Earnings summaries and quarterly performance for OMEGA HEALTHCARE INVESTORS.

Executive leadership at OMEGA HEALTHCARE INVESTORS.

Board of directors at OMEGA HEALTHCARE INVESTORS.

Research analysts who have asked questions during OMEGA HEALTHCARE INVESTORS earnings calls.

Juan Sanabria

BMO Capital Markets

6 questions for OHI

Farrell Granath

Bank of America

5 questions for OHI

Michael Carroll

RBC Capital Markets

5 questions for OHI

John Kilichowski

Wells Fargo & Company

4 questions for OHI

Jonathan Hughes

Raymond James Financial

4 questions for OHI

Alec Feygin

Robert W. Baird & Co. Incorporated

3 questions for OHI

John Pawlowski

Green Street

3 questions for OHI

Nicholas Yulico

Scotiabank

3 questions for OHI

Omotayo Okusanya

Deutsche Bank AG

3 questions for OHI

Vikram Malhotra

Mizuho Financial Group, Inc.

3 questions for OHI

Alex Fagan

Robert W. Baird & Co. Incorporated

2 questions for OHI

Elmer Chang

Scotiabank

2 questions for OHI

Emily Meckler

Green Street

2 questions for OHI

Julian Blouin

Goldman Sachs

2 questions for OHI

Michael Goldsmith

UBS

2 questions for OHI

Michael Griffin

Citigroup Inc.

2 questions for OHI

Nick Joseph

Citigroup Inc.

2 questions for OHI

William John Kilichowski

Wells Fargo

2 questions for OHI

Daniel Bion

Bank of America

1 question for OHI

Joseph Dickstein

Jefferies

1 question for OHI

Justin Haasbeek

RBC Capital Markets

1 question for OHI

Michael Stroyeck

Green Street Advisors, LLC

1 question for OHI

Nick Yulico

Scotiabank

1 question for OHI

Richard Anderson

Wedbush Securities

1 question for OHI

Sam

Deutsche Bank

1 question for OHI

Seth Bergey

Citi

1 question for OHI

Wesley Golladay

Robert W. Baird & Co.

1 question for OHI

Recent press releases and 8-K filings for OHI.

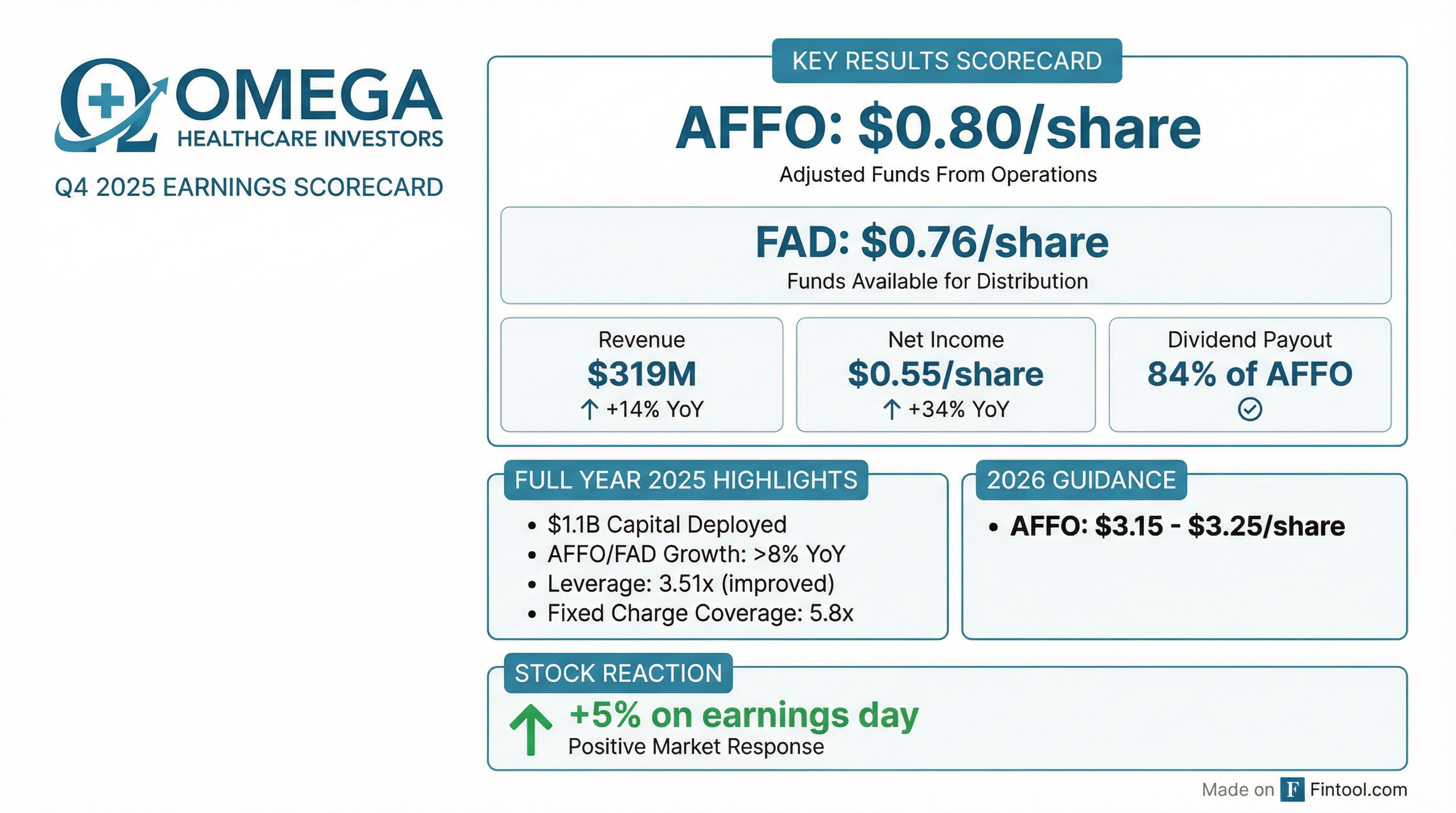

- Omega Healthcare Investors reported Q4 2025 adjusted Funds From Operations (AFFO) of $0.80 per share and Funds Available for Distribution (FAD) of $0.76 per share, with full-year 2025 AFFO and FAD growth exceeding 8% year-over-year.

- The company issued full-year 2026 adjusted FFO guidance of $3.15 to $3.25 per share.

- In 2025, Omega deployed $1.1 billion in new investments, including $334 million in Q4 2025, expanding into RIDEA structures and the Canadian long-term care market.

- The balance sheet was strengthened in Q4 2025 with over $700 million in debt reduction, lowering leverage to 3.51 times and improving the fixed charge coverage ratio to 5.8 times.

- The Genesis bankruptcy is expected to conclude in Q3 or Q4 of 2026, with Omega anticipating full repayment of its $137 million in loans.

- Omega Healthcare Investors reported fourth quarter 2025 adjusted funds from operations (AFFO) of $0.80 per share and funds available for distribution (FAD) of $0.76 per share. Full year 2025 AFFO and FAD growth exceeded 8% year-over-year.

- Revenue for the fourth quarter of 2025 was $319 million, an increase from $279 million in the fourth quarter of 2024. Net income for Q4 2025 was $172 million, or $0.55 per common share.

- The company deployed $1.1 billion in new investments in 2025, with $334 million in new investments during Q4 2025, including RIDEA transactions and an expanded Saber relationship. Subsequent to quarter end, Omega closed on an additional $212 million in investments, including the purchase of 9.9% of Saber's operating company for $93 million.

- Omega Healthcare Investors reduced its funded debt by over $700 million in Q4 2025, resulting in a leverage ratio of 3.51 times and a fixed charge coverage ratio of 5.8 times.

- The company provided full year 2026 Adjusted FFO guidance in the range of $3.15 to $3.25 per share. The Genesis bankruptcy process is now anticipated to conclude in Q3 or Q4 of 2026, with Omega expecting its lease to be assumed and its loans to be paid in full.

- Omega Healthcare Investors reported Q4 2025 Adjusted FFO of $0.80 per share and FAD of $0.76 per share, contributing to full year AFFO and FAD growth exceeding 8% year-over-year. The company issued full year 2026 Adjusted FFO guidance of $3.15-$3.25 per share.

- The company demonstrated strong capital deployment in 2025 with $1.1 billion in new investments, including $334 million in Q4 2025 and an additional $212 million subsequent to quarter-end, notably expanding its Saber relationship and making its initial entry into the Canadian market.

- Omega significantly strengthened its balance sheet in Q4 2025 by reducing funded debt by over $700 million, achieving a leverage ratio of 3.51x and a fixed charge coverage ratio of 5.8x.

- The Genesis bankruptcy process is now anticipated to conclude in Q3 or Q4 of 2026, with Omega expecting the lease assumption and full repayment of its loans by the winning bidder, 101 West State Street.

- For Q4 2025, Omega Healthcare Investors reported net income of $172 million, or $0.55 per diluted share, and Adjusted Funds From Operations (AFFO) of $250 million, or $0.80 per diluted share. For the full year 2025, net income was $609 million, or $1.94 per common share, and AFFO was $946 million, or $3.10 per diluted share.

- The company is providing 2026 Adjusted FFO guidance to be between $3.15 and $3.25 per diluted share.

- Omega completed $334 million in new investments in Q4 2025, consisting of $52 million in real estate acquisitions, $16 million in real estate loans, and $266 million in investments in unconsolidated entities. For the full year 2025, new investments totaled $1.1 billion.

- In Q4 2025, Omega repaid $1.27 billion of aggregate debt , including $600 million of senior unsecured notes and a $429 million unsecured term loan. For the full year 2025, $1.7 billion in debt was repaid.

- On January 29, 2026, the Board of Directors declared a quarterly cash dividend of $0.67 per share, to be paid on February 17, 2026.

- Omega Healthcare Investors reported Q4 2025 net income of $172 million ($0.55 per diluted share) and full-year 2025 net income of $609 million ($1.94 per common share). Adjusted FFO for Q4 2025 was $250 million ($0.80 per diluted share) and for the full year 2025 was $946 million ($3.10 per diluted share).

- The company provided 2026 Adjusted FFO guidance in the range of $3.15 to $3.25 per diluted share.

- In Q4 2025, Omega completed $334 million in new investments, issued $223 million in equity, and repaid $1.27 billion of aggregate debt. For the full year 2025, new investments totaled $1.1 billion and debt repayment was $1.7 billion.

- A quarterly cash dividend of $0.67 per share was declared on January 29, 2026, payable on February 17, 2026.

- Omega Healthcare Investors, Inc. entered into a new "at-the-market" equity offering sales agreement on November 3, 2025.

- This agreement allows for the issuance and sale of common stock with an aggregate gross sales price not to exceed $2,000,000,000.

- The new agreement replaces a prior "at the market" equity offering sales agreement dated September 6, 2024.

- Sales Agents and Forward Sellers will receive compensation not exceeding 2.0% of the gross sales price.

- The company continues to meet the requirements for qualification and taxation as a REIT.

- Omega (OHI) reported Q3 2025 revenue of $312 million and adjusted FFO of $0.79 per share, and raised its full-year adjusted FFO guidance to a range of $3.08 to $3.10 per share.

- The company made over $978 million in total new investments through October 2025, including $151 million in Q3 2025, and is expanding its capital allocation strategy to include joint ventures, minority interests, and RIDEA-like structures for higher returns.

- A notable new investment is the acquisition of a 49% equity interest in a portfolio of 64 healthcare facilities for $222 million and a planned $93 million investment for a 9.9% equity ownership interest in SABR Healthcare Holdings' operating company, expected to close in January 2026.

- Omega's balance sheet remains strong with $737 million in cash at quarter-end, a new $2.3 billion credit facility, and the repayment of $600 million in senior unsecured notes.

- The Genesis bankruptcy process is anticipated to conclude in Q1 or Q2 2026, with Genesis continuing to pay full contractual rent and Omega having fully funded its $8 million debtor-in-possession financing.

- Omega Healthcare Investors reported Q3 2025 adjusted FFO of $0.79 per share and FAD of $0.75 per share, with revenue increasing to $312 million from $276 million in Q3 2024.

- The company raised and narrowed its 2025 AFFO guidance to $3.08 to $3.10 per share, projecting 8% year-over-year AFFO growth at the midpoint.

- Portfolio performance showed improvement, with trailing 12-month operator EBITDA coverage increasing to 1.55 times as of June 30, 2025, and the below-one-times rent coverage dropping to 4.3% of total rent.

- Omega completed $151 million in new investments during Q3 2025 and, subsequent to quarter-end, invested $222 million for a 49% equity interest in a SABR Healthcare joint venture, with an additional $93 million planned for a 9.9% equity stake in SABR Healthcare Holdings.

- The company's balance sheet remains robust, ending Q3 2025 with $737 million in cash, a fixed charge coverage ratio of 5.1 times, and leverage reduced to 3.59 times, supported by a new $2.3 billion credit facility and the repayment of $600 million in senior unsecured notes.

- Omega Healthcare Investors reported Q3 2025 adjusted FFO of $0.79 per share and FAD of $0.75 per share, driven by $312 million in revenue, up from $276 million in Q3 2024.

- The company raised and narrowed its 2025 AFFO guidance to $3.08-$3.10 per share, with the midpoint reflecting 8% year-over-year growth.

- OHI made over $978 million in new investments through October 2025, including a significant $222 million investment for a 49% equity interest in a real estate joint venture with SABR Healthcare and a planned $93 million investment for a 9.9% equity ownership in SABR's operating company, expected to close in January 2026.

- The balance sheet remains strong, with $737 million in cash at quarter-end, a fixed charge coverage ratio of 5.1x, and leverage reduced to 3.59x.

- Omega Healthcare Investors, Inc. reported net income of $185 million, or $0.59 per diluted share, and Adjusted FFO of $243 million, or $0.79 per diluted share, for the third quarter of 2025.

- The company completed approximately $151 million in new investments during Q3 2025 and acquired a 49% equity interest in a joint venture with Saber Healthcare Holdings for $222 million in October 2025.

- Omega closed a new $2.3 billion unsecured credit facility, extended a $428.5 million term loan, and repaid $600 million of senior unsecured notes in October 2025.

- The company increased its full-year 2025 Adjusted FFO guidance to between $3.08 and $3.10 per diluted share, up from the previous range of $3.04 to $3.07 per diluted share.

Quarterly earnings call transcripts for OMEGA HEALTHCARE INVESTORS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more