Earnings summaries and quarterly performance for Offerpad Solutions.

Executive leadership at Offerpad Solutions.

Board of directors at Offerpad Solutions.

Research analysts who have asked questions during Offerpad Solutions earnings calls.

Dae Lee

JPMorgan Chase & Co.

6 questions for OPAD

Ryan Tomasello

Keefe, Bruyette & Woods

6 questions for OPAD

Gaurav Mehta

Alliance Global Partners

2 questions for OPAD

John Colantuoni

Jefferies

2 questions for OPAD

Michael Ng

Goldman Sachs

2 questions for OPAD

Vincent Kardos

Jefferies

2 questions for OPAD

Dae K. Lee

JPMorgan

1 question for OPAD

Juan Chung

Keefe, Bruyette & Woods

1 question for OPAD

Luke Edward Meindl

JMP Securities

1 question for OPAD

Nicholas Jones

Citizens JMP

1 question for OPAD

Recent press releases and 8-K filings for OPAD.

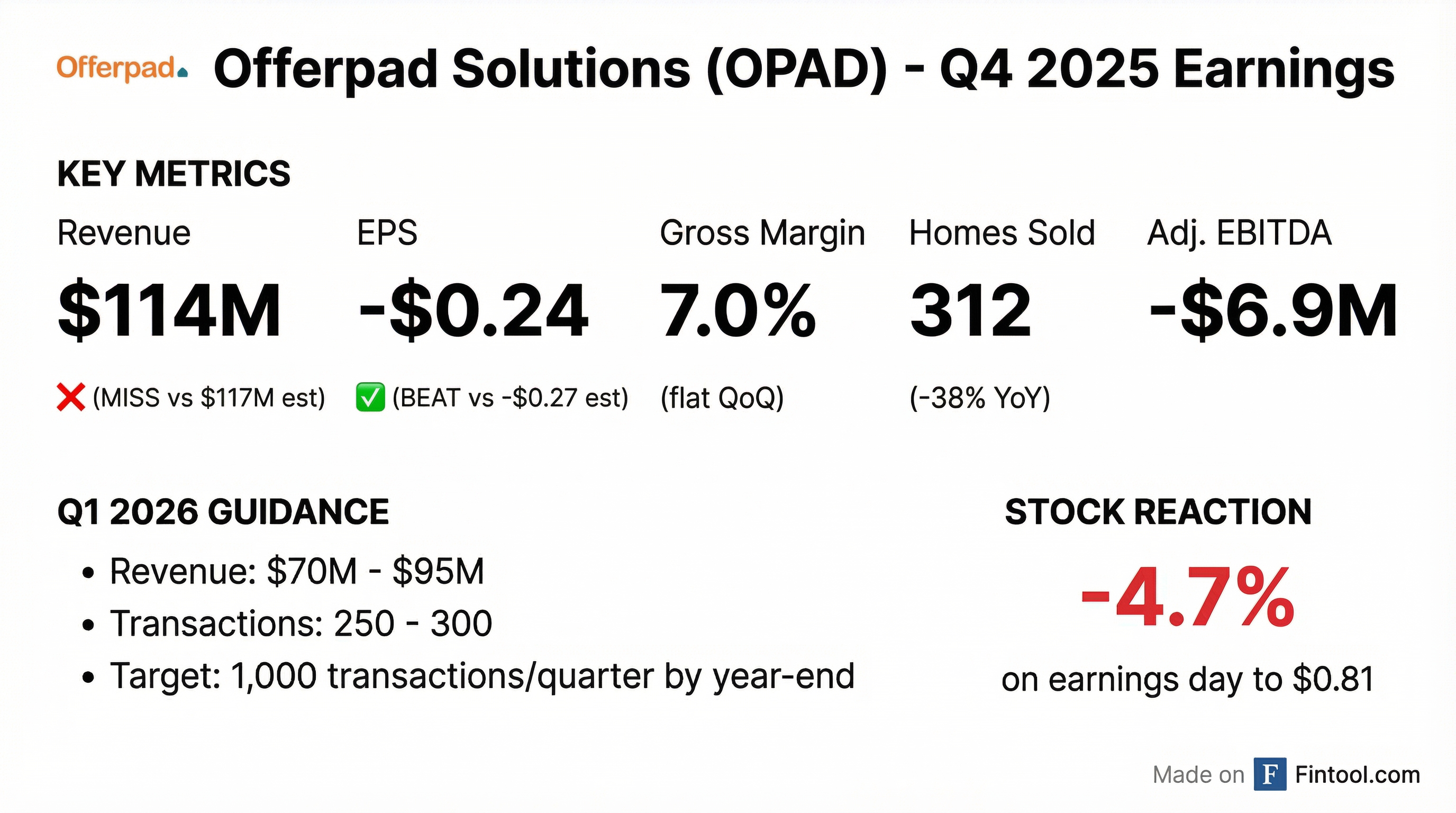

- Offerpad Solutions reported Q4 2025 revenue of $114 million and a full-year 2025 revenue of $568 million, with a Q4 2025 Adjusted EBITDA loss of $6.9 million.

- The company strengthened its liquidity with an $18 million capital raise in early Q1 2026, bringing total liquidity to over $70 million, and has reduced annualized expenses by over $140 million since 2022.

- Offerpad has evolved into a four-solution real estate platform, including Cash Offer, Cash Offer Marketplace, Brokerage Services, and Renovate, with the Renovate segment generating $27 million in revenue in 2025, an increase of approximately 50% year-over-year.

- For Q1 2026, the company guides for 250-300 real estate transactions and revenue of $70 million-$95 million, anticipating sequential improvement in Adjusted EBITDA. Offerpad aims to reach approximately 1,000 transactions per quarter by the end of 2026 and expects to achieve positive Adjusted EBITDA within 2026.

- Offerpad reported Q4 2025 revenue of $114 million and full-year 2025 revenue of $568 million, with a Q4 Adjusted EBITDA loss of $6.9 million.

- The company strengthened its liquidity to over $70 million following an $18 million capital raise in early Q1 2026, and has removed over $140 million of annualized expenses since 2022.

- Offerpad is evolving into a four-solution real estate platform (Cash Offer, Cash Offer Marketplace, Brokerage Services, and Renovate), with Renovate generating $27 million in revenue in 2025.

- For Q1 2026, the company guides for 250-300 real estate transactions and revenue of $70 million-$95 million, aiming to reach 1,000 transactions per quarter by the end of 2026 and achieve positive Adjusted EBITDA within the year.

- Offerpad Solutions reported Q4 2025 revenue of $114 million and full-year 2025 revenue of $568 million, with a Q4 gross margin of 7% and an Adjusted EBITDA loss of $6.9 million.

- The company's liquidity was over $55 million at quarter-end, including $27 million in unrestricted cash, which increased to over $70 million after an $18 million capital raise in early Q1 2026.

- Offerpad is guiding for Q1 2026 revenue of $70 million-$95 million and 250-300 real estate transactions.

- The company expects to reach 1,000 home transactions per quarter across its multi-solution platform as it exits 2026, aiming for positive Adjusted EBITDA within 2026.

- Offerpad has transitioned to a four-solution real estate platform (Cash Offer, Cash Offer Marketplace, Brokerage Services, and Renovate), with Renovate revenue growing approximately 50% year-over-year to $27.1 million in 2025.

- Offerpad Solutions reported Q4 2025 revenue of $114.1 million, a 14% decrease quarter-over-quarter (QoQ). The company posted a net loss of $(8.8) million, which was a 24% improvement QoQ, while Adjusted EBITDA declined by 50% QoQ to $(6.9) million.

- In Q4 2025, Offerpad acquired 312 homes, a 15% decrease QoQ, and sold 110 homes, a 46% decrease QoQ.

- The company's third-party renovation services, Offerpad Renovate, completed 422 projects in Q4 2025, generating $6.9 million in total revenue.

- Offerpad's growth plan includes increasing market share to 3-4% from current levels, expanding solutions for sellers, and growing B2B services such as the Cash Offer Marketplace and renovation-as-a-service.

- Offerpad reported Q4 CY2025 revenue of $114.1 million, marking a 34.5% year-over-year decline, and a GAAP loss of $0.24 per share. The company also posted a 7% gross margin and an adjusted EBITDA loss of $6.9 million for the quarter.

- For Q1 2026, the company is guiding revenue of $70–$95 million and aims for roughly 1,000 transactions per quarter by year-end, with a goal of achieving positive adjusted EBITDA by the end of 2026.

- Operational improvements include over $140 million in annualized expense reductions since 2022, Q4 operating expenses reduced to $15 million, and liquidity increasing to over $70 million after an $18 million capital raise.

- Analysts highlight weak multi-year sales trends, sharply lower homes bought and sold, declining margins, and a negative Altman Z-Score, signaling continued financial risk despite the company's strategic pivot.

- Offerpad Solutions Inc. reported revenue of $114.1 million and a net loss of ($8.8 million) for the fourth quarter ended December 31, 2025, during which 312 homes were sold.

- For the full fiscal year 2025, the company recorded a net loss of ($46.384 million).

- For the first quarter of 2026, Offerpad expects revenue in the range of $70 million to $95 million and 250-300 real estate transactions.

- The company anticipates Adjusted EBITDA to improve sequentially in Q1 2026, with an objective to reach EBITDA positive before the end of the year.

- Offerpad's objective is to exit 2026 at a run-rate of approximately 1,000 home transactions per quarter across its Cash Offer, Cash Offer Marketplace, and Brokerage Services solutions.

- Offerpad reported revenue of $114.1 million and sold 312 homes in Q4 2025.

- For Q4 2025, the company posted a net loss of ($8.8 million) and Adjusted EBITDA of ($6.9 million).

- In 2025, Offerpad evolved into a four-solution platform and aims to exit 2026 at approximately 1,000 transactions per quarter.

- For Q1 2026, Offerpad expects revenue in the range of $70 million to $95 million and 250-300 real estate transactions.

- The company anticipates Adjusted EBITDA to improve sequentially in Q1 2026, with an objective to reach EBITDA positive before the end of 2026.

- Offerpad Solutions Inc. entered into a securities purchase agreement on January 11, 2026, for the issuance and sale of 10,000,000 shares of Class A common stock at $1.80 per share.

- This offering is expected to generate gross proceeds of $18.0 million and is anticipated to close on January 13, 2026.

- The company will pay A.G.P./Alliance Global Partners a 5.0% fee of the aggregate gross proceeds for serving as the exclusive placement agent.

- The net proceeds from the sale of these securities will be utilized for working capital and general corporate purposes.

- Following the closing, Offerpad has agreed to a 60-day restriction on issuing additional common stock or engaging in variable rate transactions, with certain exceptions.

- Offerpad Solutions Inc. announced the pricing of a registered direct offering for 10,000,000 shares of its common stock at a purchase price of $1.80 per share.

- The offering is expected to generate approximately $18 million in gross proceeds.

- The closing of the offering is anticipated on or about January 13, 2026.

- The net proceeds from the offering are intended for general working capital, including supporting growth initiatives, inventory optimization, and strengthening the balance sheet.

- Offerpad reported revenue of $132.7 million and a net loss of $11.6 million for Q3 2025. The company's Adjusted EBITDA was ($4.6 million) for the same period.

- In Q3 2025, Offerpad sold 367 homes and acquired 203 homes.

- For Q4 2025, Offerpad expects revenue between $100 million and $125 million and homes sold between 300 and 350. Adjusted EBITDA is anticipated to be similar to Q3 2025.

Quarterly earnings call transcripts for Offerpad Solutions.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more