Earnings summaries and quarterly performance for QUALCOMM INC/DE.

Executive leadership at QUALCOMM INC/DE.

Cristiano Amon

Chief Executive Officer

Akash Palkhiwala

Chief Financial Officer and Chief Operating Officer

Alexander Rogers

President, Qualcomm Technology Licensing (QTL) and Global Affairs

Ann Chaplin

General Counsel and Corporate Secretary

Baaziz Achour

Chief Technology Officer

Heather Ace

Chief Human Resources Officer

Patricia Grech

Chief Accounting Officer

Board of directors at QUALCOMM INC/DE.

Ann Livermore

Director

Christopher Young

Director

Irene Rosenfeld

Director

Jamie Miller

Director

Jean-Pascal Tricoire

Director

Jeffrey Henderson

Director

Marie Myers

Director

Mark Fields

Director

Mark McLaughlin

Chair of the Board

Neil Smit

Director

Sylvia Acevedo

Director

Zico Kolter

Director

Research analysts who have asked questions during QUALCOMM INC/DE earnings calls.

Joshua Buchalter

TD Cowen

8 questions for QCOM

Samik Chatterjee

JPMorgan Chase & Co.

8 questions for QCOM

Stacy Rasgon

Bernstein Research

8 questions for QCOM

Timothy Arcuri

UBS

7 questions for QCOM

Ben Reitzes

Melius Research LLC

5 questions for QCOM

Ross Seymore

Deutsche Bank

5 questions for QCOM

Tal Liani

Bank of America

5 questions for QCOM

Chris Caso

Wolfe Research LLC

3 questions for QCOM

Christopher Caso

Wolfe Research

3 questions for QCOM

CJ Muse

Cantor Fitzgerald

3 questions for QCOM

C J Muse

Tanner Fitzgerald

2 questions for QCOM

Joseph Moore

Morgan Stanley

2 questions for QCOM

Christopher Rolland

Susquehanna Financial Group

1 question for QCOM

Recent press releases and 8-K filings for QCOM.

- Surge in AI data-center demand is creating a high-bandwidth memory shortage, threatening a “great memory crunch” and capping smartphone production.

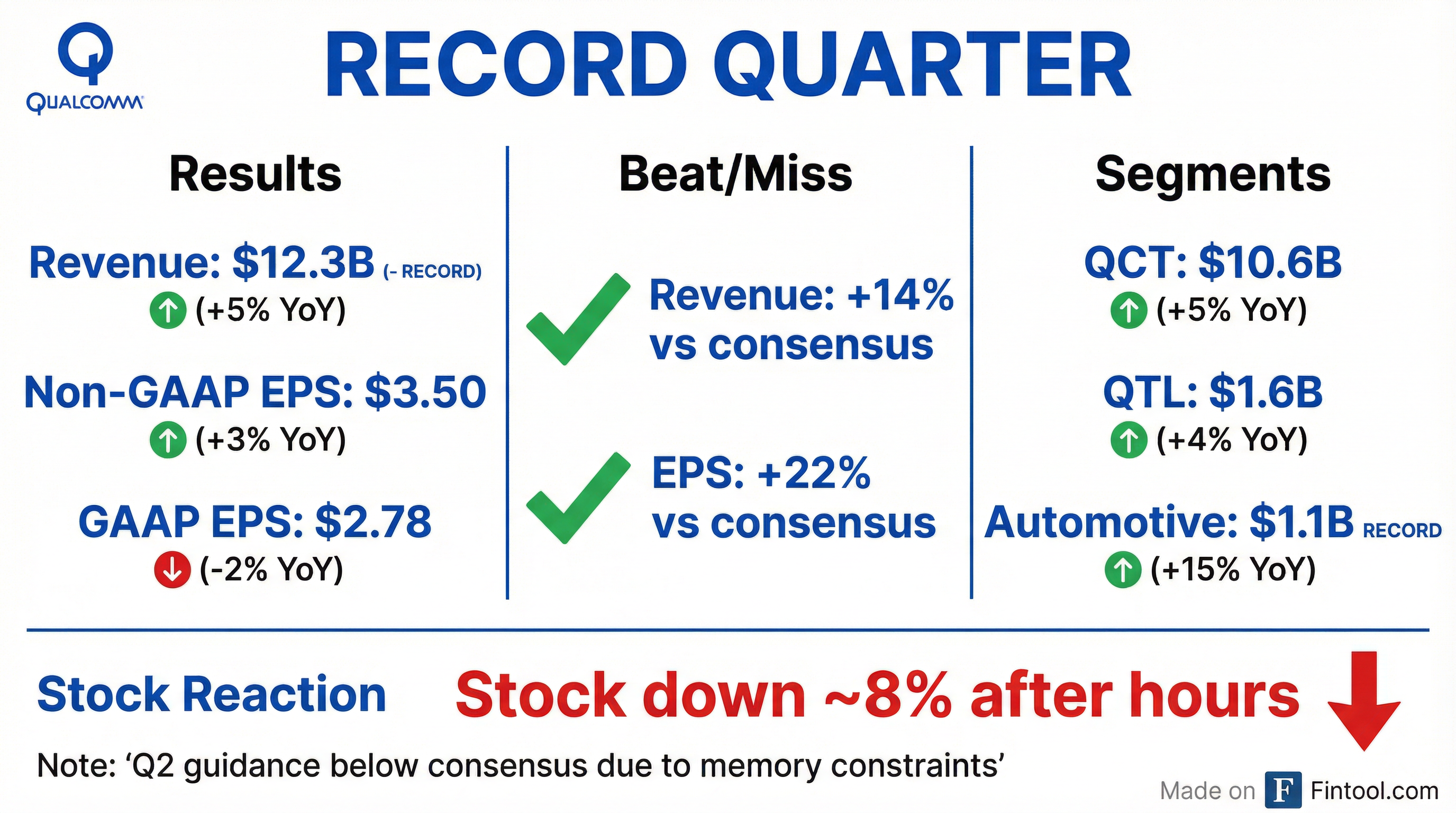

- Qualcomm posted $12.25 B in fiscal Q1 revenue (ended Dec. 29, 2025), a 5% YoY increase, narrowly beating the $12.21 B consensus, but shares fell over 9% pre-market after issuing guidance tied to memory constraints.

- Industry insiders warn the shortage will make electronics purchases harder and pricier, as chipmakers prioritize higher-end AI and data-center customers over conventional devices.

- Analysts at Goldman and CFRA, along with MediaTek and Intel executives, caution the memory shortfall is real, accelerating, and likely to persist, potentially slowing smartphone and PC growth.

- Delivered record revenues of $12.3 billion and non-GAAP EPS of $3.50 in Q1 FY2026.

- QCT segment achieved record revenues of $10.6 billion, with handset revenues of $7.8 billion, IoT up 9% YoY to $1.7 billion, and automotive up 15% YoY to $1.1 billion.

- Handset sales outlook constrained by industry-wide DRAM shortages due to AI data center demand, leading to conservative Q2 QCT handset revenue guidance of $6 billion.

- Q2 FY2026 guidance: total revenues $10.2 billion–$11 billion, non-GAAP EPS $2.45–$2.65, QTL revenues $1.2 billion–$1.4 billion, and QCT revenues $8.8 billion–$9.4 billion.

- Returned $3.6 billion to shareholders in Q1, including $2.6 billion in share repurchases and $949 million in dividends.

- Record Q1 revenue and EPS: Total revenue of $12.3 billion and non-GAAP EPS of $3.50, both all-time highs.

- QCT segment strength: QCT revenue of $10.6 billion, including handset $7.8 billion, IoT $1.7 billion (+9% YoY) and automotive $1.1 billion (+15% YoY).

- Licensing and capital returns: Licensing revenue of $1.6 billion with a 77% EBT margin; returned $3.6 billion to shareholders via $2.6 billion in buybacks and $949 million in dividends.

- Q2 guidance: Forecasting $10.2–11 billion in revenue and $2.45–2.65 EPS; QCT handset revenue around $6 billion and automotive growth >35% YoY.

- Memory supply headwind: DRAM availability is expected to limit handset industry scale through FY 2026 as capacity shifts to AI data centers.

- Record Q1 fiscal 2026 total revenues of $12.3 billion and non-GAAP EPS of $3.50

- Record segment performance: QCT revenues of $10.6 billion (handset $7.8 billion; IoT $1.7 billion, +9% YoY; automotive $1.1 billion, +15% YoY) and QTL licensing revenues of $1.6 billion with a 77% EBT margin

- Due to industry-wide DRAM shortages, handset OEMs are reducing chipset orders; Q2 guidance: revenue $10.2–11.0 billion, non-GAAP EPS $2.45–2.65, and QCT handset revenues ~$6 billion

- Returned $3.6 billion to shareholders in Q1, including $2.6 billion in share repurchases and $949 million in dividends

- Record Q1 revenue of $12.25 billion, GAAP EPS of $2.78, and Non-GAAP EPS of $3.50 for the quarter ended December 28, 2025.

- QCT segment delivered $10.6 billion in revenues (+5%), including $1.10 billion in automotive revenue (+15%), while QTL revenues reached $1.59 billion (+4%).

- Completed the acquisition of Alphawave IP Group plc to accelerate expansion into the data center market.

- Returned $3.6 billion to stockholders in Q1 FY 2026, including $949 million in dividends and $2.6 billion in share repurchases (15 million shares).

- Provided Q2 FY 2026 guidance of $10.2–11.0 billion in revenues and Non-GAAP EPS of $2.45–2.65, factoring in memory supply constraints.

- Qualcomm partners with Rakuten Mobile and 1Finity to deploy massive MIMO Open RAN radios using the Dragonwing QRU100 platform at scale in Rakuten Mobile’s fully virtualized, cloud-native network in Japan this year.

- The 1Finity mMIMO O-RUs leverage advanced beamforming and spatial multiplexing to significantly boost network capacity, coverage, and energy efficiency through O-RAN open fronthaul integration with Rakuten Symphony’s CU and DU.

- Rakuten Mobile will deploy the 1Finity 32A37 mMIMO O-RU operating at 3.7 GHz, complementing its existing 44R21 Open RAN radios for expanded coverage.

- Qualcomm emphasizes that the Dragonwing QRU100 platform enables operators to achieve greater capacity, coverage, and cost efficiency in 5G infrastructure deployments.

- QCI closed 2025 with 100 new customer engagements across hundreds of properties and delivered over 40% compound annual growth in gaming, hospitality, and tribal markets.

- The November 2024 launch of Chatalytics™ was adopted by more than 400 properties in its first year, marking QCI’s most successful product debut.

- Adoption extended across QCI’s broader platform—VizExplorer, QCI Player, QCI Customer, and the AGI56 framework—underscoring a multi-product, multi-market growth trajectory.

- Geographic expansion covered North America, Australia, Canada, and Asia, with QCI entering 2026 on the back of sustained inbound demand and expanding enterprise partnerships.

- At CES 2026, Qualcomm broadened its addressable market beyond smartphones by launching the Snapdragon X2 Plus for Windows laptops, claiming up to 35% faster peak performance, 43% lower power and an 80 TOPS NPU for multiday battery life.

- The Dragonwing IQ10 Series robotics platform delivers about 350 dense TOPS via an on-chip NPU paired with an 18-core CPU/GPU, plus safety and error-correction features, supporting over 20 cameras as well as lidar and radar for AI/LLM workloads.

- Qualcomm introduced companion Dragonwing chips (Q17790 and Q18750) for connected video and edge devices and showcased reference robots from partners like VinMotion and Advantech to accelerate real-world deployment.

- These launches support Qualcomm’s strategy to diversify revenue beyond its smartphone-focused QCT segment while expanding automotive initiatives and cloud-native developer tooling.

- Qualcomm unveils next-generation Physical AI robotics architecture and the Dragonwing IQ10 Series processor, delivering high-performance, energy-efficient compute for general-purpose robots and humanoids.

- The end-to-end stack integrates hardware, software, and compound AI to enable scalable, safety-grade robotics applications across retail, logistics, and manufacturing.

- Qualcomm builds a robotics ecosystem with partners including Advantech, APLUX, AutoCore, Booster, Figure, Kuka Robotics, Robotec.ai, and VinMotion to accelerate deployment-ready solutions.

- At CES, the company showcased VinMotion’s Motion 2 humanoid (IQ9 Series), Booster’s K1 Geek, and Advantech’s robotics development kit, highlighting real-world automation use cases.

- Qualcomm has completed the acquisition of Alphawave IP Group plc approximately one quarter ahead of schedule.

- The deal integrates Alphawave’s high-speed wired connectivity technologies with Qualcomm’s Oryon CPU and Hexagon NPU processors.

- Tony Pialis, Alphawave’s co-founder and CEO, will lead Qualcomm’s newly formed data center business.

- The acquisition bolsters Qualcomm’s position in AI compute and connectivity solutions for data centers and other high-growth markets.

Fintool News

In-depth analysis and coverage of QUALCOMM INC/DE.

Quarterly earnings call transcripts for QUALCOMM INC/DE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more