Engineered Carbons revised its Full Year 2025 guidance, projecting Adjusted EBITDA between $220 million and $235 million and Adjusted EPS between $0.80 and $0.95 per share.

- During Q3 2025, the company recovered $7.3 million in fraud-related losses and amended its credit agreement to increase RCF capacity.

Quarterly earnings call transcripts for Orion.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more