Earnings summaries and quarterly performance for PORTLAND GENERAL ELECTRIC CO /OR/.

Executive leadership at PORTLAND GENERAL ELECTRIC CO /OR/.

Maria Pope

Chief Executive Officer

Angelica Espinosa

Senior Vice President, Chief Legal and Compliance Officer

Benjamin Felton

Executive Vice President, Chief Operating Officer

John McFarland

Vice President, Chief Commercial and Customer Officer

Joseph Trpik

Senior Vice President, Finance and Chief Financial Officer

Board of directors at PORTLAND GENERAL ELECTRIC CO /OR/.

Research analysts who have asked questions during PORTLAND GENERAL ELECTRIC CO /OR/ earnings calls.

Anthony Crowdell

Mizuho Financial Group

6 questions for POR

Julien Dumoulin-Smith

Jefferies

4 questions for POR

Paul Fremont

Ladenburg Thalmann

4 questions for POR

Richard Sunderland

JPMorgan Securities LLC

4 questions for POR

Chris Ellinghaus

Siebert Williams Shank

3 questions for POR

Michael Lonegan

Evercore ISI

3 questions for POR

Nicholas Campanella

Barclays

3 questions for POR

Travis Miller

Morningstar

3 questions for POR

Andy Levi

HITE Hedge

2 questions for POR

Brian Russo

Jefferies

2 questions for POR

Gregg Orrill

UBS Group AG

2 questions for POR

Shahriar Pourreza

Guggenheim Partners

2 questions for POR

Shar Pourreza

Wells Fargo

2 questions for POR

Steve Fleishman

Wolfe Research, LLC

2 questions for POR

Christopher Ellinghaus

Siebert Williams Shank & Co., LLC

1 question for POR

Nathan Richardson

Barclays

1 question for POR

Sophie Karp

KeyBanc Capital Markets Inc.

1 question for POR

Recent press releases and 8-K filings for POR.

- Portland General Electric Company priced a public offering of 9,467,455 shares of common stock at $50.70 per share on February 17, 2026.

- The underwriters' option to purchase an additional 1,380,670 shares was exercised in full on February 18, 2026, bringing the total shares offered to 10,848,125.

- The offering closed on February 19, 2026, with the forward purchasers borrowing and selling the total shares to the underwriters.

- The company expects to physically settle the associated forward sale agreements by February 22, 2028, and intends to use the net proceeds for general corporate purposes, investment in renewable energy and non-emitting dispatchable capacity, and repayment of indebtedness.

- Portland General Electric Company (PGE) priced an underwritten public offering of 9,467,455 shares of its common stock at $50.70 per share.

- The offering is expected to close on February 19, 2026, and is being conducted in connection with forward sale agreements.

- The underwriters have been granted a 30-day option to purchase up to 1,380,670 additional shares of common stock.

- PGE intends to use the net proceeds from the future settlement of these agreements for general corporate purposes and investment in renewable energy and non-emitting dispatchable capacity, potentially including repayment of indebtedness.

- Portland General Electric Company (POR) announced an underwritten public offering of $480,000,000 of shares of its common stock on February 17, 2026.

- The underwriters have a 30-day option to purchase up to an additional $70,000,000 of common stock.

- The offering involves forward sale agreements with Wells Fargo Bank, National Association and Bank of America, N.A..

- The company also entered into an equity distribution agreement for an at-the-market offering of up to $500.0 million of common stock.

- Net proceeds from the offerings are intended for general corporate purposes and investment in renewable energy and non-emitting dispatchable capacity, which may include repayment of indebtedness.

- Portland General Electric Company (PGE) announced an underwritten public offering of $480,000,000 of its common stock, with underwriters having a 30-day option to purchase up to an additional $70,000,000.

- The offering is structured through forward sale agreements, meaning PGE will not initially receive proceeds, but expects to physically settle these agreements within 24 months.

- Proceeds from the future settlement are intended for general corporate purposes and investment in renewable energy and non-emitting dispatchable capacity, which may include repayment of indebtedness.

- Portland General Electric (POR) announced a definitive agreement to acquire PacifiCorp's Washington electric utility business for $1.9 billion, partnering with Manulife Investment Management as a 49% minority partner. This acquisition is forecast to be accretive in the first year and is expected to close approximately 12 months after regulatory filings.

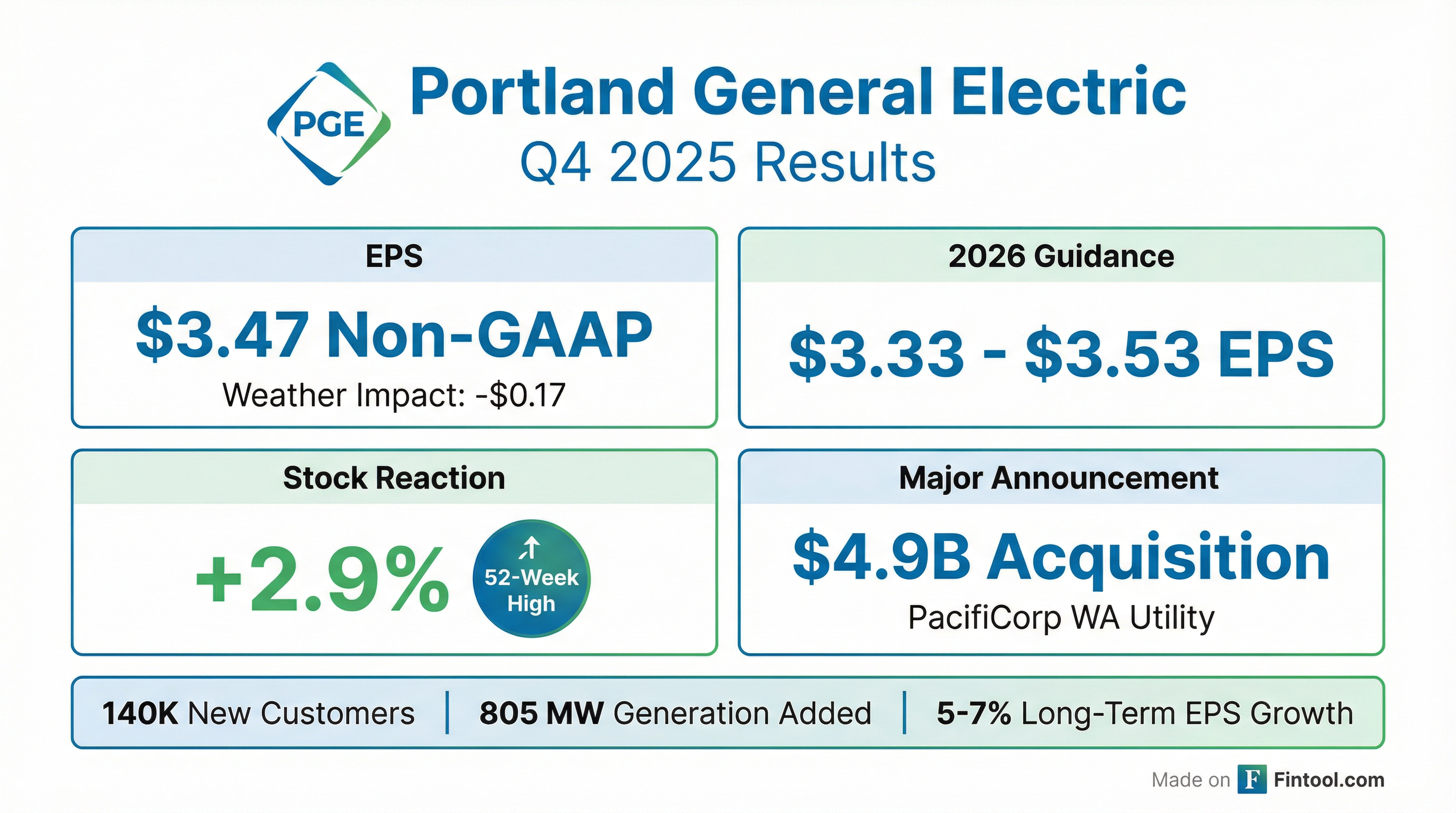

- For the full year 2025, POR reported GAAP net income of $306 million or $2.77 per diluted share, and non-GAAP net income of $336 million or $3.05 per share. The company provided 2026 earnings guidance of $3.33-$3.53 per share and reaffirmed its long-term EPS and dividend growth guidance of 5%-7%.

- In 2025, POR experienced total weather-adjusted load growth of about 5%, with industrial load increasing 14% compared to 2024, driven by high-tech manufacturers and data centers. The company also announced four new energy projects, including solar and battery storage facilities, slated to come online by the end of 2027.

- Portland General Electric initiated full-year 2026 adjusted earnings guidance of $3.33 to $3.53 per diluted share and reaffirmed 5% to 7% long-term EPS and dividend growth.

- The company forecasts $1,655 million in capital expenditures for 2026, primarily allocated to distribution, transmission, and 2023 RFP projects.

- PGE is acquiring select PacifiCorp utility assets in Washington for $1.9 billion, forming a joint venture with Manulife IM where PGE will hold a 51% ownership stake.

- The acquisition's financing plan includes ~$600 million equity from Manulife IM, ~$600 million raised at HoldCo, and ~$700 million secured debt at WA Utility.

- As of December 31, 2025, Total Liquidity was $954 million, supported by investment-grade credit ratings of BBB+ (S&P) and A3 (Moody's) with a Stable Outlook.

- Portland General Electric (PGE) has entered into a definitive agreement to acquire PacifiCorp's Washington electric utility business for $1.9 billion, with Manulife Investment Management taking a 49% minority stake.

- The acquisition is projected to be accretive in the first year and supports PGE's long-term EPS and dividend growth guidance of 5%-7%. The company also issued 2026 earnings guidance of $3.33-$3.53 per share.

- For the full year 2025, PGE reported GAAP net income of $306 million or $2.77 per diluted share, and non-GAAP net income of $336 million or $3.05 per share.

- PGE experienced 5% total weather-adjusted load growth in 2025, with industrial growth of 14% driven by data centers, and secured 430 MW in new data center contracts.

- The company announced new solar and battery storage projects, including build transfer agreements for 125 MW solar and 125 MW battery storage at Biglow, and 240 MW solar and 125 MW battery for the Wheatridge expansion, alongside procuring an additional 400 MW of battery capacity.

- Portland General Electric (PGE) announced a definitive agreement to acquire PacifiCorp's Washington electric utility business for $1.9 billion, with Manulife Investment Management as a 49% minority partner. This acquisition is expected to be accretive in the first year and enhance long-term EPS and dividend growth of 5%-7%.

- For the full year 2025, the company reported GAAP diluted EPS of $2.77 and non-GAAP EPS of $3.05. These results were impacted by unprecedented warm weather in Q4 2025, which reduced earnings by $0.17 per share.

- The acquisition will increase PGE's overall portfolio by approximately 18%, adding 140,000 customers and expanding generation, transmission, and distribution assets. The financing plan includes a $600 million equity contribution from Manulife, $700 million secured debt at the Washington utility, and $600 million raised at the proposed holdco.

- Total load increased 3.8% overall and 4.7% weather adjusted in 2025 compared to 2024, driven by a 14% increase in industrial load. Industrial customers have grown at 10% compounded annually from 2020 to 2025 and are expected to continue this pace through 2030.

- Portland General Electric Co /OR/ is acquiring electric utility operations and assets in Washington state from PacifiCorp, aiming to enhance scale, diversify its regional presence, and expand future rate base investment. This acquisition is expected to be accretive in the first full year and support long-term EPS and dividend growth.

- The company projects substantial rate base growth, reaching $9 billion (combined with the WA Utility) in 2026E and $15.6 billion by 2029E. PGE also forecasts long-term EPS and dividend growth of 5% to 7%.

- For 2025, PGE reported $3.5 billion in revenue, $2.77 GAAP diluted EPS, and $3.05 adjusted non-GAAP diluted EPS. The 2026E adjusted non-GAAP diluted EPS guidance is $3.33 to $3.53.

- PGE is focused on clean energy and infrastructure investments, with 46% non-emitting resources in its 2025 total system mix and plans to procure 2,500 to 3,500 MW of additional non-emitting resources through 2030. The company is also capitalizing on high-tech demand, with 430 MW of executed contracts with data center customers in 2025 and 2026 YTD.

- Portland General Electric Company (PGE) announced an agreement to acquire select Washington state utility operations and assets from PacifiCorp for $1.9 billion, partnering with Manulife Investment Management as a minority owner.

- For the full year ended December 31, 2025, PGE reported GAAP net income of $2.77 per diluted share and non-GAAP adjusted net income of $3.05 per diluted share, reflecting 14% year-over-year industrial demand growth.

- The company initiated full-year 2026 adjusted earnings guidance of $3.33 to $3.53 per diluted share and reaffirmed 5% to 7% long-term earnings per share growth.

- PGE also entered into agreements to construct two solar and battery hybrid projects totaling 615 MW, with 425 MW Company-owned, and approved a quarterly common stock dividend of $0.525 per share.

Fintool News

In-depth analysis and coverage of PORTLAND GENERAL ELECTRIC CO /OR/.

Quarterly earnings call transcripts for PORTLAND GENERAL ELECTRIC CO /OR/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more